As filed with the Securities and Exchange

Commission on February 25, 2015

Registration No. 333-

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

AMERIS BANCORP

(Exact name of registrant as specified in its

charter)

| Georgia |

58-1456434 |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

310 First St., S.E.

Moultrie, Georgia 31768

(229) 890-1111

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Mr. Edwin W. Hortman,

Jr.

Chief Executive Officer

Ameris Bancorp

310 First St., S.E.

Moultrie, Georgia 31768

(229) 890-1111

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copy to:

Lori A. Gelchion, Esq.

Rogers & Hardin LLP

2700 International Tower

229 Peachtree Street, NE

Atlanta, Georgia 30303

(404) 522-4700

(404) 525-2224 (facsimile)

Approximate date of commencement of proposed

sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on

this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ¨

If any of the securities being registered on

this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended,

other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: x

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, as amended, please check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act of 1933, as amended, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant

to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act of 1933, as amended, check the following box: x

If this Form is a post-effective amendment

to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes

of securities pursuant to Rule 413(b) under the Securities Act of 1933, as amended, check the following box: ¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions

of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2

of the Securities Exchange Act of 1934, as amended:

| Large accelerated filer ¨ |

|

Accelerated filer x |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) |

|

Smaller reporting company ¨ |

CALCULATION

OF REGISTRATION FEE

Title of each class of

securities to be registered | |

Amount

to be registered(1) | | |

Proposed

maximum

offering price

per unit(2) | | |

Proposed

maximum

aggregate

offering price | | |

Amount of

registration fee | |

| Common Stock | |

| 5,320,000 | | |

$ | 25.78 | | |

| 137,149,600.00 | | |

$ | 15,936.78 | |

(1) Pursuant to Rule 416 under the Securities

Act of 1933, as amended, this registration statement also registers a currently indeterminate number of additional shares of the

Registrant’s common stock that may be issuable with respect to the shares being registered hereunder as a result of stock

splits, stock dividends or similar transactions.

(2) Estimated solely for purposes of computing

the registration fee in accordance with Rule 457(c) of the Securities Act of 1933, as amended, based on the average of the high

and low sale prices for the Registrant’s common stock as reported by The NASDAQ Global Market on February 20, 2015.

PROSPECTUS

5,320,000 Shares of Common Stock

This prospectus covers

the resale by the selling shareholders named in this prospectus of up to an aggregate of 5,320,000 shares of our common stock,

par value $1.00 per share (the “common stock”), issued in a private placement transaction on January 28, 2015. See

“Prospectus Summary – Private Placement Transaction.”

The selling shareholders

may offer and sell any of the shares covered by this prospectus from time to time through public or private transactions, at prevailing

market prices, at prices related to prevailing market prices or at privately negotiated prices, or otherwise as described under

“Plan of Distribution.” We are not offering any shares of common stock for sale under this prospectus, and we will

not receive any proceeds from the sale of any of the shares by the selling shareholders. See “Use of Proceeds.”

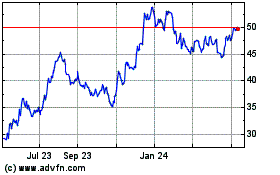

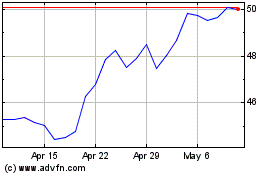

The common stock is currently

traded on The NASDAQ Global Select Market under the symbol “ABCB.” As of February 24, 2015, the closing sale

price of the common stock as reported by The NASDAQ Global Market was $26.26 per share.

Investing in our securities involves risks.

You should carefully read and consider the risks discussed in “Risk Factors” beginning on page 5 of this prospectus

before making an investment decision.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is February 25,

2015.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is a part

of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”). As permitted

by the rules and regulations of the SEC, the registration statement filed by us includes additional information not contained in

this prospectus. You should read this prospectus and the documents incorporated by reference into this prospectus in their entirety

before making an investment decision. You should also read and consider the information in the documents to which we have referred

you to under “Incorporation of Certain Information by Reference” and “Where You Can Find More Information.”

You should rely only on

the information contained in this prospectus, any prospectus supplement and the documents incorporated by reference into this prospectus.

Neither we nor the selling shareholders have authorized anyone to provide you with different information. No dealer, salesperson

or other person is authorized to give you any written information other than this prospectus or any prospectus supplement, or to

make representations as to matters not stated in this prospectus or any prospectus supplement. This prospectus and any prospectus

supplement do not constitute an offer to sell these securities, and the selling shareholders are not soliciting offers to buy these

securities, in any state where the offer or sale of these securities is not permitted. You should not assume that the information

contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus, or that the

information contained in any prospectus supplement or any document incorporated by reference is accurate as of any date other than

the date of the prospectus supplement or the document incorporated by reference, regardless of the time of delivery of this prospectus

or any sale of common stock.

Unless the context otherwise

requires, the term “Ameris” refers to Ameris Bancorp, and the terms “we,” “us,” “our”

and “the Company” refer to Ameris Bancorp, together with its wholly owned subsidiary, Ameris Bank.

PROSPECTUS SUMMARY

This prospectus summary

highlights important information about our business and about this prospectus. This summary does not contain all of the information

that may be important to you. You should carefully read this prospectus and any prospectus supplement in their entirety before

making an investment decision. In particular, you should read “Risk Factors” and the financial statements and related

notes incorporated by reference into this prospectus.

About Ameris

Ameris Bancorp, a Georgia

corporation, is a bank holding company whose business is conducted primarily through Ameris Bank, a Georgia state-chartered bank

and a wholly owned subsidiary of Ameris. As a bank holding company, Ameris performs certain shareholder and investor relations

functions and seeks to provide financial support, if necessary, to Ameris Bank.

We are headquartered in

Moultrie, Georgia, and provide a full range of banking services to our retail and commercial customers through branches primarily

concentrated in select markets in Georgia, Alabama, Northern Florida and South Carolina. These branches serve distinct communities

in our business areas with autonomy but do so as one bank, leveraging our favorable geographic footprint in an effort to acquire

more customers.

We were incorporated on

December 18, 1980 as a Georgia corporation. We operate 73 domestic banking offices with no foreign activities. At December 31,

2014, we had approximately $4.0 billion in total assets, $2.8 billion in total loans (excluding loans held for sale), $3.4 billion

in total deposits and shareholders’ equity of $366.0 million. Deposits with Ameris Bank are insured, up to applicable limits,

by the Federal Deposit Insurance Corporation.

Our executive offices

are located at 310 First St., S.E., Moultrie, Georgia 31768. Our telephone number is (229) 890-1111 and website is www.amerisbank.com.

The information on our website is not a part of this prospectus, and the reference to our website address does not constitute

incorporation by reference of any information on that website into this prospectus or any prospectus supplement.

Private Placement Transaction

On January 29, 2015, we

completed a private placement transaction whereby we sold to certain institutional investors, pursuant to a Securities Purchase

Agreement dated as of January 28, 2015, 5,320,000 shares of common stock at a purchase price of $22.50 per share, for net proceeds

to us of $114.5 million (after deducting placement agent commissions and our estimated offering expenses). We intend to use the

proceeds from the private placement: (i) to fund our previously announced, pending acquisition of Merchants & Southern Banks

of Florida, Inc. (“Merchants & Southern”), the parent company of Merchants and Southern Bank, Gainesville, Florida,

and eighteen Bank of America branches located in North Florida and South Georgia; and (ii) for general corporate purposes. See

“ – Other Recent Developments.”

