TIDMAUK

RNS Number : 3598A

Aukett Swanke Group PLC

07 June 2016

Aukett Swanke Group Plc

Interim Results

For the six months ended 31 March 2016

Aukett Swanke Group Plc, the international practice of

architects, interior design specialists and engineers, is pleased

to announce its interim results for the six month period ended 31

March 2016.

Highlights

-- Revenues up 9% at GBP10.0m (2015: GBP9.2m)

-- Profit before tax lower at GBP417,000 (2015: GBP815,000)

-- Net funds of GBP1.5m (GBP1.9m at 30 September 2015) after net

debt of GBP0.5m to fund acquisition

-- Earnings per share 0.17p (2015: 0.43p)

-- Interim dividend 0.07 pence per share (2015: 0.11 pence per share)

-- Acquisition of Shankland Cox Limited augments United Arab

Emirates presence to over 100 staff

Commenting on today's interim results announcement, CEO Nicholas

Thompson said;

"The EU Referendum in the UK has clearly impacted these results

and is likely to do so for the full financial year. Encouragingly

the Group has benefitted from its recent investment in the UAE. In

addition we anticipate improved performance in both Germany and

Turkey in the second half."

Enquiries

Aukett Swanke Group Plc - 020 7843 3000

Nicholas Thompson, Chief Executive Officer

Beverley Wright, Chief Financial Officer

finnCap - 020 7220 0500

Corporate Finance: Julian Blunt/James Thompson

Corporate Broking: Alice Lane

Hermes Financial PR

Trevor Phillips - 07889 153628

Chris Steele - 07979 604687

Interim statement

Overview

We are pleased to report another period of profitability.

The result for the half year is lower than the prior year at

GBP417,000 (2015: GBP815,000) reflecting a slowdown in continuing

United Kingdom ("UK") instructions on existing projects as the

market pauses for the outcome of the EU Referendum which has been

partially offset by an improvement in the United Arab Emirates

("UAE") following recent investments. Revenues at GBP10.0m (2015:

GBP9.2m) represent further progress in our aim to grow the size of

the organisation with revenues less sub consultant costs improving

by 11% to GBP9.1m (2015: GBP8.2m). This growth has been achieved

through non UK revenues which are now 33% of the total (2015:

18%).

Acquisition of Shankland Cox Limited ("SCL")

The first half saw our second acquisition in the UAE in less

than twelve months; which provides a game changing move for our

operation in that geography. The consideration for SCL at a maximum

of AED 16m (GBP2.97m) represents the book value of the company. The

consideration is phased to take account of, firstly, the net cash

available and, secondly, the recoverability of debtors and work in

progress. Our bankers, Coutts, have provided a term loan equal to

the initial consideration thus allowing us to maintain our

operational working capital at a gross cash position which remains

at GBP2.6m (30 September 2015: GBP2.5m), including SCL's cash

balances. The enlarged size of our organisation continues to

improve our service offer in the region.

Business Model Re-Structure

With the SCL acquisition we progressed the re-balancing of our

business which now comprises three main geographies: the UK centred

on London; Continental Europe comprising the Czech Republic,

Germany, Russia and Turkey; and the Middle East - United Arab

Emirates - including Abu Dhabi, Al Ain, Dubai and Ras Al Khaimah.

These geographies are broadly equal in size by staff numbers and

will be managed on that basis in the future.

United Kingdom

Revenue at GBP6.7m (2015: GBP7.5m) is 11% down on the prior year

but profits have fallen by more to GBP498,000 (2015: GBP927,000) as

equivalent cost reductions were difficult to achieve in the short

term. Economic data on the state of the UK construction industry

performance and direction is inconclusive which has meant that our

revenues are reverting to our core markets' strengths as peripheral

sectors find new business in short supply. These results also

reflect the early impact of the EU Referendum in June 2016 which is

typified by two negative characteristics: firstly apprehension at

committing to significant post planning services (we have 2m ft(2)

of developments - all with planning consents outside London in this

category), and a more specific anomaly with Heads of (leasing)

Terms including 'Brexit' clauses. Management is now focused on

rebalancing the cost profile of the business to reflect the current

slowdown which may be impacted more by the Referendum than

previously thought. Encouragingly our new work enquiry rate remains

buoyant and we expect new instructions to flow through from

July.

Our current workload is impressive with over 1.5m ft(2) under

construction outside London including three schemes in Cambridge,

two schemes for Goodman, offices in Hemel Hempstead, Bristol,

Reading and West London, and a retail scheme in Colchester. Inside

the capital we continue to deliver four significant Aukett Swanke

designed projects, with our executive arm, Veretec adding a further

six projects.

