TIDMARR

RNS Number : 0097E

Aurora Investment Trust PLC

30 October 2015

AURORA INVESTMENT TRUST plc

Half Yearly Financial Report

For the six months ended 31 August 2015

Investment Policy

The policy of the Company is to achieve capital appreciation

through investments listed mainly on the London Stock Exchange,

primarily comprising equities but with some exposure also to fixed

interest. The portfolio comprises a mix of large, mid and smaller

capitalised stocks. A distinctive feature is an emphasis on

investments in companies with exposure to economies growing at a

faster rate than the UK.

CHAIRMAN'S STATEMENT

The half year returns were:

At 28/02/15 At 31/08/15 Change At 31/08/14

Net Asset Value per

share 171.37p 161.64p (5.7%) 186.98p

Share price 147.50p 151.50p 2.7% 164.25p

Discount 13.9% 6.3% 7.6% 12.2%

Gearing (net)* 19.2% 6.01% (13.2%) 18.8%

*Borrowings less net current assets (excluding short term

borrowings) as a percentage of Net Asset Value

Review of the period

The six months to end August have been a difficult time for

global stock-markets. Investors have been stalked by a series of

worries ranging from the unsustainability of the levels of Greek

indebtedness, to the timing of the expected US interest rate

increase and growing confirmation of a slow-down in the Chinese

economy. The ramifications for the global economy, particularly

that part represented by emerging economies, have caused many

investors to raise cash and await developments from the sidelines.

The FTSE ALL-Share index declined by 8.3%, whereas the FTSE100

Index, on account of its high exposure to oils and commodities,

fell by 10.0%. In comparison the Net Asset Value of the portfolio

reduced by 5.7%, representing some welcome outperformance.

In the USA the rate of unemployment has continued to reduce

reaching its current level of 5.1%, close to the level which is

viewed as potentially inflationary. Despite this apparent good news

about the strength of the US economy, the Federal Reserve Board has

been cautious about raising rates, fearing the impact of a stronger

US $ abroad and on export industries.

Conversely, in China a period of tighter monetary policy and

reduced money supply earlier in the year brought the significant

bull market to an end in June with sharp retrenchment thereafter.

The devaluation of the Renmimbi by 3% in August added to bearish

sentiment. The Authorities have responded with a fourth interest

rate reduction this year and a relaxation of Reserve ratio

requirements to boost money supply. In consequence, the latest

evidence is demonstrating that house prices in Tier 1 and 2 cities

are rising rapidly once more. Although many recently published

economic statistics have proved disappointing, the likelihood is

that the economy may have already bottomed and that future reports

will be more positive.

In the UK, post the unexpected overall victory by the

Conservative Party in May, the economy has remained robust, led by

the services industries. The confidence of a further five years of

domestic political certainty has resulted in a spurt of increased

levels of investment by the private sector. Meanwhile in

Continental Europe, despite the adverse effects of economic

sanctions against Russia, there has been definite evidence of

improvement in certain economies, notably Germany, Spain and

Ireland, resulting from the belated introduction of Q.E., together

with the dramatic falls in commodity prices in general.

Against such a global background of inflation remaining very low

in most territories and the possibility of further stimulation of

the Chinese economy, investor sentiment could improve rapidly. With

deployment by both institutions and corporates of the high current

levels of liquidity a sharp bounce in equity valuations would be a

logical result.

Investment Policy

There has been no overall change in the Investment Policy. The

Manager has continued in the belief that Asian economies will grow

more strongly than the economies of developed nations in the West.

This major weighting in the portfolio is represented both by

smaller Chinese companies listed on the AIM market in London as

well as by a variety of larger UK quoted companies oriented to

energy and metals. Although these investments should benefit from

the recovery in the world economy they have performed poorly during

the period largely due to the unexpected weakness in all commodity

markets.

By contrast, the section of the portfolio represented by

housebuilders (Berkeley Group, Persimmon and Barratt Developments)

has continued to perform well at a time when UK consumer confidence

is returning in the UK on account of falling unemployment and

reduced oil prices. The Manager has reduced the level of gearing in

the portfolio.

Change of Management contract

As I announced at last year's AGM on 18 July 2014, the Manager

indicated an intention to retire within the next three years, as a

result of which no further Continuation Votes would be sought in

the future.

Since then, the Board has been in contact with a number of other

Investment Trusts to discuss possible merger options, with the

intent of selecting and putting a proposal to shareholders next

year.

In the meantime, the Phoenix Asset Management Partners

("Phoenix") approached the Board with a proposal to take on the

management of Aurora.

An announcement was made by the Board to the London Stock

Exchange advising that it had agreed in principle to proposals

which it believes will achieve the Board's objective of offering an

attractive continuing vehicle and cash exit for shareholders. The

proposal is for the Company's existing Manager to be acquired by

Phoenix. It is then intended that the Company's investment policy

and strategy will reflect the successful investment style adopted

by Phoenix since its establishment in 1998.

