TIDMAUK

RNS Number : 2305N

Aukett Swanke Group PLC

28 January 2016

Embargoed until 7.00am on Thursday 28 January 2016

Aukett Swanke Group Plc

Announcement of final audited results

for the year ended 30 September 2015

Aukett Swanke Group Plc (the "Group"), the international group

of architects and interior designers, announces its final audited

results for the year ended 30 September 2015.

Financial Highlights

-- Revenues up 8.1% to GBP18.7m (2014: GBP17.3m)

-- PBT up 33.6% to GBP1.9m (2014: GBP1.4m)

-- EPS up 53.8% to 1.00p (2014: 0.65p)

-- Final dividend payment of 0.11p making 0.22p for the year (2014: 0.2p)

-- Net funds at year end GBP1.9m (2014: GBP1.8m)

Operational Highlights

-- Evolution of the business via non organic growth strategy progressing

-- Positive contribution from John R Harris & Partners Limited

-- UK strong performance

-- Overall profit from Europe operations

-- Middle East positioned for further growth

Commenting on the results CEO Nicholas Thompson said

"We are very pleased to be reporting a strong set of numbers

despite a wide variety of market related issues. Considerable

progress has been made in the evolution of the business. The

integration of John R Harris & Partners Limited has gone well

and we see further potential in the UAE. Meanwhile our other

overseas operations have responded well to management actions given

difficult trading conditions."

Enquiries

Aukett Swanke - 020 7843 3000

Nicholas Thompson, Chief Executive Officer

Beverley Wright, Chief Financial Officer

finnCap - 020 7220 0500

Corporate Finance: Julian Blunt / James Thompson

Corporate Broking: Stephen Norcross

Hermes Financial PR

Trevor Phillips - 07889 153628

Chris Steele - 07979 604687

Chairman's statement

I am pleased to report on another successful year for the

Company to 30 September 2015 in which we achieved an improvement in

each of our key financial criteria.

Revenue increased by 8.1% to GBP18.7m (2014: GBP17.3m). However,

it is pleasing to report that profit before tax increased by 33.6%

to GBP1.9m (2014: GBP1.4m) reflecting our success in minimising the

losses in those operations where revenues were delayed. Our results

also benefitted from a lower effective tax rate thereby increasing

our Earnings Per Share by 53.8% to 1.00p (2014: 0.65p).

During the year we announced the acquisition of a majority

interest (80%) in John R Harris & Partners Limited (JRHP) for a

cash consideration of GBP897k which represents further progress in

the evolution of our stated policy of growing the business through

a non organic strategy. Following this acquisition we were still

able to increase our net funds, which at the year end stood at

GBP1.9m (2014: GBP1.8m). The Group remains debt free.

We have also continued our policy of regular dividends and have

declared two payments totalling 0.22 pence in the year. These

dividends are covered 4.6 times by after tax profits.

During the year John Bullough, one of our non executive

directors, was appointed to the Audit Committee. On 22 December

2015, we announced that David Hughes, the former CEO of Swanke

Hayden Connell Europe Limited (SHC) stepped down from the Board and

will be dedicating his time to expanding his portfolio of

commissions as an Expert Witness for the UK business. I would like

to thank David for his contribution to the Board since the

acquisition of SHC in December 2013.

In 2016 we shall continue to focus on consolidating our success

in the UK whilst expanding our operations in the Middle East, and

more specifically in the United Arab Emirates (UAE), where we

believe there is both political stability and project

opportunities. In those countries where difficult conditions have

prevailed we shall seek to minimise any further adverse impact on

the Group's overall performance.

I am therefore comfortable that the Company will continue to

progress and maintain its financial strength and I am pleased to

announce that we will pay a second and final dividend in respect of

the year ended 30 September 2015 of 0.11 pence per share. Subject

to approval at the Annual General Meeting, this dividend will

become payable on 22 April 2016 to shareholders on the register on

8 April 2016.

I would like to thank all our staff for their continuing

contributions to our success and for their hard work and dedication

in delivering high quality projects and these excellent results,

whilst at the same time maintaining and developing our blue chip

client portfolio.

I look forward to further success for your Company in 2016.