Continental Europe

Our business in this geography comprises a mixture of

wholly-owned subsidiaries, joint ventures and an associate. Overall

the half year result has fallen due to losses in Russia and Turkey

along with a lower contribution from Germany.

Turkey (100% owned) - this operation has started to recover from

the market challenges created by the fall in oil prices and

currency decline, and the sequence of local and central government

elections in 2014 and 2015. There have been a number of significant

new commissions from NIDA Insaat, GE, Vodafone, Allianz Turkey,

FIBA Gayrimenkul, Cengiz Insaat, Nurol GYO and Yuksel Insaat. The

first half results do not yet reflect this recent success due to

delays arising from ongoing changes to Municipality building

regulations and due to a court ruling against developer choice on

the use of zoning regulations from June 2015 which was subsequently

over-ruled by the Government in February 2016. These events coupled

with the continuing geo-political situation, saw our first quarter

earnings stall. We have since recovered this position and expect to

return the operation to a full year's profit by the end of the

second half. With GDP being forecast as one of the highest in

Europe and our location within the commercial capital, Istanbul, we

remain committed to this location.

Russia (100% owned) - significant management time has been spent

on incrementally downsizing this operation since 2014, following

the currency decline and imposition of international sanctions,

which contained losses to a manageable level by the end of 2015.

However, in H1 revenues fell by over 67% to GBP227,000 (2015:

GBP692,000) which could not be mitigated by cost reductions alone

and our losses widened to GBP118,000 (2015: loss GBP11,000) of

which GBP44,000 is notionally recharged by the UK. Breakeven by the

year end is unlikely and so we are re-structuring the business to a

single corporate entity to remove any residual duplicated costs. On

a brighter note the office won the Best Office Award 2016 with a

design for Japan Tobacco International. This follows the Arcus III

win in 2015.

The Czech Republic (50% joint venture) - with little economic

activity and no political direction this market offers few

opportunities. However, the local skill base is being utilised

within the Group to support major projects in both Germany and the

UK with a positive outcome for the Group as a whole and this has

produced a small surplus of GBP6,000 (2015: GBP3,000).

Germany (25% associate - Berlin) - our best European operation

continues to perform well. Continued instructions from repeat

clients such as KfW bank, Siemens, Stone Brewing, Berlin Airport

and Hochtief along with other major developments in the city have

maintained our market position. The H1 share of the result is below

last year at GBP65,000 (2015: GBP150,000) as the office carried

expansion costs in anticipation of new instructions - which have

started to follow through with the $230m Mercedes Platz in East

Berlin and at the Allianz HQ in Aldershof. A considerable

improvement is expected in the second half.

Germany (50% joint venture - Frankfurt). The office has had a

successful start to the year by winning a major drawing programme

for Hochtief, two further commissions from Microsoft and numerous

landlord and tenant instructions on the Messe Tower for Tishman

Speyer. This has improved longer term revenue visibility.

Middle East - United Arab Emirates

With a full six months contribution from John R Harris &

Partners revenues jumped to GBP2.9m (2015: GBP0.4m) and prior year

losses converted into a profit of GBP83,000 (2015: loss

GBP91,000).

Whilst SCL was acquired in February 2016 we assumed the balance

sheet with effect from 31 December 2015 which gave rise to a small

amount of goodwill arising through short term losses. SCL

contributed GBP683,000 to H1 revenues.

Prior to the half year we won our first major project with

former client Aldar on Yas Island, Abu Dhabi for a new build

370-key hotel for operator Mövenpick. Part of the winning

submission was supported by the enlarged resource available to the

Group in the UAE.

Group costs

These fell by GBP103k during the period as a result of reduced

M&A costs and some minor exchange gains.

Prospects

We approach H2 with a certain degree of caution as the post

planning order book in the UK may take longer to unwind following

the EU Referendum than expected. In addition we have yet to

eliminate the losses in Russia which requires a higher level of

sustainable fee income. On the positive side we anticipate

continued progress in our UAE performance as the enlarged entity

gathers momentum with new and larger enquiries along with

significant improvements in both Turkey and Germany.

In consequence of the economic climate but maintained cash

positon we resolved to declare a slightly reduced interim dividend

of 0.07 pence per share (2015: 0.11 pence per share) which will be

paid on Monday 10 October 2016 to shareholders on the register at

the close of business on Friday 9 September 2016.