In connection with the

private placement, we entered into a Registration Rights Agreement, dated as of January 28, 2015 (the “Registration Rights

Agreement”), pursuant to which we agreed to file with the SEC by February 27, 2015 the registration statement of which this

prospectus forms a part to register the resale or other disposition of the shares of common stock sold in the private placement.

Pursuant to the Registration Rights Agreement, we are also required to use our commercially reasonable efforts to cause the registration

statement to be declared effective by the SEC as soon as practicable and no later than April 28, 2015 (or, in the event the registration

statement is subject to review by the SEC, by May 28, 2015), and to keep the registration statement continuously effective under

the Securities Act of 1933, as amended (the “Securities Act”), until the earlier of: (i) such time as all shares covered

by the registration statement have been publicly sold; or (ii) the date that the shares covered by the registration statement may

be sold by non-affiliates without volume or manner of sale restrictions under Rule 144 under the Securities Act.

We will be required to

make certain payments as liquidated damages in the amounts determined pursuant to the Registration Rights Agreement, if among other

reasons, the registration statement: (i) is not filed with the SEC within specific time period; (ii) is not declared effective

by the SEC within specified time periods; or (iii) ceases for any reason to remain continuously effective as to all shares of common

stock for which it is required to be effective or the prospectus therein is not permitted to be used to resell such shares, subject

to certain limited exceptions.

We will bear all registration

expenses specified in the Registration Rights Agreement as well as all other expenses incurred by us in connection with the performance

of our obligations under the Registration Rights Agreement. The selling shareholders will bear any underwriting discounts and selling

commissions, if any, and any related legal expenses incurred by them. We will indemnify the selling shareholders against certain

liabilities, including some liabilities under the Securities Act, in accordance with the Registration Rights Agreement, or the

selling shareholders will be entitled to contribution. We may be indemnified by the selling shareholders against civil liabilities,

including liabilities under the Securities Act, that may arise from any written information furnished to us by the selling shareholders

specifically for use in this prospectus, in accordance with the Registration Rights Agreement, or we may be entitled to contribution.

Other Recent Developments

Strategic Acquisitions

On January 28, 2015, we

entered into a Stock Purchase Agreement with Merchants & Southern and Dennis R. O’Neil, the sole shareholder of Merchants

& Southern, which provides that, subject to the terms and conditions set forth in the agreement, we will purchase all of the

issued and outstanding shares of common stock of Merchants & Southern for a total purchase price of $50,000,000. As of December

31, 2014, Merchants & Southern reported assets of $473 million, gross loans of $214 million and deposits of $336 million. The

closing of the transaction is subject to customary closing conditions and regulatory approvals.

Also on January 28, 2015,

we entered into a Purchase and Assumption Agreement with Bank of America, National Association, pursuant to which we have agreed

to purchase, subject to the terms and conditions set forth in the agreement, eighteen branches of Bank of America located in North

Florida and South Georgia. We will assume an estimated $812 million of deposits at a deposit premium of 3.00 percent based on deposit

balances near the time the transaction closes. We will also acquire an immaterial amount of loans as part of the transaction. The

closing of the transaction is subject to customary closing conditions and regulatory approvals.

Financial Results for 2014

On January 29, 2015, we

announced preliminary, unaudited earnings and operating results for the quarter and twelve months ended December 31, 2014. The

Company reported operating net income of $41.0 million, or $1.56 per share, for the year ended December 31, 2014, compared to $21.4

million, or $0.89 per share, in 2013. Operating net income excludes $2.6 million and $3.2 million of after-tax merger charges in

2014 and 2013, respectively. Additional selected highlights of the announcement are as follows:

| • | Ameris completed the acquisition of Coastal Bankshares, Inc., increasing total assets by $449.0

million. |

| • | The Company declared cash dividends of $0.15 per common share. |

| • | Profitability ratios improved significantly, with operating return on assets increasing to 1.10%

and operating return on tangible common equity increasing to 15.51%. |

| • | Total recurring revenue increased 30.8% to $212.6 million as compared to 2013. |

| • | Organic growth in non-purchased loans totaled $202 million, or 9.8%. |

| • | Non-interest bearing demand deposits increased 25.6% during 2014 to finish at 24.5% of total deposits. |

| • | Annualized net charge-offs for 2014 declined to 0.31% of total loans, compared to 0.69% for the

year ended December 31, 2013. |

| • | Credit costs (provision and problem loan resolution and other real estate owned expenses) declined

to $19.2 million in 2014, compared to $27.0 million in 2013. |

| • | Noninterest income, excluding gains in investment securities, increased 35.2% to $62.7 million

during 2014. |

| • | Net income from the Company’s mortgage division increased 94.4% during 2014 to $6.2 million.

Net income increased at more than twice the rate of revenue growth for this division. |

Increase in Net Interest

Income. Net interest income on a tax equivalent basis increased 29.3% in 2014 to $151.5 million, up from $117.2 million reported

in 2013. Growth in earning assets from internal sources as well as acquisition activity contributed to the increase. Average earning

assets in 2014 increased 33.6% to $3.3 billion, compared to $2.5 billion for 2013. Although net interest income increased favorably,

the Company’s net interest margin continued to be adversely affected by historically low interest rates. For the year ended

December 31, 2014, the Company’s net interest margin declined to 4.59%, compared to 4.74% during 2013.

Margins and yields were

more stable during the most recent quarter. For the quarter ended December 31, 2014, the Company’s net interest margin was

4.64%, compared to 4.50% in the third quarter of 2014. Excluding the effect of accretion, the Company’s margin remained flat

compared to the third quarter of 2014 at 4.17%. Yields on earning assets, excluding accretion, were 4.60% in the fourth quarter

of 2014, compared to 4.63% in the third quarter of 2014.

Interest income on loans

on a tax equivalent basis increased substantially during 2014 to $149.1 million. During the quarter ended December 31, 2014, interest

income on loans increased to $40.6 million, compared to $39.1 million in the third quarter of 2014 and $28.9 million in the same

quarter of 2013. Yields on loans, excluding accretion, declined during 2014 to 5.15%, compared to 5.49% in 2013. For the current

quarter, loan yields declined only two basis points to 5.09% compared to the third quarter of 2014. Quarterly loan production yields

have been increasingly close to the overall portfolio yields for several quarters.

Deposit costs were stable

for most of 2014, ending the year at 0.30%, compared to 0.34% in 2013. Deposit costs, at 0.30%, were flat in the current quarter

of 2014 as compared to the third quarter in 2014. Continued improvement in the Company’s mix of deposits, mostly toward non-interest

bearing deposits, has allowed for more aggressive retention efforts on money market deposit accounts and certificates of deposits

without negatively impacting overall deposit costs.

Non-Interest Income.

Excluding gains on investment securities, non-interest income increased 35.2% in 2014 to $62.7 million, compared to $46.4 million

in 2013. Growth rates were notably strong among most sources. Mortgage revenues increased to $26.0 million as the Company’s

mortgage division reached a mature stage with a team of long-tenured mortgage bankers producing reliable results from referral

sources. Net income in the Company’s mortgage division increased at more than twice the pace of total growth in revenue,

reflecting a mature, well managed division. The Company’s recent efforts to build a small business association (“SBA”)

division resulted in significant gains in revenue and net income. For the year ended December 31, 2014, the Company’s net

income from SBA activities increased to $2.3 million, compared to $1.2 million in 2013. Total servicing income and gains on SBA

production amounted to $4.9 million, up 128.6% from 2013.

Service charges on deposit

accounts increased 25.9% in 2014, the result of acquisition activity as well as successful efforts on commercial deposit accounts.