Anthony Simmonds

Non Executive Chairman

27 January 2016

Extracts from strategic and directors' reports

Overview

Revenues grew during the year to GBP18.7m (2014: GBP17.3m), 8.1%

higher.

Our profit before tax was much improved at GBP1.9m (2014:

GBP1.4m) showing a 34% growth rate. We had, however, hoped to

report a better result but this became progressively unattainable

following the negative events in both Russia and Turkey. After tax

and the non controlling interests there is dividend cover of 4.6

times on an EPS of 1.00 pence per share (2014: 0.65 pence per

share).

Our balance sheet, including non controlling interests of

GBP0.1m, has grown by over GBP1.2m to GBP6.3m (2014: GBP5.1m).

Within this, net funds at GBP1.9m (2014: GBP1.8m) were slightly

higher than the prior year and achieved after paying GBP897,000 in

cash for JRHP (2014: GBP209k cash element for SHC).

In June 2015 we acquired an 80% holding in JRHP, a practice

established in 1949 and carrying out the majority of its services

in the Middle East. This brought an immediate return to the Group

through a net profit achieved in the last quarter. Given that our

continuing operation, even with the addition JRHP, remains under

sized in its market, we do not expect any synergy cost savings to

emerge in the short term.

The strategy of the Group is to become a major player in the

professional services sector through the provision of architectural

and design services both in the United Kingdom and the wider

international market place. In following this M&A strategy we

have acquired two practices operating in the United Kingdom,

Russia, Turkey and the Middle East over the past two years. These

acquisitions have resulted in Aukett Swanke Group Plc climbing

twenty two places in the recently published WA100 2016 rankings to

51(st) making us the sixth largest UK practice by international

measurement.

On the design front we won four awards this year: two in Russia,

and one in each of the United Kingdom and Germany. Our London and

Moscow offices jointly achieved Winner of Golden Brick Award (CBRE

awards) and Winner Best Lobby (Best office awards) for Arcus III in

Moscow. Our retail store for M&S at Cheshire Oaks won its

14(th) award - this time the 'Test of Time' at the Buildings award

ceremony. Finally our fit out for BNP in Frankfurt won a LEED Gold

(the third for this office). We also had project representation at

numerous other award ceremonies.

United Kingdom

The UK maintained its financial performance during the year but

saw a slow down in the second half with costs catching up with

previous revenue advances and one major project being temporarily

suspended in the second half. As a result of these factors, whilst

revenue increased by 12.4% compared to 2014, the profit before tax

result of GBP2.0m (2014: GBP1.8m) grew more modestly at 9.8%. A

combination of more FTE technical staff and higher productivity saw

revenue per FTE technical staff improve from GBP98k per person to

GBP106k.

During the year we completed the integration of Aukett Fitzroy

Robinson Limited and Swanke Hayden Connell International Limited

and rebranded the business Aukett Swanke Limited (ASL). ASL and

Veretec, our Executive architecture business, represent our UK

trading companies.

The UK workload in 2015 was underpinned by projects progressing

to the construction site phase. This was well illustrated by the

practice heading Building's Top Architects by Project Value in

December 2014 with 15 projects valued at GBP924m.

There were numerous projects being constructed 'on site' in

London including a major hotel at Ten Trinity Square in the City, a

further academic building for Imperial College and two major office

refurbishments - one for Tishman Speyer in Victoria and another for

Blackstone near The Strand.

2015 also saw Veretec maintain its premium market position with

a number of large residential schemes in progress including Lillie

Square and De Vere Gardens for Sir Robert McAlpine along with

schemes in Hanover Terrace, Charlotte Street and a single dwelling

in Chelsea.

Significantly, a higher proportion of our offices' portfolio in

the year has been outside London, including Eastside Locks in

Birmingham for Goodman; Aspire, a redevelopment in Bristol; Forbury

Place in Reading for M&G; the Bradfield Centre in Cambridge for

Gilead; Gade Zone in Hemel Hempstead and a mixed use development,

Staines Central. We also commenced work on a mid tech office park

in Alconbury for Urban&Civic plc.

The interiors business gained momentum in the year evidenced by

project wins from Zurich ReInsurance, JP Morgan Chase, Ince &

Co, Merrill Lynch, Sumitomo Mitsui Banking Corporation and

Richemont.

