TIDMAURR

RNS Number : 1816Z

Aurora Russia Limited

09 December 2014

8 December 2014

Aurora Russia Limited ("Aurora Russia" or the "Company")

Results for the six months ended 30 September 2014

-- Performance in the underlying companies has been impacted by

tough trading conditions and the deterioration in the value of the

Rouble.

-- The environment for selling the portfolio companies is

difficult, but the Board is reviewing options for obtaining value

for shareholders.

Financial highlights

-- Net asset value per share as at 30 September 2014 of 24.4

pence per share (Net asset value GBP10.9 million) down from 27.9

pence per share.

-- Cash and cash equivalents as at 30 September 2014 were GBP2.29 million.

Portfolio highlights

Unistream Bank

-- Net revenues for the nine month period ended 30 September

2014 were RUR2.1 billion, up 16.2% year-on-year.

-- Profit before tax for the nine months to 30 September 2014

was RUR56.3 million, down from RUR71.3 million for the same period

last year.

-- Equity valuation of Aurora Russia's stake in Unistream at 30

September 2014 was GBP8.4million, compared to the valuation at 31

March 2014 of GBP8 million.

Superstroy

-- Net sales for the nine month period ended 30 September 2014

were RUR6.8 billion, down 4.8year on year.

-- Gross profit for the nine months to 30 September 2014 was

RUR1.75 billion, down from RUR2.04 billion for the same period last

year.

-- Equity valuation of Aurora Russia's stake in Superstroy at 30

September 2014 was GBP280,000, compared to the valuation at 31

March 2014 of GBP1.8 million.

Commenting, Gilbert Chalk, Chairman of Aurora Russia, said:

"The Board will continue to monitor closely the performance of

the investee companies and seek exits from its investments. Clearly

in the case of Superstroy the immediate priority is to achieve a

turnaround in the Company's trading performance. In the case of

Unistream, the current trading and overall environment is not the

most favourable, but Unistream has performed well in current

circumstances and has a strategic position in the money

transmission market. The Board with the assistance of the

Investment Advisor will continue to work in conjunction with

Unistream's majority owners to achieve a sale of this investee

company at a price that reflects its strategic value.

The Board remains determined to achieve value for shareholders

through sales of the Company's investments as trading and market

conditions allow."

Enquiries:

Aurora Russia Limited

Gilbert Chalk +44 (0)7768 527973

Numis Securities Limited

Nominated Advisor: Hugh Jonathan +44 (0)20 7260 1000

Corporate Broking: Rupert Krefting /

Nathan Brown

Chairman's Statement

Introduction

The results of Aurora Russia Limited ('the Company' or 'Aurora

Russia') for the 6 months ended 30 September 2014 are presented

below.

The last six months have been a period of transition,

rationalisation and change against a difficult market backdrop at

both the macro and micro level.

The Annual General Meeting ('AGM')

I would like to take this opportunity to thank our shareholders

for their support at the AGM on 24 September 2014 for voting in

favour of all of the resolutions put forward, including the re-

appointment of me and Tim Slesinger.

Review

In April the Board achieved and completed the sale of the

non-cash mortgage assets held by Kreditmart Finance Limited ('KFL')

for a total consideration of RUR100 million (approximately GBP1.7

million) plus $450,000 (approximately GBP267,500), which was KFL's

cash balance at the time of the transaction. KFL's non-mortgage

cash assets were previously transferred from Flex Bank to KFL at a

nominal value of RUR144 million (approximately GBP2.4 million). The

Board agreed to the sale at a discount in the light of the then

current Russian market for banking assets and the difficult nature

of the portfolio, which will have only deteriorated further since

this sale.

Following this latter sale and the earlier sale in March of

Flexinvest Bank, the Board announced in May a second tender offer

to shareholders for an aggregate gross consideration of GBP8.28

million. This, together with the earlier tender offer of GBP20.11

million in May 2013, brings the total proceeds returned to

shareholders in the last 18 months to some GBP28.39 million.

Since completing negotiations on 20 June, the Board has been

working closely with the Company's new Investment Advisor, Nicholas

Henderson-Stewart, on getting to grips with the trading performance

of the Company's two residual investments and working with the

investee companies' shareholders and management to try to optimise

each company's performance in poor trading conditions and position

them best for when sales of the companies can be achieved.

As the Investment Advisor's Report highlights and as is

generally well known, the overall trading and investment

environment in Russia has been and remains difficult as a result of

Western sanctions and the fall in the oil price.

This has not assisted either the trading performance of the

investee companies or the environment for achieving a sale of the

Company's assets at realistic and acceptable prices. That said,

Unistream has performed well in a highly competitive market and is

a key player in its market. The Board and the majority shareholders

are determined that Unistream's market position and strength be

recognised at whatever juncture that Unistream may be sold.

In the case of Superstroy, an already difficult retail backdrop

has deteriorated further over the last six months for the reasons

cited and this has not made the management's task of restructuring

the business any easier. As highlighted in the Investment Advisor's

report, Superstroy twice changed senior management in the last six

months as it sought to implement its restructuring strategy.

Recovery of value will require convincing Superstroy's lenders that

it has the right strategy and the capability to implement the

necessary changes. This is the clear priority in the short and

medium term. A sale is unlikely to be feasible until there are

tangible signs of improvement in performance and the overall market

backdrop at least stabilises.

