AutoNation Profit Slumps on Incentives, Hail Costs -- Update

April 22 2016 - 8:50AM

Dow Jones News

By Jeff Bennett

AutoNation Inc., the largest operator of automotive dealerships

in the U.S., reported a 14% drop in its first-quarter profit as a

slight uptick in incentives and costs associated with hail damage

weighed on results.

Chief Executive Mike Jackson said automotive retail sales have

plateaued as new vehicle purchases by consumers remained flat

year-over-year during the quarter despite auto makers boosting

their incentives by 14% compared with the same period a year

earlier.

Dealers have called on auto makers to take more proactive steps

to reduce small car production or face an incentive war that could

undermine the entire industry at a time when consumers are paying

more to buy higher-end sport-utility vehicles and pickup trucks.

General Motors Co., on Thursday, posted a $1.95 billion

first-quarter profit due in part to sales of pickup trucks and SUVs

in the U.S.

"If there had not been dramatic increases in incentives, there

would have been a decline in sales [during the first quarter] and,

by the way, incentives are reaching the danger level of almost 10%

of the asking price," Mr. Jackson said during an interview on CNBC

Friday morning.

For the quarter, AutoNation said net income dropped to $96

million, or 89 cents a share, compared with $112 million or 97

cents a share a year earlier.

The company's operating profit of 90 cents a share trailed

analyst expectations of 93 cents but included a 3-cent charge for

hail damage caused by storms in Texas and a 3-cent stock-based

compensation expense. Excluding those costs, the company generated

96 cents a share.

Revenue during the period came in at $5.12 billion, a 3.6%

increase over the same period a year earlier but trailing analyst

expectations of $5.29 billion.

AutoNation dealers handed out more manufacturer incentives,

driving costs of new vehicle sales up 2% to $2.65 billion. As a

result, the gross profit per new vehicle sold slipped 8% to

$1,888.

Separately, the company said it repurchased 7.9 million shares

of common stock for an aggregate purchase price of $371 million.

The company has $175 million remaining on its share repurchasing

authorization.

Investors sent shares down as much as 2.2%, or $1.05, to $47 in

premarket trading. AutoNation's stock has dropped more than 20%

since the start of the year when Mr. Jackson first warned the

industry that overall sales were slowing.

Industry forecasters still expect overall U.S. auto sales to

reach 17.8 million for 2016, marking a new milestone and breaking

last year's record of 17.5 million. The new level will be reached

by auto makers selling more of their vehicles to fleet

operators.

A fuller picture of the health of the automotive industry will

come into focus over the next week with Penske Automotive Group

Inc. set to deliver its results on Tuesday followed by Group 1

Automotive Inc. reporting sales on Wednesday.

Write to Jeff Bennett at jeff.bennett@wsj.com

(END) Dow Jones Newswires

April 22, 2016 08:35 ET (12:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

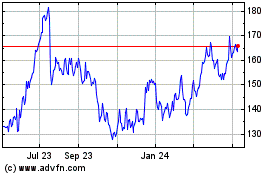

AutoNation (NYSE:AN)

Historical Stock Chart

From Mar 2024 to Apr 2024

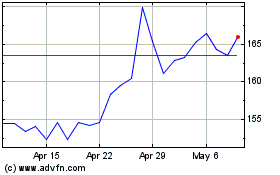

AutoNation (NYSE:AN)

Historical Stock Chart

From Apr 2023 to Apr 2024