TIDMAUK

RNS Number : 9565T

Aukett Swanke Group PLC

12 January 2017

Embargoed until 7.00am on Thursday 12 January 2017

Aukett Swanke Group Plc

Announcement of final audited results

for the year ended 30 September 2016

Aukett Swanke Group Plc (the "Group"), the international group

of architects and interior designers, announces its final audited

results for the year ended 30 September 2016

Financial Highlights

-- Achieved revenue target of GBP20.8m (2015: GBP18.7m)

-- Profit before tax below target at GBP0.9m (2015: GBP1.9m)

-- EPS 0.47p (2015: 1.00p) per share

-- Cash maintained at GBP1.8m (2015: GBP1.9m) with net funds

GBP0.8m after new acquisition loan

-- Net assets grew to GBP7.2m (2015: GBP6.3m)

Operational Highlights

-- Successfully completed the acquisition of a major second

business in the Middle East to further diversify revenue streams

and increase resource capability

-- A difficult year in the UK as uncertainties around Brexit led

to a substantial weakness in the market requiring some

downsizing

-- Middle East integration progressing well with our larger

operation attracting a higher level of enquiries

-- Continental Europe making good progress, strong performance

in Germany and Turkey where we see scope for growth; Russia

continues to be very weak

-- Won six Industry Awards in the UK, Russia and Turkey

Commenting on the results CEO Nicholas Thompson said:

"We have made considerable progress with our strategic growth

plans for the Group by making a further acquisition in the Middle

East. 2017 will see a period of consolidation of our recent

additions in order to benefit the Group over the longer term."

Enquiries

Aukett Swanke - 020 7843 3000

Nicholas Thompson, Chief Executive Officer

Beverley Wright, Chief Financial Officer

finnCap - 020 7220 0500

Corporate Finance: Julian Blunt / James Thompson

Corporate Broking: Alice Lane

Investor / Media Enquiries

Ben Alexander 07926 054 111

Chairman's statement

Encouragingly this year revenues have continued to climb and now

stand at GBP20.8m (2015: GBP18.7m) achieving our stated strategy.

This improvement reflects new earnings flowing from the recent

acquisitions in the Middle East offsetting a slowdown in the United

Kingdom and Russian operations. This growth in our revenue has

enabled us to enlarge our business footprint.

The year turned out to be more difficult in achieving our profit

target. Profit before tax at GBP0.93m (2015: GBP1.87m) was the

result of a number of matters that are more specifically described

below. After tax, our EPS was 0.47p (2015: 1.00p) and our cash

funds were equivalent to the prior year at GBP1.84m (2015:

GBP1.87m).

During the year the Company recorded two dividends totalling

0.18 pence per share. We declared a slightly lower interim dividend

at 0.07 pence per share as a reflection of market conditions.

Whilst the Group is still confident of its long term position,

given the slow down in the UK and the funding requirements in the

UAE, as explained on page 3, the Board has resolved to defer the

decision regarding a dividend until the AGM which will take place

in March 2017.

As always I wish to acknowledge the contribution of the staff in

our business as well as my colleagues on the Board who continually

respond positively to the challenges and opportunities that our

organisation presents. To them, I offer my personal thanks for

their individual contributions.

Anthony Simmonds

Chairman

11 January 2017

Extracts from strategic and directors' reports

Overview

Revenues for the year were GBP20.8m, an increase of 11.2% on the

previous year (2015: GBP18.7m). Revenues less sub consultants also

rose to GBP18.4m (2015: GBP16.9m), an 8.9% increase.

Profitability has fallen during the year with profit before tax

at GBP0.9m compared to GBP1.9m in 2015. Whilst lower than the

previous year, the result reflects a solid performance after taking

account of the challenges which the Group has faced including

volatility in the UK market, particularly in the light of Brexit;

the geopolitical challenges in Russia; and integration in the

Middle East following our second acquisition there in eight

months.

The results for the second half show a slightly improved

position when compared with the first half. Revenues, including our

second acquisition Shankland Cox Limited, improved by 8% whilst

profit before tax at GBP510k was 22% higher compared to GBP417k at

March 2016.

