Australian Dollar Rises Ahead Of U.S. Jobs Data

March 06 2015 - 1:58AM

RTTF2

The Australian dollar strengthened against the other major

currencies in the Asian session on Friday, as traders await U.S.

jobs report, due later in the day.

The U.S. Labor Department is set to release jobs data for

February, due later. Economists expect the job growth to fall to

240, 000 in February from 257,000 in January, while the

unemployment rate is forecasted to drop 5.6 percent from 5.7

percent.

A strong reading could prompt the Federal Reserve to hike rates

soon.

Sentiment also improved after the European Central Bank detailed

its bond-buying program.

ECB President Mario Draghi revealed on Thursday that the bank

will purchase $66.3 billion worth of bonds each month beginning on

March 9 and expects the impact from it stimulus measures to return

inflation to the euro area next year. The central bank previously

indicated that the $1.1 trillion asset purchase program is expected

to continue until September of 2016.

At its monetary policy meeting, the ECB maintained its interest

rates unchanged for a fifth consecutive session. The ECB also

raised its forecast for European economic growth in 2015 to 1.5

percent from 1 percent.

Meanwhile, data from the Australian Industry Group showed that

the construction sector in Australia contracted at a faster pace in

February, with a Performance of Construction Index score of

43.9.

That's down significantly from 45.9 in January, and it moves

further beneath the boom-or-bust reading of 50 that separates

expansion from contraction. Overall, it's the fourth straight month

of decline.

Thursday, the Australian dollar showed mixed trading against its

major rivals. While the Australian dollar fell against the U.S.

dollar, the yen and the Canadian dollar, it rose against the euro

and the NZ dollar.

In the Asian trading today, the Australian dollar rose to an

8-day high of 1.0419 against the NZ dollar and a 2-day high of

0.9745 against the Canadian dollar, from yesterday's closing quotes

of 1.0388 and 0.9715, respectively. If the aussie extends its

uptrend, it is likely to find resistance around 1.05 against the

kiwi and 0.99 against the loonie.

Against the U.S. dollar, the yen and the euro, the aussie edged

up to 0.7812, 93.75 and 1.4112 from yesterday's closing quotes of

0.7781, 93.47 and 1.4169, respectively. On the upside, 0.80 against

the greenback, 95.49 against the yen and 1.39 against the euro are

seen as the next resistance levels for the aussie.

Looking ahead, the German industrial production for January is

due to be released at 2:00 am ET.

In the European session, Swiss CPI for February, U.K. BoE/GfK's

consumer inflation expectations for next 12 months and first

estimate of Eurozone fourth quarter GDP data are slated for

release.

In the New York session, U.S. jobs data for February, trade

balance and consumer credit - both for January and Canada trade

data for January are set to be published.

At 1:30 pm ET, U.S. Federal Reserve Bank of Dallas President

Richard Fisher will deliver a speech on "State of the Economy and

Farewell, Dallas" before a Dallas Regional Chamber luncheon.

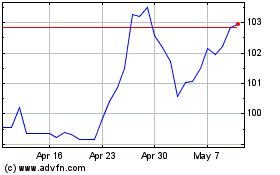

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Mar 2024 to Apr 2024

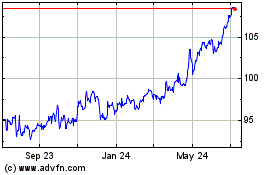

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Apr 2023 to Apr 2024