The Company measures fair values using the following fair value

hierarchy that reflects the significance of the inputs used in

making the measurements:

> Level 1: Quoted market price (unadjusted) in an active

market for an identical instrument.

> Level 2: Valuation techniques based on observable inputs,

either directly (i.e. as prices) or indirectly (i.e. derived from

prices). This category includes instruments valued using: quoted

market prices in active markets for similar instruments; quoted

prices for identical or similar instruments in markets that are

considered less than active; or other valuation techniques where

all significant inputs are directly or indirectly observable from

market data.

> Level 3: Valuation techniques using significant

unobservable inputs. This category includes all instruments where

the valuation technique includes inputs not based on observable

data and the unobservable inputs have a significant effect on the

instrument's valuation. This category includes instruments that are

valued based on quoted prices for similar instruments where

significant unobservable adjustments or assumptions are required to

reflect differences between the instruments.

The table below analyses financial instruments, measured at fair

value at the end of the reporting period, by the level in the fair

value hierarchy into which the fair value measurement is

categorised:

Level 1 Level 2 Level 3 Total

At 31 March 2014: GBP'000 GBP'000 GBP'000 GBP'000

Investments at fair value through profit or loss:

-Unlisted Equities - 1,968 9,800 11,768

- 1,968 9,800 11,768

At 31 March 2013: Level 1 Level 2 Level 3 Total

GBP'000 GBP'000 GBP'000 GBP'000

Investments at fair value through profit or loss:

-Unlisted Equities - - 32,800 32,800

- - 32,800 32,800

The following table shows a reconciliation from the beginning

balances to the ending balances for fair value measurements in

Level 3 of the fair value hierarchy of the Company:

Level 3

GBP'000 GBP'000

2014 2013

Opening balance 32,800 74,600

Disposal of investments (5,817) (29,863)

Total fair value gains or losses in profit or loss (15,215) (11,937)

Transfer to level 2 (1,968) -

Closing balance 9,800 32,800

Although the Company believes that its estimates of fair values

are appropriate, the use of different methodologies or assumptions

could lead to different measurements of fair value. Investments

classified with level 3 have significant unobservable inputs, as

they trade infrequently. As observable prices are not available for

these securities, the Company has used valuation techniques to

derive the fair value. Transfers between levels are deemed to take

place at the end of the year.

Level 3 investments have been valued in accordance with the

methodologies in Note 21.8. The value of the investments and the

fair value movements are disclosed in note 8.

Unrealised loss on fair value movements from revaluation of

level 3 investments still held at year end and recognised in the

Statement of Comprehensive Income amounted to GBP12.6 million

(2013: unrealised loss of GBP12.97 million).

Superstroy was valued using 100% EBITDA multiple with 25%

liquidity discount. Unistream was valued using 75% EBITDA multiple

and 25% revenue multiple basis and 30% liquidity discount and KFL

was valued based on an agreed sales price.

The average of the EBITDA multiple range observed when valuing

Superstroy was 7.8x. For Unistream the Revenue multiple observed

was 2.0x and for EBITDA was 7.4x.

Price sensitivity

The sensitivity analysis below has been determined based on the

exposure to equity price risks as at the reporting date.

At the reporting date, if the valuations had been 20% higher

while all other variables were held constant net profit would

increase by GBP2,353,600 (2013: GBP6,560,000) for the Company. This

sensitivity rate was determined by the Directors as reasonable

taking market conditions into account.

If the Revenue multiple weighting was increased by 10% the value

of Superstroy would become GBP2.6 million and Unistream's value

would become GBP9.1 million.

21.7 Interest rate risk

Interest rate risk is the risk that the fair value or future

cash flows of a financial instrument will fluctuate because of

changes in market interest rates.

The Company is exposed to interest rate risk as a result of the

cash and bank balances that are invested at floating interest

rates. The Company monitors its interest rate exposure regularly

and allocates its cash resources to an appropriate mix of floating

and fixed rate instruments of varying maturities.

The following table details the Company's exposure to interest

rate risk as at period end by the earlier of contractual maturities

or re-pricing:

At 31 March 2014: No Less than 1 months 1 to 2 2 to 5 Greater Total

contractual 1 month to 1 year years than 5

terms of years years

repayment

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Assets

Non-interest bearing 11,768 - 3 - - - 11,771

Floating interest rate instruments 4,726 - - - - - 4,726

Fixed interest rate instruments - 4,410 - - - - 4,410

Total 16,494 4,410 3 - - - 20,907

Liabilities

Non-interest bearing - - (219) - - (219)

Total - - (219) - - - (219)

Net Exposure 16,494 4,410 (216) - - - 20,688

At 31 March 2013: No Less than 1 months 1 to 2 2 to 5 Greater Total

contractual 1 month to 1 year years than 5

terms of years years

repayment

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Assets

Non-interest bearing 32,800 - 5,584 1,105 - - 39,489

Floating interest rate instruments 277 - - - - - 277

Fixed interest rate instruments - 22,857 - - - 22,857

Total 33,077 22,857 5,584 1,105 - - 62,623

Liabilities

Non-interest bearing - (456) (364) (611) - (1,431)

Total - (456) (364) (611) - - (1,431)

Net Exposure 33,077 22,401 5,220 494 - - 61,192

* The Company's fixed interest rate instruments represents cash

accounts placed on deposit. The Company does not account for any

fixed rate financial assets and liabilities at fair value through

profit or loss. Therefore a change in interest rates at the

reporting date would not affect profit or loss.

Sensitivity analysis

The sensitivity analysis below has been determined based on the

Company's exposure to interest rates for interest bearing assets

and liabilities at the reporting date and the stipulated change

taking place at the beginning of the financial year and held

constant throughout the reporting period in the case of instruments

that have floating rates.

If interest rates had been 50 basis points higher and all other

variables were held constant, the Company's net profit and equity

for the year ended 31 March 2014 would have increased by GBP23,634

(2013: GBP1,387).

If interest rates had been 50 basis points lower it would have

had the equal but opposite effect, on the basis that all other

variables remain the same.

21.8 Fair value measurement

Methodologies and assumptions used in valuing investments and

investments in subsidiaries:

1) Market Approach:

The market approach uses industry specific benchmarks as its

basis and indicates the market value of the shares of the company

based on a comparison of the subject company to other comparable

companies in similar lines of business that are publicly traded or

which are part of a public or private transaction.

The market comparable method indicates the market value of the

ordinary shares of a business by comparing it to publicly traded

companies in similar lines of business. The conditions and

prospects of companies in similar lines of business depend on

common factors such as overall demand for their products and

services. An analysis of the market multiples of companies engaged

in similar businesses yields insight into investor perceptions and,

therefore, the value of the subject company.

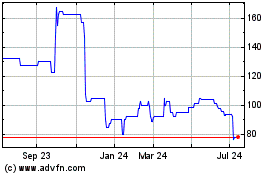

Aurrigo (LSE:AURR)

Historical Stock Chart

From Mar 2024 to Apr 2024

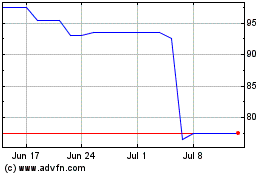

Aurrigo (LSE:AURR)

Historical Stock Chart

From Apr 2023 to Apr 2024