TIDMAUK

RNS Number : 8367K

Aukett Swanke Group PLC

30 June 2014

Aukett Swanke Group Plc

Interim Results

For the Six Months ended 31 March 2014

Aukett Swanke Group Plc, the international practice of

architects and interior design specialists, is pleased to announce

its interim results for the six month period ended 31 March

2014.

Highlights

-- Much improved trading performance and outlook, particularly in the UK

-- Successful acquisition of Swanke Hayden Connell Europe

-- Group revenues rise to GBP7.58m with pre-tax profit of GBP750,000

-- Revenue from pre-acquisition operations up 58% to GBP5.39m

-- First time revenue contribution for three months from Swanke

Hayden Connell of GBP2.19m

-- GBP749,000 of pre-tax profit from pre-acquisition operations

(2013: loss of GBP79,000)

-- UK pre-tax profit GBP945,000 (2013: GBP127,000)

-- GBP82,000 of pre-tax profit from newly acquired Swanke Hayden

Connell Turkey operation

-- Middle East delivers returns to profit with activity levels picking up

-- All three jointly owned Continental Europe operations in

profit, producing a total of GBP176,000 (2013: GBP134,000)

-- Earnings per share of 0.31p (2013: loss of 0.02p)

-- Group net funds GBP1.33m at 31 March 2014 (30 September 2013: GBP1.08m)

-- Interim dividend of 0.1p per share to be paid in July

Commenting on today's interim results announcement, CEO Nicholas

Thompson said;

"We are extremely pleased by a very strong performance in the UK

coupled with improving performances in Continental Europe and the

new Turkish operation, all of which offer good signs of progress

from previous turnover levels. The UK will continue to grow in

profitability for the foreseeable future and the associated cash

generation should provide the group with funding to invest in new

opportunities. As a result of this performance we are pleased to

confirm the continuation of an interim dividend payment to

shareholders."

Enquiries

Aukett Swanke Group Plc - 020 7843 3000

Nicholas Thompson, Chief Executive Officer

Duncan Harper, Group Finance Director

FinnCap - 020 7220 0500

Corporate Finance: Julian Blunt/James Thompson

Corporate Broking: Stephen Norcross

Hermes Financial PR

Trevor Phillips - 07889 153628

Chris Steele - 07979 604687

Interim statement

Overview

The first half of this year has produced a group profit before

tax of GBP750,000 which is an extremely pleasing outcome when

compared with the last year's loss for the same period of GBP79,000

and the full year's profit of GBP550,000. The overall result is

well above our original expectations and in line with the most

recent trading update, and includes a breakeven result from Swanke

Hayden Connell for a three month period.

The driving force has been the on-going recovery in the UK

market which began some eighteen months ago and which we see

continuing well into 2015 and beyond.

Against this strong UK market other areas have found life more

difficult, but we remain committed to our operations in both

Russia, and the Middle East where we believe operational

readjustments and an improving economic background will bear fruit.

Indeed our operation in the Middle East has returned a small

profit. Turkey is a strategically placed operation which offers

much promise and similarly our jointly owned operations in Germany

and Czech Republic are also doing well given local economic

circumstances.

Operations

First half pre-tax profits in the UK rose significantly to

GBP945,000 (2013: GBP127,000) on revenues of GBP6.08m. The first

half saw some extra costs as the UK reinstated salaries and other

benefits across the board and paid a Christmas bonus for the first

time in five years. The first half also saw the first integration

costs relating to SHC being absorbed which in the main will be

self-financing over the next three years, or recovered against

second half property savings. Within these figures SHC's UK

operations made a loss in the period of GBP105,000 as a result of a

delay in the instruction of a major project, which commenced at the

end of the second quarter, and holding excess property space, which

has subsequently been sub-let.

A clear change in the UK property market could be seen in the

first half with the return of the speculative office market

development outside of London - a phenomenon that has been absent

since 2009. We now have schemes underway in Cambridge (150,000 sq

ft), Reading (470,000 sq ft), Oxford (campus 1,000,000 sq ft) and

Birmingham (195,000 sq ft) with three other schemes awaiting

further instructions: Norwich (140,000 sq ft), Bristol (170,000 sq

ft) and Sheffield (70,000 sq ft). That they total over 2m sq ft is

news in itself but that some phases are being instructed to

construction gives a far more positive view of the economic upturn

in our sector and in developer confidence. Our client base behind

these projects is at the premium end of the market.