Nicholas Thompson

Chief Executive Officer

6 June 2016

Consolidated income statement

For the six months ended 31 March 2016

Note Unaudited Unaudited Audited

six months six months year to

to 31 to 31 30 September

March March 2015

2016 2015 GBP'000

GBP'000 GBP'000

Revenue 3 10,007 9,164 18,668

Sub consultant costs (869) (933) (1,782)

------------ ------------ --------------

Revenue less sub consultant

costs 9,138 8,231 16,886

Personnel related costs (6,725) (5,641) (11,464)

Property related costs (1,286) (1,357) (2,730)

Other operating expenses (1,062) (907) (1,715)

Other operating income 290 338 626

------------ ------------ --------------

Operating profit 355 664 1,603

Finance income 8 - 3

Finance costs (11) (8) (13)

------------ ------------ --------------

Profit after finance

costs 352 656 1,593

Share of results of

associate and joint

ventures 65 159 277

------------ ------------ --------------

Profit before tax 3 417 815 1,870

Taxation (111) (107) (215)

------------ ------------ --------------

Profit for the period 306 708 1,655

------------ ------------ --------------

Profit attributable

to:

Owners of Aukett Swanke

Group Plc 283 708 1,653

Non controlling interests 23 - 2

------------ ------------ --------------

306 708 1,655

------------ ------------ --------------

Earnings per share

Basic 4 0.17p 0.43p 1.00p

Diluted 4 0.17p 0.43p 1.00p

------------ ------------ --------------

Consolidated statement of comprehensive income

For the six months ended 31 March 2016

Unaudited Unaudited Audited

six months six months year to

to 31 to 31 30 September

March March 2015

2016 2015 GBP'000

GBP'000 GBP'000

Profit for the period 306 708 1,655

Other comprehensive

income:

Currency translation

differences 129 (101) (201)

Other comprehensive

income for the period 129 (101) (201)

Total comprehensive

income for the period 435 607 1,454

------------ ------------ --------------

Total comprehensive

income is attributable

to:

Owners of Aukett Swanke

Group Plc 401 607 1,451

Non controlling interests 34 - 3

------------ ------------ --------------

435 607 1,454

------------ ------------ --------------

Consolidated statement of financial position

At 31 March 2016

Note Unaudited Unaudited Audited

at 31 at 31 at 30

March March September

2016 2015 2015

GBP'000 GBP'000 GBP'000

Non current assets

Goodwill 2,541 1,825 2,283

Other intangibles 787 550 818

Property, plant and

equipment 539 630 563

Investment in associate

and joint ventures 446 394 354

Deferred tax 243 254 288

---------- ---------- -----------

Total non current assets 4,556 3,653 4,306

Current assets

Trade and other receivables 10,155 5,578 6,430

Current tax - 15 -

Cash and cash equivalents 6 2,567 2,540 1,873

---------- ---------- -----------

Total current assets 12,722 8,133 8,303

Total assets 17,278 11,786 12,609

Current liabilities

Trade and other payables (8,475) (5,970) (5,833)

Short term borrowings 6 (223) - -

Provisions - - -

Current tax (120) (156) (117)

Total current liabilities (8,818) (6,126) (5,950)

Non current liabilities

Long term borrowings 6 (891) - -

Provisions (1,025) (112) (354)

Deferred tax (50) (66) (54)

Total non current liabilities (1,966) (178) (408)

Total liabilities (10,784) (6,304) (6,358)

Net assets 6,494 5,482 6,251

---------- ---------- -----------

Capital and reserves

Share capital 1,652 1,652 1,652

Merger reserve 1,176 1,176 1,176

Foreign currency translation

reserve (158) (175) (276)

Retained earnings 2,084 856 1,801

Other distributable

reserve 1,610 1,973 1,791

---------- ---------- -----------

Total equity attributable

to

equity holders of the

Company 6,364 5,482 6,144

---------- ---------- -----------

Non controlling interest 130 - 107

Total equity 6,494 5,482 6,251

---------- ---------- -----------

Consolidated statement of cash flows

For the six months ended 31 March 2016

Note Unaudited Unaudited Audited

six months six months year to

to 31 to 31 30 September

March March 2015

2016 2015 GBP'000

GBP'000 GBP'000

Cash flows from operating

activities

Cash from operations 5 2,083 1,032 1,443

Interest paid (11) (8) (13)

Taxation paid (63) (58) (238)

------------ ------------ --------------

Net cash from operating

activities 2,009 966 1,192

Cash flows from investing

activities

Purchase of property,

plant and equipment (31) (125) (163)

Sale of property, plant

and equipment - - 2

Acquisition of subsidiary,

net of cash acquired (2,425) - (824)

Interest received 8 - 3

Dividends received from

associate - 115 278

------------ ------------ --------------

Net cash used in investing

activities (2,448) (10) (704)

