In the market approach, recent sales, listings of comparable

assets and such other factors as the Board deems relevant are

gathered and analysed. After identifying and selecting the

comparable publicly traded companies, their business and financial

profiles are analysed for relative similarity. Price or EV

multiples of the publicly traded companies are calculated and then

adjusted for factors such as relative size, growth, profitability,

risk, and return on investment. The adjusted multiples are then

applied to the relevant element of the subject company's

business.

All valuations of unquoted investments and investments in

subsidiaries (collectively referred to as the "portfolio") were

performed using weighted combination of revenue and/or EBITDA

multiples (except for KFL where an agreed sales price was used).

17% (2013: 32%), by value at year-end, of the portfolio was valued

using an agreed sales price with the remaining 83% (2013: 68%) of

the portfolio being valued using an enterprise value/EBITDA

multiple approach and/or enterprise value/revenue multiple.

The key assumptions in the valuations were as follows:

- Liquidity adjustment: 25% to 30% (31 March 2013: 20% to

30%)

2) Income Approach:

The income approach methodology is used as a cross-check for the

Market Approach and indicates the market value of a business

enterprise based on the present value of the cash flows that the

business can be expected to generate in the future. Such cash flows

are discounted at a discount rate that reflects the time value of

money and the risks associated with the cash flows.

The reconciliation between beginning and ending balances of

Level 3 investments is disclosed in Note 21.6. There was a transfer

to level 2 from level 3 during the year. The investment was moved

from level 3 to level 2 as the sales price could be used to value

the investment. The investment was sold after year end, refer to

note 25.

22. Segmental information

The Board of Directors of the Company decides on the strategic

resource allocations of the Company. The operating segments of the

Company are the business activities that earn revenue or incur

expenses, whose operating results are regularly reviewed by the

Board of Directors of the Company, and for which discrete financial

information is available. The Board of Directors considers the

Company to be made up of one segment, which is reflective of the

business activities of the Company and the information used for

internal decision-making which includes the monthly reporting to

management of investment holdings on a fair value basis:

- Aurora Russia

The Investment Manager's Report provides more information on the

Company's business and the operations of each investment.

The Company derives its revenues from its investments primarily

through fair value gains or losses.

The Company regards the holders of its ordinary shares as its

customers, as it relies on their funding for continuing operations

and meeting its objectives. The Company's shareholding structure is

not exposed to a significant shareholder concentration.

The Company is engaged in investment in small and mid-sized

companies in Russia and in one principal geographical area, being

Russia..

23. Related party transactions

The Company had three direct subsidiaries, KFL, Flexinvest and

Flex Bank during the year and one subsidiary at the year end (see

note 7 and 8). Details of the investments in Unistream Bank and

Grindelia Holdings are presented in note 8.

Michael Hough, who is a director of AIAL, holds 100,000 (2013:

100,000) of the shares in Aurora Russia as at 31 March 2014.

AIAL holds 1,224,072 (2013: 2,576,534) of the shares in Aurora

Russia as at 31 March 2014.

The management fees paid to AIAL were GBP744,743 (2013:

GBP1,103,705); at year end there was no prepayment of management

fees. There were no amounts payable at year end (2013: GBPNil).

Per the Amended and Restated Management Agreement, the

management fee and performance fee payable to AIAL were as

follows:

(a) Management fee of an amount equal to i) for all Valuation

Dates up to and including 31 March 2011, 1% of the net asset value

of the Company; and ii) for all Valuation Dates after 31 March

2011, 0.75% of net asset value of the Company;

(b) Performance fee is calculated as follows:

- 2.5% of the value of any disposals realised by the Company

would be payable to the Manager, calculated on the value of assets

of the Company realised up to GBP45 million, i.e. GBP0.40 per share

(the "2.5% Tranche");

- 7.5% of the value of any disposals realised by the Company

would be payable to the Manager, calculated on the value of assets

of the Company realised between GBP45 million and GBP99 million,

i.e. GBP0.40 per share to GBP0.88 per share (NAV) (the "7.5%

Tranche"); and

- 20% of the value of any disposals realised by the Company

would be payable to the Manager, calculated on the value of assets

of the Company realised over GBP99 million, i.e. over GBP0.88 per

share (the "20% Tranche").

Performance fees to decline by 20% per annum from 1 January 2012

in respect of the 2.5% Tranche, and by 20% per annum from 1 January

2013 in respect of each of the 7.5% Tranche and the 20%

Tranche.

The performance fees paid by the Company to AIAL during the year

was GBP27,735 (2013: GBP470,758); at year end GBP40,960 (2013:

GBP107,520) was outstanding. The performance fees became payable on

the sale of Flexinvest, calculated at 1.28% on the cash

consideration of GBP3.2 million. At year end GBP40,960 was still

payable.

