By Jeff Bennett

Auto-parts makers with big exposure to the diesel-car market are

racing to salvage the technology's reputation in the wake of the

Volkswagen AG emissions-cheating scandal.

Shares of the parts makers, which include Tenneco Inc.,

BorgWarner Inc., Delphi Automotive PLC and Continental AG, were

pummeled last week following the Environmental Protection Agency's

disclosure that VW cheated for years on emissions tests of its

diesel-powered cars.

The parts industry's focus has shifted to defending the

viability of diesel technology amid concerns that betrayed

consumers or auto makers, which face tighter government scrutiny of

diesel, will turn their attention to hybrids and electric-powered

vehicles.

"You can't have an event like this without questions being

raised, but that doesn't mean the technology doesn't work," said

Terrence Hahn, chief executive of Honeywell International Inc.'s

$3.8 billion Transportation Systems unit.

"We have seen proven results around clean-diesel technology, and

we don't want what one auto maker has done to tarnish the industry

or the technology," Mr. Hahn said.

Wall Street wasn't convinced, however. Shares of Honeywell, a

major supplier of the turbochargers often used to make

diesel-powered cars peppier, fell 10 cents Friday to $93.52, down

about 5% from their close on Sept. 18. That was the day the EPA

accused VW of installing illegal software that sharply reduces

nitrogen-oxide emissions, but only when the cars are undergoing

strict emission tests.

VW later acknowledged its use of the software and issued an

apology.

The company promised to find a remedy to repair the 482,000 VW

diesel cars in the U.S. as soon as possible. On Sunday, it launched

the website vwdieselinfo.com to tell VW diesel owners about the

company's plans to fix their vehicles.

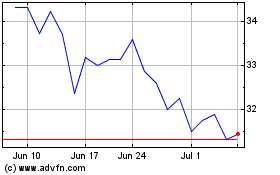

Shares of Tenneco, which makes emissions systems and gets 8% of

its revenue from VW, sank almost 8% last week, while those of

BorgWarner, which generates 17% of its revenue from the auto maker,

fell 6%, finishing the week at $40.

BorgWarner recently opened plants in Portugal and South Korea,

partly to produce more components used in starting diesel

engines.

Continental, a German supplier of engine components, also was

under pressure. Its stock lost nearly 6% of its market value last

week.

Closely held Robert Bosch GmbH, the German giant that supplied

the components now at the center of the emissions probe, has said

VW was responsible for how the parts were installed.

On Friday, the EPA indicated it would step up scrutiny of diesel

vehicles by overhauling the way it oversees the industry's

compliance with emissions standards.

The regulator sent a letter to auto makers saying that it will

conduct tests of 2015 and 2016 vehicles under normal driving

conditions, rather than accepting lab results, as it has done in

the past.

In the U.S., diesel engines are largely confined to heavier

trucks, with diesel-powered cars representing just a small part of

the passenger-car market. But diesel is dominant in Europe,

accounting for more than 50% of the passenger-car market in 2015,

according to Barclays.

Before the scandal broke, J.D. Power & Associates expected

diesel to expand to 7% of the U.S. light-vehicle market by 2017

from 3% this year.

Barclays analyst Brian Johnson suggests those growth

expectations need to change, both in the U.S. and Europe. And that

will squeeze some parts makers.

"Whatever the specifics that emerge from a VW investigation, we

believe strongly that the VW scandal will heighten the pressure on

diesel in Europe," he said in a research note last week.

"The end result of the VW issues will be to accelerate a move

away from diesel in the European mass market, pressuring suppliers

leveraged to diesel," Mr. Johnson said.

Mike Jackson, chief executive of AutoNation Inc., the largest

U.S. auto retailer, said it would tough to rebuild trust with

potential diesel buyers in the U.S. "It is another black eye for

diesel engines overall," he said.

Mr. Johnson of Barclays added that auto makers might need to

accelerate development efforts of electric vehicles, hybrid and

more-efficient gasoline engines.

That could help parts makers, since many of the same companies

will have to supply those component. But their investments in

diesel-powered cars could be lost if the industry shifts to those

alternatives.

Write to Jeff Bennett at jeff.bennett@wsj.com

Access Investor Kit for "Continental AG"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=DE0005439004

Access Investor Kit for "Volkswagen AG"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=DE0007664039

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 27, 2015 19:18 ET (23:18 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

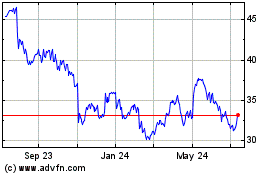

BorgWarner (NYSE:BWA)

Historical Stock Chart

From Mar 2024 to Apr 2024

BorgWarner (NYSE:BWA)

Historical Stock Chart

From Apr 2023 to Apr 2024