Despite this regional upturn, the main stay of the first half's

income relates to London centric projects - as earlier instructions

than regional UK - they are feeding through to revenues sooner and

with values that are a multiple of the new build cost in the

regions. Interestingly Veretec, our executive architect business,

is seeing its best growth in many years and is the fastest growing

part of the London business which reflects the intent of developers

to build as the office leasing market and residential accommodation

stock build-up gathers momentum and the UK service industry emerges

rapidly from the recession.

Against this the performance of our pre-acquisition Russian

operation was disappointing although largely due to outside

factors. First half losses widened to GBP323,000 (2013: loss of

GBP245,000) which includes a goodwill impairment write down of

GBP125,000. Whilst losses continue, we remain hopeful of a move

into profit in this important and large market. The losses were due

principally to variability in workload along with project

deferrals, delays in decisions and the need to maintain staffing

levels at client required levels rather than a lack of actual work

opportunities. We are implementing a plan to correct this position

by the end of the year which includes the co-location of our

pre-acquisition team with that of SHC's Moscow operation. This

newly acquired operation made a modest profit in the period of

GBP24,000. It should be noted that the troubles in Ukraine have had

no visible impact on enquiries or our day to day activities in

Russia.

Turkey is a new, wholly-owned operation arising from the

acquisition of SHC and has been established for 16 years in

Istanbul. Its profit contribution is welcome at GBP110,000 (before

intangible amortisation of GBP28,000) on revenues of GBP441,000.

This profit was well ahead of original expectations when the SHC

acquisition was being negotiated. We see Turkey as strategically

important in our network linking Moscow and the Middle East. The

office is in the process of completing the forty four storey

Palladium tower in the financial district of Istanbul.

The Middle East remains under-resourced, mainly due to

registration issues as we have moved to Dubai from our existing

licenced location of Abu Dhabi. Dubai has the far more active

market of the two for our breadth of services. At present we have

relied on third parties to manage the registration issue and we are

actively looking to resolve this situation. We have a single

project at present with Majid Al Futtaim, but there are numerous

bids in progress and the small profit of GBP4,000 (2013: loss of

GBP54,000) is a credible achievement by local management given the

high operating cost exposure. Once the licensing issue is resolved

we can embark upon an expansion of our resourcing which should then

lead to a regular contribution to profit.

Continental Europe is the group's second best performer at

present with all three of the jointly owned operations in profit.

The overall result at GBP176,000 (2013: GBP135,000) reflects a

slightly lower performance by Berlin (25% owned) but a considerable

uplift in Frankfurt (50% owned) and a return to profit in Prague

(50% owned) - a pleasing result given the low market activity

levels in the Czech Republic.

In South America we have embarked upon a process of identifying

a collaboration partner in Brazil on the basis of a limited amount

of direct investment by the group.

Board

We have seen a number of new joiners to the board during the

period. Andrew Murdoch, David Hughes and Nick Pell all joined as

executive directors in December last year, David and Nick as part

of the acquisition of SHC. We welcome them all to the board and

feel sure that they will add much to the group. Since the period

end John Bullough has joined the board in a non-executive capacity

and we welcome him similarly.

John Vincent retired in March after a long career with the group

and Duncan Harper, the Group Finance Director, has announced his

decision to resign after six and a half years' service, though he

will remain with the group during his notice period to ensure an

orderly handover to his successor. The board has begun a process of

finding a replacement and further announcements will be made in due

course.

Prospects

Undoubtedly the UK is and will remain the greatest source of the

group's future profit, based on the growth in the pipeline of

opportunities and improving rate of conversions. The London market

has provided much of the pick-up in activity to date, though we

expect the regional UK market to begin to contribute meaningfully

in the second half and into 2015. Coupled with a full contribution

to second half revenues by SHC and with the start of property

savings which should more than offset the integration costs of the

2013 transaction, we expect that total UK profits will continue to

perform well despite some cost inflation in the second half which

will marginally lower returns until volumes lift further.

Outside the UK the drive to revive revenue generation in Russia

and resolve our Middle East organisational issues should further

assist the group to build on current performance.

Overall therefore we take an optimistic view of the profit

potential of the group for the foreseeable future in our

traditional areas of expertise and, as we have said before, we will

continue to review and evaluate opportunities to expand the

business.

Meanwhile, as our underlying business returns to full strength,

the board is also actively considering alternative strategies to

both counter the cyclical nature of our revenue streams and find

ways to diversify away from our single revenue discipline. This

will have the twin-fold benefit of providing greater revenue

visibility and broader growth opportunities in order to preserve

longer term profitability.

