Australian Dollar Extends Decline Against Majors

January 23 2015 - 1:42AM

RTTF2

The Australian dollar continued its decline against its major

rivals in late Asian deals on Friday, as softening commodity prices

and the European Central Bank's announcement of quantitative easing

program raised expectations that Australia's central bank may

further ease interest rates from a record low.

The ECB on Thursday launched quantitative easing program of 1.1

trillion euros, consisting of the purchases of public and private

sector securities, which will start in March. Denmark last night

lowered its interest rate for the second time this week, to -0.35

percent, to offset the effect of the ECB's QE program.

The Bank of Canada unexpectedly cut its key lending rate to 0.75

percent on Wednesday in reaction plunging oil prices.

Australia's inflation data for the fourth quarter is due next

week. Plunging oil prices are expected to weigh on inflation,

giving the RBA room to cut rates further.

The Reserve Bank of Australia meets on February 3. Surprise rate

cuts from several central banks around the world have arise

speculation that the RBA might follow their suit.

The central bank's cash rate is at 2.5 percent.

The aussie hit a 9-day low of 94.66 against the yen, 3-day low

of 1.0656 against the kiwi and a 2-day low of 0.9892 against the

loonie, compared to yesterday's closing values of 95.08, 1.0694 and

0.9937, respectively. The next key support for the aussie is seen

around 92.5 against the yen, 1.05 against the kiwi and 0.975

against the loonie.

The aussie slipped to 0.7983 against the greenback, a level not

seen since July 2009. At Thursday's close, the pair was worth

0.8025. If the aussie extends slide, 0.78 is likely seen as its

next support level.

The aussie edged down to 1.4203 against the euro, from

yesterday's closing value of 1.4158. Continuation of the aussie's

downtrend may lead it to a support around the 1.45 zone.

Looking ahead, PMIs from major European economies are due in the

European session.

U.S. existing home sales and leading indicators for December and

Markit's manufacturing PMI for January, as well as Canada CPI for

December and retail sales for November are set for release in the

New York session.

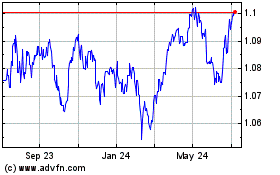

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2023 to Apr 2024