Australian Dollar Rises As Traders Focus On Greece Referendum

July 01 2015 - 1:29AM

RTTF2

The Australian dollar strengthened against the other major

currencies in the Asian session on Wednesday, as traders await this

weekend's Greece referendum on whether the nation should accept the

reform proposals by its international creditors.

The Greek referendum is scheduled on July 5.

Over last weekend, bailout negotiations between Greece and its

creditors broke down after Tsipras called for a referendum on the

country's bailout.

European leaders, including German Chancellor Angela Merkel and

French President Francois Hollande, have expressed their

willingness to continue the talks if there was a 'yes' vote in the

referendum. However, they also warned that a 'no' vote in the

referendum would mean Greeks are rejecting Europe and opting to

exit the Eurozone, dubbed the 'Grexit'.

The ECB is set to hold a Governing Council meeting today to

review the emergency funding assistance to Greek banks. The lender

had refused to raise the cap of its emergency liquidity assistance

on Sunday as the Eurogroup rejected any bailout extension a day

earlier.

Meanwhile, the Asian stock markets traded higher, as investors

were cautious after cash-strapped Greece became the only developed

country ever to fall into default after it missed a 1.6 billion

euro payment to the International Monetary Fund overnight.

Greece is now formally in arrears which has also been confirmed

by the IMF, even as fears emerge that the country might leave the

euro.

The currency showed muted reaction to the China PMI data.

Data from HSBC showed that China's manufacturing sector

contracted at a slightly slower pace in June, with the revised

manufacturing PMI at 49.4. That was a downward revision from last

month's preliminary reading of 49.6 but up from the 49.2 reading in

May.

Also, China's official manufacturing PMI released by the

National Bureau of Statistics showed that the manufacturing sector

continued its path of narrow expansion in June, with a

manufacturing PMI score of 50.2. That was unchanged from the May

reading.

The bureau also said that its services PMI came in with a score

of 53.8 in June, up from 53.2 in the previous month.

In other economic news, data from the Australian Bureau of

Statistics showed that the total number of building approvals in

Australia issued in May was up a seasonally adjusted 2.4 percent on

month in May, coming in at 19,414. That beat forecasts for an

increase of 1.2 percent following the 4.4 percent decline in

April.

On a yearly basis, building approvals jumped 17.6 percent - also

topping expectations for a gain of 14.4 percent following the 16.3

percent spike in the previous month.

Tuesday, the Australian dollar showed mixed trading against the

other major currencies. While the aussie rose against the U.S., the

New Zealand and the Canadian dollars, it held steady against the

yen and the euro.

In Asian trading today, the Australian dollar rose to nearly a

4-week high of 0.9663 against the Canadian dollar and a 2-day high

of 1.4394 against the euro, from yesterday's closing quotes of

0.9624 and 1.4445, respectively. If the aussie extends its uptrend,

it is likely to find resistance around 0.98 against the loonie and

1.41 against the euro.

Against the U.S. dollar and the yen, the aussie advanced to

5-day highs of 0.7737 and 94.79 from yesterday's closing quotes of

0.7702 and 94.36, respectively. On the upside, 0.79 against the

greenback and 96.00 against the yen are seen as the next resistance

level for the aussie.

Looking ahead, final June PMI reports for major European

economies are due to be released in the European session.

At 5:30 am ET, the Bank of England will publish the financial

stability report followed by Governor Mark Carney's news

conference, in London.

In the New York session, U.S. manufacturing PMI reports for

June, U.S. construction spending for May and weekly U.S. oil

inventories report are slated for release.

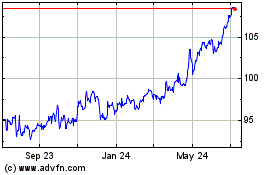

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Mar 2024 to Apr 2024

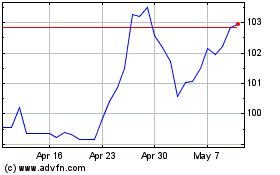

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Apr 2023 to Apr 2024