Our tax charge for the year is GBP106k (2015: GBP215k),

representing an effective tax rate of 11% (2015: 11%). Reflecting

this low effective tax rate, our profit after tax at GBP0.8m gives

an EPS of 0.47 pence per share (2015: 1.00 pence per share).

Our total equity is now GBP7.2m, an increase of GBP0.9m over the

prior year (2015: GBP6.3m).

Financing

Net funds at year end were GBP0.8m, comprising cash of GBP1.8m

and the loan taken out in respect of the acquisition of Shankland

Cox Limited ("SCL"), which now stands at GBP1.0m. Excluding any

balances and financing costs in respect of SCL our net funds have

been maintained at the same level of the previous year (GBP1.9m).

However, given the increased footprint in the Middle East and the

need for regulatory and banking collateral, in the short term there

is less available free cash than previously.

The loan to acquire Shankland Cox Limited was taken out in

February 2016 for the principal sum of USD 1.6m representing AED

6m. It is being repaid in equal quarterly instalments of USD 80k

over five years. Other than this loan there were no other

borrowings at year end, although the Group has the benefit of a net

zero overdraft facility from its bankers Coutts & Co. This

facility is used by the Group to hedge foreign exchange

exposures.

The Group has a strong focus on cash management and visibility

of its liquidity position as well as future flows. The Plc acts as

the Group's central banker, and whilst it may, subject to formal

approval, advance short term working capital support, all

businesses are required to be cash generative or as a minimum cash

neutral.

Strategy

In order to create a more resilient operating trading platform

we embarked on an acquisition strategy to strengthen our UK and

Middle East operations in 2013. The objective being to mitigate as

far as possible reliance on any one geographical market and at the

same time to balance the economic and political risks that property

development activity faces in cyclical markets. A further

beneficial aspect of this strategy has been to spread our currency

exposure which has been particularly beneficial in the post Brexit

period where our primary currency, the pound Sterling, was heavily

devalued.

With this more robust services platform now in place our aim is

to reinforce our position in the three regional operations through

local investment into our skills and service offer to the extent

that each of the local markets allow. The immediate objectives are

to provide a high quality design service and, at the same time,

create a sustainable business model.

Beyond this we will continue to grow organically or by specific

acquisition if deemed appropriate, although our longer term growth

strategy will be to focus more on diversifying our services offer

to areas with a less transactional revenue profile.

Awards

In addition to financial performance we also measure our success

through recognised Design Awards. During the period we won six new

awards. In the UK we won two categories in the Office Agents'

Society Awards for the Adelphi Building in the West End and Forbury

Place in Reading. In addition Veretec, our executive delivery

group, won the AJ 'Executive Architect of the year' with two of its

building projects being RIBA winners. Further afield our Russian

studio won the Best Office Award for Japan Tobacco International

and Arcus III was recognised for a second year. Finally, our

Turkish studio won 'Sign of the City Award' with the Bomonti Modern

Palas in Istanbul.

United Kingdom

As we highlighted in the Interim Announcement, the operation was

impacted by a general slowdown in construction activity in the

first half but more so in the second half as a result of Brexit.

Whilst we saw new enquiries in the second half, these did not

result in any material increase in short term revenues other than

in Veretec. As a result net revenues for the year are 16% down on

prior year and 22% in the second half alone, compared to the same

period in the prior year.

Profits are down by half as fixed costs and staff reductions do

not immediately follow in tandem. The second half profit was

similar to the first half. Looking forward the UK is likely to see

a further reduction in revenues in the first part of the new year

before the position stabilises. Therefore we do not expect any

contribution in profit terms from the UK until the second half.

After the year end we reduced our staffing levels consistent

with anticipated income but are cognisant that we need to maintain

our core skill base which carries with it an excess cost in the

short term.

