Automatic Data's Revenue Falls Short of Views

April 28 2016 - 10:27AM

Dow Jones News

By Austen Hufford

Automatic Data Processing Inc. on Thursday said revenue and

profit grew and reaffirmed its guidance, but results fell short of

Wall Street expectations.

ADP backed its previous growth guidance for revenue and

world-wide bookings, a key metric. For the fiscal year ending in

June, ADP said it now expects per-share earnings growth of 12%,

which its previous range bracketed.

Chief Executive Carlos Rodriguez said results were helped by

companies using its services to ensure compliance with the

Affordable Care Act.

For the quarter ended March 31, the company reported a profit of

$532.5 million, or $1.17 a share, up from $489.6 million, or $1.03

a share, a year earlier. Excluding discontinued operations,

earnings rose to $1.17 a share from $1.03 a share.

Total revenue rose 7.4% to $3.25 billion.

Analysts polled by Thomson Reuters had forecast earnings of

$1.18 a share on revenue of $3.27 billion.

World-wide new-business bookings grew 13%.

Revenue at the employer-services segment, the company's biggest

top-line contributor, rose 5% to $2.58 billion on a continuing

operations basis. The number of employees on its clients' payrolls

rose 2.5% in the U.S. on a comparable basis.

Revenue from professional-employer-organizations services unit,

which outsources administration services, jumped 16% to $866.3

million.

ADP shares fell 0.5% to $89.58 and are up 11% in the last three

months.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

April 28, 2016 10:12 ET (14:12 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

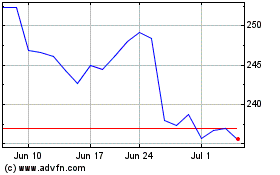

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Mar 2024 to Apr 2024

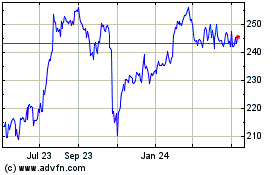

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Apr 2023 to Apr 2024