TIDMAURR

RNS Number : 4413O

Aurora Russia Limited

08 February 2016

8 February 2016

Aurora Russia Limited (the "Company")

Extraordinary General Meeting and Voluntary Liquidation

The Company announced on 22 December 2015 that it had entered

into sale arrangements relating to its one residual investment, a

minority interest in OJSC Unistream Commercial Bank ("Unistream").

In that same announcement the Board advised that they intended as

soon as reasonably practicable following completion of the sale of

Unistream to convene an extraordinary general meeting (the "EGM")

to consider proposals to include, inter alia, measures to

facilitate the distribution to Shareholders of substantially all of

the Company's net realised cash, in a cost effective, tax efficient

and timely manner. The Company then announced on 29 December 2015

that the proceeds of USD 4.975 million had been received and that

completion of the sale of Unistream had occurred. The Board now

intends to effect the distribution of cash by procuring that the

Company's shareholders vote the Company into a members' voluntary

liquidation (the "Liquidation").

The Company therefore announces that the Board has today

convened an EGM of shareholders to consider proposals for an ex

gratia payment to the Company's chairman, to cancel its admission

to trading on AIM, to vote the Company into members' voluntary

liquidation and thereafter to return available cash to

shareholders.

A circular convening the EGM, containing full details of the

proposals and setting out the timetable for the return of capital

has today been published, such EGM to be held on 9 March 2016 to

consider such proposals.

The text of the Expected Timetable and Chairman's letter

extracted from the circular and containing a recommendation from

the Board that shareholders vote in favour of the proposals is set

out below.

Expected Timetable:

Latest time and date for 11:00 a.m. on 7(th)

receipt of Proxy Appointments March 2016

for the Extraordinary General

Meeting

Closing of the Company's 6:00 p.m. on 8(th)

register and Record Date March 2016

for participation in liquidation

distributions

Suspension of the listing 7:30 a.m. on 9(th)

of the Shares March 2016

Extraordinary General Meeting 11:00 a.m. on 9(th)

and, if approved, the appointment March 2016

of the Liquidator

Announcement of the result 9(th) March 2016

of the Extraordinary General

Meeting

Interim liquidation distribution On or around 16(th)

March 2016

Cancellation of the listing 7:00 a.m. on 17(th)

of the Shares March 2016

All references to time in this document are to the time in

London.

Dear Shareholder,

1. Introduction

The Company has today announced proposals for an additional ex

gratia payment to the Chairman, followed by its voluntary

winding-up in accordance with the Companies Law and the

cancellation of admission of its Ordinary Shares to trading on AIM

(the "Proposals"). I am writing to provide you with details of

these Proposals, which are subject to Shareholders' approval, and

to explain why your Board is recommending that you vote in favour

of the resolutions to be proposed at an extraordinary general

meeting of the Company to be held at 11:00 a.m. on 9(th) March 2016

(the "Extraordinary General Meeting"). Notice of the Extraordinary

General Meeting is set out at the end of this Circular.

2. Background to the Proposals

The Company's articles of incorporation required the Directors

to propose a resolution at the Company's last annual general

meeting on 23(rd) December 2015 that the Company continue its

investment activities (the "Continuation Resolution"). The Board

was at the time of publication of the notice of that annual general

meeting in November 2015 negotiating the disposal of the Company's

one residual investment, a minority interest in OJSC Unistream

Bank, and recommended that Shareholders vote in favour of the

Continuation Resolution to give further time to complete the

disposal. The resolution was duly passed by Shareholders.

The Company announced on 22(nd) December 2015 that it had

entered into sale arrangements relating to Unistream and,

notwithstanding the passing of the Continuation Resolution, the

Board intended as soon as reasonably practicable to convene an

extraordinary general meeting to consider proposals to include,

inter alia, measures to facilitate the distribution to Shareholders

of substantially all of the Company's net realised cash in a cost

effective, tax efficient and timely manner.

Your Board has therefore now completed its previously announced

disposal programme and under the AIM Rules the Company is now

classed as an investing company. The Board has considered a number

of proposals to continue the Company's existence by way of a

reverse transaction and has canvassed the opinions of its major

Shareholders, but has concluded that it would be in the best

interests of Shareholders as a whole to wind up the Company and

return its net available cash to Shareholders as soon as

practicable.

Following the sale of the Company's final investment and the

return of invested cash to shareholders, all Directors and the

investment advisor will be paid incentive fees calculated in

accordance with the methodology announced on 31 March 2015 and

explained to Shareholders in the Company's subsequent annual and

interim reports and accounts. The Directors will be paid in

aggregate circa. GBP75,000 and Mr Henderson-Stewart will be paid

approximately GBP5,000. The Board has also resolved to recommend a

further ex gratia payment of GBP15,000 to the Chairman, which will

be subject to Shareholders' approval in general meeting and further

details of which are given in section 3 below.

Accordingly the purpose of this Circular is to provide you with

details of the Proposals and to seek your approval of them.

The Commission has been notified of the Proposals in accordance

with Part 5 of the Rules.