Notable projects during the year included: two office projects

in Uxbridge for Goodman, the PSQ HQ in Hemel Hempstead, Project

Verde for Tishman Speyer in Victoria, a GBP104m science building

for Imperial College, a new store for Fenwick in Colchester, Phase

2 at Forbury Place for M&G, the Bradfield Centre for Cambridge

University, the GBP20m Biomed Realty building at Granta Park pre

let to Heptares and a further phase on the iconic Adelphi building

off the Strand. One of our largest projects was in the City with a

major new hotel and apartments at Ten Trinity Square opposite the

Tower of London for a Chinese developer.

Our specialist group, Veretec, was also very active on a variety

of projects in Beak Street, Bishopsgate, Chelsea, Hanover Terrace,

a school in Wimbledon and a high quality residential scheme for Sir

Robert McAlpine in Lillie Square.

The next year will prove challenging in the first half as we

seek to generate revenue from current enquiries rather than from

existing projects. Encouragingly since the end of the year the

enquiry level has stabilised with 24 new project registrations

which compares with 30 for the same period last year.

Middle East

Net earnings in the region more than quadrupled to over GBP5m

following the acquisition of SCL and with a full year's

contribution from John R Harris (acquired in June 2015). Due to

planned integration initiatives, intangible amortisation of

GBP112k, release of negative goodwill arising on acquisition

totalling GBP160k and also right sizing of the cost base, we have

reported a modest profit before tax for the twelve months to

September 2016 of GBP41k (2015: GBP47k)

The local companies undertake work for a wide range of clients

including: a three year du (telecoms) framework, ADNEC, Etisalat

retail stores and data centres, Etihad, a new Mall hotel for ALDAR,

a private villa for a Sheikh, Abu Dhabi National Hotels, the new

Manar Mall retail shopping centre and Mirdif Community shopping

mall, projects for contractors Khansaheb and international

consultants WSP, villas on the Palm Jumeirah, the Bvlgari hotel and

a residential site in Al Barari. Refurbishment of the Address Dubai

Mall hotel for Emaar, the guestrooms of an iconic 5* hotel on the

Palm Jumeirah and the 5* Kempinski Mall of the Emirates hotel on

the Sheikh Zayed Road for MAF, along with a large number of smaller

projects.

We believe that our enhanced scale will provide more

opportunities for us to bid on major projects - and this is now

being evidenced in new enquiries. As such management attention is

now focused on strengthening the succession structure through

existing design and delivery skills along with achieving operating

efficiencies across the businesses.

Continental Europe

Our reported net earnings, for the wholly owned businesses in

this Hub, are under GBP1m, whilst this sum is GBP8.4m if 100% of

the associate and joint venture revenue is included. This creates

an undertaking similar in size to the UK and Middle East.

Continental Europe's result is a mix of performances across the

businesses where the greatest challenge within its portfolio during

the year was Russia.

The Russian operation has now been reduced to a minimum

operating level and works on a limited number of projects

reflecting its current scale. We expect this operation to remain at

this level for the foreseeable future and until the local market

improves.

The wholly owned Turkish operation returned to profit and

eliminated its prior year deficit.

Berlin continues to be significant contributor to the Group's

result. After a slow first half a series of major wins in the

second half lifted its performance to prior year levels. The office

and its team continue to expand and reached 125 staff by the year

end. Projects include site work at Berlin's new airport, a new

facility in Berlin for Stone Brewing of the USA, Phase 2 Gropius

Passagen for mfi-Unibail-Rodamco, a 5* hotel, The Fontenay, in

Hamburg, an office tower in Frankfurt, a new development in Berlin

for Hines, and the Anschutz Mercedes Platz with Hochtief.

Frankfurt has continued to improve its year on year performance

with a longer term order book including an office relocation of

3,600 staff for an international insurance company and regular work

for Microsoft. Interestingly we have not seen any early evidence of

financial services' relocation to the city in the aftermath of

Brexit.

Prague has achieved a small profit this year based on the

provision of drawing services to both the London and Berlin

offices.