We have seen a significant increase in on site work during the

year as we move through the development cycle. However, we now see

the market having less momentum in the future and this will be

further tempered by higher construction costs being evidenced in

the market.

Russia

Despite the challenges presented by the fall in the oil price

and the devaluation of the Rouble, our Russian business only

reported a small loss in the year. This creditable performance was

achieved by the dedication and perseverance of our team who worked

hard in difficult circumstances to deliver projects, maintain

client relationships and to ensure that we did not incur bad

debts.

(MORE TO FOLLOW) Dow Jones Newswires

January 28, 2016 02:00 ET (07:00 GMT)

During the year we also invested considerable effort in

constantly ensuring that appropriate staff levels were maintained

and overhead costs were reduced as far as possible, whilst working

to combine the SHC branch and the pre acquisition Russian

operation, ZAO Aukett Fitzroy Vostok, into one self supporting

business.

The results in Sterling, compared to previous years, show a

decrease in revenue less sub consultant costs. However taking

account of the average devaluation in the value of the Rouble of

49% during the year, 2015 was in fact a stronger result in local

currency than in prior years with revenue less subcontractor costs

24% higher than in 2014 and revenue per FTE up 78%. At a local

level the operation was profitable before central cost

allocations.

Russia remains an important market for the Group, but the Board

does not underestimate the difficulties in winning and delivering

successful projects in a market which is equally challenging and

unpredictable for our clients. 2016 will therefore be a year of

further rigorous focus on cost control to ensure that our business

model best suits the market circumstances.

Turkey

In contrast to last year's performance and the outlook this time

last year, 2015 has been a difficult year for our business in

Turkey. This is almost exclusively attributable to external

political factors, where the absence of an elected government, and

the impasse associated with that, created a hiatus in the market,

such that even contracted projects did not proceed.

This hiatus is highlighted by delays in planning submissions due

to project zoning issues that created uncertainties in development

volumes and property uses for our clients.

As a result of this, we considerably downsized our operation and

posted a small net loss before tax of GBP133k which compares to a

profit before tax of GBP90k for the previous year.

We have however maintained a sustainable presence with a highly

capable team that is now well positioned to work on many

opportunities that are re-emerging and coming to market,

particularly from our retained, blue chip customer base which

includes FIBA, Cengiz and Tahincioglu.

Middle East

With the acquisition of JRHP in June 2015, we moved a step

towards achieving our growth strategy in the Middle East. The

results for the year reflect both JRHP's contribution and that of

our existing business Aukett Fitzroy Robinson International Limited

(AFRI) and show a 165% increase in revenue less sub consultant

costs.

In the 3 months of ownership, JRHP performed in line with our

expectation and contributed a positive result. During the year,

AFRI continued to work on our key project with Majid Al Futtaim,

which is now coming to a successful close. In addition, we have bid

for and secured future work, also in conjunction with JRHP, thereby

confirming our acquisition strategy.

It has become clear, even in the short period ownership of JRHP,

that our bidding success has improved as a result of our increased

scale. However, we remain undersized in the market and as we wish

to continue our expansion in the Middle East we will pursue growth

options as well as invest in additional management capacity.

Berlin

The Berlin joint venture is again the star of our portfolio.

Notwithstanding a weakening of the Euro compared to Sterling,

revenues less sub consultant costs increased by 27% to GBP5.5m and

the average number of technical staff increased to 79 compared to

51 last year. Profit before tax also rose, but by less than the

revenue growth due to investment costs incurred in expanding the

office. Our share of post tax profits amounted to GBP264k compared

to GBP254k in the previous year. The comparable contribution of

revenue per FTE technical staff was also impacted by exchange rate

movements.

Projects worked on were for a mix of local and large

international clients, in Berlin as well as other German cities,

including the Berlin Entertainment District at the Mercedes Platz,

the 30 storey WinX office tower working drawings in Frankfurt for

BAM, the Barcel Hotel in Berlin, the working drawings of a mixed

use development in Berlin for Hines and the interior design of the

five star Fontenay Hotel in Hamburg.