In the event that the voluntary liquidation of the Company is

not approved, the AIM Rules for Companies (May 2014) will apply and

accordingly if the Company does not make an acquisition or

acquisitions which constitute a reverse takeover under Rule 14, or

otherwise fails to implement its investing policy to the

satisfaction of AIM, within twelve months of 29 December 2015, the

trading in the Shares will be suspended.

3. Liquidity Profile

As at the close of business on 4 February 2016 the Company's

unaudited estimated Net Asset Value was GBP4,648,139.06 which is

the equivalent of 12.25p per Share. The unaudited estimated NAV is

entirely comprised of cash and cash equivalents.

The Board has further estimated that the terminal NAV of the

Company, after deduction of the Joint Liquidators' estimated fees,

which have been estimated at GBP8,500, including GBP500 of

disbursements, a Retention of GBP50,000, any expenses properly

incurred by the Joint Liquidators in connection with the

liquidation and provision for all of the Company's other

liabilities will be GBP4,502,834.40, equivalent to 11.87p per

Share. This sum will be available for distribution to Shareholders

in accordance with the principles stated at section 5 below. To the

extent that your Board has over-provided for the Company's

liabilities, or any part of the Retention is otherwise unutilised,

the Company's remaining assets will also be distributed to

Shareholders in accordance with those principles.

On the recommendation of the Company's Remuneration Committee,

from whose recent meeting the Chairman absented himself due to his

conflict of interest, the Board has also resolved to propose to

Shareholders that the Chairman should be granted an additional ex

gratia payment of GBP15,000, in recognition of the significant

additional work performed by him over the past financial year, as

well as his contributions to and tenacity in the successfully

negotiated sale of Unistream at a far higher price than had

originally been offered to the Company, all in very difficult

market conditions. Without this commitment, it is doubtful whether

the value achieved on the sale would have been obtained. This

payment is subject to the approval of Shareholders at the EGM and

those Directors who hold Shares in the Company intend to vote in

favour of the proposed resolution. All Directors have agreed to

waive their entitlement to three months' notice of the termination

of their appointments. The financial information included above has

been prepared on the basis that the additional ex gratia payment is

approved by the requisite majority of Shareholders.

4. Cancellation OF ADMISSION OF THE ORIDNARY SHARES TO TRADING ON AIM

If the Shareholders vote to approve the liquidation of the

Company, it would not be possible for the Company's Ordinary Shares

to continue to be admitted to trading on AIM. Accordingly,

Shareholders are being asked to approve the Delisting by a majority

of not less than 75% of the votes cast at the Extraordinary General

Meeting, as required by the AIM Rules.

5. The Winding-up and distributions to shareholders

If the proposed Special Resolution is approved by Shareholders,

the Joint Liquidators will be appointed. The Joint Liquidators will

wind up the Company by way of a voluntary solvent liquidation in

accordance with the Companies Law.

February 08, 2016 13:19 ET (18:19 GMT)

Whether or not you intend to be present at the Extraordinary

General Meeting, you should ensure that your Proxy Appointment (and

any relevant supporting documentation) is completed in accordance

with the instructions printed thereon and returned to the Company's

Registrar, addressed to Capita Asset Services, PXS 1, 34 Beckenham

Road, Beckenham BR3 4ZF as soon as possible, but in any event not

later than 11:00 a.m. on 7(th) March 2016.

10. Recommendation

Your Board considers that the Proposals and the Resolutions are

in the best interests of Shareholders as a whole. Accordingly, your

Board unanimously recommends Shareholders to vote in favour of the

Resolutions at the Extraordinary General Meeting, as they intend to

do in respect of their beneficial holdings of Shares, amounting to

6,076,323 Shares in aggregate, held as follows:

Gilbert Chalk - 16,855 Shares;

Peregrine Moncreiffe - 381,583 Shares; and

Timothy Slesinger - 4,824,244 Shares.

Neither Mr Bridel nor Mr Trott holds any Shares in the

Company.

Yours faithfully

Gilbert Chalk

Chairman

A copy of the circular will be available to view shortly on the

Company's website in accordance with AIM Rule 26:

www.aurorarussia.com

Enquiries:

Aurora Russia Limited

Gilbert Chalk

+44 (0)7768 527 973

Numis Securities Limited

+44 (0)20 7260 1000

Nominated Adviser: Hugh Jonathan

Corporate Broking: Nathan Brown

This information is provided by RNS

The company news service from the London Stock Exchange

END

CIRVVLFBQLFFBBZ

(END) Dow Jones Newswires

February 08, 2016 13:19 ET (18:19 GMT)

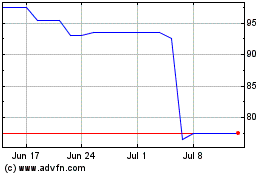

Aurrigo (LSE:AURR)

Historical Stock Chart

From Mar 2024 to Apr 2024

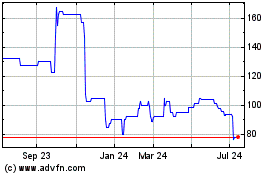

Aurrigo (LSE:AURR)

Historical Stock Chart

From Apr 2023 to Apr 2024