Atmos Energy Corporation (NYSE: ATO) today reported consolidated

results for its fiscal 2016 first quarter ended December 31,

2015.

- Fiscal 2016 first quarter consolidated

net income, excluding net unrealized margins, was $95.6 million, or

$0.93 per diluted share, compared with consolidated net income,

excluding net unrealized margins of $92.8 million, or $0.91 per

diluted share in the prior-year quarter.

- Fiscal 2016 first quarter consolidated

net income was $102.9 million, or $1.00 per diluted share, after

including unrealized net gains of $7.3 million, or $0.07 per

diluted share. Net income was $97.6 million, or $0.96 per diluted

share in the prior-year quarter, after including unrealized net

gains of $4.8 million or $0.05 per diluted share.

- The company's Board of Directors has

declared a quarterly dividend of $0.42 per common share. The

indicated annual dividend for fiscal 2016 is $1.68, which

represents a 7.7 percent increase over fiscal 2015.

“We are pleased to deliver solid first quarter financial

results,” said Kim Cocklin, chief executive officer of Atmos Energy

Corporation. “WNA mechanisms, which cover about 97 percent of our

utility margins, have largely mitigated the effects of the mild

start to this winter. In addition, our results reflect the capital

investments made in our infrastructure to meet the growing energy

needs of our customers, while striving to become the nation's

safest natural gas utility. For fiscal 2016, we remain on track to

meet our earnings guidance of between $3.20 and $3.40 per diluted

share,” Cocklin concluded.

Results for the Three Months Ended

December 31, 2015

Regulated distribution gross profit increased $9.7 million to

$333.5 million for the three months ended December 31, 2015,

compared with $323.8 million in the prior-year quarter. Gross

profit reflects a net $13.5 million increase in rates, primarily in

the Mid-Tex, Mississippi and West Texas Divisions. This increase

was partially offset by a $1.3 million decrease in revenue-related

taxes and a $1.1 million decrease in consumption. Weather was 29

percent warmer than the prior-year quarter.

Regulated pipeline gross profit increased $11.1 million to $94.7

million for the quarter ended December 31, 2015, compared with

$83.6 million in the prior-year quarter. This increase primarily

reflects a $10.1 million increase in revenue from the Gas

Reliability Infrastructure Program (GRIP) filing approved in fiscal

2015.

Nonregulated gross profit was essentially flat at $15.8 million

for the fiscal 2016 first quarter, compared with $16.0 million for

the prior-year quarter.

Consolidated operation and maintenance expense for the three

months ended December 31, 2015 was $124.8 million, compared

with $118.6 million for the prior-year quarter. The increase was

primarily driven by increased pipeline maintenance spending and

higher administrative expenses.

Capital expenditures increased to $291.7 million for the quarter

ended December 31, 2015, compared with $261.3 million in the

prior-year quarter driven by a planned increase in spending in the

company's regulated operations.

For the quarter ended December 31, 2015, the company

generated operating cash flow of $70.5 million, a $43.1 million

increase compared with the three months ended December 31,

2014. The quarter-over-quarter increase primarily reflects the

timing of customer collections and vendor payments.

The debt capitalization ratio at December 31, 2015 was 49.6

percent, compared with 47.7 percent at September 30, 2015 and

49.5 percent at December 31, 2014. At December 31, 2015,

there was $763.2 million of short-term debt outstanding, compared

with $457.9 million at September 30, 2015 and $550.9 million

at December 31, 2014.

Outlook

The leadership of Atmos Energy remains focused on enhancing

system safety and reliability through infrastructure investment

while delivering shareholder value and consistent earnings growth.

Atmos Energy continues to expect fiscal 2016 earnings to be in the

range of $3.20 to $3.40 per diluted share, excluding unrealized

margins. Capital expenditures for fiscal 2016 are still expected to

range between $1.0 billion and $1.1 billion.

Conference Call to be Webcast

February 3, 2016

Atmos Energy will host a conference call with financial analysts

to discuss the financial results for the fiscal 2016 first quarter

on Wednesday, February 3, 2016, at 8:00 a.m. Eastern. The

domestic telephone number is 877-485-3107 and the international

telephone number is 201-689-8427. Kim Cocklin, chief executive

officer, Mike Haefner, president and chief operating officer, and

Bret Eckert, senior vice president and chief financial officer,

along with other members of the leadership team, will participate

in the conference call. The conference call will be webcast live on

the Atmos Energy website at www.atmosenergy.com. A playback of the call will

be available on the website later that day.

This news release should be read in conjunction with the

attached unaudited financial information.

Forward-Looking Statements

The matters discussed in this news release may contain

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. All statements other than statements of

historical fact included in this news release are forward-looking

statements made in good faith by the company and are intended to

qualify for the safe harbor from liability established by the

Private Securities Litigation Reform Act of 1995. When used in this

news release or in any of the company's other documents or oral

presentations, the words “anticipate,” “believe,” “estimate,”

“expect,” “forecast,” “goal,” “intend,” “objective,” “plan,”

“projection,” “seek,” “strategy” or similar words are intended to

identify forward-looking statements. Such forward-looking

statements are subject to risks and uncertainties that could cause

actual results to differ materially from those discussed in this

news release, including the risks and uncertainties relating to

regulatory trends and decisions, the company's ability to continue

to access the capital markets and the other factors discussed in

the company's reports filed with the Securities and Exchange

Commission. These factors include the risks and uncertainties

discussed in the company's Annual Report on Form 10-K for the

fiscal year ended September 30, 2015 and in the company's

Quarterly Report on Form 10-Q for the three months ended

December 31, 2015. Although the company believes these

forward-looking statements to be reasonable, there can be no

assurance that they will approximate actual experience or that the

expectations derived from them will be realized. The company

undertakes no obligation to update or revise forward-looking

statements, whether as a result of new information, future events

or otherwise.