Frankfurt

After an exceptional result in 2014, the Frankfurt office

reported a fall in revenues to GBP592k and profit before tax of

GBP38k representing a more sustainable level of gradual

improvement. The studio has continued to carry out planning, design

and fit out work for local businesses as well as international

clients such as Tishman Speyer and Microsoft. In addition the

office has also been commissioned to provide construction drawing

services for a large office and laboratory for Hochtief.

Prague

This was another difficult year for the Prague joint venture,

where the local market remained very flat. Creditably the team

again achieved break even and applied its high levels of skill and

expertise supporting both the Berlin and UK studios as well as

working with their own portfolio of clients including SAB Miller,

the Riverside School, CPI and Moolson Coors.

Group costs

Group costs at GBP258k were lower than in the previous year

(GBP398k) as corporate finance and legal costs were lower and there

were no recruitment fees.

Dividends

We have continued our policy of regular dividends and have

declared two payments totalling 0.22 pence in the year. These

dividends are covered 4.6 times by after tax profits.

Summary

With the practice achieving its existing sustainable growth

targets in architectural and design services we shall also be

pursuing an alternative acquisition strategy that encompasses less

transactional revenues and broader services in order to move our

overall performance to higher levels and ensure that the Group as a

whole has less exposure to cyclical income.

Nicholas Thompson Beverley Wright

Chief Executive Officer Chief Financial Officer

27 January 2016

Consolidated income statement

For the year ended 30 September 2015

2015 2014

GBP'000 GBP'000

------------------------------------------ --------- ---------

Revenue 18,668 17,326

Sub consultant costs (1,782) (2,594)

------------------------------------------- --------- ---------

Revenue less sub consultant costs 16,886 14,732

Personnel related costs (11,464) (9,868)

Property related costs (2,730) (2,343)

Other operating expenses (1,715) (1,861)

Other operating income 626 404

------------------------------------------- --------- ---------

Operating profit 1,603 1,064

Finance income 3 -

Finance costs (13) (18)

------------------------------------------- --------- ---------

Profit after finance costs 1,593 1,046

Share of results of associate

and joint ventures 277 354

------------------------------------------- --------- ---------

Profit before tax 1,870 1,400

Tax charge (215) (354)

------------------------------------------- --------- ---------

Profit from continuing operations 1,655 1,046

Profit for the year 1,655 1,046

------------------------------------------- --------- ---------

Profit attributable to:

Owners of Aukett Swanke Group

Plc 1,653 1,046

Non controlling interests 2 -

------------------------------------------ --------- ---------

1,655 1,046

------------------------------------------ --------- ---------

Basic and diluted earnings per

share for profit attributable

to the ordinary equity holders

of the Company:

From continuing operations 1.00p 0.65p

Total earnings per share 1.00p 0.65p

------------------------------------------- --------- ---------

Consolidated statement of comprehensive income

For the year ended 30 September 2015

2015 2014

GBP'000 GBP'000

------------------------------------------ --------- ---------

Profit for the year 1,655 1,046

Other comprehensive income:

Currency translation differences (201) (103)

Other comprehensive income for

the year (201) (103)

Total comprehensive income for

the year 1,454 943

------------------------------------------- --------- ---------

Total comprehensive income for

the year is attributable to:

Owners of Aukett Swanke Group

Plc 1,451 943

Non controlling interests 3 -

1,454 943

------------------------------------------ --------- ---------

Consolidated statement of financial position

(MORE TO FOLLOW) Dow Jones Newswires

January 28, 2016 02:00 ET (07:00 GMT)

At 30 September 2015

2015 2014

GBP'000 GBP'000

-------------------------------------- --------- ---------

Non current assets

Goodwill 2,283 1,835

Other intangible assets 818 594

Property, plant and equipment 563 648

Investment in associate 254 244

Investments in joint ventures 100 131

Deferred tax 288 290

--------------------------------------- --------- ---------

Total non current assets 4,306 3,742

Current assets

Trade and other receivables 6,430 6,379

Current tax - -

Cash and cash equivalents 1,873 1,891

--------------------------------------- --------- ---------

Total current assets 8,303 8,270

Total assets 12,609 12,012

Current liabilities

Trade and other payables (5,833) (6,540)