Since 2011, the Company has devoted significant resources to both treasury deposit products and treasury sales professionals. During

2014, the treasury sales team booked new commercial deposit accounts totaling $90.8 million, contributing significantly to the

Company’s 25.6% growth rate in non-interest bearing deposits.

Non-Interest Expense.

Total operating expenses, excluding credit and merger charges, increased $31.3 million in 2014 to $133.4 million. The primary drivers

of the increase in operating expenses are the increased number of branch locations and continued growth and expansion in the Company’s

mortgage and SBA divisions. During 2014, the Company integrated two acquisitions with total assets of $1.2 billion, increasing

total assets by 40% compared to average assets in 2013. Short periods of duplicative expenses occurred after each conversion in

2014 and partially inflated the level of operating expenses reported during the year.

Continued investment in

the Company’s mortgage and SBA divisions resulted in increased operating expenses of $7.0 million, an increase of 37.0% compared

to 2013. Revenues from these divisions increased at a faster rate than did operating expenses and the contribution to net income

and the Company’s overall profitability ratios improved.

During the fourth quarter

of 2014, the Company incurred certain one-time operating expenses that negatively impacted fourth quarter results. During the fourth

quarter, the Company restructured several administrative positions, accelerated the expensing of certain restricted shares and

incurred consulting charges that management deems non-recurring. These amounts, in the aggregate, totaled approximately $1.2 million

before tax. Also, certain pieces of other real estate owned were aggressively re-evaluated, resulting in write-downs totaling $2.2

million.

Balance Sheet Trends.

Total assets increased $369.9 million during 2014, ending the year at $4.0 billion, compared to $3.7 billion at December 31, 2013.

The Company successfully completed the acquisition of Coastal Bankshares, Inc. on June 30, 2014, which added $449.0 million in

total assets. Continued redeployment of cash flows from non-performing assets and the Company’s FDIC loss-share indemnification

asset allowed the Company to limit growth in total assets while improving revenues and return on assets.

Total loans, excluding

loans held for sale and covered loans, were $2.6 billion at the end of 2014, compared to $2.1 billion at the end of 2013. Loans

held for sale increased 40.9% to $94.8 million, the result of higher production levels in the Company’s mortgage and SBA

divisions. Covered loans declined $103.5 million, or 26.5%, in 2014 to end the year at $286.8 million. At the end of 2014, covered

loans represent only 9.8% of total loans, compared to 15.5% at the same time in 2013.

Deposits increased $431.9

million to finish 2014 at $3.4 billion. The Company’s deposit sales focus has centered primarily on growth in non-interest

bearing deposits and deposit accounts with lower levels of rate sensitivity. At December 31, 2014, non-interest bearing deposit

accounts represented 24.5% of total deposits, compared to 22.3% at December 31, 2013. Non-rate sensitive deposits (NIB, NOW and

Savings) totaled $1.8 billion at December 31, 2014, compared to $1.5 billion at the same time in 2013. These funds represented

53.2% of the Company’s total deposits at the end of 2014, compared to 50.4% at the end of 2013.

Common shareholders’

equity at December 31, 2014 totaled $366.0 million, an increase of $77.3 million, or 26.8%, from the same time in 2013. During

2014, the Company issued $34.5 million in new common shares associated with the acquisition of Coastal Bankshares, Inc. Ameris

also recorded $28.6 million in intangible assets associated with the transaction. Additionally, the Company re-instituted a common

stock dividend during 2014 of $0.05 per quarter beginning in the second quarter of 2014. Tangible book value per share ended 2014

at $10.99 per share, up 11.3% from $9.87 per share at the end of 2013.

RISK FACTORS

Investing in our securities

involves risks. You should carefully review the risks and uncertainties described under “Risk Factors” contained in

our most recent Annual Report on Form 10-K, and any updates in our Quarterly Reports on Form 10-Q, together with all of the other

information appearing in this prospectus or incorporated by reference into this prospectus and any prospectus supplement, in light

of your particular investment objectives and financial circumstances. The risks so described are not the only risks we face. There

may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse

effects on our future results. Past financial performance may not be a reliable indicator of future performance and historical

trends should not be used to anticipate results or trends in future periods. Our business, financial condition and results of operations

could be materially adversely affected by any of these risks. In that event, the market price of our securities could decline and

you could lose all or part of your investment. You should carefully consider all of the information set forth in this prospectus,

any prospectus supplement and the documents incorporated by reference herein and therein before making an investment decision.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains

or incorporates by reference forward-looking statements within the meaning of Section 27A of the Securities Act, Section 21E of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Private Securities Litigation Reform

Act of 1995. These forward-looking statements represent plans, estimates, objectives, goals, guidelines, expectations, intentions,

projections and statements of our beliefs concerning future events, business plans, objectives, expected operating results and

the assumptions upon which those statements are based. Forward-looking statements include, without limitation, any statement that

may predict, forecast, indicate or imply future results, performance or achievements, and are typically identified with words such

as “may,” “could,” “should,” “will,” “would,” “believe,”

“anticipate,” “estimate,” “expect,” “intend,” “plan,” “project,”

“is confident that,” and similar expressions that are intended to identify these forward-looking statements. These

forward-looking statements involve risk and uncertainty and a variety of factors, which are in many instances beyond our control

and could cause our actual results and experience to differ materially from the anticipated results or other expectations expressed

in these forward-looking statements. We assume no obligation to update or revise forward-looking statements.

In addition to the risks

discussed in this prospectus under “Risk Factors,” the following are important factors and risks that, in our view,

could cause actual results to differ materially from those discussed in the forward-looking statements:

| • | the risk that our previously announced, pending acquisition of Merchants & Southern may not

be completed when expected, or at all, because the requisite regulatory approvals for the acquisition are not obtained or

other conditions to the completion of the acquisition set forth in the stock purchase agreement relating to the acquisition are

not satisfied or waived; |

| • | the risk that our previously announced, pending acquisition of eighteen Bank of America branches

located in North Florida and South Georgia may not be completed when expected, or at all, because the requisite regulatory approvals

for the acquisition are not be obtained or other conditions to the completion of the acquisition set forth in the purchase and

assumption agreement relating to the acquisition are not satisfied or waived; |

| • | the risk that the expected cost savings, synergies, impact on income and other financial benefits

from the pending acquisitions discussed above might not be realized within the expected timeframes or at all as a result of, among

other things, changes in general economic and market conditions, interest and exchange rates, monetary policy, laws and regulations

and their enforcement, and the degree of competition in the relevant markets; |

| • | the risk that the pending acquisitions discussed above may not be integrated into our business

successfully, or such integration may take longer to accomplish than expected, and that the operating costs, customer losses and

business disruption following the completion of the acquisitions discussed above, including adverse developments in relationships

with employees, may be greater than expected; |

| • | the risks of any other acquisitions, mergers or divestitures which we may undertake, including,

without limitation, the related time and costs of implementing such transactions, integrating operations as part of these transactions

and possible failures to achieve expected gains, revenue growth, expense savings and/or other results from such transactions; |

| • | the effects of future economic, business and market conditions and changes, including seasonality; |

| • | legislative and regulatory changes, including changes in banking, securities and tax laws, regulations

and policies and their application by our regulators; |

| • | changes in accounting rules, practices and interpretations; |

| • | the risks of changes in interest rates on the levels, composition and costs of deposits, loan demand,

and the values and liquidity of loan collateral, securities and interest-sensitive assets and liabilities; |

| • | changes in borrower credit risks and payment behaviors; |

| • | changes in the availability and cost of credit and capital in the financial markets; |

| • | changes in the prices, values and sales volumes of residential and commercial real estate; |

| • | the effects of concentrations in our loan portfolio; |

| • | our ability to resolve nonperforming assets; |

| • | the failure of assumptions and estimates underlying the establishment of reserves for possible

loan losses and other estimates and valuations; |

| • | changes in technology or products that may be more difficult, costly or less effective than anticipated;

and |

| • | the effects of war or other conflicts, acts of terrorism, hurricanes, floods, tornados or other

catastrophic events that may affect economic conditions. |

Further information on

other factors that could affect us is included in the SEC filings incorporated by reference into this prospectus under “Incorporation

of Certain Information by Reference,” all of which are accessible on the SEC’s website at www.sec.gov. See also “Risk

Factors.”