In recognition of trading year to date and our much improved

outlook we are delighted to be paying an interim dividend of 0.1p

per share on Monday 28 July 2014 to shareholders on the register at

close of business on Friday 11 July 2014.

Nicholas Thompson

Chief Executive Officer

29 June 2014

Consolidated income statement

For the six months ended 31 March 2014

Note Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2014 2013 2013

GBP'000 GBP'000 GBP'000

Revenue 2 7,575 3,403 8,406

Sub consultant costs (1,015) (580) (1,290)

------------- ------------- --------------

Revenue less sub consultant

costs 6,560 2,823 7,116

Personnel related costs (4,270) (2,064) (4,751)

Property related costs (997) (630) (1,256)

Other operating expenses (842) (455) (1,027)

Other operating income 132 121 217

------------- ------------- --------------

Operating profit / (loss) 583 (205) 299

Finance income - - 1

Finance costs (9) (8) (14)

------------- ------------- --------------

Profit / (loss) after finance

costs 574 (213) 286

Share of results of associate

& joint ventures 176 134 264

------------- ------------- --------------

Profit / (loss) before tax 2 750 (79) 550

Taxation (255) 52 (176)

------------- ------------- --------------

Profit / (loss) for the period

attributable

to equity holders of the company 495 (27) 374

------------- ------------- --------------

Earnings / (losses) per share

Basic 3 0.31p (0.02)p 0.26p

Diluted 3 0.31p (0.02)p 0.26p

------------- ------------- --------------

Consolidated statement of comprehensive income

For the six months ended 31 March 2014

Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2014 2013 2013

GBP'000 GBP'000 GBP'000

Profit / (loss) for the period 495 (27) 374

Other comprehensive income:

Currency translation differences (42) 37 (2)

Currency translation differences

recycled

on discontinued operation - - 1

------------- ------------- --------------

Other comprehensive income

for the period (42) 37 (1)

Total comprehensive income

for the period

attributable to equity holders

of the company 453 10 373

------------- ------------- --------------

Consolidated statement of financial position

At 31 March 2014

Note Unaudited Unaudited Audited

at 31 at 31 at 30

March March September

2014 2013 2013

GBP'000 GBP'000 GBP'000

Non current assets

Goodwill 1,890 1,494 1,369

Other intangibles 599 - -

Property, plant & equipment 355 287 326

Investment in associate and

joint ventures 297 231 229

Deferred tax 411 685 454

---------- ---------- -----------

Total non current assets 3,552 2,697 2,378

Current assets

Trade and other receivables 5,620 2,399 3,515

Current tax 15 193 117

Cash and cash equivalents 5 1,522 724 1,343

---------- ---------- -----------

Total current assets 7,157 3,316 4,975

Total assets 10,709 6,013 7,353

Current liabilities

Trade and other payables (5,320) (2,904) (4,005)

Short term borrowings 5 (150) (150) (150)

Provisions (260) (100) (50)

Current tax (25) - -

Total current liabilities (5,755) (3,154) (4,205)

Non current liabilities

Investment in joint ventures - (1) -

Long term borrowings 5 (38) (188) (113)

Provisions (136) - -

Deferred tax (72) (5) (6)

Total non current liabilities (246) (194) (119)

Total liabilities (6,001) (3,348) (4,324)

Net assets 4,708 2,665 3,029

---------- ---------- -----------

Capital and reserves

Share capital 1,652 1,456 1,456

Merger reserve 1,176 - -

Foreign currency translation

reserve (13) 67 29

Retained earnings (403) (1,300) (898)

Other distributable reserve 2,296 2,442 2,442

---------- ---------- -----------

Total equity attributable

to

equity holders of the company 4,708 2,665 3,029

---------- ---------- -----------

Consolidated statement of cash flows

For the six months ended 31 March 2014

Note Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2014 2013 2013

GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

Cash from / (used in) operations 4 367 (6) 646

Interest paid (9) (8) (14)

Taxation received 94 - 61

------------- ------------- --------------

Net cash from / (used in)

operating activities 452 (14) 693

Cash flows from investing

activities

Purchase of property, plant

& equipment (70) (30) (157)