Current tax (117) (131)

Short term borrowings - (113)

Provisions - (104)

--------------------------------------- --------- ---------

Total current liabilities (5,950) (6,888)

Non current liabilities

Long term borrowings - -

Deferred tax (54) (71)

Provisions (354) -

-------------------------------------- --------- ---------

Total non current liabilities (408) (71)

Total liabilities (6,358) (6,959)

Net assets 6,251 5,053

--------------------------------------- --------- ---------

Capital and reserves

Share capital 1,652 1,652

Merger reserve 1,176 1,176

Foreign currency translation reserve (276) (74)

Retained earnings 1,801 148

Other distributable reserve 1,791 2,151

--------------------------------------- --------- ---------

Total equity attributable to

equity holders of the Company 6,144 5,053

--------------------------------------- --------- ---------

Non controlling interests 107 -

-------------------------------------- --------- ---------

Total equity 6,251 5,053

--------------------------------------- --------- ---------

Consolidated statement of cash flows

For the year ended 30 September 2015

2015 2014

GBP'000 GBP'000

--------------------------------------- --------- ---------

Cash flows from operating activities

Cash generated from operations 1,443 1,360

Interest paid (13) (18)

Income taxes (paid)/ received (238) 70

---------------------------------------- --------- ---------

Net cash inflow from operating

activities 1,192 1,412

Cash flows from investing activities

Purchase of property, plant and

equipment (163) (523)

Sale of property, plant and equipment 2 4

Acquisition of subsidiary, net

of cash acquired (824) (57)

Interest received 3 -

Dividends received 278 184

---------------------------------------- --------- ---------

Net cash used in investing activities (704) (392)

Net cash inflow before financing

activities 488 1,020

Cash flows from financing activities

Repayment of bank loans (113) (150)

Dividends paid (360) (291)

---------------------------------------- --------- ---------

Net cash used in financing activities (473) (441)

Net change in cash, cash equivalents

and

bank overdraft 15 579

Cash and cash equivalents and

bank

overdraft at start of year 1,891 1,343

Currency translation differences (33) (31)

Cash, cash equivalents and bank

overdraft at end of year 1,873 1,891

---------------------------------------- --------- ---------

Consolidated statement of changes in equity

For the year ended 30 September 2015

Share Foreign Retained Other Merger Total Non-controlling Total

capital currency earnings distributable reserve Interests Equity

translation reserve

reserve GBP'000

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------- ------------ ---------- -------------- --------- --------- ---------------- ---------

At 30

September

2013 1,456 29 (898) 2,442 - 3,029 - 3,029

Profit for the

year - - 1,046 - - 1,046 - 1,046

Other

comprehensive

income - (103) - - - (103) - (103)

Issue of

ordinary

shares in

relation

to business

combination 196 - - - 1,176 1,372 - 1,372

Dividends paid - - - (291) - (291) - (291)

At 30

September

2014 1,652 (74) 148 2,151 1,176 5,053 - 5,053

Profit for the

year - - 1,653 - - 1,653 2 1,655

Other

comprehensive

income - (202) - - - (202) 1 (201)

Non

controlling

interest

arising

on business

combination - - - - - - 104 104

Dividends paid - - - (360) - (360) - (360)

--------------- --------- ------------ ---------- -------------- --------- --------- ---------------- ---------

At 30

September

2015 1,652 (276) 1,801 1,791 1,176 6,144 107 6,251

--------------- --------- ------------ ---------- -------------- --------- --------- ---------------- ---------

Notes to the audited final results

1 Basis of preparation

The financial statements have been prepared in accordance with

International Financial Reporting Standards (IFRSs) as adopted by

the European Union and the Companies Act 2006 as applicable to

companies reporting under IFRSs.

The financial statements have been prepared under the historical

cost convention and on a going concern basis.

2 Operating segments

The Group comprises a single business segment and five

separately reportable geographical segments (together with a Group

costs segment). Geographical segments are based on the location of

the operation undertaking each project.

The Group's associate and joint ventures are all based in

Continental Europe.