Forward-looking statements

should not be viewed as predictions and should not be the primary basis upon which investors evaluate us. If one or more of the

factors affecting our forward-looking information and statements proves incorrect, then our actual results, performance or achievements

could differ materially from those expressed in, or implied by, forward-looking information and statements contained in this prospectus

and in the information incorporated by reference herein. Therefore, we caution you not to place undue reliance on our forward-looking

information and statements.

USE OF PROCEEDS

We will not receive any

proceeds from the sale by the selling shareholders of the shares of common stock registered hereby. The selling shareholders will

receive all of the net proceeds from the sales of such shares.

SELLING SHAREHOLDERS

The following table identifies

the selling shareholders and indicates certain information known to us with respect to: (i) the number of shares of common stock

beneficially owned by each selling shareholder prior to the offering; and (ii) the number of shares and percentage of common stock

to be beneficially owned by each selling shareholder after completion of the offering.

The table below has been

prepared based upon the information furnished to us by the selling shareholders. We do not know when or in what amounts the selling

shareholders may sell or otherwise dispose of the shares of common stock covered hereby. As a result, we cannot estimate the number

of the shares that will be held by the selling shareholders after completion of the offering. However, for purposes of this table,

we have assumed that all of the shares of common stock covered by this prospectus will be sold by the selling shareholders.

Except for the transactions

described in this prospectus under “Prospectus Summary – Private Placement Transaction,” none of the selling

shareholders have had any position, office or other material relationship with us or any of our predecessors or affiliates within

the past three years. We are filing the registration statement of which this prospectus forms a part to fulfill a contractual obligation

to the selling shareholders under the Registration Rights Agreement entered into in connection with the private placement. See

“Prospectus Summary – Private Placement Transaction.”

| |

Shares of Common

Stock Beneficially

Owned Prior to the | | |

Number of

Shares Being | | |

Shares of Common Stock

Beneficially Owned After

the Offering(2)(4) | |

| Selling Shareholder(1) | |

Offering(2) | | |

Offered(2)(3) | | |

Number | | |

Percent | |

| Banc Fund VII L.P.(5) | |

| 43,000 | | |

| 43,000 | | |

| 0 | | |

| | * |

| Banc Fund VIII L.P.(5) | |

| 100,251 | | |

| 19,700 | | |

| 80,551 | | |

| | * |

| Banc Fund IX L.P.(5) | |

| 37,300 | | |

| 37,300 | | |

| 0 | | |

| | * |

| Basswood Financial Fund, Inc.(6) | |

| 5,000 | | |

| 5,000 | | |

| 0 | | |

| | * |

| Bridge Equities III, LLC(7) | |

| 222,222 | | |

| 222,222 | | |

| 0 | | |

| | * |

| Castine Offshore Fund, LTD(8) | |

| 293,159 | | |

| 148,750 | | |

| 144,409 | | |

| | * |

| Castine Partners, LP(8) | |

| 144,237 | | |

| 72,100 | | |

| 72,137 | | |

| | * |

| Castine Partners II, LP(8) | |

| 251,694 | | |

| 129,150 | | |

| 122,544 | | |

| | * |

| Consector Partners Master Fund, LP(9) | |

| 300,000 | | |

| 300,000 | | |

| 0 | | |

| | * |

| Corp. Fondo del Seguro del Estado(10) | |

| 30,736 | | |

| 7,846 | | |

| 22,890 | | |

| | * |

| EJF Financial Services Fund, LP(11) | |

| 775,000 | | |

| 775,000 | | |

| 0 | | |

| | * |

| Financial Opportunity Fund LLC(12) | |

| 155,556 | | |

| 155,556 | | |

| 0 | | |

| | * |

| Iron Road Multi-Strategy Fund LP(13) | |

| 40,000 | | |

| 40,000 | | |

| 0 | | |

| | * |

| Ithan Creek Master Investors (Cayman) L.P.(10)(14) | |

| 872,972 | | |

| 526,637 | | |

| 346,335 | | |

| 1.1 | % |

| JAM Partners, LP(15) | |

| 724,236 | | |

| 265,555 | | |

| 458,681 | | |

| 1.4 | % |

| JAM Special Opportunities Fund III, LP(15) | |

| 703,126 | | |

| 244,445 | | |

| 458,681 | | |

| 1.4 | % |

| JH Financial Industries Fund(16) | |

| 226,335 | | |

| 226,335 | | |

| 0 | | |

| | * |

| JH Financial Opportunities Fund(16) | |

| 309,284 | | |

| 66,018 | | |

| 243,266 | | |

| | * |

| JH Regional Bank Fund(16) | |

| 531,245 | | |

| 74,299 | | |

| 456,946 | | |

| 1.4 | % |

| JHVIT Financial Industries Trust(16) | |

| 35,353 | | |

| 35,353 | | |

| 0 | | |

| | * |

| Malta Hedge Fund, L.P.(17) | |

| 29,200 | | |

| 29,200 | | |

| 0 | | |

| | * |

| Malta Hedge Fund II, L.P.(17) | |

| 290,600 | | |

| 290,600 | | |

| 0 | | |

| | * |

| Malta MLC Fund, L.P.(17) | |

| 147,200 | | |

| 147,200 | | |

| 0 | | |

| | * |

| Malta MLC Offshore, Ltd.(18) | |

| 20,700 | | |

| 20,700 | | |

| 0 | | |

| | * |

| Malta Offshore, Ltd.(18) | |

| 78,600 | | |

| 78,600 | | |

| 0 | | |

| | * |

| Malta Titan Fund, L.P.(17) | |

| 173,800 | | |

| 173,800 | | |

| 0 | | |

| | * |

| Manulife U.S. Regional Bank Trust(16) | |

| 71,043 | | |

| 47,995 | | |

| 23,048 | | |

| | * |

| Mendon Capital Master Fund Ltd.(19) | |

| 260,000 | | |

| 260,000 | | |

| 0 | | |

| | * |

| New Hampshire Retirement System(10) | |

| 117,261 | | |

| 29,058 | | |

| 88,203 | | |

| | * |

| NYSCRF/GSAM AIMS Global Tuscarora(20) | |

| 151,674 | | |

| 50,000 | | |

| 101,674 | | |

| | * |

| Pear Tree Polaris Small Cap Fund(20) | |

| 59,000 | | |

| 59,000 | | |

| 0 | | |

| | * |

| Rock Creek FJ Fund SP(21) | |

| 22,222 | | |

| 22,222 | | |

| 0 | | |

| | * |

| | |

Shares of Common

Stock Beneficially

Owned Prior to the | | |

Number of

Shares Being | | |

Shares of Common Stock

Beneficially Owned After

the Offering(2)(4) | |

| Selling Shareholder(1) | |

Offering(2) | | |

Offered(2)(3) | | |

Number | | |

Percent | |

Russell

Institutional Funds, LLC - Russell Multi-Asset Core Plus Fund(20)

| |

55,000

| | |

10,000

| | |

45,000

| | |

| * |

| Russell Investments Canada Ltd. Wsib Investments Public Equities Pooled Fund Trust(20) | |

