4Q 2015 Net Operating Income of $65.3

million, $0.97 per diluted share

Full-Year 2015 Net Operating Income of

$454.4 million, $6.58 per diluted share

4Q 2015 Net Income of $65.7 million, $0.97

per diluted share

Full-Year 2015 Net Income of $141.6 million,

$2.05 per diluted share

- 11.3 percent annual operating ROE,

excluding AOCI1

- $379 million returned to shareholders

through dividends and share repurchases in 2015

- $460 million in corporate capital at

year-end

Assurant, Inc. (NYSE:AIZ), a premier provider of specialty

protection products and related services, today reported results

for fourth quarter and full-year ended Dec. 31, 2015.

“Assurant made significant strides in 2015 as we realigned our

business portfolio and evolved our organizational framework to

support sustainable long-term, profitable growth,” said Assurant

President and CEO Alan B. Colberg.

“While fourth quarter results were disappointing and fell short

of our expectations, we believe our transformation strategy will

improve results and drive shareholder value. We are focusing

resources and investments in targeted markets and increasing

operating efficiency across the company as we continue to return

capital to shareholders,” Colberg added.

Reconciliation of Net Operating Income to Net Income

Beginning in second quarter 2015, Assurant revised its

presentation of results to reflect the company’s previously

announced strategic realignment to focus on specialty housing and

lifestyle protection products and services. As the company

continues to wind down its health insurance business, Assurant

Health results have been removed from net operating income and now

are reflected in net income as runoff operations. Prior period

amounts have been revised to conform to the updated presentation.

In the third quarter, the company announced the sale of Assurant

Employee Benefits. Assurant will continue to report this business

under operating results until the sale of the business is closed,

which is expected to occur by the end of first quarter 2016.

(UNAUDITED) 4Q

4Q 12 Months 12

Months (dollars in millions, net of tax)

2015 2014

2015 2014 Housing and Lifestyle

Assurant Solutions $ 29.6

$ 58.1 $ 197.2

$ 218.9 Assurant Specialty Property 57.8 71.0

307.7 341.8

Subtotal

87.4 129.1 504.9

560.7 Assurant Employee Benefits 15.5 7.2 47.3 48.7

Corporate and other (30.7 ) (19.4 ) (70.4 ) (67.7 ) Amortization of

deferred gain on disposal of businesses 2.1 (8.1 ) 8.4 (1.0 )

Interest expense (9.0 ) (9.0 ) (35.8 )

(37.9 )

Net operating income 65.3 99.8

454.4 502.8

Adjustments: Assurant Health runoff operations (a)

(15.8 ) (36.8 ) (367.9 ) (63.7 ) Net realized gains on investments

6.3 11.3 20.8 39.4 Gain (loss) on divested business 10.0 (19.4 )

10.7 (19.4 ) Change in tax liabilities - (6.8 ) 16.0 14.0 Payment

received related to previous sale of subsidiary - - 9.9 - Change in

derivative investment (0.1 ) 1.7 (2.3 )

(2.2 )

Net income $ 65.7 $ 49.8 $ 141.6

$ 470.9

(a) Assurant Health runoff operations include results for the

total segment, including major medical operations and portions of

the business that Assurant sold to National General Holdings Corp.

on Oct. 1, 2015.

Note: Additional financial information, including a schedule of

disclosed items that affected Assurant’s results by business for

the last eight quarters appears on page 21 of the company’s

Financial Supplement, and is located in the Investor Relations

section of www.assurant.com.

Fourth Quarter 2015 Consolidated Results

- Net operating income2 decreased

to $65.3 million, or $0.97 per diluted share, compared to fourth

quarter 2014 net operating income of $99.8 million, or $1.38 per

diluted share. The decrease primarily reflects lower contributions

from the mobile business at Assurant Solutions and ongoing

normalization of lender-placed insurance business at Assurant

Specialty Property.

- Net income increased to $65.7

million, or $0.97 per diluted share, compared to fourth quarter

2014 net income of $49.8 million, or $0.69 per diluted share.