Summary, Group Prospects and Shareholder Value

Whilst we had hoped for a better outcome in 2016, we remain

encouraged by the progress that we have made in developing our

business model and that this will ultimately generate both the

results and cash flow that we have anticipated. Our objective is to

provide shareholders with a sustainable business model that can

positively respond to business cycles and deliver long term returns

in both cash and profits generation and dividend flow.

Nicholas Thompson Beverley Wright

Chief Executive Officer Chief Financial Officer

11 January 2017

Consolidated income statement

For the year ended 30 September 2016

Note 2016 2015

GBP'000 GBP'000

--------------------------------------- ----- --------- ---------

Revenue 2 20,841 18,668

Sub consultant costs (2,431) (1,782)

--------------------------------------- ----- --------- ---------

Revenue less sub consultant

costs 18,410 16,886

Personnel related costs (13,929) (11,464)

Property related costs (2,632) (2,730)

Other operating expenses (1,901) (1,715)

Other operating income 732 626

Operating profit 680 1,603

Finance income 8 3

Finance costs (28) (13)

--------------------------------------- ----- --------- ---------

Profit after finance costs 660 1,593

Share of results of associate

and joint ventures 267 277

--------------------------------------- ----- --------- ---------

Profit before tax 2 927 1,870

Tax charge (106) (215)

--------------------------------------- ----- --------- ---------

Profit from continuing

operations 821 1,655

Profit for the year 821 1,655

--------------------------------------- ----- --------- ---------

Profit attributable to:

Owners of Aukett Swanke

Group Plc 772 1,653

Non controlling interests 49 2

--------------------------------------- ----- --------- ---------

821 1,655

--------------------------------------- ----- --------- ---------

Basic and diluted earnings

per share for profit attributable

to the ordinary equity

holders of the Company:

From continuing operations 0.47p 1.00p

Total earnings per share 3 0.47p 1.00p

--------------------------------------- ----- --------- ---------

Consolidated statement of comprehensive income

For the year ended 30 September 2016

2016 2015

GBP'000 GBP'000

--------------------------------------------- --------- ---------

Profit for the year 821 1,655

Other comprehensive income:

Currency translation differences 424 (201)

Other comprehensive income

for the year 424 (201)

Total comprehensive income

for the year 1,245 1,454

---------------------------------------------- --------- ---------

Total comprehensive income

for the year is attributable

to:

Owners of Aukett Swanke

Group Plc 1,158 1,451

Non controlling interests 87 3

1,245 1,454

--------------------------------------------- --------- ---------

Consolidated statement of financial position

At 30 September 2016

2016 2015

GBP'000 GBP'000

------------------------------- --------- ---------

Non current assets

Goodwill 2,409 2,283

Other intangible assets 1,056 818

Property, plant and equipment 506 563

Investment in associate 529 254

Investments in joint ventures 181 100

Deferred tax 219 288

-------------------------------- --------- ---------

Total non current assets 4,900 4,306

Current assets

Trade and other receivables 9,227 6,430

Cash and cash equivalents 1,839 1,873

-------------------------------- --------- ---------

Total current assets 11,066 8,303

Total assets 15,966 12,609

Current liabilities

Trade and other payables (6,553) (5,833)

Current tax (12) (117)

Short term borrowings (247) -

Provisions (90) -

------------------------------- --------- ---------

Total current liabilities (6,902) (5,950)

Non current liabilities

Long term borrowings (802) -

Deferred tax (100) (54)

Provisions (973) (354)

-------------------------------- --------- ---------

Total non current liabilities (1,875) (408)

Total liabilities (8,777) (6,358)

Net assets 7,189 6,251

-------------------------------- --------- ---------

Capital and reserves

Share capital 1,652 1,652

Merger reserve 1,176 1,176

Foreign currency translation

reserve 110 (276)

Retained earnings 2,573 1,801

Other distributable reserve 1,494 1,791

-------------------------------- --------- ---------

Total equity attributable

to

equity holders of the

Company 7,005 6,144

-------------------------------- --------- ---------

Non controlling interests 184 107

-------------------------------- --------- ---------

Total equity 7,189 6,251

-------------------------------- --------- ---------

Consolidated statement of cash flows

For the year ended 30 September 2016

Note 2016 2015

GBP'000 GBP'000

---------------------------------- ----- --------- ---------

Cash flows from operating

activities

Cash generated from operations 4 104 1,443

Interest paid (29) (13)

