Aussie Drops As Weak Capex Data Fans Rate Cut Hopes

February 25 2015 - 11:48PM

RTTF2

The Australian dollar weakened against the other major

currencies in the Asian session on Thursday, as the weak

fourth-quarter private capex data led to speculation of an interest

rate cut next week.

Data from the Australian Bureau of Statistics showed that the

total private capital expenditure in Australia was down a

seasonally adjusted 2.2 percent on quarter in the fourth quarter of

2014, coming in at A$37.465 billion. This was steeper than the 1.6

percent drop expected by economists.

This has reinforced expectations among the markets that the

Reserve Bank of Australia could cut March cash rate again at its

next week's monetary policy meeting.

The Australian stock markets were also lower. The Australia's

benchmark S&P/ASX 200 index is currently down 39.30 points or

0.66 percent at 5,905. The broader All Ordinaries index is also

currently down 35.10 points or 0.59 percent at 5,873.

Wednesday, the Australian dollar rose against the other major

currencies on better-than-expected Chinese manufacturing data. The

Australian dollar rose 0.81 percent against the U.S. dollar, 0.79

percent against the yen, 0.51 percent against the euro and 0.02

percent against the NZ dollar.

In the Asian trading today, the Australian dollar fell to a

6-day low of 0.9748 against the Canadian dollar, from yesterday's

closing value of 0.9803. The aussie is likely to find support

around the 0.95 area.

The aussie dropped to 2-day lows of 1.4501 against the euro and

1.0378 against the NZ dollar, from yesterday's closing quotes of

1.4403 and 1.0430, respectively. If the aussie extends its

downtrend, it is likely to find support 1.49 against the euro and

1.02 against the kiwi.

Against the U.S. dollar and the yen, the aussie edged down to

0.7835 and 93.28 from yesterday's closing quotes of 0.7885 and

93.72, respectively. On the downside, 0.76 against the greenback

and 90.40 against the yen are seen as the next support levels for

the aussie.

Looking ahead , the German GfK consumer sentiment index for

March is due to be released at 2:00 am ET.

Switzerland's fourth quarter industrial production, the German

unemployment rate for February, Eurozone business climate index,

economic sentiment index -both for February and M3 money supply for

January and second estimate of U.K.'s fourth quarter GDP and index

of services for December are set to be published.

In the New York session, Canada and U.S. CPI for January, U.S.

house price index for December, durable goods orders for January

and U.S. weekly jobless claims for the week ended February 21 are

slated for release.

At 12:30 am ET, Bank of England Deputy Governor Nemat Shafik

will deliver a speech at the University of Warwick, in

Coventry.

After half-an-hour, U.S. Federal Reserve Bank of Atlanta

President Dennis Lockhart is expected to speak about economic

outlook and monetary policy at the Federal Reserve's 2015 Banking

Outlook Conference, in Atlanta. Subsequently, U.S. Federal Reserve

Bank of Dallas President Richard Fisher will give a lecture on

"Reflections on 10 Years at the Fed: Through the Financial Crisis"

at event hosted by the Imperial College of London Brevan Howard

Centre for Financial Analysis & the Centre for Economic Policy

Research in London, England at 1:15 pm ET.

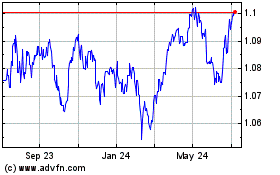

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2023 to Apr 2024