As the Investment Advisor indicates, the Russian economy

initially proved more resilient than might have been expected in

the face of Western sanctions and the fall in the oil price.

However, sentiment has deteriorated since 30 September and it is

not possible to forecast when the situation might turn more

positive.

Results

For the 6 months to 30 September 2014, Aurora Russia recorded a

loss of GBP1,535,000 or 2.82 pence per share, calculated based on

the unaudited condensed half year's statement of comprehensive

income. The net asset value ('NAV') of the Company as at 30

September 2014 was GBP10.87 million or 24.4 pence per share. This

decline in value is derived from the reasons set out above and in

the Investment Advisor's report.

Direct administration and operating expenses of the Company for

the 6 months amounted to GBP371,000. This compares to GBP684,000 in

the same period of the last financial period and reflects the lower

ongoing cost base following the termination of the contract with

the previous manager and the cutting of other direct costs by the

Board. Cash balances as at 30 September 2014 stood at GBP2.29

million.

Investments

The Company has two remaining investments:

- 24.3% of Superstroy, one of the leading DIY retailers in the Urals region of Russia.

- 26.0% of Unistream Bank, a leading Russian money transfer company.

Portfolio Valuation

A valuation of the investment portfolio was performed as at 30

September 2014, resulting in a decrease in value from GBP9.8

million to GBP8.7 million on a like for like basis. This interim

valuation, recommended by the Valuation Committee of the Board, was

prepared by the Investment Advisor in Moscow and formally adopted

by the Board on 8 December 2014. This valuation was prepared for

accounting purposes only and is in accordance with the

International Private Equity and Venture Capital Board's ('IPEV')

valuation guidelines.

The resultant valuations of investments included in the

Company's financial statements will not necessarily reflect the

market value that a third party would be prepared to pay for these

businesses. The current valuation of Aurora Russia's portfolio

reflects changes to the previous valuation performed as at 31 March

2014 as follows:

--As indicated above and in the Investment Advisor's report,

Superstroy was very seriously affected by the economic downturn,

the arrival of international competitors in its core Urals market

and a revenue growth strategy adopted at the expense of a focus on

store formatting and building a coherent offering and

profitability. As a result the value of the Company's stake in

Superstroy decreased from GBP1.8 million (based on comparable

multiples) in March 2014 to GBP280,000 (based on an adjusted NAV

valuation basis). Please note the change in valuation methodology

in relation to Superstroy. In the current circumstances, it is

likely going to be difficult for Superstroy's management to achieve

a rapid turnaround in its fortunes.

Unistream performed relatively well in the face of challenging

market conditions. The value of the Company's stake grew by

GBP400,000 to GBP8.4 million (based on comparable multiples) or +5%

since March 2014.

Other reasons for each change in the valuations are covered in

the Investment Advisor's report. These include currency translation

effects caused by unfavourable movements in the Sterling / Rouble

exchange rate of approximately 10%. Since 30 September, the

Sterling / Rouble exchange rate has deteriorated by some further

30%. If this deterioration persists, it will impact the portfolio

valuation at the March 2015 year end.

Outlook

The Board will continue to monitor closely the performance of

the investee companies and seek exits from its investments. Clearly

in the case of Superstroy the immediate priority is to achieve a

turnaround in the Company's trading performance. In the case of

Unistream, the current trading and overall environment is not the

most favourable, but Unistream has performed well in current

circumstances and has a strategic position in the money

transmission market. The Board with the assistance of the

Investment Advisor will continue to work in conjunction with

Unistream's majority owners to achieve a sale of this investee

company at a price that reflects its strategic value.

The Board remains determined to achieve value for shareholders

through sales of the Company's investments as trading and market

conditions allow.

Gilbert Chalk

Chairman of the Board

Aurora Russia Limited

8 December 2014

Investment Advisor's Report

Overview

The economic sanctions imposed on Russia as a result of the

Ukraine crisis along with the 25% fall in oil prices since July

2014 have weakened the Russian economy and led to a 10% drop in the

Sterling / Rouble exchange rate over the March to September 2014

period. Despite these challenging conditions Russia's economy has

demonstrated some resilience. GDP grew 0.7% year on year ("y-o-y")

during the first three quarters of 2014. We expect these

challenging conditions to continue in the near future and GDP is

expected to contract by up to 1% in 2015. All the same Russia's

positive fiscal balance and strong foreign currency reserves will

ensure a measure of economic stability.

Trading Updates

Superstroy

Superstroy was strongly affected by the 2013 economic slowdown,

which accelerated in 2014 as consumers cut down on non-essential

purchases. While the company's 2014 YTD revenue in Ruble terms

remains in line with the budget the company's gross margins

underperformed strongly as the challenging economic environment

made it difficult to pass on any price increases to the market

while cost of goods sold increased steadily due to the Ruble

devaluation. The company's poor performance was also compounded by

the fact that inventories were significantly built up during 2013

to prepare for future growth and massive discount sales had to be

organized to bring inventory levels under control. The competitive

environment in the Urals has also worsened in the last few years

with the arrival of International DIY chain Leroy Merlin, which

entered the Urals market and has opened a number of stores in the

region's larger cities. In the last few months Superstroy changed

senior management as it sought to implement a restructuring

strategy. The company's long standing Commercial Director has now

been appointed as Chief Executive Officer.