Sale of property, plant &

equipment - 4 4

Acquisition of subsidiary, (57) - -

net of cash acquired

Interest received - - 1

Dividends received from associate 104 83 210

------------- ------------- --------------

Net cash (used in) / from

investing activities (23) 57 58

Net cash flow before financing

activities 429 43 751

Cash flows from financing

activities

Repayment of bank loan (75) (75) (150)

Payment of asset finance liabilities (2) - -

Dividends paid (146) - -

Net cash used in financing

activities (223) (75) (150)

Net change in cash, cash equivalents

and bank overdraft 206 (32) 601

Cash, cash equivalents and

bank

overdraft at start of period 1,343 739 739

Currency translation differences (27) 17 3

------------- ------------- --------------

Cash, cash equivalents and

bank

overdraft at end of period 5 1,522 724 1,343

------------- ------------- --------------

Consolidated statement of changes in equity

For the six months ended 31 March 2014

Foreign

currency Other

Share Merger translation Retained distributable Unaudited

capital reserve reserve earnings reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 October

2013 1,456 - 29 (898) 2,442 3,029

Profit for the

period - - - 495 - 495

Other comprehensive

income - - (42) - - (42)

Dividends - - - - (146) (146)

Share issue 196 1,176 - - - 1,372

---------- ---------- ------------- ----------- ---------------- ------------

At 31 March

2014 1,652 1,176 (13) (403) 2,296 4,708

---------- ---------- ------------- ----------- ---------------- ------------

For the six months ended 31 March 2013

Foreign

currency Other

Share Merger translation Retained distributable Unaudited

capital reserve reserve earnings reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 October

2012 1,456 - 30 (1,276) 2,442 2,652

Profit for the

period - - - (27) - (27)

Other comprehensive

income - - 37 - - 37

Share based

payment value

of employee

services - - - 3 - 3

---------- ---------- ------------- ----------- ---------------- ------------

At 31 March

2013 1,456 - 67 (1,300) 2,442 2,665

---------- ---------- ------------- ----------- ---------------- ------------

For the year ended 30 September 2013

Foreign

currency Other

Share Merger translation Retained distributable Unaudited

capital reserve reserve earnings reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 October

2012 1,456 - 30 (1,276) 2,442 2,652

Profit for the

period - - - 374 - 374

Other comprehensive

income - - (1) - - (1)

Share based

payment value

of employee

services - - - 4 - 4

---------- ---------- ------------- ----------- ---------------- ------------

At 30 September

2013 1,456 - 29 (898) 2,442 3,029

---------- ---------- ------------- ----------- ---------------- ------------

Notes to the interim report

1 Basis of preparation

The financial information presented in this interim report has

been prepared in accordance with the recognition and measurement

principles of International Financial Reporting Standards ('IFRS')

as adopted by the EU that are expected to be applicable to the

financial statements for the year ending 30 September 2014 and on

the basis of the accounting policies expected to be used in those

financial statements.

2 Business combination

On 18 December 2013 the group acquired 100% of the issued share

capital of Swanke Hayden Connell Europe Ltd, a major firm of

architects and interior designers with offices in London, Moscow,

Istanbul and Sheffield.

The total consideration for the acquisition was GBP1.58m

comprising a cash payment of GBP209,053 with the balance satisfied

by the issue of 19,594,959 new shares at a price of 7.00 pence per

share.

The fair values of the identifiable assets and liabilities

acquired have only been provisionally determined and are subject to

adjustment during the measurement period.

2 Operating segments

The Group comprises a single business segment and five

separately reportable geographical segments (together with a group

costs segment). Geographical segments are based on the location of

the operation undertaking each project.

Segment revenue Pre-acquisition Acquired

operations operations Total

GBP'000 GBP'000 GBP'000

Unaudited six months to 31 March

2014

United Kingdom 4,817 1,260 6,077

Russia 154 484 638

Turkey - 441 441

Middle East 419 - 419

Continental Europe - - -

Total 5,390 2,185 7,575

---------------- ------------ ----------

Unaudited six months to 31 March

2013

United Kingdom 2,287 - 2,287

Russia 942 - 942

Turkey - - -

Middle East 174 - 174

Continental Europe - - -

Total 3,403 - 3,403

---------------- ------------ ----------

Audited year to 30 September

2013

United Kingdom 6,160 - 6,160

Russia 1,875 - 1,875

Turkey - - -

Middle East 371 - 371

Continental Europe - - -

Total 8,406 - 8,406

---------------- ------------ ----------

Segment result before tax Pre-acquisition Acquired

operations operations Total

GBP'000 GBP'000 GBP'000

Unaudited six months to 31 March

2014

United Kingdom 1,050 (105) 945

Russia (323) 24 (299)

