TIDMATY

RNS Number : 7165G

Athelney Trust PLC

06 March 2015

Embargoed 7am March 6 2015

ATHELNEY TRUST - FINAL RESULTS

Athelney Trust plc, the investor in small companies and junior

markets, announces its preliminary results for the year ended 31

December 2014.

Highlights:

-- Audited Net Asset Value ("NAV") up 4 per cent at 228p per share (2013: 219.3p)

-- Overall return (capital plus dividend) of 6.5 per cent

-- Revenue return per ordinary share rose 27 per cent to 7.8p (2013: 6.1p)

-- Recommended final dividend of 6.7p per share (2013: 5.5p) up 21.8 per cent.

Chairman Hugo Deschampsneufs said: "Squeezing out a modest

overall return proved more difficult than expected in 2014,

although Athelney NAV increased by four per cent so the overall

return (i.e. capital plus dividend) was 6.5 per cent. The Fledgling

saw an increase of 6.2 per cent with the FTSE Small Cap showing a

decrease of 1.5 per cent and the AIM All-share indices falling by

17.4 per cent.

"There were three key messages from the Autumn Statement:

economic output of 'only' 2-2.5 per cent is the new norm; there is

still a long way to go before control over public spending is

re-established; tax reform rather than tax reduction should be at

the heart of the next Parliament.

"The chancellor taking over after the General Election in May

will find a red box full of goodies: economic output should be

rising, employment strong and inflation near to five year lows.

"Yet 2015 looks like being a tricky year. My opinion, for what

it is worth, is that smaller companies are better value than blue

chips and that, with a decent tail wind, a modest uplift in asset

prices of equities and commercial property is the most likely

outcome".

-ends-

Fior further information:

Robin Boyle, Managing Director

Athelney Trust plc 020 7628 7937

Paul Quade 07947 186694

CityRoad Communications 020 7248 8010

CHAIRMAN'S STATEMENT AND BUSINESS REVIEW

I announce the results for the year ended 31 December 2014. The

salient points are as follows:

-- Audited Net Asset Value ("NAV") was 228p per share (31

December 2013: 219.3p) an increase of 4 per cent.

-- Revenue return per ordinary share was 7.8p, (31 December 2013: 6.1p).

-- Recommended final dividend of 6.7p per share (2013: 5.5p), an increase of 21.8 per cent.

Review of 2014

The inherent vice of capitalism is the unequal sharing of

blessings: the inherent virtue of socialism is the equal sharing of

miseries. - Winston Churchill

Capitalism is great when you're young, healthy and don't have

kids. As soon as you have kids, you need to move to Sweden, believe

me. - Cormac O'Brien.

My dear boy, as long as you don't invade Afghanistan you'll be

fine. - advice from MacMillan to Douglas-Hume on the latter taking

over as P.M.

Lose money for my firm and I will be understanding. Lose a shred

of reputation and I will be ruthless.- Warren Buffett.

Squeezing out a modest overall return proved more difficult than

expected in 2014. Mind you, some of the news-flow was not terribly

helpful: the tragedies of the three Malaysian airliners; the spread

of Ebola; Scotland's referendum; the rise of UKIP; Russia's

annexation of Crimea and invasion of East Ukraine; trouble in Gaza

and NATO's withdrawal from Afghanistan. More specifically, here are

my Top Ten stories which affected stock markets in the year:-

January: Signs of slowing economic growth in China led to a

sell-off in mining shares and all sorts of commodities. Prices for

such things were depressed all year.

March: Russia's military invasion of Ukraine triggered a global

flight from risky shares.

April: Big sell-off in tech shares on Wall Street.

June: Markets recovered, aided by news of a bid approach for

Shire, a London-quoted pharma.

August: The U.S. started its air campaign against Islamic State

(IS).

September: Investors sold, spooked by a single opinion poll

giving the Yes campaign a lead.

October: Markets were unimpressed by the ECB's failure to

introduce QE.

Investors bought back again on Japan's new inflationary

package.

December: Oil prices collapsed, hurt by OPEC's decision in

November not to reduce production and further signs that demand was

flagging.

Tesco issued another profit warning and worries about Greece

flared up again.

The Santa rally finally arrived on 18 December - the Fed, having

quit QE at the end of October, said that it would be patient about

raising U.S. interest rates. The plunging rouble started to

stabilize.

In major markets, New York and Tokyo rose by 3 per cent and 2.8

per cent but London, with quite a few mining and oil shares in its

index, fell by 6.2 per cent.