| 164,800 | | |

| 26,000 | | |

| 138,800 | | |

| | * |

| Russell Investment Company Global Equity Portfolio(20) | |

| 256,400 | | |

| 65,000 | | |

| 191,400 | | |

| | * |

| Malta Market Neutral Master Fund, Ltd.(18) | |

| 34,900 | | |

| 34,900 | | |

| 0 | | |

| | * |

| Stieven Financial Investors, L.P.(22) | |

| 432,623 | | |

| 355,700 | | |

| 76,923 | | |

| | * |

| Stieven Financial Offshore Investors, Ltd.(22) | |

| 96,477 | | |

| 79,300 | | |

| 17,177 | | |

| | * |

| United of Omaha Small Company Fund(10) | |

| 85,695 | | |

| 21,289 | | |

| 64,406 | | |

| | * |

| Wellington Trust Company, National Association Multiple Collective Investment Funds Trust, Small Cap 2000 Portfolio(10)(14) | |

| 268,455 | | |

| 65,725 | | |

| 202,730 | | |

| | * |

| Wellington Trust Company, National Association Multiple Collective Investment Funds Trust II Small Cap 2000 Portfolio(10)(14) | |

| 121,234 | | |

| 29,975 | | |

| 91,259 | | |

| | * |

| Wellington Trust Company, National Association Multiple Common Trust Funds Trust, Small Cap 2000 Portfolio(10)(14) | |

| 122,968 | | |

| 29,470 | | |

| 93,498 | | |

| | * |

| * | Represents less than 1% of the issued and outstanding

shares of common stock as of February 16, 2015. |

| (1) | Includes all affiliates, limited partners, donees, pledgees, transferees and other successors in

interest selling shares received from a named selling shareholder. |

| (2) | For purposes of this table,

“beneficial ownership” is determined in accordance with Rule 13d-3 under

the Exchange Act, pursuant to which a selling shareholder is deemed to have beneficial

ownership of any shares of common stock that such selling shareholder has the right to

acquire within 60 days of February 16, 2015. Based on the representations of the selling

shareholders, unless otherwise indicated, we believe the selling shareholders possess

sole voting and investment power over all shares of common stock shown as beneficially

owned by them. |

| (3) | Based upon 32,162,891 shares

of common stock outstanding as of February 16, 2015. For the purposes of computing the

percentage of outstanding shares of common stock held by the selling shareholders named

above, any shares which any selling shareholder has the right to acquire within 60 days

of February 16, 2015, are deemed to be outstanding. |

| (4) | Assumes that all shares

of common stock being offered and registered hereunder are sold, although the selling

shareholders are not obligated to sell any such shares. |

| (5) | Banc Fund VII L.P., Banc

Fund VIII L.P. and Banc Fund IX L.P. (collectively, the “BF Partnerships”)

are directly or indirectly controlled by The Banc Funds Company, L.L.C. Charles J. Moore,

as Member of The Banc Funds Company, L.L.C., has voting and investment power over all

shares beneficially owned by the BF Partnerships. |

| (6) | Basswood Capital Management,

LLC serves as the investment manager for Basswood Financial Fund, Inc. Matthew Lindenbaum

and Bennett Lindenbaum have voting and investment power over the shares beneficially

owned by Basswood Financial Fund, Inc. |

| (7) | SunBridge Manager, LLC

(“SunBridge Manager”) is the managing member of Bridge Equities, III, LLC,

and SunBridge Holdings, LLC (“SunBridge Holdings”) is the managing member

of SunBridge Manager. Realty Investment Company, Inc. is the manager of SunBridge Holdings.

Charles A. Ledsinger, Jr. has voting and investment power over the shares beneficially

owned by Bridge Equities III, LLC. |

| (8) | Castine Offshore Fund,

LTD, Castine Partners, LP and Castine Partners II, LP are affiliated entities (collectively,

the “Castine Entities”). Castine Management GP, LLC is the general partner

of Castine Partners, LP and Castine Partners II, LP and has voting and investment power

over the shares beneficially owned by them. Castine Capital Management, LLC is the investment

manager for Castine Offshore Fund, LTD and has voting and investment power over the shares

beneficially owned by it. Paul D. Magidson is the managing member of Castine Management

GP, LLC and Castine Capital Management, LLC and has voting and investment power over

the shares beneficially owned by the Castine Entities. |

| (9) | Consector Advisors, LLC,

is the General Partner of Consector Partners Master Fund, LP. William J. Black, Jr.,

as Managing Member of Consector Advisors, LLC, has voting and investment power over the

shares beneficially owned by Consector Partners Master Fund, LP. |

| (10) | Wellington Management

Company LLP is the investment advisor to this entity. Wellington Management Company LLP

is an investment advisor registered under the Investment Advisors Act of 1940, as amended,

and is an indirect subsidiary of Wellington Management Group LLP. Wellington Management

Company LLP and Wellington Management Group LLP may each be deemed to share beneficial

ownership of the shares indicated in the table, all of which are held of record by the

entity named in the table or a nominee on its behalf. The business address of the entity

named in the table is c/o Wellington Management Company LLP, 280 Congress Street, Boston,

Massachusetts 02210. The business address of Wellington Management Company LLP and Wellington

Management Group LLP is 280 Congress Street, Boston, Massachusetts 02210. |

| (11) | EJF Financial Services

GP, LLC is the general partner of EJF Financial Services Fund, LP. EJF Capital LLC is

the sole member of EJF Financial Services GP, LLC. Emanuel J. Friedman, the Chief Executive

Officer of EJF Capital LLC, has voting and investment power over the shares beneficially

owned by EJF Financial Services Fund, LP. |

| (12) | FJ Capital Management

LLC is the Managing Member of Financial Opportunity Fund LLC. Martin Friedman, as Managing

Member of FJ Capital Management LLC, has voting and investment power over the shares

beneficially owned by Financial Opportunity Fund LLC. |

| (13) | The general partner of Iron Road Multi−Strategy Fund LP is Iron Road Capital Partners LLC

and its investment adviser is RMB Capital Management LLC. Iron Road Capital Partners LLC is owned by RMB Capital Management LLC.

RMB Capital Management LLC is wholly owned by RMB Capital Holdings LLC. Richard M. Burridge, Jr., Frederick Paulman and Walter

Clark as Managers of RMB Capital Holdings LLC, share voting and investment power over the shares beneficially owned by Iron Road

Multi-Strategy Fund LP. |

| (14) | Each of (i) Ithan Creek

Master Investors (Cayman) L.P., (ii) Wellington Trust Company, National Association Multiple

Collective Investment Funds Trust, Small Cap 2000 Portfolio, (iii) Wellington Trust Company,

National Association Multiple Collective Investment Funds Trust II Small Cap 2000 Portfolio,

and (iv) Wellington Trust Company, National Association Multiple Common Trust Funds Trust,

Small Cap 2000 Portfolio, may be deemed to be an affiliate of a broker-dealer, Wellington

Management Advisers, Inc. (“WMAI”). WMAI’s business is limited to introducing

US prospects and clients to the investment management capabilities of the Wellington

Management Group LLP organization, including to prospects who ultimately may purchase

interests in private funds and pooled investment vehicles sponsored by affiliates of

Wellington Management Group LLP. WMAI does not engage in retail brokerage, lending, securities

underwriting, or proprietary trading. Each of the foregoing entities named in the table

has represented that it acquired its shares in the ordinary course of business and, at

the time of the acquisition of the shares, had no agreements or understandings, directly

or indirectly, with any person to distribute the shares. |

| (15) | JAM Partners, L.P. and

JAM Special Opportunities Fund III, L.P. (collectively, the “JAM Entities”)

are directly or indirectly controlled by Jacobs Asset Management, LLC. Sy Jacobs, Managing

Member of Jacobs Asset Management, LLC, has voting and investment power over the shares

beneficially owned by the JAM Entities. |

| (16) | Manulife Asset Management

(US) LLC is the sub-investment adviser to JH Financial Industries Fund, JH Financial

Opportunities Fund, JH Regional Bank Fund, JHVIT Financial Industries Trust and Manulife

US Regional Bank Trust (collectively, the “Manulife Entities”). Lisa Welch,

as Lead Portfolio Manager, has voting and investment power over the shares beneficially

owned by the Manulife Entities. |

| (17) | Maltese Capital Holdings,

LLC, is the general partner of, and Maltese Capital Management, LLC, is the management

company of, each of Malta Hedge Fund, L.P., Malta Hedge Fund II, L.P., Malta MLC Fund,

L.P. and Malta Titan Fund, L.P. (collectively, the “Malta L.P. Entities”).

