Australian Dollar Falls As Chinese Economic Growth Slows To 6-yr Low

April 15 2015 - 3:19AM

RTTF2

The Australian dollar declined against its major rivals on

Wednesday, as China's economy grew at the slowest pace in six years

in the first quarter, casting doubts over whether the nation could

attain its growth target in 2015.

Data from the National Bureau of Statistics showed that China's

gross domestic product expanded 7.0 percent on year in the first

quarter of 2015, coming in at 14,066.7 billion yuan.

The headline figure was in line with expectations while slowing

from 7.3 percent in the previous three months.

China's industrial production gained just 5.6 percent on year in

March - shy of forecasts for an increase of 7.0 percent and down

from 7.9 percent in February.

Retail sales advanced an annual 10.2 percent, also below

expectations for 10.9 percent and down from 11.9 percent in the

previous month. Sales were up or 0.71 percent on month.

China is Australia's biggest trading partner, and weak reports

from China could undermine Australia's trade prospectus.

The aussie traded in a mixed manner on Monday. While it fell

against the euro and the kiwi, it was up against the greenback and

the yen.

The aussie edged down to 1.4010 against the euro, from an early

high of 1.3916. The next possible support for the aussie is seen

around the 1.41 mark.

Reversing from early highs of 91.28 against the yen and 0.7631

against the greenback, the aussie weakened to 90.73 and 0.7579,

respectively. If the aussie extends slide, it may find support

around 90.00 against the yen and 0.75 against the greenback.

The aussie fell to 8-day lows of 0.9473 against the loonie and

1.0077 against the kiwi, from yesterday's closing values of 0.9514

and 1.0133, respectively. The aussie may possibly find downside

target around 0.94 against the loonie and 1.00 against the

kiwi.

Looking ahead, Eurozone trade data for February are due

shortly.

At 7:45 am ET, European Central Bank is scheduled to announce

its decision on interest rates. The bank is forecast to retain

refinancing rate at 0.05 percent. At 8:30 am ET, ECB President

Mario Draghi holds press conference.

In the New York session, Canada manufacturing sales for February

and existing home sales for March, as well as U.S. industrial

production for March, NAHB housing market index for April and

Federal Reserve's Biege book report are set for publication.

The Bank of Canada's interest rate announcement is due at 10:00

am ET. The bank rate is seen keeping on hold at 0.75 percent.

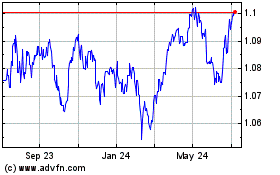

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2023 to Apr 2024