For the year to 30 September 2014, Superstroy's management

accounts showed net sales of RUR6.8 billion (GBP106.2 million) down

4.8% y-o-y. Retail sales dropped 4.7% y-o-y to RUR5.0 billion

(GBP78.4 million) and wholesale sales dropped 14.2% y-o-y to RUR1.6

billion (GBP25.1 million) as new management cut down on very low

margin wholesale sales. Nine months 2014 gross profit of RUR1.75

billion (GBP29.5 million, using average exchange rate for the

period) was down from gross profit of RUR2.04 billion (GBP39.7

million) during the same period last year, gross margin dropping 3%

y-o-y to 26.1%.

The equity valuation of the Company's stake in Superstroy at 30

September 2014 was marked down to

GBP280k, a decrease of 84.44% on the valuation as at 31 March

2014 of GBP1.8 million. Please note the change in valuation

methodology in relation to Superstroy. It is going to be difficult

for Superstroy to achieve a rapid turnaround in its fortunes in the

current circumstances.

Unistream

Besides challenging economic conditions that affected

Unistream's core market of migrants sending remittances to their

home countries, Unistream also faced a tough competitive and

regulatory environment in 2014. Key competitors continued to drop

commission prices on cash transfers and strict new government

regulations were implemented in early 2014 to crack down on

transfers of undeclared cash. Unistream has reacted well to this

challenging environment by expanding volume through its own

networks by 15% y-o-y and doubling partner network volumes in the

same period. A number of strong partnership deals were signed in

2014 notably with three large domestic financial institutions. All

three have excellent networks and are helping to drive top-line

growth. In addition Unistream continued to develop new products and

revenue streams in 2014. In particular the company launched a

number of cash desks specializing in foreign currency exchange,

which have performed strongly since their launch in November

2013.

Unistream has shown solid top-line growth in 2014. Management

accounts show transfer volumes for the 3 quarters of 2014 of

RUR153.3 billion (approximately GBP2.58 billion using average

exchange rate), up 30% y-o-y. Net revenues grew 16.2% to RUR2.1

billion (GBP35 million using average exchange rate) for the same

period. Profit before tax for the first three quarter of the year

was RUR56.3 million (GBP0.95 million using average exchange rate)

down 21% from RUR71.3 million (GBP1.36 million) for the same period

in 2013. The lower rise in revenues and the profit fall is due to

continued contraction of margins on Unistream's core money transfer

business, mainly as a reaction to the competitive environment.

The equity valuation of the Company's stake in Unistream at 30

September 2014 was marked up to GBP8.4 million, an increase of 5%

on the valuation as at 31 March 2014 of GBP8.0 million due to

higher excess cash balance and rising revenues countering the drop

in the GPB/RUR exchange rate.

Conclusion

I will continue to work closely with the Board to achieve its

stated objectives of realising the Company's investments at prices

which reflect their value as and when market and trading conditions

allow.

Independent Review Report to Aurora Russia Limited

We have been engaged by the Company to review the unaudited

condensed half year financial statements for the six months ended

30 September 2014 which comprise the unaudited condensed half year

statement of comprehensive income, the unaudited condensed half

year statement of financial position, the unaudited condensed half

year statement of changes in equity, the unaudited condensed half

year statement of cash flows and related explanatory notes. We have

read the other information contained in the interim report and

considered whether it contains any apparent misstatements or

material inconsistencies with the information in the unaudited

condensed half year financial statements.

This report is made solely to the Company, in accordance with

the terms of our engagement letter dated 27 October 2014. Our work

has been undertaken so that we might state to the Company those

matters we are required to state to them in an independent review

report and for no other purpose. To the fullest extent permitted by

law, we do not accept or assume responsibility to anyone other than

the Company, for our review work, for this report, or for the

conclusions we have reached.

Directors' responsibilities

The interim report and unaudited condensed half year financial

statements is the responsibility of, and has been approved by, the

Directors. The Directors are responsible for preparing the half

year financial report in accordance with the AIM Rules of the

London Stock Exchange.

As disclosed in note 2, the annual financial statements of the

Company are prepared in accordance with International Financial

Reporting Standards ('IFRS') issued by International Accounting

Standards Board. The unaudited condensed half year financial

statements included in this half year financial report have been

prepared in accordance with International Accounting Standard 34,

"Interim Financial Reporting".

Our responsibility

Our responsibility is to express to the Company a conclusion on

the unaudited condensed half year financial statements in the half

year financial statement based on our review.

Scope of review

We conducted our review in accordance with International

Standards on Review Engagements (UK and Ireland) ISRE 2410, 'Review

of Interim Financial Information Performed by the Independent

Auditor of the Entity' issued by the Auditing Practices Board for

use in the United Kingdom. A review of interim financial

information consists of making enquiries, primarily of persons

responsible for financial and accounting matters, and applying

analytical and other review procedures. A review is substantially

less in scope than an audit conducted in accordance with

International Standards on Auditing (UK and Ireland) and

consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the unaudited condensed half year

financial statements for the six months ended 30 September 2014 are

not prepared, in all material respects, in accordance with

International Accounting Standard 34 and the AIM Rules of the

London Stock Exchange.