China was the outstanding market of the year, being up by 42.9

per cent on hopes of lower interest rates and easier lending

conditions and, to my mind, totally ignoring the collapse in Tier

2,3 and 4 city residential property prices and the massive

over-production of everything from cement and steel to ships and

solar panels. Argentina and Venezuela (rises of 42.3 per cent and

39.8 per cent respectively) were spooked by hyper-inflation, masked

by authoritarian governments fiddling the figures. On the less

positive side Greece, Columbia and Saudi Arabia fell by 28.2, 19.8

and 14.1 per cent respectively.

Returning to London, and small caps in particular, the Athelney

Trust NAV increased by 4 per cent so the overall return for the

year (i.e. capital plus dividend) was 6.5 per cent. The Fledgling

saw an increase of 6.2 per cent with the FTSE Small Cap showing a

decrease of 1.5 per cent and the AIM All-share indices falling by

17.4 per cent.

September saw the NATO summit in Wales. This is how it was

previewed in Pravda. Like an ageing drag queen who can no longer

make a living from dressing up in skirts and parading onstage in

disguise, today no amount of make-up can hide what NATO is, and

always has been: a wolf in sheep's clothing...For many years, NATO

has been looking for something to do, like an odd-job man living in

a deserted ghost town, like a skilled factory worker in a robot

factory, like an ageing and unemployable drag queen who has gone to

seed and whose pot belly turns her into the subject of ridicule

when she tries to stuff it into her skirt, these days playing to

bawling audiences of drunks. What can Pravda mean?

Every now and then, the spivs and get-rich-quick merchants come

out of the woodwork to defend their right to sell aggressively

shares that they do not own or have borrowed specially for the

occasion, so-called hedge funds come particularly to mind. They

usually make a plausible case until it is given a sharp tap, at

which point it tends to fall to bits. So it was in November when

the short sellers said that the practice provides liquidity (how?)

and can question perceived views on over-valued shares (fair

enough).

However, their leading weapon is often a sophisticated strategy

to weaken share prices by spreading information or, to be blunt,

disinformation. This last, where it occurs, is disseminated through

co-ordinated attacks via bulletin boards and leaks to the media.

Growing doubts about a company are expressed by a number of

apparently independent commentators who are, in reality, in

collusion. If a business relies on public deposits like a retail

bank or is at an early stage of its development and so is spending

cash without much to show for it by way of profit, it can become a

sitting duck for this strategy. Short sellers must declare their

every trade, even if it is carried out in so-called secret dark

pools.

Congratulations to the designers of the eight postage stamps

introduced in October, celebrating prime ministers gazing towards

us beginning with William Pitt the Younger. However, there are two

incredible omissions: Benjamin Disraeli and David Lloyd George. Was

Harold Wilson really in the same league?

The concept of shareholder value or to run the company for the

shareholder's benefit sounds as sensible as anything else in the

financial world and to suggest otherwise is wholly heretical. Yet I

think that an American, with his typical way of phrasing things,

might well be tempted to call it the world's dumbest idea. Why so?

I believe that companies which put its customers first have done

better than those that have tried to prioritize its shareholders or

staff (examples, supermarkets and investment banks respectively)

whereas customers are often cattle merely to be milked for profit.

The focus on shareholder value has also led companies into actions

which, while flattering short-term performance ratios and keeping

shareholders temporarily flush with cash, do nothing to help

develop better products and services over the long term - financial

engineering, share buy-backs, capital underinvestment and

over-aggressive cost-cutting do not keep customers happy. My view

is that only by focusing on being a good business which loves its

customers can decent returns be delivered to shareholders over the

long term. Is this a truth universally acknowledged? Our

hypothetical American friend might say Like heck it is!

I suppose that John (now Lord, what is the country coming to?)

Prescott probably ranks as my third un-favourite Labour politician

but even I was amazed when he said in November that his party had a

problem communicating. My goodness, when you get a lecture from him

on the English language then you are in trouble, said David

Cameron. In Prescott's defence, I would say: Frankfully, to be so

irrespective of a former deputy prize milliner was unsusceptible.

Let's not mince about the bush: it was below the bolt.

December saw George Osborne's final Autumn Statement before the

General Election in May. He was able to take the credit for some

politically popular measures such as the modest reform of Stamp

Duty, a further rise in the personal income tax allowance,

reductions in Air Passenger Duty for families and help for smaller

businesses and the U.K. regions. How much more rewarding it would

have been, though, if he had embarked on some simple reforms so

that the burden of tax was distributed more fairly and

rationally.