Since its founding in 1998, the Phoenix UK Fund has risen by

435.1% compared to 110.6% for the FTSE All-Share Index, including

dividends.

It is intended that a new Investment Management Agreement will

be entered into, under which Phoenix will receive no base

management fee but will be entitled to a performance fee based on

annual outperformance of the FTSE All-Share Total Return.

The Board also intends to implement a tender offer for all

shareholders at a 2% discount to the NAV per share, less the direct

costs of the tender offer, provided the tender offer offers

shareholders a lower discount to NAV than can be achieved through

the market.

The proposals are subject to the approval in a General Meeting

of the Company's shareholders. A shareholder circular with further

detail of the proposals accompanies the Half Year Report.

Lord Flight

Chairman

30 October 2015

INTERIM MANAGEMENT REPORT

MANAGER'S REVIEW

The half year just ended started on a promising note with the

London stock-market continuing to make gains until the end of

April; thereafter it started to retrench. It then enjoyed a sudden

spurt as a result of the surprise victory by the Conservatives in

the General Election in May; this boosted both investor and

consumer confidence for a brief period. With the onset of the

summer months global events, particularly the unexpected

devaluation of the Chinese currency (albeit by only 3%) undermined

the rosy domestic picture, resulting in steadily falling markets

ever since.

Despite such a difficult background, the Fund managed to

outperform the benchmark, the FTALL-Share index by 2.6%.

The investment policy has remained broadly unchanged during the

period with the exception of the level of gearing which has been

halved.

Despite the poor performance of commodity producers and small

Chinese oriented companies, as well as by the large holding in

Aberdeen Asset Management, the Fund has outperformed during the six

months. The stocks which performed notably well were the

housebuilders, Persimmon and Berkeley Group, as a result of both

increasing margins and volumes against a background of political

pressure encouraging the industry to raise production. This sector

remains a long standing favourite of the Manager. It is, during

this disinflationary era in which we live, one of the very few

sectors with high relative pricing power caused by the shortage of

new supply in relation to rapid household formation and the influx

of foreign buyers, combined with substantial inward migration.

The surprise takeover, which came out of the blue,' of Amlin by

Mitsui towards the end of the period also boosted the

performance.

Ashtead meanwhile continues to produce one set of excellent

results after another, far in excess of its peers. Sadly, these are

currently not reflected in the share price, probably in view of

misconstrued worries over its exposure, which is minimal, to

slow-down in the oil and gas industry.

At a time when the majority of Developed Economies appear to be

strengthening and when the prospects for interest rates to remain

low are set fair, the level of investor sentiment is unduly

negative against a background of high institutional liquidity.

Accordingly, a sudden rebound in equity markets could easily occur

in the near term, with a likely catalyst being the faintest glimpse

of improved economic statistics emanating from China, where some

are already of the firm opinion that the leading indicators have

turned upwards.

MJ Barstow

Mars Asset Management Ltd

30 October 2015

(MORE TO FOLLOW) Dow Jones Newswires

October 30, 2015 07:04 ET (11:04 GMT)

ANALYSIS OF NET ASSET VALUE RETURNS

Movement Attribution

of

in net assets change to

NAV

GBP'000 pence per

share

Revenue income 483 4.65p

Trading gains 326 3.13p

Expenses, costs

and tax (310) (2.98p)

Dividend paid (400) (3.85p)

Capital losses (1,110) (10.68p)

Of which:

Change in market (1,756) (16.89p)

Net gearing (1,999) (19.23p)

Stock selection 2,645 25.44p

Total movement in

NAV (1,011) (9.73p)

-------------- ------------

SECTOR BREAKDOWN

As at 31 August 2015

SECTOR AURORA

%

Oil & Gas 7.2

Construction & Materials 27.4

Consumer Services 17.1

Financials 18.2

Information Technology 8.4

Resources (Mining) 5.1

Support Services 7.9

Consumer Goods 3.6

Industrials 0.6

Alternative Energy 1.8

97.3

-------

Fixed Interest Securities 2.7

100.0

-------

TOP TEN HOLDINGS

Consolidated portfolio

As at 31 August 2015

All holdings shown are GBP'000 Portfolio

of ordinary shares,

unless shown otherwise

Berkeley Group Housebuilding 1,853 10.4%

BTG Health Care 1,830 10.3%

Persimmon Housebuilding 1,682 9.4%

Ashtead Group Support Services 1,418 8.0%

West China Cement Building Materials 1,224 6.9%

Gresham Computing Software 1,089 6.1%

Royal Dutch Petroleum

'B' Oil Integrated 1,024 5.7%

Aberdeen Asset Management Investment 957 5.4%

Amlin Insurance 773 4.3%

Jupiter Fund Investment 668 3.8%

Total top ten holdings 12,518 70.3%

------- ---------

Other investments 5,298 29.7%

------- ---------

17,816 100.0%

------- ---------

FORMAL DECLARATIONS

The Chairman's Statement on pages 1 and 2 and the Manager's

Review on pages 4 to 5 provide details on the performance of the

Company. Those reports also include an indication of the important

events that have occurred during the first six months of the

financial year ending 28 February 2016 and the impact of those

events on the condensed set of financial statements included in

this Half-yearly financial report.