Terry Maltese, as Managing Member of Maltese Capital Holdings, LLC and Maltese Capital

Management, LLC, has voting and dispositive power over the shares beneficially owned

by the Malta L.P. Entities. |

| (18) | Maltese Capital Management,

LLC, is the management company of each of Malta MLC Offshore, Ltd., Malta Offshore, Ltd.

and Malta Market Neutral Master Fund, Ltd., formerly known as SOAM Market Neutral Master

Fund, Ltd. (collectively, the “Malta Ltd. Entities”). Terry Maltese, as Director

of each of the Malta Ltd. Entities and Managing Member of Maltese Capital Management,

LLC, has voting and dispositive power over the shares beneficially owned by the Malta

Ltd. Entities. |

| (19) | Mendon Capital Master

Fund Ltd. is owned by Mendon Capital LLC and Mendon Capital Ltd., and is managed by RMB

Mendon Managers LLC and sub-advised by RMB Capital Management LLC. RMB Mendon Managers

LLC is owned by Mendon Capital Advisers Corp. and RMB Capital Management LLC. RMB Capital

Management is wholly owned by RMB Capital Holdings LLC. Richard M. Burridge, Jr., Frederick

Paulman, and Walter Clark, as Managers of RMB Capital Holdings LLC, share voting and

investment power over the shares beneficially owned by Mendon Capital Master Fund Ltd. |

| (20) | Polaris Capital Management,

LLC is the investment advisor to NYSCRF/GSAM AIMS Global Tuscarora, Pear Tree Polaris

Small Cap Fund, Russell Institutional Funds, LLC - Russell Multi-Asset Core Plus Fund,

Russell Investments Canada Ltd. Wsib Investments Public Equities Pooled Fund Trust and

Russell Investment Company Global Equity Portfolio. Bernard R. Horn, as President and

principal owner of Polaris Capital Management, LLC, has voting and investment power over

the shares beneficially owned by such entities. |

| (21) | FJ Capital Management

LLC is the sub-advisor for Rock Creek FJ Fund SP. Martin Friedman, as Managing Member

of FJ Capital Management LLC, has voting and investment power over the shares beneficially

owned by Rock Creek FJ Fund SP. |

| (22) | Joseph A. Stieven, Stephen

L. Covington and Daniel M. Ellefson, all members of Stieven Capital GP, LLC, the general

partner of Stieven Financial Investors, L.P., and managing directors of Stieven Capital

Advisors, L.P., the investment manager of Stieven Financial Investors, L.P. and Stieven

Financial Offshore Investors, Ltd., share voting and investment power over the shares

beneficially held by Stieven Financial Investors, L.P. and Stieven Financial Offshore

Investors, Ltd., respectively. |

PLAN OF DISTRIBUTION

We are registering the

common stock issued to the selling shareholders to permit the resale of the common stock by the holders of the common stock from

time to time after the date of this prospectus. We will not receive any of the proceeds from the sale by the selling shareholders

of the common stock. We will bear all fees and expenses incident to our obligation to register the common stock.

The selling shareholders

may sell all or a portion of the common stock beneficially owned by them and offered hereby from time to time directly or through

one or more underwriters, broker-dealers or agents. If the common stock is sold through underwriters or broker-dealers, the selling

shareholders will be responsible for underwriting discounts or commissions or agent’s commissions. The common stock may be

sold on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale,

in the over-the-counter market or in transactions otherwise than on these exchanges or systems or in the over the-counter market

and in one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined

at the time of sale or at negotiated prices. These sales may be effected in transactions, which may involve crosses or block transactions.

The selling shareholders may use any one or more of the following methods when selling the common stock:

| • | ordinary brokerage transactions and transactions in which

the broker-dealer solicits purchasers; |

| • | block trades in which the broker-dealer will attempt

to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| • | purchases by a broker-dealer as principal and resale

by the broker-dealer for its account; |

| • | an exchange distribution in accordance with the rules

of the applicable exchange; |

| • | privately negotiated transactions; |

| • | settlement of short sales entered into after the effective

date of the registration statement of which this prospectus is a part; |

| • | broker-dealers may agree with the selling shareholders

to sell a specified number of such securities at a stipulated price per share; |

| • | through the writing or settlement of options or other

hedging transactions, whether such options are listed on an options exchange or otherwise; |

| • | a combination of any such methods of sale; and |

| • | any other method permitted pursuant to applicable law. |

The selling shareholders

also may resell all or a portion of the common stock in open market transactions in reliance upon Rule 144 under the Securities

Act, as permitted by that rule, or Section 4(a)(1) under the Securities Act, if available, rather than under this prospectus, provided

that they meet the criteria and conform to the requirements of those provisions.

Broker-dealers engaged

by the selling shareholders may arrange for other broker-dealers to participate in sales. If the selling shareholders effect such

transactions by selling common stock to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers or

agents may receive commissions in the form of discounts, concessions or commissions from the selling shareholders or commissions

from purchasers of the common stock for whom they may act as agent or to whom they may sell as principal. Such commissions will

be in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction

will not be in excess of a customary brokerage commission in compliance with NASD Rule 2440, and in the case of a principal transaction

a markup or markdown in compliance with NASD Rule IM 2440.

In connection with sales

of the common stock or otherwise, the selling shareholders may enter into hedging transactions with broker-dealers or other financial

institutions, which may in turn engage in short sales of the common stock in the course of hedging in positions they assume. The

selling shareholders may also sell common stock short and if such short sale shall take place after the date that this registration

statement is declared effective by the SEC, the selling shareholders may deliver the common stock covered by this prospectus to

close out short positions and to return borrowed shares in connection with such short sales. The selling shareholders may also

loan or pledge common stock to broker-dealers that in turn may sell such shares, to the extent permitted by applicable law. The

selling shareholders may also enter into option or other transactions with broker-dealers or other financial institutions or the

creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of

shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus

(as supplemented or amended to reflect such transaction). Notwithstanding the foregoing, the selling shareholders have been advised

that they may not use shares registered on this registration statement to cover short sales of the common stock made prior to the

date the registration statement, of which this prospectus forms a part, has been declared effective by the SEC.

The selling shareholders

may, from time to time, pledge or grant a security interest in some or all of the common stock owned by them and, if they default

in the performance of their secured obligations, the pledgees or secured parties may offer and sell the common stock from time

to time pursuant to this prospectus or any amendment to this prospectus under Rule 424(b)(3) under the Securities Act or other

applicable provision of the Securities Act amending, if necessary, the list of selling shareholders to include the pledgee, transferee

or other successors in interest as selling shareholders under this prospectus. The selling shareholders also may transfer and donate

the common stock in other circumstances in which case the transferees, donees, pledgees or other successors in interest will be

the selling beneficial owners for purposes of this prospectus.