National Insurance is now a much bigger burden on low earners

than is income tax - raising the threshold for NI should have been

a greater priority than increasing income tax allowances. Value

Added Tax is riddled with anomalies and inconsistencies. Books are

taxed at 20 per cent if listened to or read on computer or tablet

yet there is no VAT on hardback or software books. Caviar and other

high-value foods attract zero VAT while shoes and basic clothing

attract 20 per cent tax - I could go on and on but it just gets

boring. There were three key messages from the Autumn Statement:

economic output of 'only' 2-2.5 per cent is the new norm; there is

still a long way to go before control over public spending is

re-established; tax reform rather than tax reductions should be at

the heart of the next parliament.

Vladimir Putin, in a speech to the Kremlin in December, said:

Hitler tried to destroy Russia......Just remember how that ended.

We do, Herr Putin, it ended with Germany as a democracy and Europe

becoming a safer place.

Capital investment in the global oil industry will fall sharply

in 2015 and onwards, thus following the price of crude oil down.

OPEC's decision not to cut output in November marked the end of

four years of remarkably stable oil prices. With OPEC temporarily

abdicating the role of price stabilizer, the market has now taken

over that role - little comfort to an industry with high capital

costs and a long delay before investments become profitable. The

past 150 years have been marked by frequent boom and bust cycles,

with each low squeezing investment and creating the base for the

next boom. There are new features to the current cycle, though,

with fracking and the growth of U.S. shale oil created by a $100

oil price and how the industry will react to a $70 or even $60 oil

price is yet to be seen. Shale oil is expensive to drill but, once

tapped, produces prodigious amounts of cash. If skilled workers are

laid off and capital investment cut back as in the past, the ride

upward in the oil price might be just as wild as the fall in

2014.

Rupert Soames, the grandson of Sir Winston Churchill, took over

as CEO of troubled outsourcer Serco in June and started (as is

traditional) a review of the business. It had previously emerged

that Serco had been over-charging the Government on contracts to

tag criminals. We've gone up the street saying bring out your dead

and lots of bodies started flying out of the windows, said

Soames.

What does Brazilian billionaire Joseph Safra's purchase of the

Gherkin office block in the City and Qatar's offer for chunks of

Canary Wharf tell us? At the risk of stating the obvious, overseas

investors still find that commercial property in this country is

highly attractive even though the statistics are not particularly

exciting: since 1981, the average total annual return on City

offices has been 8.1 per cent of which three-quarters has come from

income. The picture of West End property is admittedly better, at

10.2 per cent of which 60 per cent was income. The fact is that

billionaires and sovereign wealth funds often are more concerned

about capital preservation rather than income or growth (just for

the record, the Gherkin was bought on a yield of only 3.7 per

cent). It is when we look at the country as a whole that the

argument for investment in commercial property becomes

compelling.

The current average yield on all properties across the country

is reckoned to be about 6.4 per cent, compared with a negative

yield on index-linked government debt and 1.8 per cent on 10-year

gilts. Even the FTSE index, stuffed full of high-yielding mining,

oil and bank shares, only offers 3.6 per cent. After the big run-up

in property over the last 18 months, there is bound to be some

reluctance to buy now. Yet the cushion in that 6.4 per cent is very

wide by past standards. Property is surely less vulnerable to a

market set-back than blue-chips or government or corporate bonds.

NB Your company finished the year with 20 per cent of its portfolio

in commercial and residential property shares.

According to The Economist, the business world is divided in

two: those companies that have been hacked and those that do not

know that they have been hacked.

The source of the GBP260 million discrepancy in the Tesco

accounts is as old as book-keeping itself: the premature

recognition of revenue. Suppliers make payments to supermarkets

that meet certain sales targets for their products, run promotions

or place goods in eye-catching positions such as the end of aisles.

Tesco managers appear to have been too optimistic in forecasting

these rebates and may also have under-reported the costs of stolen

or out-of-date produce. Working out how much and when to book

revenue can be a matter of fine judgement. The complexity of

Tesco's deals with suppliers may also have left too much room for

discretion but the risks of accounting for such payments are hardly

new. The auditors of several big retailers have amplified their

warnings in recent years as rebates have taken up a greater

proportion of so-called profit. In the most recent report in May,

PWC warned of the risk of manipulation.

Even if there was no fraudulent intent (and we do not know this

yet) and the problems merely stem from a misunderstanding of the

rules rather than a cynical manipulation, the huge scale of the

error suggests that Tesco's internal controls were not up to the

job.