KPMG Channel Islands Limited

Glategny Court

Glategny Esplanade

St Peter Port

Guernsey

GY1 1WR

Date: 8 December 2014

a) The maintenance and integrity of the Aurora Russia Limited

website is the responsibility of the directors; the work carried

out by the auditors does not involve consideration of these matters

and, accordingly, the auditors accept no responsibility for any

changes that may have occurred to the financial statements or

review report since they were initially presented on the

website.

b) Legislation in Guernsey governing the preparation and

dissemination of financial statements may differ from legislation

in other jurisdictions.

Unaudited Condensed Half Year Company Statement of Comprehensive

Income

For the 6 month period 1 April 2014 to 30 September 2014

1 April 2014 1 April 2013

to 30 September to 30 September

2014 2013

Notes GBP'000 GBP'000

Deferred consideration written off - (810)

Loss on sale of investments (20,675) -

Revenue 6 11

---------------- ------------------------

- Interest 6 11

---------------- ------------------------

Administration and operating expenses 3 (371) (684)

Fair value movements on revaluation

of investments 4 19,506 (9,100)

Exchange losses (1) (237)

Operating loss before tax (1,535) (10,820)

---------------- ------------------------

Income tax expense - -

Total comprehensive loss for the

period (1,535) (10,820)

================ ========================

Basic and diluted loss per share (2.82p) (13.42p)

================ ========================

All items in the above statement derive from continuing

operations.

The accompanying notes on pages 11 to 20 form an integral part

of these financial statements.

Unaudited Condensed Half Year Company Statement of Financial

Position

As at 30 September 2014

30 September 31 March

2014 2014

Notes GBP'000 GBP'000

Non-current assets

Investment in subsidiaries at fair

value through profit and loss 4 - 1,968

Investments at fair value through

profit and loss 4 8,680 9,800

8,680 11,768

------------------- ---------

Current assets

Other receivables 8 3

Cash and cash equivalents 2,288 9,136

------------------- ---------

2,296 9,139

------------------- ---------

Total assets 10,976 20,907

------------------- ---------

Current liabilities

Other payables 102 219

Total liabilities 102 219

------------------- ---------

Total net assets 10,874 20,688

=================== =========

Equity

Share capital 6 699 743

Special reserve 6 56,096 64,331

Accumulated loss (45,921) (44,386)

------------------- ---------

Total equity 10,874 20,688

=================== =========

Total equity and liabilities 10,976 20,907

------------------- ---------

Net asset value per share - basic

and diluted 24.4p 27.9p

=================== =========

The accounts on pages 7 to 20 were approved by the Board of

Directors on 8 December 2014 and signed on its behalf by:

Jonathan Bridel Gilbert Chalk

Director: Director:

Date: 8 December 2014

The accompanying notes on pages 11 to 20 form an integral part

of these financial statements.

Unaudited Condensed Half Year Statement of Changes in Equity

For the 6 month period 1 April 2014 to 30 September 2014

(Accumulated

loss)/

Share Special Retained

Capital Reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000

Balance as at 1 April 2013 1,125 84,073 (24,006) 61,192

Total comprehensive loss for the

period

Loss for the period - - (10,820) (10,820)

Share buyback - NUMIS (382) (19,742) - (20,124)

At 30 September 2013 743 64,331 (34,826) 30,248

========= ========= ============= =========

Balance as at 1 April 2014 743 64,331 (44,386) 20,688

Total comprehensive loss for the

period

Loss for the period - - (1,535) (1,535)

Share buyback - NUMIS (44) (8,235) - (8,279)

At 30 September 2014 699 56,096 (45,921) 10,874

========= ========= ============= =========

The accompanying notes on pages 11 to 20 form an integral part

of these financial statements.

Unaudited Condensed Half Year Statement of Cash Flows

For the 6 month period 1 April 2014 to 30 September 2014

1 April 2014 1 April 2013

to 30 September to 30 September

Notes 2014 2013

Cash flows from operating activities GBP'000 GBP'000

Total comprehensive loss (1,535) (10,820)

Adjustments for movements in working

capital:

(Increase)/decrease in operating

trade and other

Receivables (5) 3,766

Decrease in operating trade and

other

payables (117) (790)

Adjust for:

Revaluation of investments 4 (19,506) 9,100

Exchange losses 1 237

Loss on disposal of Kreditmart

Finance Limited 20,675 -

Decrease in fair value of loan - (49)

Interest received (6) (11)

Loan interest received - (1)

Net cash (outflow)/inflow from operating

activities (493) 1,432

---------------- ----------------

Cash flows from investing activities

Proceeds on disposal of Kreditmart

Finance Limited 1,919 -

Bank interest received 6 11

Net cash inflow from investing activities 1,925 11

---------------- ----------------

Cash flows from financing activities

Share buyback - NUMIS (8,279) (20,124)

Interest income - long term loans - 1

Net cash (outflow) from financing

activities (8,279) (20,123)

---------------- ----------------

Net decrease in cash and cash equivalents (6,847) (18,680)

---------------- ----------------

Opening cash and cash equivalents 9,136 23,134

Effect of exchange rate changes (1) (237)

Closing cash and cash equivalents 2,288 4,217

================ ================

The accompanying notes on pages 11 to 20 form an integral part

of these financial statements.