Net cash flow before

financing activities (439) 956 488

Cash flows from financing

activities

Bank loan 1,114 - -

Repayment of bank loan - (113) (113)

Dividends paid - (178) (360)

Net cash used in financing

activities 1,114 (291) (473)

Net change in cash,

cash equivalents

and bank overdraft 675 665 15

Cash, cash equivalents

and bank

overdraft at start of

period 1,873 1,891 1,891

Currency translation

differences 19 (16) (33)

------------ ------------ --------------

Cash, cash equivalents

and bank

overdraft at end of

period 6 2,567 2,540 1,873

------------ ------------ --------------

Consolidated statement of changes in equity

For the six months ended 31 March 2016

Share Foreign Retained Other Merger Total Non-controlling Total

capital currency earnings distributable reserve Interests Equity

translation reserve

reserve GBP'000

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------- ------------ ---------- -------------- --------- --------- ---------------- ---------

At 1 October

2015 1,652 (276) 1,801 1,791 1,176 6,144 107 6,251

Profit for

the year - - 283 - - 283 23 306

Other

comprehensive

income - 118 - - - 118 11 129

Non

controlling

interest

arising

on business

combination - - - - - - (11) (11)

Dividends

paid - - - (181) - (181) - (181)

--------------- --------- ------------ ---------- -------------- --------- --------- ---------------- ---------

At 30

September

2016 1,652 (158) 2,084 1,610 1,176 6,364 130 6,494

--------------- --------- ------------ ---------- -------------- --------- --------- ---------------- ---------

For the six months ended 31 March 2015

Share Foreign Retained Other Merger Total Non-controlling Total

capital currency earnings distributable reserve Interests Equity

translation reserve

reserve GBP'000

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------- ------------ ---------- ---------------- --------- --------- ---------------- ---------

At 1 October

2014 1,652 (74) 148 2,151 1,176 5,053 - 5,053

Profit for

the year - - 708 - - 708 - 708

Other

comprehensive

income - (101) - - - (101) - (101)

Non

controlling

interest - - - - - - - -

arising

on business

combination

Dividends

paid - - - (178) - (178) - (178)

--------------- --------- ------------ ---------- ---------------- --------- --------- ---------------- ---------

At 31 March

2015 1,652 (175) 856 1,973 1,176 5,482 - 5,482

--------------- --------- ------------ ---------- ---------------- --------- --------- ---------------- ---------

For the year ended 30 September 2015

Share Foreign Retained Other Merger Total Non-controlling Total

capital currency earnings distributable reserve Interests Equity

translation reserve

reserve GBP'000

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------- ------------ ---------- ---------------- --------- --------- ---------------- ---------

At 1 October

2014 1,652 (74) 148 2,151 1,176 5,053 - 5,053

Profit for

the year - - 1,653 - - 1,653 2 1,655

Other

comprehensive

income - (202) - - - (202) 1 (201)

Non

controlling

interest

arising

on business

combination - - - - - - 104 104

Dividends

paid - - - (360) - (360) - (360)

--------------- --------- ------------ ---------- ---------------- --------- --------- ---------------- ---------

At 30

September

2015 1,652 (276) 1,801 1,791 1,176 6,144 107 6,251

--------------- --------- ------------ ---------- ---------------- --------- --------- ---------------- ---------

Notes to the interim report

1 Basis of preparation

The financial information presented in this interim report has

been prepared in accordance with the recognition and measurement

principles of International Financial Reporting Standards ('IFRS')

as adopted by the EU that are expected to be applicable to the

financial statements for the year ending 30 September 2016 and on

the basis of the accounting policies expected to be used in those

financial statements.

2 Business combination

On 10 February 2016 the group acquired 100% of the issued share

capital of Shankland Cox Limited, a company incorporated in England

and Wales but operating through 4 branches in the United Arab

Emirates.

The total consideration, all to be paid in cash, was structured

as follows:

-- AED 4.5m on completion.

-- AED 1.5m upon release of banking guarantees, paid after the reporting date.

-- Maximum deferred consideration of AED 9.8m dependant on the

collection of debtors and work in progress from the completion

balance sheet within 2 years from the completion date.

3 Operating segments

The Group comprises a single business segment and three

separately reportable geographical segments (together with a group

costs segment). Geographical segments are based on the location of

the operation undertaking each project.

During the period, the Group changed its operating segments as

management now considers the business is based on geographic area,

rather than by individual country. Accordingly, the Group's

operating segments now consist of the United Kingdom, the Middle

East and Continental Europe. Turkey and Russia are no longer

reported as separate reporting operating segments, but are included

within Continental Europe together with Germany and the Czech

Republic. All comparatives have been restated to reflect these

changes.