Oh, and another thing! Sir Terry Leahy, ex-CEO and doyen of the

supermarket trade, is shocked at the way that Tesco has lost sight

of its customers. It is true that fewer can be seen in the stores

three years after he stepped down. It is shocking that billions of

shareholders' funds were destroyed in search of Fresh & Easy in

California; the build-out of mega-stores in the UK, many of which

are now white elephants; the push for growth in Asia and shocking

that the return on capital during his reign slumped while declared

earnings rose. Yes, we are all shocked Sir Terry!

A joke which went round the foreign exchange market early in the

year:

Q. What do the rouble and Vladimir Putin have in common?

A. 62.

This prediction was correct on both counts - Putin had his

62(nd) birthday on 7 October and the rouble hit 62 to the dollar in

frenzied trading several weeks later.

Even as Britain enters the sixth year of recovery, economists

find excuses to be dismal. Every silver lining has a cloud, high

consumer confidence is stoking a large trade deficit and housing

boom. Normality will only be reached, they say, when interest rates

lift off the floor but this could push householders over the edge.

Economic growth is failing to generate much needed tax revenues.

Yet the chancellor taking over after the General Election in May

will find a red box full of goodies: economic output should be

rising, employment strong and inflation near to five-year lows.

Looking further ahead, the sort of economy to prosper will be

flexible and open. Britain has a head start while continental

rivals argue about structural reform. The U.K. has clear advantages

- the English language, an adaptable labour market which is quick

to switch workers between industries and is attractive to skilled

people from all over the world. While U.K. manufacturing has been

in relative decline, what is left is highly productive. It can

remain that way thanks to a strong science base and every big city

has its own Silicon quarter. Politics, though, poses the greatest

threat to economic prosperity. A dysfunctional planning system,

held hostage by local politics, has resulted in chronic housing

shortages. Major projects like high speed rail or a new airport

runway take decades to complete. Politicians love to rail against

the imagined weaknesses in the immigration laws. By the 2050s

(sorry to say that I will not be there), Britain's deep strengths

could propel it towards being Europe's largest and most prosperous

economy - we have nothing to fear but our politicians.

Deflation is bad for you, ergo cheaper oil is bad for the EU.

Assuming that the average crude oil price is $70 for 2015, this

would save the Eurozone the handy sum of $145 billion, or 0.9 per

cent of economic output even before knock-on effects. Maybe Europe

should be our contrarian bet for 2015?

Capital Gains

During the year the Company realised capital profits arising on

the sale of investments in the sum of GBP478,743

(31 December 2013: GBP297,801).

Portfolio Review

Holdings of Andrews Sykes, Beazley, Brit, Capital &

Regional, DX Group, Epwin Group, Games Workshop, Hiscox, John

Menzies, McColls Retail, Novae Group and UK Commercial were all

purchased for the first time. Additional holdings of Amlin, Catlin,

Costain, Lancashire Holdings, Londonmetric, Picton Property Income,

Treatt, and Vianet, were also acquired. Arbuthnot Banking Group, H

& T Group andMacfarlane Group, were sold. In addition, a total

of twenty holdings were top-sliced to provide capital for the new

purchases.

Corporate Activity

Holdings of Abbey Protection and ACM Shipping were taken over in

the year with Abbey Protection having a profit as a percentage of

cost of 27.2 percent. Connect Group undertook a rights issue which

was fully taken up.

Dividend

The Board is pleased to recommend an increased annual dividend

of 6.7p per ordinary share (2013: 5.5p). This represents an

increase of 21.8 per cent over the previous year. Subject to

shareholder approval at the Annual General Meeting on 9 April 2015,

the dividend will be paid on 16 April 2015 to shareholders on the

register on 20 March 2015.

For those patient investors who subscribed for Athelney Trust

shares in the IPO of 1994, the annual return has now risen to 13.4

per cent net of basic rate tax on the capital originally

invested.

Update

The unaudited NAV at 28 February 2015 was 237.2p whereas the

share price on the same day stood at 195p. Further updates can be

found on www.athelneytrust.co.uk

Post Balance Sheet Date

On 30 January 2015 David Horner resigned as a Director having

held the position for 12 years. The Board as a whole express their

sincere thanks to David for all his input during his time with the

Company.

Prospects

It looks like being another tricky year. I defy anyone

(including the respective heads of the central banks which have

dominated markets since 2008/9) to know the answers to: will

Vladimir Putin succeed in dragging America into a proxy war in

Ukraine, how will the coalition dislodge IS from the towns of Iraq

and Syria, will the problem of Greece be fixed, will China

deliberately devalue the reminbi thus exporting even more

deflation, will quantitative easing in the euro zone and Japan be

enough to counteract any tightening or threat of tightening (i.e.

raising interest rates) in America and Britain? What will happen to

commodity prices such as oil, gas, iron ore and gold and what

effect will that have on investor confidence? How will all these

various factors impact on equity markets? My opinion, for what it

is worth, is that smaller companies are better value than blue

chips and that, with a decent tail-wind, a modest uplift in asset

prices of equities and commercial property is the most likely

outcome.

