Australian, Canadian Dollars Fall On Oil Price Slide

October 19 2016 - 10:08PM

RTTF2

The Australian and the Canadian dollars weakened against their

major counterparts in the Asian session on Thursday, as the crude

oil prices fell after a strong rally in the previous day.

Crude for the December delivery is currently down 0.19 percent

or $51.63 per barrel.

The Organization of the Petroleum Exporting Countries (OPEC) is

scheduled to meet on November 30 to discuss about oil production

cut for stabilizing the oil market.

The oil prices rose on Wednesday, as official data confirmed

U.S. inventories fell unexpectedly last week. The U.S. Energy

Information Administration reported that domestic crude supplies

dropped by 5.2 million barrels in the week ended Oct. 14.

Saudi Arabia's oil minister Khalid al-Falih said certain

non-OPEC countries will join OPEC and Russia in curbing supplies,

also supported the investor sentiment.

The Australian dollar retreated against its major rivals, as

traders bet that the the Reserve Bank of Australia is likely to cut

its interest rates in November on the back of surprise drop in

jobs.

Data from the Australian Bureau of Statistics showed that the

the Australian economy lost 9,800 jobs last month, well shy of

expectations for an increase of 15,000 following the loss of 8,600

jobs in August. Full-time employment fell by 53,000 persons, while

part-time employment increased by 43,200 persons.

The unemployment rate in Australia was a seasonally adjusted 5.6

percent in September. That was beneath forecasts for 5.7 percent,

which would have been unchanged from the previous month following a

revision from 5.6 percent.

Wednesday, the Australian and the Canadian dollars showed mixed

trading against their major rivals. The aussie and the loonie rose

against the U.S. dollar and the yen. Against the yen, the aussie

held steady and the loonie fell.

In the Asian trading, the Australian dollar fell to 0.7677

against the U.S. dollar and 79.45 against the yen, from an early

more than a 2-month high of 0.7734 and a 2-day high of 80.01,

respectively. If the aussie extends its downtrend, it is likely to

find support around 0.75 against the greenback, and 78.00 against

the yen.

Against the euro and the Canadian dollar, the aussie dropped to

1.4290 and 1.0094 from an early near 1-1/2-year high of 1.4184 and

nearly a 1-year high of 1.0158, respectively. The aussie may test

resistance around 1.45 against the euro, and 0.99 against the

loonie.

The Canadian dollar fell to a 3-day low of 1.3146 against the

U.S. dollar and a 2-day low of 1.4425 against the euro, from

yesterday's closing quotes of 1.3114 and 1.4389, respectively. If

the loonie extends its downtrend, it is likely to find support

around 1.34 against the greenback and 1.47 against the euro.

Against the yen, the loonie dropped to 78.76 from yesterday's

closing value of 78.87. The loonie is likely to find support around

the 76.00 region.

Looking ahead, Swiss trade balance for and German PPI, both for

September, are due to be released at 2:00 am ET, respectively.

Eurozone current account data for August and U.K. retail sales

data for September are slated for release later in the day.

The European Central bank will announce its interest rate

decision at 7:45 am ET. The bank is forecast to keep its refi rate

at zero percent and the deposit rate at -0.4 percent.

Following the announcement, European Central Bank President

Mario Draghi will hold the customary post-meeting press

conference.

In the New York session, U.S. weekly jobless claims for the week

ended October 15, U.S. existing home sales data, leading

indicators, for September, and U.S. Philly Fed manufacturing index

for October are set to be published.

At 8:00 am ET, Bank of England Deputy Governor Nemat Shafik is

expected to participate in a panel discussion about reform in the

financial services industry at the Federal Bank of New York's

conference.

At 8:30 am ET, Federal Reserve Bank of New York President

William Dudley is scheduled to give welcome remarks at a conference

entitled "Reforming Culture and Behavior in the Financial Services

Industry: Expanding the Dialogue", in New York.

European Union leaders summit is due to be held in Brussels,

later in the day.

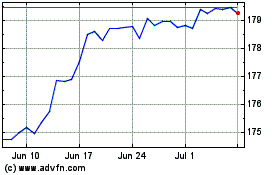

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Mar 2024 to Apr 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Apr 2023 to Apr 2024