Segment revenue Unaudited Unaudited Audited

six months six months year to

to 31 to 31 30 September

March March 2015

2016 2015 GBP'000

GBP'000 GBP'000

United Kingdom 6,686 7,485 14,488

Middle East 2,885 432 2,129

Continental Europe 436 1,247 2,051

Total 10,007 9,164 18,668

------------ ------------ --------------

Segment result before Unaudited Unaudited Audited

tax six months six months year to

to 31 to 31 30 September

March March 2015

2016 2015 GBP'000

GBP'000 GBP'000

United Kingdom 498 927 1,993

Middle East 83 (91) 47

Continental Europe (94) 152 88

Group costs (70) (173) (258)

------------ ------------ --------------

Total 417 815 1,870

------------ ------------ --------------

4 Earnings per share

The calculations of basic and diluted earnings per share are

based on the following data:

Earnings Unaudited Unaudited Audited

six months six months year to

to 31 to 31 30 September

March March 2015

2016 2015 GBP'000

GBP'000 GBP'000

Profit for the period 283 708 1,653

------------ ------------ --------------

Number of shares Unaudited Unaudited Audited

six months six months year to

to 31 to 31 30 September

March March 2015

2016 2015 '000

'000 '000

Weighted average number

of shares 165,214 165,213 165,214

Effect of dilutive options 256 321 305

------------ ------------ --------------

Diluted weighted average

number of shares 165,470 165,534 165,519

------------ ------------ --------------

5 Reconciliation of profit before tax to net cash from operations

Unaudited Unaudited Audited

six months six months year to

to 31 to 31 30 September

March March 2015

2016 2015 GBP'000

GBP'000 GBP'000

Profit before tax 417 815 1,870

Finance income (8) - (3)

Finance costs 11 8 14

Share of results of associate

and joint ventures (65) (159) (277)

Goodwill written off 17 - -

Depreciation 172 176 345

Amortisation 73 25 80

Profit on disposal of

property, plant and equipment - - (2)

Change in trade and other

receivables (76) 636 597

Change in trade and other

payables 1,480 (481) (1,273)

Change in provisions 62 12 92

------------ ------------ --------------

Net cash from operations 2,083 1,032 1,443

------------ ------------ --------------

6 Analysis of net funds

Unaudited Unaudited Audited

at at at

31 March 31 March 30 September

2016 2015 2015

GBP'000 GBP'000 GBP'000

Cash and cash equivalents 2,567 2,540 1,873

Secured bank overdraft - - -

---------- ---------- --------------

Cash, cash equivalents

and bank overdraft 2,567 2,540 1,873

Secured bank loan (1,114) - -

Net funds 1,453 2,540 1,873

---------- ---------- --------------

Cash and cash equivalents 2,567 2,540 1,873

Short term borrowings (223) - -

Long term borrowings (891) - -

---------- ---------- --------------

Net funds 1,453 2,540 1,873

---------- ---------- --------------

7 Status of interim report

The interim report covers the six months ended 31 March 2016 and

was approved by the Board of Directors on 6 June 2016. The interim

report is unaudited.

The interim condensed set of consolidated financial statements

in the interim report are not statutory accounts as defined by

Section 434 of the Companies Act 2006.

Comparative figures for the year ended 30 September 2015 have

been extracted from the statutory accounts of the group for that

period.

The statutory accounts for the year ended 30 September 2015 have

been reported on by the Group's auditors and delivered to the

Registrar of Companies. The audit report thereon was unqualified,

did not include references to matters which the auditors drew

attention by way of emphasis without qualifying the report, and did

not contain a statement under Section 498 of the Companies Act

2006.

8 Further information

Copies of the interim report will be dispatched by post to

holders of 50,000 or more shares in due course. An electronic

version will be available on the Group's website

(www.aukettswanke.com).

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LLFSRRDIRIIR

(END) Dow Jones Newswires

June 07, 2016 02:00 ET (06:00 GMT)

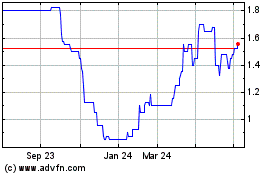

Aukett Swanke (LSE:AUK)

Historical Stock Chart

From Mar 2024 to Apr 2024

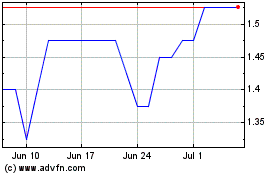

Aukett Swanke (LSE:AUK)

Historical Stock Chart

From Apr 2023 to Apr 2024