Notes to the Unaudited Condensed Half Year Financial

Statements

For the 6 month period 1 April 2014 to 30 September 2014

1. Reporting entity

The Company is a closed-ended investment fund that was

incorporated in Guernsey on 22 February 2006, and was admitted to

the Alternative Investment Market of the London Stock Exchange

('AIM') on 20 March 2006. The Company was established to acquire

interests in small and mid-sized private companies in Russia,

focusing on the financial, business and consumer services

sectors.

2. Accounting Policies

2.1 Basis of preparation

These unaudited condensed half year financial statements (the

"interim financial statements") have been prepared in accordance

with International Accounting Standard (IAS) 34 'Interim Financial

Reporting' and the AIM Rules for Companies.

The interim financial statements do not include all the

information and disclosures required for a complete set of

International Financial Reporting Standards ('IFRS') financial

statements, and should be read in conjunction with the Company's

audited annual report and financial statements for the year ended

31 March 2014. Selected explanatory notes are included to explain

events and transactions that are significant to an understanding of

the changes in the financial position and performance since the

last audited annual report and financial statements

as at and for the year ended 31 March 2014.

2.2 Accounting period

The comparative numbers used for the unaudited condensed half

year statement of comprehensive income, unaudited condensed half

year statement of changes in equity and unaudited condensed half

year statement of cash flows are that of the half year period ended

30 September 2013, which is considered a comparable period as

defined per IAS 34. The comparatives used in the unaudited interim

statement of financial position are that of the previous financial

year ended 31 March 2014.

2.3 Significant accounting policies

The same accounting policies, presentation and methods of

computation are followed in these interim financial statements as

those followed in the preparation of the Company's audited

financial statements for the year ended 31 March 2014..

New standards adopted during the year:

-- Amendment to IAS 32 Financial instruments: Presentation', on

offsetting financial assets and financial liabilities (Effective

for periods beginning on or after 1 January 2014)

This amendment updates the application guidance in IAS 32,

'Financial instruments: Presentation', to clarify some of the

requirements for offsetting financial assets and financial

liabilities on the balance sheet. The standard has no material

impact on the financial statements of the Company.

New standards and interpretations not yet adopted:

There are a number of new standards, amendments to standards and

interpretations that are not yet effective for the year ended 31

March 2014, and have not been applied in preparing these financial

statements.

-- IFRS 9 Financial Instruments (Effective date for periods

beginning on or after 1 January 2018)

IFRS 9 deals with classification and measurement of financial

assets and its requirements represent a significant change from the

existing requirements in IAS 39 in respect of financial assets:

amortised cost and fair value. Financial assets are measured at

amortised cost when the business model is to hold assets in order

to collect contractual cash flows. All other financial assets are

measured at fair value with changes recognised in profit or loss.

For an investment in an equity instrument that is not held for

trading, an entity may on initial recognition elect to present all

fair value changes from the investment in other comprehensive

income. Once adopted, IFRS 9 will be applied retrospectively,

subject to certain transitional provisions. The standard is not

expected to have a significant impact on the financial statements

since all of the Company's financial assets are designated at fair

value through profit and loss.

2.4 Revenue

Interest income is accrued on a time basis, by reference to the

principal outstanding and at the effective interest rate

applicable, which is the rate that exactly discounts estimated

future cash receipts through the expected life of the financial

asset to that asset's net carrying amount.

Dividend income from investments is recognised when the

Company's right to receive payment has been established, which is

the last date of registration of shareholders.

2.5 Segmental reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the Chief Operating Decision Maker.

The Chief Operating Decision Maker, who is responsible for

allocating resources, assessing performance of the operating

segments and making strategic decisions, has been identified as the

Board of Directors of the Company. There have been no changes to

operating segments since year end.

2.6 Investments

Unquoted investments, including investments in subsidiaries, are

designated as fair value through profit or loss. Investments are

initially recognised at fair value (excluding transaction costs).

The investments are subsequently re-measured at fair value, which

is determined by the Directors on the recommendation of the

Valuation Committee; all the Directors are currently on the

Valuation Committee. Unrealised gains and losses arising from the

revaluation of investments are taken directly to profit or loss.

Investments deemed to be denominated in a foreign currency are

revalued in Sterling even if there is no revaluation of the

investment in its currency of denomination. Acquisition of

investments is recorded on the trade date or when substantially all

the risks and rewards of ownership transfer to the Company.

Investments are denominated in Russian Roubles, which the

Directors believe best reflect the underlying nature of the

currency exposure of the investee companies. The investments are

translated into Sterling at period end, which is the functional and

presentation currency of the Company. Unrealised gains and losses

arising from the revaluation of investments are taken directly to

the Statement of Comprehensive Income.

2.7 Critical accounting judgements and key sources of estimation uncertainty

In preparing these interim financial statements management has

made judgements, estimates and assumptions that affect the

application of policies and the reported amounts of assets and

liabilities, income and expenses. The estimates and associated

assumptions are based on historical experience and various other

factors that are believed to be reasonable under the circumstances,

the results of which form the basis of making judgements about the

carrying values of assets and liabilities that are not readily

apparent from other sources. Actual results may differ from these

estimates. The estimates and underlying assumptions are reviewed on

an ongoing basis. Revisions to accounting estimates are recognised

in the period in which the estimate is revised if the revision

affects only that period or in the period of the revision and

future periods if the revision affects both current and future

periods.