Turkey - 82 82

Middle East 4 - 4

Continental Europe 176 - 176

Group costs (158) - (158)

---------------- ------------ ----------

Total 749 1 750

---------------- ------------ ----------

Unaudited six months to 31 March

2013

United Kingdom 127 - 127

Russia (245) - (245)

Turkey - - -

Middle East (54) - (54)

Continental Europe 135 - 135

Group costs (42) - (42)

---------------- ------------ ----------

Total (79) - (79)

---------------- ------------ ----------

Audited year to 30 September

2013

United Kingdom 961 - 961

Russia (395) - (395)

Turkey - - -

Middle East (132) - (132)

Continental Europe 260 - 260

Group costs (144) - (144)

---------------- ------------ ----------

Total 550 - 550

---------------- ------------ ----------

3 Earnings / (losses) per share

The calculations of basic and diluted earnings / (losses) per

share are based on the following data:

Earnings / (Losses) Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2014 2013 2013

GBP'000 GBP'000 GBP'000

Profit / (Loss) for the period 495 (27) 374

------------- ------------- --------------

Number of shares Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2014 2013 2013

'000 '000 '000

Weighted average number of shares 157,616 145,619 145,619

Effect of dilutive options 394 - -

------------- ------------- --------------

Diluted weighted average number

of shares 158,010 145,619 145,619

------------- ------------- --------------

4 Reconciliation of profit / (loss) before tax to net cash from / (used in) operations

Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2014 2013 2013

GBP'000 GBP'000 GBP'000

Profit / (Loss) before tax 750 (79) 550

Currency translation differences

recycled - - 1

Share based payment value of

employee services - 3 4

Finance income - - (1)

Finance costs 9 8 14

Share of results of associate

& joint ventures (176) (134) (264)

Goodwill written off 125 - 125

Depreciation 106 62 149

Amortisation 36 - -

Loss on disposal of property,

plant & equipment - (4) (4)

Change in trade & other receivables 70 161 (1,022)

Change in trade & other payables (506) 198 1,365

Change in provisions (47) (221) (271)

------------- ------------- --------------

Net cash from / (used in) operations 367 (6) 646

------------- ------------- --------------

5 Analysis of net funds

Unaudited Unaudited Audited

at 31 at 31 at 30

March March September

2014 2013 2013

GBP'000 GBP'000 GBP'000

Cash and cash equivalents 1,522 724 1,343

Secured bank overdraft - - -

---------- ---------- -----------

Cash, cash equivalents and bank

overdraft 1,522 724 1,343

Secured bank loan (188) (338) (263)

Net funds 1,334 386 1,080

---------- ---------- -----------

Cash and cash equivalents 1,522 724 1,343

Short term borrowings (150) (150) (150)

Long term borrowings (38) (188) (113)

---------- ---------- -----------

Net funds 1,334 386 1,080

---------- ---------- -----------

6 Status of interim report

The interim report covers the six months ended 31 March 2014 and

was approved by the board of directors on 29 June 2014. The interim

report is unaudited.

The interim condensed set of consolidated financial statements

in the interim report are not statutory accounts as defined by

Section 434 of the Companies Act 2006.

Comparative figures for the year ended 30 September 2013 have

been extracted from the statutory accounts of the group for that

period.

The statutory accounts for the year ended 30 September 2013 have

been reported on by the group's auditors and delivered to the

Registrar of Companies. The audit report thereon was unqualified,

did not include references to matters which the auditors drew

attention by way of emphasis without qualifying the report, and did

not contain a statement under Section 498 of the Companies Act

2006.

7 Further information

Copies of the interim report will be dispatched by post to

holders of 10,000 or more shares in due course. An electronic

version will be available on the Group's website

(www.aukettswanke.com).

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LFFSLRRIAFIS

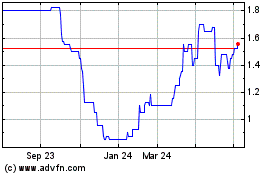

Aukett Swanke (LSE:AUK)

Historical Stock Chart

From Mar 2024 to Apr 2024

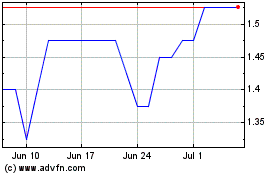

Aukett Swanke (LSE:AUK)

Historical Stock Chart

From Apr 2023 to Apr 2024