Income taxes paid (99) (238)

---------------------------------- ----- --------- ---------

Net cash (outflow) / inflow

from operating activities (24) 1,192

Cash flows from investing

activities

Purchase of property, plant

and equipment (147) (163)

Sale of property, plant

and equipment 4 2

Acquisition of subsidiary,

net of cash acquired (761) (824)

Interest received 8 3

Dividends received - 278

---------------------------------- ----- --------- ---------

Net cash used in investing

activities (896) (704)

Net cash (outflow) / inflow

before financing activities (920) 488

Cash flows from financing

activities

Proceeds from bank loans 1,123 -

Repayment of bank loans (175) (113)

Dividends paid (181) (360)

---------------------------------- ----- --------- ---------

Net cash inflow / (outflow)

from financing activities 767 (473)

Net change in cash, cash

equivalents and

bank overdraft (153) 15

Cash and cash equivalents

and bank

overdraft at start of year 1,873 1,891

Currency translation differences 119 (33)

Cash, cash equivalents and

bank

overdraft at end of year 1,839 1,873

---------------------------------- ----- --------- ---------

Consolidated statement of changes in equity

For the year ended 30 September 2016

Share Foreign Retained Other Merger Total Non Total

capital currency earnings distributable reserve controlling Equity

translation reserve interests

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------- ------------- ---------- -------------- --------- --------- -------------- ---------

At 30

September

2014 1,652 (74) 148 2,151 1,176 5,053 - 5,053

Profit for

the year - - 1,653 - - 1,653 2 1,655

Other

comprehensive

income - (202) - - - (202) 1 (201)

Non

controlling

interest

arising

on business

combination - - - - - - 104 104

Dividends

paid - - - (360) - (360) - (360)

At 30

September

2015 1,652 (276) 1,801 1,791 1,176 6,144 107 6,251

Profit for

the year - - 772 - - 772 49 821

Other

comprehensive

income - 386 - - - 386 38 424

Other

adjustments - - - - - - (10) (10)

Dividends

paid - - - (297) - (297) - (297)

At 30

September

2016 1,652 110 2,573 1,494 1,176 7,005 184 7,189

--------------- --------- ------------- ---------- -------------- --------- --------- -------------- ---------

The other distributable reserve was created in September 2007

during a court and shareholder approved process to reduce the

capital of the Company.

Notes to the audited final results

1 Basis of preparation

The financial statements for the Group and parent have been

prepared in accordance with International Financial Reporting

Standards (IFRSs) as adopted by the European Union and the

Companies Act 2006 as applicable to companies reporting under

IFRSs.

The financial statements have been prepared under the historical

cost convention and on a going concern basis.

2 Operating segments

The Group comprises a single business segment and three

separately reportable geographical segments (Hubs), together with a

group costs segment. Geographical segments are based on the

location of the operation undertaking each project.

During the period, the Group changed its operating segments as

management now considers the business is based on geographic area,

rather than by individual country. Accordingly, the Group's

operating segments now consist of the United Kingdom, the Middle

East and Continental Europe. Turkey and Russia are no longer

reported as separate reporting operating segments, but are included

within Continental Europe together with Germany and the Czech

Republic. All comparatives have been restated to reflect these

changes.