Segment revenue 2015 2014

GBP'000 GBP'000

-------------------- --------- ---------

United Kingdom 14,488 13,882

Russia 1,283 1,598

Turkey 768 853

Middle East 2,129 993

Continental Europe - -

Revenue 18,668 17,326

--------------------- --------- ---------

The geographical split of revenue based on the location of

project sites was:

2015 2014

GBP'000 GBP'000

-------------------- --------- ---------

United Kingdom 14,262 12,267

Russia 1,283 1,921

Turkey 768 884

Middle East 2,311 1,744

Continental Europe 34 183

Rest of the World 10 327

--------------------- --------- ---------

Revenue 18,668 17,326

--------------------- --------- ---------

Segment revenue less sub consultant 2015 2014

costs GBP'000 GBP'000

------------------------------------- --------- ---------

United Kingdom 14,368 12,779

Russia 638 774

Turkey 574 687

Middle East 1,306 492

Continental Europe - -

Revenue less sub consultant

costs 16,886 14,732

-------------------------------------- --------- ---------

(MORE TO FOLLOW) Dow Jones Newswires

January 28, 2016 02:00 ET (07:00 GMT)

Segment result

2015 Segment result Before goodwill Goodwill Total

impairment impairment GBP'000

GBP'000 GBP'000

--------------------- ---------------- ------------ ---------

United Kingdom 1,993 - 1,993

Russia (56) - (56)

Turkey (133) - (133)

Middle East 47 - 47

Continental Europe 277 - 277

Group costs (258) - (258)

--------------------- ---------------- ------------ ---------

Profit before tax 1,870 - 1,870

--------------------- ---------------- ------------ ---------

2014 Segment result Before goodwill Goodwill Total

impairment impairment GBP'000

GBP'000 GBP'000

--------------------- ---------------- ------------ ---------

United Kingdom 1,815 - 1,815

Russia (350) (125) (475)

Turkey 90 - 90

Middle East 14 - 14

Continental Europe 354 - 354

Group costs (398) - (398)

--------------------- ---------------- ------------ ---------

Profit before tax 1,525 (125) 1,400

--------------------- ---------------- ------------ ---------

3 Earnings per share

The calculations of basic and diluted earnings per share are

based on the following data:

Earnings 2015 2014

GBP'000 GBP'000

----------------------- --------- ---------

Continuing operations 1,653 1,046

Profit for the year 1,653 1,046

----------------------- --------- ---------

Number of shares 2015 2014

Number Number

-------------------------------------- ------------ ------------

Weighted average of Ordinary Shares

in issue 165,213,652 161,026,436

Effect of dilutive options 305,482 463,370

-------------------------------------- ------------ ------------

Diluted weighted average of ordinary

shares in issue 165,519,134 161,489,806

-------------------------------------- ------------ ------------

4 Cash generated from operations

Group 2015 2014

GBP'000 GBP'000

--------------------------------------- --------- ---------

Profit before tax - continuing

operations 1,870 1,400

Finance income (3) -

Finance costs 14 18

Share of results of associate

and joint ventures (277) (354)

Goodwill impairment provision

/ write off - 125

Intangible amortisation 80 82

Depreciation 345 259

Profit on disposal of property,

plant & equipment (2) (4)

Change in trade and other receivables 597 (604)

Change in trade and other payables (1,273) 676

Change in provisions 92 (238)

Net cash generated from operations 1,443 1,360

---------------------------------------- --------- ---------

5 Analysis of net funds

Group 2015 2014

GBP'000 GBP'000

--------------------------------- --------- ---------

Cash and cash equivalents 1,873 1,891

Secured bank overdraft - -

--------------------------------- --------- ---------

Cash, cash equivalents and bank

overdraft 1,873 1,891

Secured bank loan - (113)

Net funds 1,873 1,778

---------------------------------- --------- ---------

2015 2014

GBP'000 GBP'000

--------------------------- --------- ---------

Cash and cash equivalents 1,873 1,891

Short term borrowings - (113)

Long term borrowings - -

Net funds 1,873 1,778

---------------------------- --------- ---------

6 Business Combination

On 15 June 2015 the Group acquired 80% of the issued share

capital of John R Harris & Partners Limited (JRHP), a

well-established firm of architects, interior designers, engineers

and master planners incorporated in Cyprus and operating in the

Middle East.

