Audioboom Group PLC Half Yearly Report -4-

July 24 2015 - 2:00AM

UK Regulatory

Notes to the financial statement

1. General information and basis of preparation.

Audioboom Group plc is incorporated in Jersey under the

Companies (Jersey) Law 1991. The Company's shares are traded on the

Alternative Investment Market of the London Stock Exchange

("AIM").

These consolidated interim financial statements, which are

unaudited, have been approved by the Board of Directors on 23 July

2015. They have been drawn up using accounting policies and

presentation expected to be adopted in the Group's full financial

statements for the year ending 30 November 2015, which are not

expected to be significantly different to those set out in note 1

to the Company's audited financial statements for the period ended

30 November 2014.

The consolidated interim financial statements have been prepared

under the historical cost convention and in accordance with

International Financial Reporting Standards ("IFRS") and with IAS

34 "Interim financial reporting", as adopted by the EU.

The preparation of financial statements in accordance with IFRS

requires the use of estimates and assumptions that affect the

reported amounts of assets and liabilities, and disclosure of

contingent assets and liabilities at the date of the financial

statements and the reported amounts of revenues and expenses during

the reporting period. Although these estimates are based on

management's best knowledge of current events and actions, actual

results may ultimately differ from those estimates.

The comparative periods provided in these financial statements

are for the 5 months to 31 May 2014 (unaudited) and 11 months to 30

November 2014 (audited). This is due to the 31 December year end

that had been used by Audioboom Limited, which was acquired by the

Company during 2014. Further detail on the basis of preparation of

those comparative periods is set out in note 1 to the Company's

audited financial statements for the period ended 30 November

2014.

Going concern

These interim financial statements have been prepared on the

going concern basis, which assumes that the Company will have

sufficient funds to continue in operational existence for the

foreseeable future. The Company's forecasts for the combined group,

including due consideration of the continued operating losses of

the group, and projections, taking account of reasonably possible

changes in trading performance, indicate that the group has

sufficient cash available to continue in operational existence for

at least the next 12 months. The Board has considered various

alternative operating strategies should these be necessary and are

satisfied that revised operating strategies could be adopted if and

when necessary. As a consequence, the Board believes that the Group

is well placed to manage its business risks, and longer term

strategic objectives, successfully. Therefore the Directors

consider the going concern basis appropriate.

2. Loss per share

Basic earnings per share is calculated by dividing the loss

attribuable to shareholders by the weighted average number of

ordinary shares in issue during the period.

IAS33 requires presentation of diluted EPS when a company coud

be called upon to issue shares that would decrease earnings per

share, or increase the loss per share. For a loss-making company

with outstanding share options, net loss per share would be

decreased by the exercise of share options. Therefore, as per

IAS33:36, the antidilutive potential ordinary shares are

disregarded on the the calculation of diluted EPS.

Reconciliation of the loss and weighted average number of shares

used in the calculation are set out below:

31-May-15

Loss Weighted average number Per share

of shares amount

Basic and Diluted EPS GBP'000 Thousand Pence

Loss attributable to shareholders:

- Continuing and discontinued

operations (3,273) 532,988 (0.61)

31-May-14

Loss Weighted average number Per share

of shares amount

Basic and Diluted EPS GBP'000 Thousand Pence

Loss attributable to shareholders:

- Continuing and discontinued

operations (2,078) 15,507 (13.40)

30-Nov-14

Loss Weighted average number Per share

of shares amount

Basic and Diluted EPS GBP'000 Thousand Pence

Loss attributable to shareholders:

- Continuing and discontinued

operations (3,825) 326,118 (1.17)

3. Share Capital

Issued and fully paid - ordinary shares of no par value

At 30 November 2014 532,734,557

At 31 May 2015 533,014,577

On 17 December 2014 the Company issued 280,000 new ordinary

shares to Malcolm Wall, a director, pursuant to his terms of

appointment and in lieu of his first year's director's fee.

The total number of instruments over equity outstanding at the

period end was 91,479,985, comprising 40,219,884 warrants and

51,260,101 share options.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR DMGZNLFFGKZM

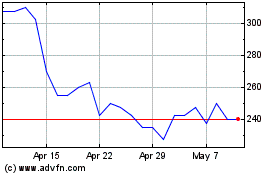

Audioboom (LSE:BOOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

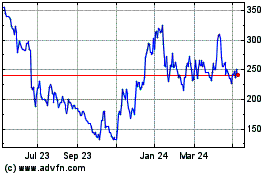

Audioboom (LSE:BOOM)

Historical Stock Chart

From Apr 2023 to Apr 2024