Australia, NZ Dollars Rise Amid Risk Appetite

October 04 2015 - 8:54PM

RTTF2

The Australian and the New Zealand dollars strengthened against

their major counterparts in the Asian session on Monday amid risk

appetite, as weaker than expected U.S. jobs data boosted

expectations that the Federal Reserve will delay raising interest

rates later this month.

In addition, higher commodity prices, which lifted resource

stocks, and hopes that a deal for the Trans Pacific Partnership may

soon be reached also boosted investor sentiment.

A report from the Labor Department on Friday showed that U.S.

non-farm payroll employment rose by 142,000 jobs in September, well

below economist estimates for an increase of about 203,000

jobs.

The lackluster jobs report also fueled speculation that the

timing of the initial rate hike by the Federal Reserve may be

pushed out to early 2016.

Meanwhile, crude oil prices rose, as Russia's energy minister

said on Saturday that the nation was prepared to meet other oil

producers to discuss the situation in the global oil market.

Additionally, a report showed that the U.S. oil rig count reduced

26 in the latest week, also supported the demand of oil.

Crude oil for November delivery are currently up $0.35 to $45.89

a barrel.

In other economic news, data from the Australian Industry Group

showed that the service sector in Australia expanded for the fourth

consecutive month in September, marking its longest period of

continuous growth since March 2008 . The AiG Australian Performance

of Services Index, or PSI, fell by 3.4 points to 52.3 in September

from 55.7 in August.

Traders now await the GlobalDairyTrade auction due later in the

day.

Last Friday, the Australian and the New Zealand dollars showed

mixed performance against their major rivals. The aussie and the

kiwi fell against the yen and the euro. Against the U.S. dollar,

the aussie held steady and the kiwi rose.

In the Asian trading, the Australian dollar rose to 4-day highs

of 0.7080 against the U.S. dollar and 84.93 against the yen, from

Friday's closing quotes of 0.7047 and 84.48, respectively. If the

aussie extends its uptrend, it is likely to find resistance around

0.73 against the greenback and 87.00 against the yen.

Against the euro and the Canadian dollar, the aussie edged up to

1.5877 and 0.9307 from last week's closing quotes of 1.5890 and

0.9266, respectively. The aussie may test resistance near 1.55

against the euro and 0.94 against the loonie.

Meanwhile, the Australian dollar fell to more than a 2-month low

of 1.0909 from Friday's closing value of 1.0928 and held steady

thereafter.

The NZ dollar rose to nearly a 6-week high of 0.6472 against the

U.S. dollar and nearly a 4-week high of 77.65 against the yen, from

Friday's closing quotes of 0.6436 and 77.27, respectively. If the

kiwi extends its uptrend, it is likely to find resistance around

0.66 against the greenback and 79.00 against the yen.

Against the euro, the kiwi edged up to 1.7364 from an early high

of 1.7420. This can be compared to an early 4-day high of 1.7355.

The kiwi may test resistance near the 1.68 region.

Meanwhile, the safe haven yen fell against its most major rivals

amid risk appetite.

In other economic news, data from Markit Economics showed that

the Japan's service sector growth slowed in September, as output

and new orders rose at slower rates. The services purchasing

managers' index, or PMI, dropped to 51.4 in September from August's

22-month high of 53.7.

Data from the Ministry of Health, Labor and Welfare showed that

the total labor cash earnings in Japan increased for the second

straight month in August, but at a slower pace than in the prior

month.

The yen fell to nearly a 2-week low of 123.71 against the Swiss

franc, from Friday's closing value of 123.29. The yen is likely to

find support around the 126.00 area.

Against the euro and the pound, the yen dropped to 5-day lows of

134.88 and 182.66 from last week's closing quotes of 134.32 and

181.97, respectively. If the yen extends its downtrend, it is

likely to find support around 137.00 against the euro and 187.00

against the pound.

Against the Canadian dollar, the yen slipped to a 2-week low of

91.40 from last week's closing quote of 91.12. The yen may test

support near the 92.50 region.

Looking ahead, services PMI reports from major European

economies for September and Eurozone retail sales data for August

are due to be released later in the day.

In the New York session, U.S. service sector PMI report and

labor market conditions index, both for September, are slated for

release.

Most Australian banks will be closed in observance of Labor Day

holiday. Also, the Chinese markets will be closed in observance of

National Day holiday.

At 9:00 am ET, euro group finance ministers will hold a meeting

in Brussels.

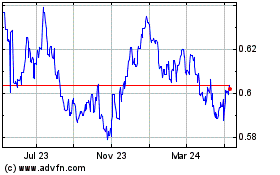

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Mar 2024 to Apr 2024

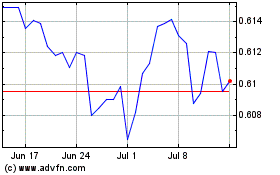

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Apr 2023 to Apr 2024