Details of the largest ten investments held at the period end

and the structure of the portfolio at the period end are provided

on page 6.

Principal Risks and Uncertainties

The Board considers that the main risks and uncertainties faced

by the Company fall into the categories of (i) Market risks and

(ii) Corporate governance and internal control risks. A detailed

explanation of these risks and uncertainties can be found in the

Company's most recent Annual Report for the year ended 28 February

2015. Except as disclosed in the Chairman's Statement and Manager's

Review, the principal risks and uncertainties facing the Company

remain unchanged from those disclosed in the Annual Report.

Related Party Transactions

Details of the investment management arrangements were provided

in the Annual Report. There have been no material changes to the

related party transactions described in the Annual Report that

could have an effect on the financial position or performance of

the Company. Amounts payable to the investment manager in the

period are detailed in the Income Statement on page 9.

Board of Directors

30 October 2015

DIRECTORS STATEMENT OF RESPONSIBILITY

FOR THE HALF YEARLY REPORT

The Directors confirm to the best of their knowledge that:

-- The condensed set of financial statements contained within

the half yearly financial report has been prepared in accordance

with International Accounting Standard 34 "Interim Financial

Reporting"; and

-- The interim management report includes a fair review of the

information required by 4.2.7R and 4.2.8R of the FSA's Disclosure

and Transparency Rules.

The half yearly financial report was approved by the Board on **

October 2015 and the above responsibility statement was signed on

its behalf by:

Lord Flight

Chairman

30 October 2015

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

6 months to 31 August 2015 6 months to 31 August 2014

(unaudited) (unaudited)

Revenue Capital Total Revenue Capital Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

(Losses)/gains

on investments

designated

at fair value

through profit

or loss 326* (1,110) (784) (17)* (303) (320)

-------- ---------- -------- ------------------- -------- --------

Income

Investment

income 483 - 483 536 - 536

483 - 483 536 - 536

-------- ---------- -------- ------------------- -------- --------

Expenses

Investment

management

fees (37) (37) (74) (45) (45) (90)

Other expenses (150) - (150) (126) - (126)

-------- ---------- -------- ------------------- -------- --------

(187) (37) (224) (171) (45) (216)

-------- ---------- -------- ------------------- -------- --------

Profit/(loss)

before finance

costs and

tax 622 (1,147) (525) 348 (348) -

Finance costs (42) (42) (84) (52) (52) (104)

Profit/(loss)

before tax 580 (1,189) (609) 296 (400) (104)

Tax (2) - (2) - - -

-------- ---------- -------- ------------------- -------- --------

Profit/(loss)

and total

comprehensive

income for

the period 578 (1,189) (611) 296 (400) (104)

-------- ---------- -------- ------------------- -------- --------

Earnings per

share 5.56p (11.44p) (5.88p) 2.85p (3.85p) (1.00p)

The total column of this statement represents the Group's Income

Statement, prepared in accordance with IFRS. The supplementary

revenue return and capital return columns are both prepared under

guidance published by the Association of Investment Companies. All

items in the above statement derive from continuing operations. All

income is attributable to the equity holders of the parent company.

There are no minority interests.

*Trading subsidiary (losses) and gains.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Six months Six months

Ended Ended Year ended

31 August 2014 31 August 28 February

2014 2015

Notes

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Opening equity 17,817 19,939 19,939

Total comprehensive

income for the financial

period/year (611) (104) (1,727)

Dividends paid (400) (395) (395)

Closing equity 16,806 19,440 17,817

-------------- ----------- -----------

(MORE TO FOLLOW) Dow Jones Newswires

October 30, 2015 07:04 ET (11:04 GMT)

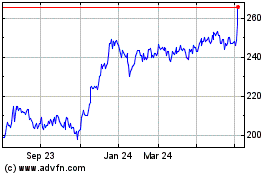

Aurora Investment (LSE:ARR)

Historical Stock Chart

From Mar 2024 to Apr 2024

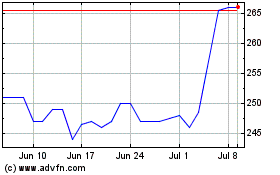

Aurora Investment (LSE:ARR)

Historical Stock Chart

From Apr 2023 to Apr 2024