To the extent required

by the Securities Act and the rules and regulations thereunder, the selling shareholders and any broker-dealer or agents participating

in the distribution of the common stock may be deemed to be “underwriters” within the meaning of Section 2(11) of the

Securities Act in connection with such sales. In such event, any commissions paid, or any discounts or concessions allowed to,

any such broker-dealer or agent and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions

or discounts under the Securities Act. Selling shareholders who are “underwriters” within the meaning of Section 2(11)

of the Securities Act will be subject to the applicable prospectus delivery requirements of the Securities Act and may be subject

to certain statutory liabilities of, including, but not limited to, Sections 11, 12 and 17 of the Securities Act and Rule

10b-5 under the Exchange Act.

Each selling shareholder

has informed us that it is not a registered broker-dealer and does not have any written or oral agreement or understanding, directly

or indirectly, with any person to distribute the common stock. Upon our notification in writing by a selling shareholder that any

material arrangement has been entered into with a broker-dealer for the sale of common stock through a block trade, special offering,

exchange distribution or secondary distribution or a purchase by a broker or dealer, a supplement to this prospectus will be filed,

if required, pursuant to Rule 424(b) under the Securities Act, disclosing (i) the name of each such selling shareholder and of

the participating broker-dealer(s), (ii) the number of shares involved, (iii) the price at which such the shares of common stock

were sold, (iv) the commissions paid or discounts or concessions allowed to such broker-dealer(s), where applicable, (v) that such

broker-dealer(s) did not conduct any investigation to verify the information set out or incorporated by reference in this prospectus,

and (vi) other facts material to the transaction. In no event shall any broker-dealer receive fees, commissions and markups, which,

in the aggregate, would exceed eight percent (8%).

Under the securities laws

of some states, the common stock may be sold in such states only through registered or licensed brokers or dealers. In addition,

in some states the common stock may not be sold unless such shares have been registered or qualified for sale in such state or

an exemption from registration or qualification is available and is complied with.

There can be no assurance

that any selling shareholder will sell any or all of the common stock registered pursuant to the shelf registration statement,

of which this prospectus forms a part.

Each selling shareholder

and any other person participating in such distribution will be subject to applicable provisions of the Exchange Act and the rules

and regulations thereunder, including, without limitation, to the extent applicable, Regulation M of the Exchange Act, which may

limit the timing of purchases and sales of any of the common stock by the selling shareholder and any other participating person.

To the extent applicable, Regulation M may also restrict the ability of any person engaged in the distribution of the common stock

to engage in market-making activities with respect to the common stock. All of the foregoing may affect the marketability of the

common stock and the ability of any person or entity to engage in market-making activities with respect to the common stock.

We will pay all expenses

of the registration of the common stock pursuant to the registration rights agreement, including, without limitation, SEC filing

fees and expenses of compliance with state securities or “blue sky” laws; provided, however, that each

selling shareholder will pay all underwriting discounts and selling commissions, if any and any related legal expenses incurred

by it. We will indemnify the selling shareholders against certain liabilities, including some liabilities under the Securities

Act, in accordance with the Registration Rights Agreement, or the selling shareholders will be entitled to contribution. We may

be indemnified by the selling shareholders against civil liabilities, including liabilities under the Securities Act, that may

arise from any written information furnished to us by the selling shareholders specifically for use in this prospectus, in accordance

with the Registration Rights Agreement, or we may be entitled to contribution.

DESCRIPTION OF CAPITAL

STOCK

The following summary

does not describe every aspect of our capital stock and is qualified in its entirety by reference to the relevant sections of our

articles of incorporation, as amended, which are filed as an exhibit to the registration statement of which this prospectus forms

a part.

General

As of February 16, 2015,

our authorized capital stock consisted of:

| • | 100,000,000 shares of common stock, par value $1.00 per

share, 32,162,891 of which were outstanding; and |

| • | 5,000,000 shares of preferred stock, of which 52,000

have been designated as Fixed Rate Cumulative Preferred Stock, Series A, all of which have been repurchased and redeemed pursuant

to the terms of such series and have been cancelled and are no longer outstanding. |

Common Stock

Voting Rights.

Each holder of the common stock is entitled to one vote per share held on any matter submitted to a vote of shareholders. There

are no cumulative voting rights in the election of directors.

Dividends. Holders

of the common stock are entitled to receive dividends only if, as and when declared by the our board of directors out of funds

legally available, subject to certain restrictions imposed by state and federal laws and the preferential dividend rights of any

preferred stock then outstanding.

No Preemptive or Conversion

Rights. Holders of the common stock do not have preemptive rights to purchase additional shares of any class of capital stock,

nor do they have conversion or redemption rights.

Calls and Assessments.

All of the issued and outstanding shares of the common stock are fully paid and non-assessable.

Liquidation Rights.

In the event of the liquidation, dissolution or winding up of us, the holders of the common stock (and the holders of any class

or series of stock entitled to participate with the common stock in the distribution of assets) shall be entitled to receive, in

cash or in kind, our assets available for distribution remaining after payment or provision for payment of our debts and liabilities

and distributions or provision for distributions to holders of the preferred stock having preference over the common stock.

Preferred Stock

Our board of directors

may, from time to time, issue shares of the authorized, undesignated preferred stock in one or more classes or series without shareholder

approval. In connection with any such issuance, our board of directors may by resolution determine the designation, preferences,

limitations, conversion rights, cumulative, relative, participating, optional or other rights, including voting rights, qualifications,

limitations or restrictions, of such shares of preferred stock.

Certain Provisions of Our Articles of Incorporation

and Bylaws and the GBCC

Our articles of incorporation

and bylaws contain provisions that could make more difficult an acquisition of us by means of a tender offer, a proxy contest or

otherwise. These provisions are expected to discourage specific types of coercive takeover practices and inadequate takeover bids

as well as to encourage persons seeking to acquire control to first negotiate with our board of directors. Although these provisions

may have the effect of delaying, deferring or preventing a change in control, we believe that the benefits of increased protection

through the potential ability to negotiate with the proponent of an unfriendly or unsolicited proposal to acquire or restructure

us outweighs the disadvantages of discouraging these proposals because, among other things, negotiation of such proposals could

result in an improvement of their terms.

The Georgia Business Corporation

Code (the “GBCC”) also provides additional provisions which, if adopted by our board of directors, would further inhibit

certain unsolicited acquisition proposals.

Classified Board of

Directors. Our bylaws provide that our board of directors shall consist of not less than seven and not more than 15 members.

Our bylaws provide for a classified board of directors, divided into three classes, with each class consisting as nearly as possible

of one-third of the total number of directors, and with shareholders electing one class each year for a three-year term. Between

shareholders’ meetings, only our board of directors is permitted to appoint new directors to fill vacancies or newly created

directorships so that no more than the number of directors in any given class could be replaced each year and it would take three

successive annual meetings to replace all directors.

Shareholder Action

Through Written Consent. Our bylaws only provide for shareholder action by written consent in lieu of a meeting if all shareholders

entitled to vote on such action sign such consent.

Nominations to Board

of Directors. Our articles of incorporation and bylaws provide that nominations for the election of directors may be made by

our board of directors or any committee appointed by our board of directors or by any shareholder entitled to vote generally in

the election of directors. Our bylaws establish an advance notice procedure for shareholder nominations to our board of directors.

A shareholder may only make a nomination to our board of directors if he or she complies with the advance notice and other procedural

requirements of our bylaws and is entitled to vote on such nomination at the meeting.

