Aussie Gains As Australia Core CPI Rises Unexpectedly

January 28 2015 - 12:14AM

RTTF2

The Australian dollar strengthened against the other major

currencies in the Asian session on Wednesday after the nation's

core inflation rose more-than-expected for the fourth quarter,

dashing expectations for a near-term rate cut.

The Reserve Bank of Australia's trimmed mean was up 0.7 percent

on quarter and up 2.2 percent on year in the fourth quarter, while

the weighted median added 0.7 percent on quarter and 2.3 percent on

year.

Meanwhile, data from the Australian Bureau of Statistics showed

that consumer prices in Australia were up just 1.7 percent on year

in the fourth quarter of 2014. That was below forecasts for 1.8

percent, and down from 2.3 percent in the third quarter. On a

quarterly basis, inflation added just 0.2 percent versus forecasts

for 0.3 percent rise and down from 0.5 percent increase in the

previous three months.

Traders pared bets on a surprise interest rate cut in the

monetary policy meeting scheduled for February 3, in response to

the slightly higher than expected underlying inflation figure.

Markets await the Federal Reserve Open Market Committee meeting

for its latest monetary policy decision at 2:00 pm ET. Although the

Federal Reserve is expected to hike rates in the middle of 2015,

markets will be watching for any forward guidance on when the

tightening will begin and keep a close eye on any changes to the

accompanying statement.

Tuesday, the aussie rose 0.50 percent against the U.S. dollar,

2.08 percent against the yen and 0.40 percent against the Canadian

dollar.

In the Asian trading today, the Australian dollar rose to a

6-day high of 1.0745 against the NZ dollar, from an early 2-day low

of 1.0614. At yesterday's close, the aussie was trading at 1.0642

against the kiwi. If the aussie extends its uptrend, it is likely

to find resistance around the 1.08 area.

Against the U.S. and the Canadian dollars, the aussie advanced

to 5-day highs of 0.8008 and 0.9942 from early 2-day lows of 0.7899

and 0.9799, respectively. At yesterday's close, the aussie was

trading at 0.7935 against the greenback and 0.9831 against the

loonie. The aussie may test resistance near 0.82 against the

greenback and 1.00 against the loonie.

The aussie, which ended yesterday's deals at 93.52 against the

yen, strengthened to a 5-day high of 94.45. On the upside, 98.00 is

seen as the next resistance level for the aussie.

The aussie edged up to 1.4171 against the euro, from an early

6-day low of 1.4366. The pair closed yesterday's trading at 1.4337.

The aussie is likely to find resistance around the 1.39 area.

Looking ahead, German GfK consumer confidence index for February

and import price index for December are due to be released at 2:00

am ET.

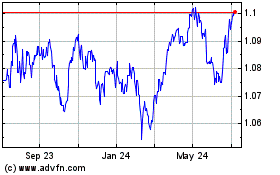

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2023 to Apr 2024