Income statement segment information

Segment revenue 2016 2015

GBP'000 GBP'000

-------------------- --------- ---------

United Kingdom 12,142 14,488

Middle East 7,383 2,129

Continental Europe 1,316 2,051

Revenue 20,841 18,668

--------------------- --------- ---------

Segment revenue by project 2016 2015

site GBP'000 GBP'000

---------------------------- --------- ---------

United Kingdom 12,014 14,262

Middle East 7,349 2,311

Continental Europe 1,396 2,085

Rest of the World 82 10

----------------------------- --------- ---------

Revenue 20,841 18,668

----------------------------- --------- ---------

Segment revenue less 2016 2015

sub consultant costs GBP'000 GBP'000

----------------------------- --------- ---------

United Kingdom 12,080 14,368

Middle East 5,424 1,306

Continental Europe 906 1,212

Revenue less sub consultant

costs 18,410 16,886

------------------------------ --------- ---------

Segment result

2016 Segment Before Release Goodwill Total

result goodwill of negative impairment

impairment goodwill

GBP'000 GBP'000 GBP'000 GBP'000

-------------------- ------------ ------------- ------------ ---------

United Kingdom 1,052 - - 1,052

Middle East (119) 160 - 41

Continental Europe 112 - (17) 95

Group costs (261) - - (261)

-------------------- ------------ ------------- ------------ ---------

Profit before

tax 784 160 (17) 927

-------------------- ------------ ------------- ------------ ---------

2015 Segment Before Release

result goodwill of negative Goodwill

impairment goodwill impairment Total

GBP'000 GBP'000 GBP'000 GBP'000

-------------------- ------------ ------------- ------------ ---------

United Kingdom 1,993 - - 1,993

Middle East 47 - - 47

Continental Europe 88 - - 88

Group costs (258) - - (258)

-------------------- ------------ ------------- ------------ ---------

Profit before

tax 1,870 - - 1,870

-------------------- ------------ ------------- ------------ ---------

3 Earnings per share

The calculations of basic and diluted earnings per share are

based on the following data:

Earnings 2016 2015

GBP'000 GBP'000

----------------------- --------- ---------

Continuing operations 772 1,653

Profit for the year 772 1,653

----------------------- --------- ---------

Number of shares 2016 2015

Number Number

------------------------------ ------------ ------------

Weighted average of Ordinary

Shares in issue 165,213,652 165,213,652

Effect of dilutive options 153,916 305,482

------------------------------ ------------ ------------

Diluted weighted average of

ordinary shares in issue 165,367,568 165,519,134

------------------------------ ------------ ------------

4 Cash generated from operations

Group 2016 2015

GBP'000 GBP'000

--------------------------------- --------- ---------

Profit before tax - continuing

operations 927 1,870

Finance income (8) (3)

Finance costs 28 14

Share of results of associate

and joint ventures (267) (277)

Goodwill impairment provision 17 -

Intangible amortisation 177 80

Depreciation 359 345

Loss/(profit) on disposal

of property, plant & equipment 10 (2)

Change in trade and other

receivables 628 597

Change in trade and other

payables (1,583) (1,273)

Change in provisions 16 92

Negative goodwill (160) -

Unrealised foreign exchange

differences (40) -

Net cash generated from

operations 104 1,443

---------------------------------- --------- ---------

5 Analysis of net funds

Group 2016 2015

GBP'000 GBP'000

--------------------------- --------- ---------

Cash and cash equivalents 1,839 1,873

Cash and cash equivalents 1,839 1,873

Secured bank loan (1,049) -

Net funds 790 1,873

---------------------------- --------- ---------

6 Business Combination

On 10 February 2016 the Group acquired 100% of the issued share

capital of Shankland Cox Limited ('SCL'), a company incorporated in

England and Wales but operating through 4 branches in the United

Arab Emirates.

The total consideration, all to be paid in cash, was structured

as follows:

-- AED 4.5m on completion.

-- AED 1.5m upon release of banking guarantees, paid after the acquisition date.

-- Maximum deferred consideration of AED 9.8m dependant on the

collection of trade receivables and work in progress from the

agreed Balance Sheet within 2 years from the completion date.

The deferred consideration up to a maximum of AED 9.8m had a

fair value of AED 5.4m at acquisition. The minimum amount currently

payable in respect of this deferred consideration is AED1.3m,

representing receivables which have been collected. The maximum

amount payable is currently AED 8.7m, which is contingent on the

collection of all acquired trade receivables before 10 February

2018.