The total consideration for the acquisition was GBP897,000

satisfied in cash.

The acquisition considerably improves our market position and

offer in the Middle East. The acquisition will further provide the

opportunity for some overhead cost savings. The goodwill acquired

on the acquisition represents the knowledge and experience of the

assembled workforce in addition to expected integration savings and

economies of scale. The goodwill is not considered deductible for

income tax purposes.

The table below summarises the consideration paid for JRHP, the

fair value of assets acquired and liabilities assumed at the

acquisition date.

Consideration at 15 June 2015 GBP'000

------------------------------------------------------ --------

Cash 897

Total consideration transferred 897

Recognised amounts of identifiable assets acquired

and liabilities assumed

Cash and cash equivalents 73

Property, Plant and Equipment 75

Customer relationships (included in other intangible

assets) 158

Order book (included in other intangible assets) 117

Trade licence (included in other intangible assets) 63

Amounts recoverable on contracts -

Trade and other receivables 887

Trade and other payables (689)

Provision for liabilities (164)

Total identifiable net assets 520

------------------------------------------------------ --------

Non-controlling interest (104)

Goodwill 481

Total 897

------------------------------------------------------ --------

Acquisition costs of GBP57,000 have been included in other

operating charges in the consolidated income statement for the year

ended 30 September 2015.

The fair value of trade and other receivables is GBP887,000 and

includes trade receivables with a fair value of GBP845,000. The

gross contractual amount for trade receivables due is GBP1,166,000,

of which GBP321,000 is expected to be uncollectable. The fair value

of trade and other receivables is provisional pending future

receipts.

The fair values of the acquired identifiable intangibles are

based on finalised valuations.

The revenue included in the consolidated income statement since

15 June 2015 contributed by JRHP was GBP865,000. The revenue less

sub consultant costs contributed by JRHP over the same period was

GBP618,000. The profit before tax and amortisation contributed over

the same period was GBP42,000.

Had JRHP been consolidated from 1 October 2014 the consolidated

income statement would show pro-forma revenue of GBP21,000,000 and

profit before tax of GBP2,162,000.

7 Status of final audited results

This announcement of final audited results was approved by the

Board of Directors on 27 January 2016.

The financial information presented in this announcement has

been extracted from the Group's audited statutory accounts for the

year ended 30 September 2015 which will be delivered to the

Registrar of Companies following the Company's Annual General

Meeting.

The auditor's report on these accounts was unqualified, did not

include references to any matters to which the auditors drew

attention by way of emphasis without qualifying their report, and

did not contain a statement under section 498 of the Companies Act

2006.

Statutory accounts for the year ended 30 September 2014 have

been delivered to the registrar of companies and the auditors'

report on these accounts was unqualified, did not include

references to any matters to which the auditors drew attention by

way of emphasis without qualifying their report, and did not

contain a statement under section 498 of the Companies Act

2006.

The financial information presented in this announcement of

final audited results does not constitute the Group's statutory

accounts for the year ended 30 September 2015.

8 Annual General Meeting

The Annual General Meeting of the Company will be held at

10:00am on Wednesday 30 March 2016 at 25 Christopher Street,

London, EC2A 2BS.

9 Annual report and accounts

Copies of the 2015 audited accounts will be available today on

the Company's website (www.aukettswanke.com) for the purposes of

AIM rule 26 and will be posted to shareholders who have elected to

receive a printed version in due course.

This information is provided by RNS

(MORE TO FOLLOW) Dow Jones Newswires

January 28, 2016 02:00 ET (07:00 GMT)

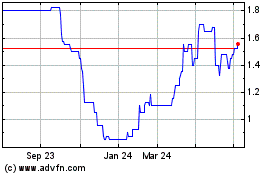

Aukett Swanke (LSE:AUK)

Historical Stock Chart

From Mar 2024 to Apr 2024

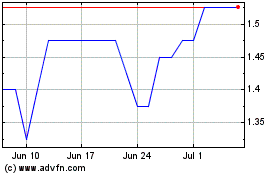

Aukett Swanke (LSE:AUK)

Historical Stock Chart

From Apr 2023 to Apr 2024