The following areas are a key source of estimation uncertainty

for the Company and are included within the relevant accounting

policy note:

-- Valuation of Investments in Subsidiaries and Investments

Significant estimates in the Company's interim financial

statements include the amounts recorded for the fair value of the

investments. By their nature, these estimates and assumptions are

subject to measurement uncertainty and the effect on the Company's

interim financial statements of changes in estimates in future

periods could be significant.

1 April 2014

to

30 September 1 April 2013 to

2014 30 September 2013

GBP'000 GBP'000

3. Administration and operating expenses

Investment management fee 49 458

Auditors' remuneration 61 47

Directors' remuneration 110 88

Other operating and administrative

expenses

- Administration fees 71 35

- Professional fees - 62

- Bonus liability written off - (97)

- Aurora Investment Advisors performance

fee written off - (16)

- Performance fee 25 3

- Marketing costs 19 18

- Bonus liability - 22

- Other 36 64

371 684

-------------- -------------------

4. Investments

Investments in Subsidiaries

30 September 31 March

2014 2014

GBP'000 GBP'000

KFL

At beginning of period 1,968 4,583

Proceeds on sale (1,919) -

Loss on sale (20,675) -

Reversal of unrealised losses 20,626 -

Fair value revaluation - (2,615)

At end of period - 1,968

-------------- ----------

Flexinvest Limited

At beginning of period - 5,817

Proceeds on sale - (2,940)

Loss on disposal - (2,877)

At end of period* - -

-------------- ----------

- 1,968

============== ==========

Investments

30 September 31 March

2014 2014

GBP'000 GBP'000

Unistream Bank 8,400 8,000

Grindelia Holdings 280 1,800

Total investments at fair

value through profit and

loss 8,680 9,800

============== ==========

Change in fair value of investments

1 April

1 April 2014 2013 to

to 30 September 30 September

2014 2013

GBP'000 GBP'000

Unistream Bank 400 (1,300)

Grindelia Holdings* (1,520) (4,100)

KFL and Flexinvest - (3,700)

Reversal of KFL unrealised

losses 20,626 -

Total unrealised losses 19,506 (9,100)

================= ==============

*Holding company for Superstroy.

The valuations of the investments at 30 September 2014 was

prepared by Mr. Nicholas Henderson-Stewart and 31 March 2014 was

performed by Aurora Investment Advisors Limited, who both are

considered to have the necessary experience in valuing investments

of this nature, and were approved by the Valuation Committee.

In the view of the Valuation Committee, the values of the

investments in Unistream Bank ("Unistream") and Grindelia Holdings

("Grindelia") as at 30 September 2014 were estimated at GBP8.4

million (31 March 2014: GBP8 million) and GBP0.28 million (31 March

2014: GBP1.8 million) respectively, resulting in a decrease in the

total value of investments from the prior year end.

The Company holds 26% (31 March 2014: 26%) in Unistream and

24.3% (31 March 2014: 24.3%) in Grindelia respectively; all shares

carry equal voting rights in both cases. Unistream is a Russian

company with the principal place of business in Russia, Grindelia

is a Cyprus holding company with its principal place of business in

Russia.

Methodologies and assumptions used in valuing investments and

investments in subsidiaries:

The Company uses a market approach in valuing the Unistream

investment.

The industry valuation benchmark methodology uses industry

specific benchmarks as its basis and indicates the market value of

the shares of the company based on a comparison of the subject

company to other comparable companies in similar lines of business

that are publicly traded or which are part of a public or private

transaction.

The market comparable method indicates the market value of the

ordinary shares of a business by comparing it to publicly traded

companies in similar lines of business. The conditions and

prospects of companies in similar lines of business depend on

common factors such as overall demand for their products and

services. An analysis of the market multiples of companies engaged

in similar businesses yields insight into investor perceptions and,

therefore, the value of the subject company.

In the market approach, recent sales, listings of comparable

assets and such other factors as the Board deems relevant are

gathered and analysed. After identifying and selecting the

comparable publicly traded companies, their business and financial

profiles are analysed for relative similarity. Price or EV

multiples of the publicly traded companies are calculated and then

adjusted for factors such as relative size, growth, profitability,

risk, and return on investment. The adjusted multiples are then

applied to the relevant element of the subject company's

business.

Unistream was valued using a weighted combination of revenue

and/or EBITDA multiples with discount applied for liquidity and

marketability. KFL was valued using an agreed sales price in the

prior year and Superstroy's valuation is based on an adjusted NAV

valuation basis (see note 7 for details).

The valuation methodology for Superstroy has changed since the

prior year (see note 7 for details). The valuation is now based on

adjusted NAV valuation basis and in the prior year it was based on

EBITDA multiples.

5. Sale of Kreditmart Finance Limited

30 September 31 March

2014 2014

GBP'000 GBP'000

Proceeds on sale 1,919 -

Less: Cost of Investment (22,594) -

Loss of sale (20,675) -

============= =========

Reversal of unrealised losses (20,626) -

------------- ---------

The Company sold 100% of its shares in Kreditmart Finance

Limited to Amikson Business Limited on 24 April 2014. The proceeds

of the sale was RUB 100,000,000 and USD 450,000, the total amount

of which was paid in USD.