Of the AED 11.4m fair value of consideration transferred, AED

6.0m cash consideration has been paid and the full deferred

consideration remains outstanding at the balance sheet date. At the

year end, the fair value of deferred consideration has been

estimated to be AED 4.8m.

The acquisition considerably improves our market position and

offering in the Middle East.

The table below summarises the consideration paid for SCL, the

fair value of assets acquired and liabilities assumed at the

acquisition date.

Consideration at 10 February 2016 GBP'000

--------------------------------------------- --------

Cash 1,126

Fair value of deferred consideration

at acquisition 1,015

Total consideration transferred at

acquisition 2,141

Recognised amounts of identifiable

assets acquired and liabilities assumed

Cash and cash equivalents 365

Property, Plant and Equipment 132

Brand Name 282

Customer relationships 28

Amounts recoverable on contracts 401

Trade and other receivables 2,530

Trade and other payables (848)

Provision for liabilities (589)

Total identifiable net assets 2,301

--------------------------------------------- --------

Release of negative goodwill on acquisition (160)

Total 2,141

--------------------------------------------- --------

Negative goodwill of GBP160,000 has arisen on acquisition

following recognition of the intangible assets noted above. This

credit to the income statement compensates for short term costs

incurred to restructure the business.

Acquisition costs of GBP58,000 have been included in other

operating charges in the consolidated income statement for the year

ended 30 September 2016.

The fair value of trade and other receivables is GBP2,530,000

and includes trade receivables with a fair value of GBP2,146,000.

The gross contractual amount for trade receivables due is

GBP2,842,000, of which GBP696,000 is expected to be

uncollectable.

The fair values of the acquired identifiable intangibles are

based on finalised valuations.

The revenue included in the consolidated income statement since

10 February 2016 contributed by SCL was GBP2,275,000. The revenue

less sub consultant costs contributed over the same period was

GBP2,067,000. The loss before tax, amortisation and gain on bargain

purchase during the period since acquisition was GBP557,000.

Had SCL been consolidated from 1 October 2015, the consolidated

income statement would show pro-forma revenue of GBP22,608,000 and

profit before tax of GBP709,000.

7 Status of final audited results

This announcement of final audited results was approved by the

Board of Directors on 11 January 2017.

The financial information presented in this announcement has

been extracted from the Group's audited statutory accounts for the

year ended 30 September 2016 which will be delivered to the

Registrar of Companies following the Company's Annual General

Meeting.

The auditor's report on these accounts was unqualified, did not

include references to any matters to which the auditors drew

attention by way of emphasis without qualifying their report, and

did not contain a statement under section 498 of the Companies Act

2006.

Statutory accounts for the year ended 30 September 2015 have

been delivered to the registrar of companies and the auditors'

report on these accounts was unqualified, did not include

references to any matters to which the auditors drew attention by

way of emphasis without qualifying their report, and did not

contain a statement under section 498 of the Companies Act

2006.

The financial information presented in this announcement of

final audited results does not constitute the Group's statutory

accounts for the year ended 30 September 2016.

8 Annual General Meeting

Notice of the annual general meeting will follow in due course

and no later than 21 days before the meeting is due to be held.

9 Annual report and accounts

Copies of the 2016 audited accounts will be available today on

the Company's website (www.aukettswanke.com) for the purposes of

AIM rule 26 and will be posted to shareholders who have elected to

receive a printed version in due course.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR OKDDKFBKDDDD

(END) Dow Jones Newswires

January 12, 2017 02:00 ET (07:00 GMT)

Aukett Swanke (LSE:AUK)

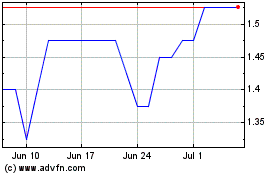

Historical Stock Chart

From Mar 2024 to Apr 2024

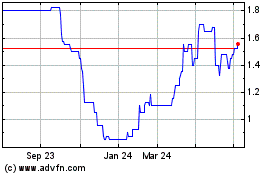

Aukett Swanke (LSE:AUK)

Historical Stock Chart

From Apr 2023 to Apr 2024