Australian Betting Firm Tabcorp Wagers on Lotteries in $4.9 Billion Deal

October 19 2016 - 1:20AM

Dow Jones News

SYDNEY—Australian betting firm Tabcorp Holdings Ltd. said

Wednesday it would buy gambling company Tatts Group Ltd., in a deal

that values it at around US$4.9 billion, a move designed to help

both companies fend off competition from online and offshore rivals

in a fast-changing market.

The acquisition, which would help Tabcorp diversify its revenues

with the addition of Tatts' lottery business, would create a

combined group valued at roughly 11 billion Australian dollars

(US$8.5 billion), the company said.

Tatts shareholders will receive 0.80 Tabcorp shares and 42.5

Australian cents (US$0.326) in cash for each share held in Tatts.

The implied value of A$4.34 per Tatts share is a 21% premium on the

company's closing price Monday, and including debt, values Tatts at

A$7.4 billion (around US$5.7 billion).

The deal "comes at a time of escalating competition from new

business models and rapid consolidation of gaming and wagering

companies globally," said Tatts Chairman Harry Boon. "The scale and

efficiency benefits from this combination will provide a stronger

platform in this dynamic environment."

Tabcorp Chairwoman Paula Dwyer said the deal creates a business

that is "well placed to invest, innovate and compete, both in

Australia and globally."

Both Tabcorp and Tatts run betting businesses, accepting wagers

from customers on events such as horse racing, but executives

described the takeover as complementary. Tabcorp derived 76% of its

revenue from betting in its most recent fiscal year, which ended

June 30, while Tatts derived just 21%, according to research from

Morgan Stanley. The bulk of Tatts' revenue, 72%, came from its

lottery business, and is viewed as more stable compared with

sports-betting, where online competitors have mounted a challenge

to Tabcorp's brick-and-mortar locations in pubs and clubs.

"The jewel in the crown here would be the lotteries business,

and that in our opinion does improve the diversity of earnings and

the stability of earnings," said Graeme Ferguson, director at

S&P Global Ratings in Melbourne. "It does provide [Tabcorp]

with somewhat of a buffer against some of the structural changes

[and] evolving landscape in the wagering business."

Overseas companies such as Ladbrokes PLC and William Hill PLC

have opened online betting platforms in Australia in recent years,

making it easier for Australians to bet online and forgo more

traditional retail betting. Tabcorp said in the most recent fiscal

year that wagering activity at its retail locations fell 1.1%,

though that was offset by a 12% increase on its digital

platforms.

The companies said they expect the tie-up to be completed in

mid-2017, subject to the approval of Tatts shareholders and the

Australian Competition and Consumer Commission, which is expected

to take a close look at the transaction.

Tabcorp and Tatts were in talks last year, but ultimately

decided against a merger at the time. Now, some investors are

cheering the long-awaited move. The companies said retirement fund

AustralianSuper, one of Tatts' largest shareholders, has signaled

it will vote in favor of the deal.

"It is a massive win for all shareholders," Matthew Felsman,

private wealth adviser at brokerage and investment bank APP

Securities, said in an email. "The company will be big enough to

fend off international competition," he also said.

The combined group also plans to complete a A$500 million share

buyback after the deal if it goes ahead.

Rebecca Thurlow contributed to this article.

Write to Mike Cherney at mike.cherney@wsj.com and Rhiannon Hoyle

at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

October 19, 2016 01:05 ET (05:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

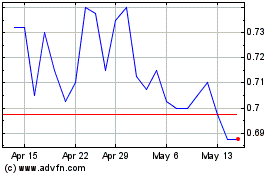

Tabcorp (ASX:TAH)

Historical Stock Chart

From Mar 2024 to Apr 2024

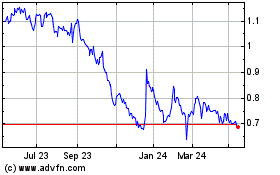

Tabcorp (ASX:TAH)

Historical Stock Chart

From Apr 2023 to Apr 2024