Australian, Canadian Dollars Fall Amid Risk Aversion

October 26 2016 - 10:15PM

RTTF2

The Australian and the Canadian dollars weakened against their

major currencies in the Asian session on Thursday as the

risk-averse investors digested disappointing corporate earnings

results and the continued decline in crude oil prices. Crude oil

prices slipped on Wednesday after the American Petroleum Institute

or API reported that U.S. crude stocks rose by 4.8 million

barrels.

Concerns over whether OPEC would reduce its production at its

November meeting also weighed on the oil price demand. Russia and

OPEC are dragging their feet over a planned reduction in output

that would have helped to stabilize oil prices.

Interfax reports Russia is now against OPEC production cuts,

while Iraq and others say they should be exempt.

In other economic news, the Australian Bureau of Statistics

showed that export prices in Australia advanced 3.5 percent on

quarter in the third quarter of 2016. That beat forecasts for an

increase of 2.0 percent following the 1.4 percent gain in the

previous three months.

Import prices were down 1.0 percent on quarter versus

expectations for a 0.8 percent decline. They were unchanged from

the second quarter.

Data from the National Bureau of Statistics showed that China's

industrial profits grew only 7.7 percent year-on-year in September

after expanding 19.5 percent in August. The increase in August was

the fastest in three years.

Wednesday, the Australian dollar rose 0.70 percent against the

U.S. dollar, 0.37 percent against the yen, and 0.76 percent against

the euro. The Canadian dollar fell 0.10 percent against the U.S.

dollar, 0.02 percent against the yen, and 0.55 percent against the

euro

In the Asian trading, the Australian dollar fell to 2-day lows

of 0.7622 against the U.S. dollar and 1.4304 against the euro, from

yesterday's closing quotes of 0.7649 and 1.4256, respectively. If

the aussie extends its downtrend, it is likely to find support

around 0.75 against the greenback and 1.47 against the euro.

Against the yen, the Canadian, and the New Zealand dollars, the

aussie dropped to 79.56, 1.0206 and 1.0655 from yesterday's closing

quotes of 79.92, 1.0234 and 1.0690, respectively. The aussie may

test support near 77.00 against the yen, 0.99 against the loonie

and 1.05 against the kiwi.

The Canadian dollar fell to a 3-day low of 1.3395 against the

U.S. dollar, from yesterday's closing value of 1.3379. The loonie

may test support near the 1.35 region.

Against the yen and the euro, the loonie dropped to 77.89 and

1.4603 from yesterday's closing quotes of 78.08 and 1.4594,

respectively. If the loonie extends its downtrend, it is likely to

find support around 76.00 against the yen, and 1.48 against the

euro.

Meanwhile, the safe-haven yen recovered from early losses

against its major rivals on risk aversion.

The yen rose to 113.70 against the euro and 74.65 against the NZ

dollar, from early lows of 114.17 and 74.85, respectively. If the

yen extends its uptrend, it is likely to find resistance around

112.00 against the euro and 73.00 against the kiwi.

Against the pound, the U.S. dollar and the Swiss franc, the yen

advanced to 127.42, 104.30 and 104.93 from an early 9-day low of

128.14, a 2-day low of 104.69 103.00 and a 1-week low of 105.35,

respectively. The yen may test resistance around 125.00 against the

pound, 103.00 against the greenback and 103.00 against the

franc.

Looking ahead, Swiss UBS consumption indicator data for

September is due for release in the pre-European session at 2:00 am

ET.

Eurozone M3 money supply data for September and U.K. third

quarter GDP data are slated for release later in the day.

At 6.00 am ET, the Confederation of British Industry is

scheduled to release Distributive Trades survey results.

In the New York session, U.S. durable goods orders for

September, U.S. weekly jobless claims for the week ended October

22, and U.S. pending home sales data for September are set to be

published. At 1:00 am ET, European Central Bank board member Yves

Mersch is expected to speak at the Hachenburg Conference organised

by Hochschule der Deutschen Bundesbank in Hachenburg, Germany.

Later in the day, a number of EU commissioners and finance

ministers are scheduled to meet to discuss Brexit, migration and

economic growth at Globsec Tatra Summit in Bratislava.

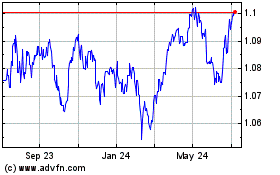

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2023 to Apr 2024