6. Share buyback

30 September 31 March

Number of shares 2014 2014

Authorised share capital:

Ordinary Shares of 1p each 200,000,000 200,000,000

============== =============

Issued share capital:

Opening balance as at 1 April 74,262,617 112,500,000

Shares redeemed in share buyback

- 30 May 2013 - (38,237,383)

Shares redeemed in share buyback

- 4 June 2014 (29,651,486) -

-------------- -------------

44,611,131 74,262,617

============== =============

30 September 31 March

2014 2014

GBP'000 GBP'000

Share Capital

Opening balance as at 1 April 743 1,125

38,237,383 Ordinary Shares of 0.01p bought

back - (382)

4,343,081 Ordinary Shares of 0.01p bought

back (44) -

699 743

------------- -------------

Number of shares

Treasury Shares

Opening balance as at 1 April - -

38,237,383 Ordinary Shares bought - 38,237,383

Shares cancelled - (38,237,383)

29,651,486 Ordinary Shares bought 29,651,486 -

4,343,081 Shares cancelled (4,343,081) -

------------- -------------

25,308,405 -

============= =============

Special Reserve

Opening balance as at 1 April 64,331 84,073

38,237,383 Ordinary Shares bought back by

NUMIS - (19,617)

Professional and legal fees incremental to

Share buyback (111) (125)

25,308,405 Ordinary Shares bought back by

NUMIS (6,971) -

4,343,081 Ordinary Shares bought back by

NUMIS (1,153) -

56,096 64,331

======== =========

On 30 April 2013 the Company entered into a repurchase agreement

to purchase ordinary shares of the Company from Numis Securities

Limited ("Numis"). On 30 May 2013, the Company purchased 38,237,383

ordinary shares at 0.523048p per Share for an aggregate gross

consideration of GBP19,999,947.

On 1 May 2014 the Company entered into a repurchase agreement to

purchase ordinary shares of the Company from Numis Securities

Limited ("Numis"). On 4 June 2014, the Company purchased 29,651,486

ordinary shares at 0.275454p per Share for an aggregate gross

consideration of GBP8,167,619.

The treasury shares carry no voting rights. On 1 October 2014,

25,308,405 treasury shares were cancelled.

7. Financial risk factors

Other than as set out below, the risks faced by the Company and

its management of those risks are consistent with the prior year

end.

Market price risk

Market price risk arises principally from uncertainty concerning

future values of financial instruments used in the Company's

operations.

It represents the potential loss the Company might suffer

through holding interests in unquoted private companies whose value

may fluctuate and which may be difficult to value and/or to

realise. The Company seeks to mitigate such risk by assessing such

risks as part of the due diligence process related to all potential

investments, and by establishing a clear exit strategy for all

potential investments. There is a rigorous due diligence process

before an investment can be approved which will cover financial,

legal and market risks. Following investment the Company/Manager

will always have Board representation, the investee company is

required to submit regular management information to an agreed

standard and timeliness and the Manager undertakes regular

monitoring. The Board receives and considers the most recent

monitoring report prepared by the Manager at every Board

meeting.

Pricing Risk Table

All security investments present a risk of loss of capital, the

maximum risk resulting from instruments is determined by the fair

value of the financial instrument. The following represents the

Company's market pricing exposure at period end:

At 30 September 2014:

Fair value % of Net

Notes GBP'000 Assets

Investments

- Unlisted Equities 4 8,680 79.82

At 31 March 2014:

Investments Notes

- Unlisted Equities 4 11,768 56.88

Valuation of financial instruments

The Company measures fair values using the following fair value

hierarchy that reflects the significance of the inputs used in

making the measurements:

> Level 1: Quoted market price (unadjusted) in an active

market for an identical instrument.

> Level 2: Valuation techniques based on observable inputs,

either directly (i.e. as prices) or indirectly (i.e. derived from

prices). This category includes instruments valued using: quoted

market prices in active markets for similar instruments; quoted

prices for identical or similar instruments in markets that are

considered less than active; or other valuation techniques where

all significant inputs are directly or indirectly observable from

market data.

> Level 3: Valuation techniques using significant

unobservable inputs. This category includes all instruments where

the valuation technique includes inputs not based on observable

data and the unobservable inputs have a significant effect on the

instrument's valuation. This category includes instruments that are

valued based on quoted prices for similar instruments where

significant unobservable adjustments or assumptions are required to

reflect differences between the instruments.

The table below analyses financial instruments, measured at fair

value at the end of the reporting period, by the level in the fair

value hierarchy into which the fair value measurement is

categorised:

At 30 September 2014:

Level 1 Level 2 Level 3 Total

GBP'000 GBP'000 GBP'000 GBP'000

Investments

- Unlisted Equities - - 8,680 8,680

---------- --------- --------- ---------

- - 8,680 8,680

================================ ========= ========= =========

At 31 March 2014:

Investments

- Unlisted Equities - 1,968 9,800 11,768

---------- --------- --------- ---------

- 1,968 9,800 11,768

================================ ========= ========= =========

The following table shows a reconciliation from the beginning

balances to the ending balances for fair value measurements in

Level 3 of the fair value hierarchy of the Company:

Level 3 Level 3

GBP'000 GBP'000

2014 2013

Opening balance 9,800 32,800

Disposal of investments - (5,817)

Total fair value gains

or losses in profit or

loss (1,120) (15,215)

Transfer to level 2 - (1,968)

--------- ---------

8,680 9,800

========= =========

Although the Company believes that its estimates of fair values

are appropriate, the use of different methodologies or assumptions

could lead to different measurements of fair value. Investments

classified with level 3 have significant unobservable inputs, as

they trade infrequently. As observable prices are not available for

these securities, the Company has used valuation techniques to

derive the fair value. Transfers between levels are deemed to take

place at the end of the period/year.