If the remaining investments were sold at their fair values as

at 31 March 2014, GBP150,630 (GBP11,767,500 at 1.28%) would be

payable to AIAL by way of performance fees.

24. Contingencies and capital commitments

The Company had no contingencies and capital commitments

outstanding at the reporting date other than disclosed in note

23.

25. Events after the reporting date

Sale of KFL

On 28 April 2014 the Company announced that it has agreed to

sell KFL for a total consideration of RUR100 million (approximately

GBP1.7 million) plus US$450,000 (approximately GBP267,500). The

Board have agreed to the sale at a discount in the light of the

current Russian market for banking assets and the difficult nature

of the portfolio, which is the rump of the Flexinvest mortgage book

and which could only otherwise be disposed of on a protracted

piecemeal basis, which would be lengthy and uncertain.

Tender offer

On 1 May 2014 the Company announced a tender offer to

Shareholders for up to 29,651,549 Shares, being approximately 39.9

per cent. of the current issued share capital of the Company, at a

price of 27.5454p per Share (the "Repurchase Price"). The

Repurchase Price has been calculated by reference to the Unaudited

Net Asset Value of 27.8464p per Share as at 31 March 2014 and after

deducting 0.3010p per Share of costs of the Tender Offer (such

costs representing approximately 1.1 per cent. of the Unaudited Net

Asset Value per Share). The full amount of shares under the tender

offer was repurchased at 27.5454 pence per Share by the Company and

subsequently cancelled.

Following the implementation of the Tender Offer and the

cancellation, the Company has 44,611,131 shares in issue (being

74,262,617 shares in issue less 29,651,486 shares being repurchased

under the Tender Offer and subsequently cancelled).

Termination of Investment Advisor

On 30 April 2014 the Management agreement between the Manager,

Aurora Russia Investment Advisors Limited, and the Company was

terminated by mutual agreement. Under the termination agreement

GBP40,960 is payable to the Manager in respect of the sale of

Flexinvest as a performance fee as well as GBP15,000 per calender

month for the service to be provided for the two months to 30 June

2014. Mr Nicholas Henderson-Stewart was appointed as advisor to the

Company on 19 June 2014 to assist in managing, monitoring and

realising the Company's residual investments. This will include

representing the Company on Investee company boards if so requested

by Aurora Russia Board, assistance with certain administrative

functions and the provision of financial information, including

management accounts, and other relevant information on the Investee

companies.

Fees payable to the Advisor comprise a modest annual fee. In

addition the Advisor will obtain a commission of 2 per cent of any

payment made by the Company to its shareholders (whether by way of

dividends, capital return, share buy backs or otherwise) during the

term of the agreement.

Change in directors interests

The Company announced that as a result of the tender offer for

Shares on 30 May 2014, the Company's directors' beneficial

shareholdings in the Company have changed as follows:-

Gilbert Chalk: from 33,005 ordinary shares to 19,827 ordinary

shares.

Tim Slesinger: from 9,446,850 ordinary shares to 5,674,913

ordinary shares.

Peregrine Moncreiffe: from 635,209 ordinary shares to 381,583

ordinary shares.

There are no further events after reporting date that require

disclosure.

Directors and Advisors

Directors Independent Auditor

Gilbert Chalk - Chairman - appointed 25 February KPMG Channel Islands Limited

2013 20 New street

Geoffrey Miller - resigned 12 April 2013 St Peter Port

Tim Slesinger - appointed 22 August 2011 Guernsey GY1 4AN

Grant Cameron - resigned 1 May 2013

John Whittle - resigned 12 April 2013

Jonathan Bridel - appointed 12 April 2013

Peregrine Moncreiffe - appointed 12 April 2013 CREST Service Provider and UK Transfer Agent

Lyndon Trott - appointed 1 May 2013 Capita Registrars

The Registry

Manager 34 Beckenham Road

Aurora Investment Advisors Limited Beckenham

(terminated 30 June 2014) Kent BR3 4TU

Sarnia House

Le Truchot

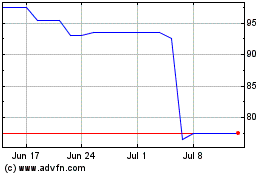

Aurrigo (LSE:AURR)

Historical Stock Chart

From Mar 2024 to Apr 2024

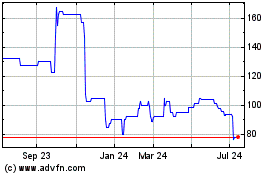

Aurrigo (LSE:AURR)

Historical Stock Chart

From Apr 2023 to Apr 2024