H.B. Deschampsneufs

Chairman

4 March 2015

INCOME STATEMENT

(INCORPORATING THE REVENUE ACCOUNT)

For the Year Ended

For the Year Ended 31 December

31 December 2014 2013

Note Revenue Capital Total Revenue Capital Total

GBP GBP GBP GBP GBP GBP

Gains on

investments

held at fair

value 8 - 221,717 221,717 - 1,466,773 1,466,773

Income from

investments 2 189,458 - 189,458 155,571 - 155,571

Investment

Management

expenses 3 (5,661) (51,644) (57,305) (5,765) (53,034) (58,799)

Other expenses 3 (28,668) (44,156) (72,824) (27,922) (42,804) (70,726)

Net return on

ordinary 155,129 125,917 281,046 121,884 1,370,935 1,492,819

activities before

taxation

Taxation 5 - - - - - -

Net return on

ordinary

activities

after taxation

6 155,129 125,917 281,046 121,884 1,370,935 1,492,819

Net return

per ordinary

share 6 7.8p 6.3p 14.1p 6.1p 69.1p 75.3p

Dividend per

ordinary share

paid during

the year 7 5.5p 5.0p

The total column of this statement is the profit and loss

account for the Company.

All revenue and capital items in the above statement derive from

continuing operations.

No operations were acquired or discontinued during the above

financial years.

A statement of movements of reserves is given in note 12.

A Statement of Total Recognised Gains and Losses is not required

as all gains and losses of the Company have been reflected in the

above Statement.

RECONCILIATION OF MOVEMENTS IN SHAREHOLDERS' FUNDS

Called-up Capital Capital Total

Share Share reserve reserve Revenue Shareholders'

Capital Premium realised unrealised reserve Funds

GBP GBP GBP GBP GBP GBP

Balance brought

forward at

1 January

2013 495,770 545,281 752,028 939,882 223,067 2,956,028

Net profits

on realisation

of investments - - 297,801 - - 297,801

Increase in

unrealised

Appreciation - - - 1,168,972 - 1,168,972

Expenses allocated

to

Capital - - (95,838) - - (95,838)

Profit for

the year - - - - 121,884 121,884

Dividend paid

in year - - - - (99,154) (99,154)

Shareholders'

Funds at 31

December 2013 495,770 545,281 953,991 2,108,854 245,797 4,349,693

========== ======== ========= =========== ========= ==============

Balance brought

forward at

1 January

2014 495,770 545,281 953,991 2,108,854 245,797 4,349,693

Net profits

on realisation

of investments - - 478,743 - - 478,743

(Decrease)/Increase

in

Unrealised

appreciation - - - (257,026) - (257,026)

Expenses allocated

to

Capital - - (95,800) - - (95,800)

Profit for

the year - - - - 155,129 155,129

Dividend paid

in year - - - - (109,069) (109,069)

Shareholders'

Funds at 31

December 2014 495,770 545,281 1,336,934 1,851,828 291,857 4,521,670

======== ======== ========== ========== ========== ==========

BALANCE SHEET AS AT 31 DECEMBER 2014

Company Number: 02933559

Note 2014 2013

GBP GBP

Fixed assets

Investments held at

fair value through

profit and loss 8 4,432,113 4,298,919

---------- ----------

Current assets

Debtors 9 87,246 41,782

Cash at bank and in

hand 18,137 24,709

105,383 66,491

Creditors: amounts

falling due within

one year 10 (15,826) (15,717)

---------- ----------

Net current assets 89,557 50,774

---------- ----------

Total assets less current

liabilities 4,521,670 4,349,693

Provisions for liabilities

and charges - -

Net assets 4,521,670 4,349,693

========== ==========

Capital and reserves

Called up share capital 11 495,770 495,770

Share premium account 12 545,281 545,281

Other reserves (non

distributable)

Capital reserve -

realised 12 1,336,934 953,991

Capital reserve -

unrealised 12 1,851,828 2,108,854

Revenue reserve (distributable) 12 291,857 245,797

Shareholders' funds

- all equity 4,521,670 4,349,693

========== ==========

Net Asset Value per

share 14 228.0p 219.3p

Approved and authorised for issue by the Board of Directors on 4

March 2015.

.....................................