Level 3 investments have been valued in accordance with the

methodologies in Note 4. The value of the investments and the fair

value movements are disclosed in note 4.

Unrealised loss on fair value movements from revaluation of

level 3 investments still held at period end and recognised in the

Unaudited Condensed Half Year Statement of Comprehensive Income

amounted to GBP1.12 million (31 March 2014: GBP12.6 million).

Unistream

Unistream was valued using 75% EBITDA multiple and 25% Revenue

multiple and 30% liquidity discount as at 30 September 2014 and 31

March 2014.

For Unistream the Revenue multiple observed was 1.96x and for

EBITDA was 7.83x (31 March 2014 revenue multiple was 2.0x and for

EBITDA was 7.4x).

If the Revenue multiple weighting was increased by 10% the value

of Unistream's value would become GBP9.5 million (31 March 2014:

GBP9.1 million).

Superstroy

Superstroy was valued using 100% EBITDA multiple with 25%

liquidity discount in the prior year and was valued using an

adjusted NAV Valuation basis as at 30 September 2014. The change in

valuation technique is due to the fact that this basis is deemed to

be more appropriate given the change in fundamentals, performance

and lifecycle stage of Superstroy during the period.

The average of the EBITDA multiple range observed when valuing

Superstroy was 7.8x as at 31 March 2014.

8. Segmental information

The Board of Directors of the Company decides on the strategic

resource allocations of the Company. The operating segments of the

Company are the business activities that earn revenue or incur

expenses, whose operating results are regularly reviewed by the

Board of Directors of the Company, and for which discrete financial

information is available. The Board of Directors considers the

Company to be made up of one segment, which is reflective of the

business activities of the Company and the information used for

internal decision-making which includes the monthly reporting to

management of investment holdings on a fair value basis:

- Aurora Russia Limited.

The Investment Manager's Report provides more information on the

Company's business and the operations of each investment.

The Company derives its revenues from its investments primarily

through fair value gains or losses.

The Company regards the holders of its ordinary shares as its

customers, as it relies on their funding for continuing operations

and meeting its objectives. The Company's shareholding structure is

not exposed to a significant shareholder concentration.

The Company is engaged in investment in small and mid-sized

companies in Russia and in one principal geographical area, being

Russia.

9. Related party transactions

Details of the investments in Unistream Bank and Grindelia

Holdings are presented in note 4.

Michael Hough, who was a director of Aurora Investment Advisors

Limited ("AIAL"), held Nil (31 March 2014: 100,000) shares in the

Company as at 30 September 2014.

AIAL held 286,354 (31 March 2014: 1,224,072) shares in the

Company as at 30 September 2014.

The management fees paid to AIAL during the 6 months ended 30

September 2014 were GBP30,000 (2013: 458,940). At the period end

there were no management fees owing.

The Company's management contract with AIAL to provide

investment advisory and management services which ran for 8 years

was terminated effective 30 April 2014. AIAL's services were

extended to 30 June 2014. Mr Nicholas Henderson-Stewart was

appointed as Advisor effective 19 June 2014.

Per the Amended and Restated Management Agreement (the

"agreement"), certain provisions of that agreement survived the

termination of the agreement, including the provisions relating to

performance fees. The performance fees are to decline by 20% per

annum from 1 January 2012 in respect of the 2.5% Tranche, and by

20% per annum from 1 January 2013 in respect of each of the 7.5%

Tranche and the 20% Tranche. These performance fee provisions

remain applicable up to 31 March 2018.

The performance fees paid by the Company to AIAL during the

period was GBP24,558 (2013: GBP44,808); at period end GBPNil (2013:

GBP45,696) was outstanding. The performance fees became payable on

the sale of KFL, calculated at 1.28% on the cash consideration of

GBP1.9 million.

If the remaining investments were sold at their fair values as

at 30 September 2014, GBP111,104 would be payable to AIAL by way of

performance fees.

10. Contingencies

The Company had no contingencies outstanding at the reporting

date other than those disclosed in note 9.

11. Events after the reporting date

No further material post balance sheet events were noted.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR VVLFBZLFBFBE

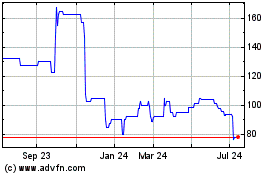

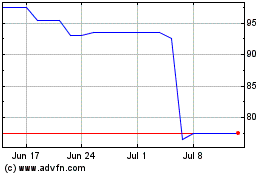

Aurrigo (LSE:AURR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aurrigo (LSE:AURR)

Historical Stock Chart

From Apr 2023 to Apr 2024