Removal of Directors;

Board of Directors Vacancies. Our articles of incorporation provide that members of our board of directors may only be removed

for cause and then only with a vote of at least a majority of the outstanding shares entitled to vote in the election of directors.

Our bylaws further provide that only our board of directors may fill vacant directorships. These provisions would prevent a shareholder

from gaining control of our board of directors by removing incumbent directors and filling the resulting vacancies with such shareholder’s

own nominees.

Authorized But Unissued

Stock. The authorized but unissued shares of the common stock and preferred stock are available for future issuance without

shareholder approval. These additional shares may be used for a variety of corporate purposes, including future public offerings

to raise additional capital, corporate acquisitions and employee benefit plans. The existence of authorized but unissued and unreserved

shares of the common stock and preferred stock may enable our board of directors to issue shares to persons friendly to current

management, which could render more difficult or discourage any attempt to obtain control of us by means of a proxy contest, tender

offer, merger or otherwise, and thereby protect the continuity of our management.

Georgia “Fair

Price” Statute. Sections 14-2-1110 through 14-2-1113 of the GBCC (the “Fair Price Statute”), generally restrict

a company from entering into certain Business Combinations (as defined in the GBCC) with an interested shareholder unless:

| • | the transaction is unanimously approved by the continuing

directors who must constitute at least three members of the board of directors at the time of such approval; or |

| • | the transaction is recommended by at least two-thirds

(2/3) of the continuing directors and approved by a majority of the shareholders excluding the interested shareholder. |

Georgia “Business

Combination” Statute. Sections 14-2-1131 through 14-2-1133 of the GBCC (the “Business Combination Statute”),

generally restrict a company from entering into certain business combinations (as defined in the GBCC) with an interested shareholder

for a period of five (5) years after the date on which such shareholder became an interested shareholder unless:

| • | the transaction is approved by the board of directors

of the company prior to the date the person became an interested shareholder; |

| • | the interested shareholder acquires at least 90% of the

company’s voting stock in the same transaction (calculated pursuant to GBCC Section 14-2-1132) in which such person

became an interested shareholder; or |

| • | subsequent to becoming an interested shareholder, the

shareholder acquires at least 90% (calculated pursuant to GBCC Section 14-2-1132) of the company’s voting stock and

the business combination is approved by the holders of a majority of the voting stock entitled to vote on the matter (excluding

the stock held by the interested shareholder and certain other persons pursuant to GBCC Section 14-2-1132). |

The GBCC provides that

the restrictions set forth in the Fair Price Statute and the Business Combination Statute will not apply unless the bylaws of the

corporation specifically provide that these provisions of the GBCC are applicable to the corporation (and in certain other situations).

We have not elected to be covered by such statutes, but we could do so by action of ours board of directors, without a vote by

shareholders except as may be prohibited by law, at any time.

Transfer Agent and Registrar

The transfer agent and

registrar for the common stock is Computershare Investor Services.

LEGAL MATTERS

The validity of the shares

of common stock offered by this prospectus will be passed upon by Rogers & Hardin LLP, Atlanta, Georgia.

EXPERTS

The consolidated financial

statements of Ameris Bancorp appearing in its Annual Report on Form 10-K for the twelve months ended December 31, 2013, and the

effectiveness of its internal control over financial reporting as of December 31, 2013, have been audited by Porter Keadle Moore,

LLC, independent registered public accounting firm, as set forth in their report thereon, included therein, and incorporated herein

by reference. Such consolidated financial statements are incorporated herein by reference in reliance upon such reports given on

the authority of such firm as experts in accounting and auditing.

INCORPORATION OF

CERTAIN INFORMATION BY REFERENCE

The SEC allows us

to “incorporate by reference” information into this prospectus. This means that we can disclose important information

to you by referring you to other documents we have filed separately with the SEC, without actually including the specific information

in this prospectus or any prospectus supplement. The information incorporated by reference is consider to be part of this prospectus

and any applicable prospectus supplement, and information that we file later with the SEC will automatically update, and may supersede,

information in this prospectus and any prospectus supplement.

We incorporate by

reference the following documents that we have filed or may file with the SEC:

| • | Our Annual Report on Form 10-K for the year ended December 31, 2013, including the portions of

our Definitive Proxy Statement on Schedule 14A filed on April 17, 2014, and incorporated into that Form 10-K by reference; |

| • | Our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2014, June 30, 2014 and September

30, 2014; |

| • | Our Current Reports on Form 8-K filed on February 21, 2014 (except Item 7.01 thereof), March 11,

2014, March 25, 2014, June 2, 2014, June 4, 2014, June 12, 2014, June 25, 2014, July 1, 2014, September 29, 2014, November 19,

2014, December 18, 2014, January 29, 2015 (except Items 2.02 and 7.01 thereof) and January 30, 2015; |

| • | Our Current Report on Form 8-K/A filed on March 4, 2014; and |

| • | The description of the common stock contained under the caption “Description of Capital Stock”

found in our Preliminary Prospectus dated as of April 21, 1994, filed as part of our Registration Statement on Form SB-2 (Registration

No. 33-77930) with the SEC on April 21, 1994, and any amendments or reports filed for the purpose of updating such description. |

All documents filed

by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this filing of the registration

statement of which this prospectus forms a part until all of the common stock to which this prospectus relates has been sold or

the offering is otherwise terminated shall be deemed to be incorporated by reference in this prospectus and any accompanying prospectus

supplement and to be a part hereof from the date of filing of such documents, except in each case for information contained in

any such filing where we indicate that such information is being furnished and is not to be considered filed under the Exchange

Act.

You may request a

copy of any of the documents that we incorporate by reference into this prospectus, at no cost, by writing or telephoning us at

the following address or telephone number:

Ameris Bancorp

310 First St., S.E.

Moultrie, Georgia 31768

Attn: Corporate Secretary

(229) 890-1111

You may also access

the documents incorporated by reference into this prospectus by accessing our Investor Relations section of our website at www.amerisbank.com.

The other information and content contained on or linked from our website are not part of this prospectus or any prospectus supplement.

Any statements contained in a document incorporated by reference in this prospectus shall be deemed to be modified or superseded

for purposes of this prospectus to the extent that a statement contained in this prospectus (or in any other subsequently filed

document which also is incorporated by reference in this prospectus) modifies or supersedes such statement. Any statement so modified

or superseded shall not be deemed to constitute a part of this prospectus except as so modified or superseded.

WHERE YOU CAN FIND

MORE INFORMATION

We have filed with

the SEC a registration statement under the Securities Act with respect to the shares of common stock offered hereby. This prospectus

does not contain all of the information included in the registration statement and the exhibits and schedules thereto. You will

find additional information about us and the common stock in the registration statement. We are subject to the informational requirements

of the Exchange Act, and, in accordance therewith, we file reports and other information with the SEC. You may read and copy the

registration statement and the exhibits and schedules thereto, as well as other information that we file with the SEC, at the public

reference facilities maintained by the SEC at 100 F Street, N.E., Washington, DC 20549. You may obtain information on the operation

of the Public Reference Room by calling the Sec at 1-800-SEC-0330. The SEC also maintains a website at www.sec.gov that

contains information that registrants, including us, file electronically with the SEC. Statements made in this prospectus about

legal documents may not necessarily be complete and you should read the documents, which are filed as exhibits to the registration

statement or otherwise filed with the SEC. Our website address is www.amerisbank.com. The other information and content

contained on or linked from our website are not part of this prospectus or any prospectus supplement.

PART II

INFORMATION NOT REQUIRED

IN PROSPECTUS

Item

14. Other Expenses of Issuance and Distribution.