Australian Dollar Falls After China Manufacturing PMI

March 23 2015 - 11:20PM

RTTF2

The Australian dollar weakened against the other major

currencies in the Asian session on Tuesday, after data showed that

the manufacturing sector in China dipped into contraction territory

in March.

Data from HSBC Bank showed that the manufacturing sector in

China dipped into contraction territory in March, with a PMI score

of 49.2. That was well shy of forecasts for 50.5, and it was down

sharply from 50.7 in February.

Now at an 11-month low, the index also dipped below the

boom-or-bust line of 50 that separates expansion from

contraction.

The Australian dollar fell to 93.83 against the yen, 1.3930

against the euro and 1.0260 against the NZ dollar, from yesterday's

closing quotes of 94.32, 1.3889 and 1.0293, respectively.

Against the Canada and U.S. dollars, the aussie dropped to

0.9814 and 0.7836 from an early near 2-month high of 0.9880 and

nearly a 4-week high of 0.7901, respectively. At yesterday's close,

the aussie was trading at 0.9863 against the loonie and 0.7878

against the greenback.

If the aussie extends its downtrend, it is likely to find

support around 91.50 against the yen, 1.36 against the euro, 1.01

against the kiwi, 0.96 against the loonie and 0.75 against the

greenback.

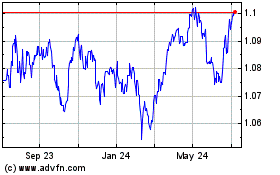

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2023 to Apr 2024