Australia Growth Data Raises Prospect Winning Streak Is Ending

December 06 2016 - 8:50PM

Dow Jones News

SYDNEY—Australia's economy recorded its first negative quarter

of growth since early 2011, raising the prospect that the longest

ongoing winning streak in the developed world may be coming to an

end.

Gross domestic product, the broadest measure of economic output,

fell 0.5% in the three months through September from the quarter

before. The resource-rich economy expanded 1.8% from a year

earlier, the slowest pace in more than three years. Economists

surveyed by The Wall Street Journal expected the economy to

contract by 0.1% from the previous quarter and grow by 2.2% from a

year earlier.

Australia has been enjoying the longest economic expansion in

the developed world today—25 years and counting. But the commodity

boom that underpinned its growth is ending. Other resource-reliant

economies are tumbling into recession. Resource companies have shed

thousands of workers as mining projects were completed, while

others were scrapped.

Some economists say a shift in investment away from mining and

into other industries such as services appears to have stalled.

Australian companies scaled back investment spending by 4.0% in the

three months through September compared with the previous

quarter.

"The transition towards non-mining investment is taking place at

a snail's pace," Capital Economics said in a recent note.

Most economists, and the country's central bank, think Australia

has headroom to avoid a recession.

"While a contraction will no doubt invite talk of a

recession…we, like the Reserve Bank of Australia, see growth

bouncing back again," Shane Oliver, Sydney-based chief economist at

AMP Capital Investors—one of Australia's biggest fund managers—said

ahead of Wednesday's growth data.

Still, cracks are appearing in the economy. While Australia's

jobless rate has fallen recently, many of the new jobs being

created are part-time positions in service jobs, such as cashiers

and baristas. That is contributing to the worst wage growth on

record and stubbornly low overall inflation, since wages are a

major business cost. The labor participation rate—the share of

Australians either working or actively looking for work—has slumped

to a decade low.

Meanwhile, record-low interest rates—currently at 1.5%—have

fanned a property investment boom, with high-rise apartments

sprouting up in previously downtrodden suburbs of big east coast

cities like Sydney. Foreign investors have played a major role in

driving up prices for everything from waterfront homes to cramped

studio apartments. Economists and the central bank now worry about

a possible glut of new apartments, which could weigh on prices and

hit borrowers who have taken on record high levels of debt.

At the same time, industries such as manufacturing—which once

supplied a steady stream of full-time jobs—have struggled to

rebound after the mining boom drove up the Australian dollar, which

made it costlier to produce goods locally.

U.S. food company General Mills Inc., which makes everything

from Betty Crocker cake mixes to Latina pasta sauces and Old El

Paso Mexican foods, recently said it would close one Australian

manufacturing plant, in Victoria state, and shift some production

to its Sydney factory.

General Mills is cutting as many as 600 jobs globally as it

struggles to boost sales, as customers shift to less-processed and

sugary foods. The company, which expanded its Mt. Waverley facility

in suburban Melbourne only three years ago, creating 40 new jobs,

said in a statement last month it was simplifying its supply chain

to "secure the future growth of the business."

A generation of Australians has grown up without the pain of

rising unemployment and widespread business failures. The last time

the country underwent a recession—commonly defined as two straight

quarters of contraction—was in the early 1990s, when interest rates

were raised to 18% to head off a credit boom. The country's jobless

rate peaked at 11.2%, double the current level.

Reserve Bank of Australia Gov. Philip Lowe said Tuesday the

economy was likely to slow in the final months of 2016 before

picking up again. Commodity prices have recovered recently

"providing a boost to national income," although they remain much

lower than they have been in recent years, Mr. Lowe said, as he

said official rates would remain unchanged for a fourth-straight

month.

Some economists are more pessimistic. Citi Research economists

said the central bank governor's remark Tuesday about growth

picking up again after slowing into the year's end is "very much a

forecast."

"The sharper-than-expected slowdown may be temporary, but

equally it may not," Citi said in a note ahead of the GDP data.

Write to Rachel Pannett at rachel.pannett@wsj.com

(END) Dow Jones Newswires

December 06, 2016 20:35 ET (01:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

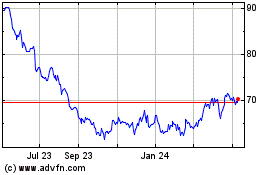

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

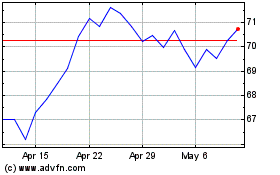

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024