Atmos Energy Corporation Completes Sale of Natural Gas Distribution Assets in Missouri, Illinois and Iowa

August 01 2012 - 5:01PM

Business Wire

Atmos Energy Corporation (NYSE: ATO) today announced that it

completed the sale of its natural gas distribution assets located

in Missouri, Illinois and Iowa to Liberty Energy (Midstates) Corp.,

an affiliate of Algonquin Power & Utilities Corp. The

transaction included the transfer of approximately 84,000

residential and commercial meters.

Net cash proceeds for rate base and related working capital were

approximately $129 million. These proceeds will be redeployed to

fund growth opportunities in the remaining jurisdictions the

company serves. Atmos Energy expects to record a net of tax gain on

the sale of approximately $6 million, or $0.06 per diluted share,

subject to final purchase price adjustments. For the ten months

ended July 31, 2012, these operations provided approximately $7

million of net income, or $0.07 per diluted share.

Forward-Looking Statements

The matters discussed in this news release may contain

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. All statements other than statements of

historical fact included in this news release are forward-looking

statements made in good faith by the company and are intended to

qualify for the safe harbor from liability established by the

Private Securities Litigation Reform Act of 1995. When used in this

news release or in any of the company’s other documents or oral

presentations, the words “anticipate,” “believe,” “estimate,”

“expect,” “forecast,” “goal,” “intend,” “objective,” “plan,”

“projection,” “seek,” “strategy” or similar words are intended to

identify forward-looking statements. Such forward-looking

statements are subject to risks and uncertainties that could cause

actual results to differ materially from those discussed in this

news release, including the risks and uncertainties relating to

regulatory trends and decisions, the company’s ability to continue

to access the capital markets and the other factors discussed in

the company’s reports filed with the Securities and Exchange

Commission. These factors include the risks and uncertainties

discussed in the company’s Annual Report on Form 10-K for the

fiscal year ended September 30, 2011 and in the company’s Quarterly

Report on Form 10-Q for the three and six months ended March 31,

2012. Although the company believes these forward-looking

statements to be reasonable, there can be no assurance that they

will approximate actual experience or that the expectations derived

from them will be realized. The company undertakes no obligation to

update or revise forward-looking statements, whether as a result of

new information, future events or otherwise.

About Atmos Energy

Atmos Energy Corporation, headquartered in Dallas, is one of the

country's largest natural- gas-only distributors, serving about

three million natural gas distribution customers in over 1,400

communities in nine states from the Blue Ridge Mountains in the

East to the Rocky Mountains in the West. Atmos Energy also provides

natural gas marketing and procurement services to industrial,

commercial and municipal customers primarily in the Midwest and

Southeast and manages company-owned natural gas pipeline and

storage assets, including one of the largest intrastate natural gas

pipeline systems in Texas. For more information, visit

www.atmosenergy.com.

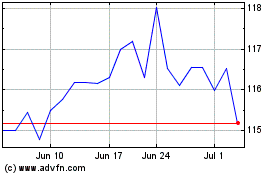

Atmos Energy (NYSE:ATO)

Historical Stock Chart

From Mar 2024 to Apr 2024

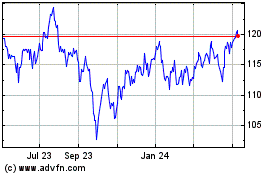

Atmos Energy (NYSE:ATO)

Historical Stock Chart

From Apr 2023 to Apr 2024