About Atmos Energy

Atmos Energy Corporation, headquartered in Dallas, is one of the

country's largest natural-gas-only distributors, serving over three

million natural gas distribution customers in over 1,400

communities in eight states from the Blue Ridge Mountains in the

East to the Rocky Mountains in the West. Atmos Energy also manages

company-owned natural gas pipeline and storage assets, including

one of the largest intrastate natural gas pipeline systems in Texas

and provides natural gas marketing and procurement services to

industrial, commercial and municipal customers primarily in the

Midwest and Southeast. For more information, visit www.atmosenergy.com.

Atmos Energy Corporation

Financial Highlights

(Unaudited)

Statements of

Income

Three Months EndedDecember 31, (000s except per share) 2015

2014 Gross Profit: Regulated distribution segment $ 333,461

$ 323,812 Regulated pipeline segment 94,677 83,567 Nonregulated

segment 15,758 16,039 Intersegment eliminations (133 )

(133 ) Gross profit 443,763 423,285 Operation and

maintenance expense 124,848 118,582 Depreciation and amortization

71,239 67,593 Taxes, other than income 51,471

49,385 Total operating expenses 247,558 235,560 Operating

income 196,205 187,725 Miscellaneous expense (1,209 ) (1,707 )

Interest charges 30,483 29,764 Income

before income taxes 164,513 156,254 Income tax expense

61,652 58,659 Net income $ 102,861 $

97,595 Basic and diluted earnings per share $ 1.00 $ 0.96

Cash dividends per share $ 0.42 $ 0.39 Basic and diluted weighted

average shares outstanding 102,713 101,581

Three Months EndedDecember 31,

Summary Net Income

(Loss) by Segment (000s)

2015 2014 Regulated distribution $ 73,255 $ 71,387

Regulated pipeline 25,586 22,035 Nonregulated (3,241 ) (584 )

Unrealized margins, net of tax 7,261 4,757

Consolidated net income $ 102,861 $ 97,595

Atmos Energy

Corporation

Financial Highlights, continued

(Unaudited)

Condensed Balance

Sheets

December 31, September 30, (000s) 2015 2015 Net property, plant and

equipment $ 7,653,287 $ 7,430,580 Cash and cash equivalents 78,903

28,653 Accounts receivable, net 456,904 295,160 Gas stored

underground 236,017 236,603 Other current assets 91,446

70,569 Total current assets 863,270 630,985 Goodwill 742,702

742,702 Deferred charges and other assets 295,394

288,678 $ 9,554,653 $ 9,092,945 Shareholders' equity $

3,272,109 $ 3,194,797 Long-term debt 2,455,474

2,455,388 Total capitalization 5,727,583 5,650,185 Accounts payable

and accrued liabilities 280,487 238,942 Other current liabilities

471,333 457,954 Short-term debt 763,236 457,927 Total

current liabilities 1,515,056 1,154,823 Deferred income taxes

1,441,325 1,411,315 Deferred credits and other liabilities

870,689 876,622 $ 9,554,653 $ 9,092,945

Atmos Energy Corporation

Financial Highlights, continued

(Unaudited)

Condensed Statements

of Cash Flows

Three Months EndedDecember 31,

(000s) 2015 2014

Cash flows from operating

activities Net income $ 102,861 $ 97,595 Depreciation and

amortization 71,239 67,593 Deferred income taxes 59,299 55,418

Other 4,733 5,164 Changes in assets and liabilities (167,639

) (198,355 ) Net cash provided by operating activities

70,493 27,415

Cash flows from investing activities Capital

expenditures (291,674 ) (261,313 ) Other, net 1,029

(739 ) Net cash used in investing activities (290,645 )

(262,052 )

Cash flows from financing activities Net increase

in short-term debt 305,309 350,574 Net proceeds from issuance of

long-term debt — 493,538 Settlement of Treasury lock agreements —

13,364 Repayment of long-term debt — (500,000 ) Cash dividends paid

(43,636 ) (39,592 ) Repurchase of equity awards — (7,985 ) Issuance

of common stock 8,729 6,312 Net cash

provided by financing activities 270,402

316,211 Net increase in cash and cash equivalents 50,250

81,574 Cash and cash equivalents at beginning of period

28,653 42,258 Cash and cash equivalents at end

of period $ 78,903 $ 123,832

Three Months EndedDecember 31,

Statistics

2015 2014 Consolidated distribution throughput (MMcf

as metered) 100,928 123,434 Consolidated pipeline transportation

volumes (MMcf) 129,159 120,634 Consolidated nonregulated delivered

gas sales volumes (MMcf) 85,131 90,930 Regulated distribution

meters in service 3,167,352 3,133,951 Regulated distribution

average cost of gas $ 4.44 $ 6.02 Nonregulated net physical

position (Bcf) 23.5 17.1

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160202006454/en/

Atmos Energy CorporationSusan Giles, 972-855-3729

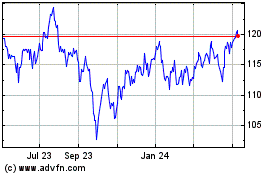

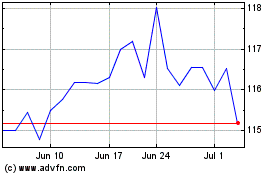

Atmos Energy (NYSE:ATO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Atmos Energy (NYSE:ATO)

Historical Stock Chart

From Apr 2023 to Apr 2024