A successful bid for Deutsche Bank provided the studio with a

turnaround performance in the year and much needed revenue

visibility.

Revenues grew by 83% to GBP909k (2013: GBP496k) and profits up

five fold to GBP292k (2013: GBP58k).

The office retains a high calibre client portfolio including:

The Bank of New York Mellon, JP Morgan, Microsoft, Morgan Stanley

and Tishman Speyer.

Prague

The market for services in the Czech Republic is depressed and

achieving a breakeven result has been a considerable achievement.

The Group's decision to move to a JV arrangement has been

vindicated by recent results. As the studio has considerable design

skills, the Group will remain committed to its continuation as part

of the Group until the economy recovers.

Group costs

Group costs rose to GBP398k (2013: GBP144k). The increase

comprises one off costs in respect of corporate finance and legal

work and the acquisition of SHCE. It also reflects the impacts of

salary reinstatements, the addition of a new non executive director

and an enhanced Head Office team to support the enlarged Group,

together with recruitment fees for those individuals.

Swanke Hayden Connell Europe Limited integration

During the past nine months significant progress has been made

to integrate SHCE into our business model. Both IT platforms and

software systems have been aligned and we have co located our joint

offices in London and Moscow. This has resulted in a significant

capital spend in IT infrastructure and property refurbishment, but

brings identified cost savings that should materialise downstream.

Additionally we have been able to commence joint working on new

projects in order to yield longer term synergies and maximise our

combined expertise on project delivery.

Little of this benefit (but all of the cost) has been seen in

these results. However, our end of year reviews have highlighted

little or no further capex requirements in 2014/15 for either IT or

property (other than volume expansion) and budgets reflect an

ongoing underlying cost saving profile in these areas.

We are pleased to report that the merger will bring the expected

longer term benefits not only in critical mass and brand quality,

but in greater efficiency from our underlying overhead.

Dividends

It is the Board's intention to bring the timing of any future

dividend into line with market practice, declaring final and

interim dividends at the time of our final and interim results,

respectively.

Summary

The 2014 results reflect a considerable improvement in our

underlying performance and the executive directors are confident

that this performance can be maintained as the markets in which we

operate also improve.

Nicholas Thompson Beverley Wright

Chief Executive Officer Group Finance Director

28 January 2015

Consolidated income statement

For the year ended 30 September 2014

2014 2013

GBP'000 GBP'000

---------------------------------- --------- ---------

Revenue 17,326 8,406

Sub consultant costs (2,594) (1,290)

----------------------------------- --------- ---------

Revenue less sub consultant

costs 14,732 7,116

Personnel related costs (9,868) (4,751)

Property related costs (2,343) (1,256)

Other operating expenses (1,861) (1,027)

Other operating income 404 217

----------------------------------- --------- ---------

Operating profit 1,064 299

Finance income - 1

Finance costs (18) (14)

----------------------------------- --------- ---------

Profit after finance costs 1,046 286

Share of results of associate

and joint ventures 354 264

----------------------------------- --------- ---------

Profit before tax 1,400 550

Tax charge (354) (176)

----------------------------------- --------- ---------

Profit from continuing

operations 1,046 374

Profit for the year attributable

to equity

holders of the Company 1,046 374

----------------------------------- --------- ---------

Basic and diluted earnings

per share

From continuing operations 0.65p 0.26p

Total earnings per share 0.65p 0.26p

----------------------------------- --------- ---------

Consolidated statement of comprehensive income

For the year ended 30 September 2014

2014 2013

GBP'000 GBP'000

---------------------------------- --------- ---------

Profit for the year 1,046 374

Other comprehensive income:

Currency translation differences (103) (2)

Currency translation differences

recycled on discontinued

operations - 1

----------------------------------- --------- ---------

Other comprehensive income

for the year (103) (1)

Total comprehensive income

for the year

attributable to equity

holders of the Company 943 373

----------------------------------- --------- ---------

Consolidated statement of financial position

At 30 September 2014

2014 2013

GBP'000 GBP'000

------------------------------- --------- ---------

Non current assets

Goodwill 1,835 1,369

Other intangible assets 594 -

Property, plant and equipment 648 326

Investment in associate 244 190

Investments in joint ventures 131 39

Deferred tax 290 454

-------------------------------- --------- ---------

Total non current assets 3,742 2,378

Current assets

Trade and other receivables 6,379 3,515

Current tax - 117

Cash and cash equivalents 1,891 1,343

-------------------------------- --------- ---------

Total current assets 8,270 4,975

Total assets 12,012 7,353

Current liabilities

Trade and other payables (6,540) (4,005)

Current tax (131) -

Short term borrowings (113) (150)

Provisions (104) (50)

-------------------------------- --------- ---------

Total current liabilities (6,888) (4,205)

Non current liabilities

Long term borrowings - (113)

Deferred tax (71) (6)

-------------------------------- --------- ---------

Total non current liabilities (71) (119)

Total liabilities (6,959) (4,324)

Net assets 5,053 3,029

-------------------------------- --------- ---------

Capital and reserves

Share capital 1,652 1,456

Merger reserve 1,176 -

Foreign currency translation

reserve (74) 29

Retained earnings 148 (898)

Other distributable reserve 2,151 2,442

-------------------------------- --------- ---------

Total equity attributable

to

equity holders of the

Company 5,053 3,029

-------------------------------- --------- ---------

Consolidated statement of cash flows

For the year ended 30 September 2014

2014 2013

GBP'000 GBP'000

---------------------------------- --------- ---------

Cash flows from operating

activities

Cash generated from operations 1,360 646

Interest paid (18) (14)

Income taxes received

/ (paid) 70 61

----------------------------------- --------- ---------

Net cash inflow from operating

activities 1,412 693

Cash flows from investing

activities

Purchase of property,

plant and equipment (523) (157)

Sale of property, plant

and equipment 4 4

Acquisition of subsidiary, (57) -

net of cash acquired

Interest received - 1

Dividends received 184 210

----------------------------------- --------- ---------

Net cash generated from

/ (used in) investing

activities (392) 58

Net cash inflow before

financing activities 1,020 751

Cash flows from financing

activities

Repayment of bank loans (150) (150)

Payment of asset finance - -

liabilities

Dividends paid (291) -

---------------------------------- --------- ---------

Net cash used in financing

activities (441) (150)

Net change in cash, cash

equivalents and

bank overdraft 579 601

Cash and cash equivalents

and bank

overdraft at start of

year 1,343 739

Currency translation differences (31) 3

Cash, cash equivalents

and bank

overdraft at end of year 1,891 1,343

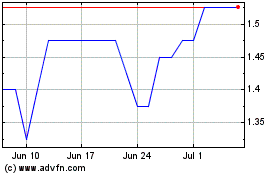

Aukett Swanke (LSE:AUK)

Historical Stock Chart

From Mar 2024 to Apr 2024

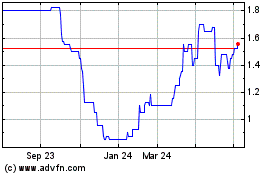

Aukett Swanke (LSE:AUK)

Historical Stock Chart

From Apr 2023 to Apr 2024