R.G. Boyle

Director

CASHFLOW STATEMENT FOR THE YEAR ENDED 31 DECEMBER 2014

2014 2013

GBP GBP GBP GBP

Net cash inflow from

operating activities 13,974 74,969

Taxation

Corporation tax paid - -

Capital Expenditure

and Financial Investment

Purchases of investments (679,659) (722,310)

Sales of investments 768,182 749,835

Net cash inflow from

Capital Expenditure

and Financial Investment 88,523 27,525

Equity dividends paid (109,069) (99,154)

(Decrease)/Increase

in cash in the year (6,572) 3,340

=========== ===========

Reconciliation of operating

net revenue to

net cash outflow from

operating activities GBP GBP

Revenue on ordinary

activities before taxation 155,129 121,884

(Increase)/decrease

in debtors (45,464) 48,427

Increase in creditors 109 496

Investment management

expenses charged to

capital (51,644) (53,034)

Other expenses charged

to capital (44,156) (42,804)

Net cash inflow from

operating activities 13,974 74,969

=========== ===========

Reconciliation of net

cash flow to movement

in net funds

Net funds Net funds

at at

Cash

31.12.2013 flow 31.12.2014

GBP GBP GBP

Cash at bank and in

hand 24,709 (6,572) 18,137

=========== ========== ===========

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2014

1. Accounting Policies

1.1 Basis of Preparation of Financial Statements

The financial statements are prepared on a going concern basis

under the historical cost convention as modified by the revaluation

of investments held at fair value.

The financial statements are prepared in accordance with the

Companies Act 2006, applicable UK accounting standards and the

provisions of the Statement of Recommended Practice "Financial

Statements of Investment Trust Companies and Venture Capital

Trusts" (SORP) issued by the A.I.C. in January 2009.

The financial statements have been prepared on the assumption

that approval as an investment trust will continue to be granted.

The financial statements, and the net asset value per share

figures, have been prepared in accordance with UK Generally

Accepted Accounting Practice (UK GAAP).

1.2 Income

Income from investments including taxes deducted at source is

recognised when the right to the return is established (normally

the ex-dividend date). UK dividend income is reported net of tax

credits in accordance with FRS 16 "Current Tax". Interest is dealt

with on an accruals basis.

1.3 Investment Management Expenses

Of the two directors involved in investment management, 10% of

their salaries have been charged to revenue and the other 90% to

capital. All other investment management expenses have been charged

to capital. The Board propose continuing this basis for future

years.

1.4 Other Expenses

Expenses (including VAT) and interest payable are dealt with on

an accruals basis and charged through the Revenue and Capital

Accounts in an allocation that the Board consider to be a fair

distribution of the costs incurred.

1.5 Investments

Listed investments comprise those listed on the Official List of

the London Stock Exchange. Profits or losses on sales of

investments are taken to realised capital reserve. Any unrealised

appreciation or depreciation is taken to unrealised capital

reserve.

Investments have been classified as "fair value through profit

and loss" upon initial recognition.

Subsequent to initial recognition, investments are measured at

fair value with changes in fair value recognised in the Income

Statement.

Securities of companies quoted on a recognised stock exchange

are valued by reference to their quoted bid prices at the close of

the year.

1.6 Taxation

The tax effect of different items of income and expenses is

allocated between capital and revenue on the same basis as the

particular item to which it relates, using the Company's effective

rate of tax for the year.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2014

1. Accounting Policies (continued)

1.7 Deferred Taxation

Deferred tax is recognised in respect of all timing differences

that have originated but not reversed by the balance sheet date.

Deferred tax liabilities are recognised for all taxable timing

differences but deferred tax assets are only recognised if it is

considered more likely than not that there will be suitable profits

from which the future reversal of the underlying timing differences

can be deducted. Deferred tax assets and liabilities are calculated

at the tax rates expected to be effective at the time the timing

differences are expected to reverse. Deferred tax assets and

liabilities are not discounted.

1.8 Capital Reserves

Capital Reserve - Realised

Gains and losses on realisation of fixed asset investments are

dealt with in this reserve.

Capital Reserve - Unrealised

Increases and decreases in the valuations of fixed asset

investments are dealt with in this reserve.

1.9 Dividends

In accordance with FRS 21 "Events after the Balance Sheet Date",

dividends are included in the financial statements in the year in

which they are paid.

1.10 Share Issue Expenses

The costs associated with issuing shares are written off against

any premium arising on the issue of Share Capital.

