Australia, New Zealand Dollars Falls

January 26 2015 - 1:43AM

RTTF2

The Australia and New Zealand dollars fell against their major

currencies in the Asian session on Monday as traders speculate that

the sliding commodity prices and weak global demand may prompt the

Reserve Banks of Australia and New Zealand to reduce their interest

rates in near future.

The Reserve Bank of New Zealand will announce decision on

Thursday, while the the Reserve Bank of Australia meets next

week.

Australia's Q4 inflation results due to be released on Wednesday

are expected to be weaker than forecasts and will likely fuel

speculation of RBA rate cuts in 2015.

In other economic news, data from the Reserve Bank of New

Zealand showed that New Zealand's credit card spending fell 0.6

percent month-over-month in December after the 0.4 percent rise in

November. On a year-over-year basis, credit card spending advanced

4.5 percent, slower than the 5.1 percent increase in November.

Meanwhile, Asian stocks fell amid fears of a possible exit of

Greece from the eurozone, after the anti-austerity Syriza party

emerged victorious in the Greek snap elections.

The Australian and New Zealand markets are closed for the

Australia Day and Auckland Anniversary holidays, respectively.

Last Friday, the Australia and the New Zealand dollars traded

lower against the U.S. dollar and the yen. The Australian dollar

fell 1.57 percent against the U.S. dollar and 2.10 percent against

the yen. The NZ dollar fell 0.85 percent against the U.S. dollar

and 1.28 percent against the yen.

In the Asian trading today, the Australian dollar fell to 0.7857

against the U.S. dollar for the first time since July 2009. At

Friday's close, the aussie was trading at 0.7898 against the

greenback. If the aussie extends its downtrend, it is likely to

find support around the 0.71 area.

Against the yen and the Canadian dollar, the aussie slipped to

more than a 3-month low of 92.16 and a6-day low of 0.9780 from last

week's closing quotes of 93.08 and 0.9826, respectively. The aussie

may test support near 91.60 against the yen and 0.95 against the

loonie.

The aussie edged down to 1.4193 against the euro from Friday's

closing value of 1.4147. On the downside, 1.46 is seen as the next

support level for the aussie.

The NZ dollar fell to more than a 3-year low of 0.7404 against

the U.S. dollar and nearly a 3-month low of 86.83 against the yen

in the Asian trading today, from last week's closing quotes of

0.7438 and 87.75, respectively. If the kiwi extends its downtrend,

it is likely to find support around 0.72 against the greenback and

85.15 against the yen.

Against the euro, the kiwi edged down to 1.5066 from Friday's

closing value of 1.5009. On the downside, 1.55 is seen as the next

support level for the kiwi.

Looking ahead, the German IFO business climate index for January

is due to be released in the European session.

At 9:00 am ET, Eurozone finance ministers hold a meeting to

discuss a range of financial issues in Brussels.

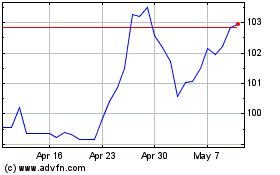

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Mar 2024 to Apr 2024

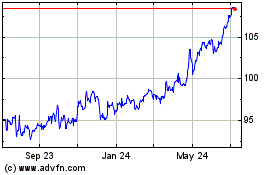

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Apr 2023 to Apr 2024