2. Income

Income from investments

2014 2013

GBP GBP

UK dividend income 189,403 155,543

Bank interest 55 28

Total income 189,458 155,571

======== ========

UK dividend income

2014 2013

GBP GBP

UK Main Market listed investments 121,081 94,552

UK AIM traded shares 68,322 60,991

189,403 155,543

======== ========

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2014

3. Return on Ordinary Activities before Taxation

2014 2013

GBP GBP

The following amounts (inclusive

of VAT) are included

within investment management

and other expenses:

Directors' remuneration:

- Services as a director 17,500 17,500

- Otherwise in connection

with management 45,000 45,000

Auditors' remuneration:

- Audit Services - Statutory

audit 10,500 10,260

- Audit Services - Statutory 200 -

audit movement on accruals

from

previous years

- Audit Services - Audit

related regulatory reporting 1,050 1,050

Miscellaneous expenses:

- Other wages and salaries 31,074 32,035

- PR and communications 7,098 6,065

- Stock Exchange subscription 6,844 8,241

- Sundry investment management

and other expenses 10,863 9,374

130,129 129,525

======== ========

4. Employees

2014 2013

GBP GBP

Costs in respect of Directors:

Wages and salaries 62,500 62,500

Social security costs 4,424 5,495

66,924 67,995

======= =======

Costs in respect of administrator:

Wages and salaries 25,250 24,250

Social security costs 1,400 2,290

26,650 26,540

======= =======

Total:

Wages and salaries 87,750 86,750

Social security costs 5,824 7,785

93,574 94,535

------- -------

Average number of employees:

Chairman 1 1

Investment 2 2

Administration 1 1

4 4

======= ========

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2014

5. Taxation

(i) On the basis of these financial statements no provision has

been made for corporation tax (2013: Nil).

(ii) Factors affecting

the tax charge for the

year

The tax charge for the period is lower than

(2013: lower than) the average small company

rate of corporation tax in the UK of 20 per

cent. The differences are explained below:

2014 2013

GBP GBP

Total return on ordinary

activities before tax 281,046 1,492,819

---------- --------------------

Total return on ordinary

activities multiplied by

the average small company

rate of corporation tax 20%

(2013: 20%) 56,209 298,564

Effects of:

UK dividend income

not taxable (27,662) (27,412)

Revaluation of shares

not taxable 51,405 (233,794)

Capital gains not

taxable (95,749) (59,560)

Unrelieved management

expenses 15,797 22,202

Current tax charge

for the year - -

========== ====================

The Company has unrelieved excess revenue management expenses of

GBP65,539 at 31 December 2014 (2013: GBP82,300) and GBP102,597

(2013: GBP102,597) of capital losses for Corporation Tax purposes

and which are available to be carried forward to future years. It

is unlikely that the Company will generate sufficient taxable

profits in the future to utilise these expenses and therefore no

deferred tax asset has been recognised.

For the year ended 31 December 2013, the Company received

approval from HM Revenue and Customs under Section 1158 of the

Corporation Tax Act 2010, therefore the Company was not liable to

Corporation Tax on any realised investment gains for 2013. The

Directors intend to continue to meet the conditions required to

obtain approval and therefore no deferred tax has been provided on

any capital gains or losses arising on the revaluation or disposal

of investments.

6. Return per Ordinary Share

The calculation of earnings per share has been

performed in accordance with FRS 22 "Earnings

Per Share".

2014 2013

GBP GBP GBP GBP GBP GBP

Revenue Capital Total Revenue Capital Total

Attributable

return on

ordinary activities

after taxation 155,129 125,917 281,046 121,884 1,370,935 1,492,819

Weighted average

number of shares 1,983,081 1,983,081

Return per

ordinary share 7.8p 6.3p 14.1p 6.1p 69.1p 75.3p

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2014

7. Dividend

2014 2013

GBP GBP

Final dividend in respect

of 2013 of 5.5p (2013: a

final dividend of 5p was

paid in respect of 2012)

per share 109,069 99,154

======== =======

Set out below is the total dividend payable in respect of the

financial year, which is the basis on which the requirements of

Section 1158 of the Corporation Tax Act 2010 are considered.

It is recommended that a final dividend of 6.7 p (2013: 5.5p)

per ordinary share be paid amounting to a total of GBP132,866. For

the year 2013, a final dividend of 5.5p was paid on 12 April 2014

amounting to a total of GBP109,069.

2014 2013

GBP GBP

Revenue available for

distribution 155,129 121,884

Final dividend in respect

of financial year ended

31 December 2014 (132,866) (109,069)

---------- ----------

Undistributed Revenue

Reserve 22,263 12,815

========== ==========

8. Investments

2014 2013

GBP GBP

Movements

in year

Valuation at beginning

of year 4,298,919 2,859,671

Purchases

at cost 679,659 722,310

Sales - proceeds (768,182) (749,835)

- realised gains

on sales 478,743 297,801

(Decrease)/Increase in unrealised

appreciation (257,026) 1,168,972

Valuation

at end of

year 4,432,113 4,298,919

========== ==========

Book cost

at end of

year 2,580,285 2,190,065

Unrealised appreciation at

the end of the year 1,851,828 2,108,854

4,432,113 4,298,919

========== ==========

UK Main Market

listed investments 2,852,033 2,679,736

UK AIM traded

shares 1,580,080 1,619,183

4,432,113 4,298,919

========== ==========

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2014

8. Investments (continued)

Gains on investments

2014 2013

GBP GBP

Realised gains

on sales 478,743 297,801

(Decrease)/Increase in unrealised

appreciation (257,026) 1,168,972

221,717 1,466,773

========== ==========

The purchase costs and sales proceeds above include transaction

costs of GBP3,484 (2013: GBP4,496) and GBP3,527 (2013: GBP3,615)

respectively.

9. Debtors

2014 2013

GBP GBP

Investment transaction

debtors 82,794 37,105

Other debtors 4,452 4,677

87,246 41,782

======= =======

10. Creditors: amounts falling due within one year

2014 2013

GBP GBP

Social security

and other taxes 3,238 3,198

Other creditors 172 172

Accruals and

deferred income 12,416 12,347

15,826 15,717

======= =======

11. Called Up Share Capital

2014 2013

GBP GBP

Authorised

10,000,000 Ordinary Shares

of 25p 2,500,000 2,500,000

========== ==========

Allotted, called up and fully

paid

1,983,081 Ordinary Shares

of 25p 495,770 495,770

========== ==========

(2013: 1,983,081 Ordinary

Shares of 25p)

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2014

12. Reserves

2014

Share Capital Capital

premium reserve reserve Revenue

account realised unrealised reserve

GBP GBP GBP GBP

Balance at 1 January

2014 545,281 953,991 2,108,854 245,797

Net profits on realisation

of investments - 478,743 - -

(Decrease)/Increase

in unrealised appreciation - - (257,026) -

Expenses allocated

to capital - (95,800) - -

Profit for the year - - - 155,129

Dividend paid in

year - - - (109,069)

Balance at 31 December

2014 545,281 1,336,934 1,851,828 291,857

======== ========== =========== ==========

13. Financial Instruments

The Company's financial instruments comprise equity investments,

cash balances and debtors and creditors that arise directly from

its operations, for example, in respect of sales and purchases

awaiting settlement. Short term debtors and creditors are excluded

from disclosure.

Fixed asset investments (see note 8) are valued at market bid

price where available which equates to their fair values. The fair

values of all other assets and liabilities are represented by their

carrying values in the balance sheet.

The major risks associated with the Company are market and

liquidity risk. The Company has established a framework for

managing these risks. The directors have guidelines for the

management of investments and financial instruments.

Market Risk

Market risk arises from changes in interest rates, valuations

awarded to equities, movements in prices and the liquidity of

financial instruments.

At the end of the year the Company's portfolio was invested in

UK securities with the exception of 14.16 per cent, which was

invested in overseas securities.

Liquidity Risk

Liquidity Risk is the risk that the Company may have difficulty

in meeting obligations associated with financial liabilities. The

Company has no borrowings; therefore there is no exposure to

interest rate changes.

The company is able to reposition its investment portfolio when

required so as to accommodate liquidity needs.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2014

14. Net Asset Value per Share

The net asset value per share is based on net assets of

GBP4,521,672 (2013: GBP4,349,693) divided by 1,983,081 (2013:

1,983,081) ordinary shares in issue at the year end.

2014 2013

Net asset value 228.0p 219.3p

======= =======

15. Related Parties

During the year the following dividends were paid to the

directors of the company as a result of their total

shareholding:

Mr Robin Boyle GBP23,550

Mr Hugo Deschampsneufs GBP4,292

Mr David Horner GBP1,100

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UVAKRVVAORAR

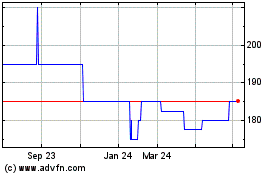

Athelney (LSE:ATY)

Historical Stock Chart

From Mar 2024 to Apr 2024

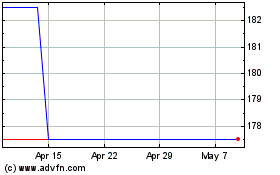

Athelney (LSE:ATY)

Historical Stock Chart

From Apr 2023 to Apr 2024