Results primarily benefited from a $10.0 million gain from the

fourth quarter sale of an Assurant Specialty Property legacy auto

title business, compared to a $19.4 million net loss on the sale of

Assurant Specialty Property’s general agency business and

associated insurance carrier, American Reliable Insurance Company

(ARIC), recognized in fourth quarter 2014.

- Net earned premiums, fees and other

income, excluding Assurant Health runoff operations, decreased

to $1.9 billion, compared to $2.0 billion in fourth quarter 2014.

The decline reflects the divestiture of ARIC, the ongoing

normalization of lender-placed insurance business, the loss of

business from an Assurant Specialty Property client and the effect

of foreign exchange volatility at Assurant Solutions. Fee income

increased to $376.3 million, compared to $304.7 million in fourth

quarter 2014, driven by expanded service offerings in mobile and

mortgage solutions.

- Net investment income, excluding

Assurant Health runoff operations, totaled $152.8 million, compared

to $151.0 million in fourth quarter 2014.

Full-Year 2015 Consolidated Results

- Net operating income decreased

to $454.4 million, or $6.58 per diluted share, compared to $502.8

million, or $6.87 per diluted share in 2014, primarily due to the

factors noted above.

- Net income decreased to $141.6

million, or $2.05 per diluted share, compared to $470.9 million, or

$6.44 per diluted share in 2014, reflecting increased claims from

Affordable Care Act (ACA) qualified policies and charges associated

with the wind down of the Assurant Health business including an

accrual for premium deficiency reserves.

- Net earned premiums, fees and other

income, excluding Assurant Health runoff operations, were $7.4

billion, down 4.0 percent compared to $7.7 billion in 2014. The

divestiture of ARIC, the ongoing normalization of lender-placed

insurance business as well as the loss of business from an Assurant

Specialty Property client and the effect of foreign exchange

volatility at Assurant Solutions reduced premiums. Fee income

increased to $1.2 billion, compared to $1.0 billion in 2014, due to

the expansion of mobile programs and the mortgage solutions

business.

- Net investment income, excluding

Assurant Health runoff operations, decreased to $601.7 million from

$621.1 million in 2014, due to lower investment yields and invested

assets.

Housing and Lifestyle

Assurant Solutions

(in millions)

4Q15 4Q14

% Change 12M15

12M14 % Change Net operating

income $ 29.6 $ 58.1 (49)% $ 197.2 $ 218.9 (10)%

Net earned

premiums, fees and other $ 1,003.2 $

1,000.0 0% $ 3,801.5 $

3,796.7 0%

- Net operating income decreased

compared to fourth quarter 2014, primarily due to lower

contributions from mobile, including the previously disclosed loss

of a domestic tablet program and higher operating expenses to

support existing programs and expected program launches. Results

also were negatively affected by foreign exchange losses and

approximately $8 million of prior-period accounting adjustments,

partially offset by a decrease in legal reserves related to an

outstanding matter.Full-year 2015 net operating income, excluding

disclosed items, decreased compared to 2014, primarily due to lower

service contract volumes from North American retail clients and the

loss of the domestic tablet program.

- Net earned premiums, fees and other

income were flat in the quarter and full-year 2015, compared to

the same periods in 2014. Growth in fee income from domestic mobile

and the auto warranty business were offset by the effect of foreign

exchange volatility, loss of the domestic tablet program and

declines in credit insurance and lower service contract production

from North American retailers.

- Domestic combined ratio

increased to 100.1 percent, compared to 92.9 percent in fourth

quarter 2014, reflecting lower contributions from mobile.For

full-year 2015, the domestic combined ratio increased to 95.1

percent, compared to 93.5 percent in 2014. Results reflect lower

service contract premiums from North American retailers as well as

lower contributions from credit insurance and mobile

businesses.

- International combined ratio

improved to 101.4 percent, compared to 103.4 percent in fourth

quarter 2014, primarily due to the decrease in the legal reserves

noted above.For full-year 2015, the international combined ratio

increased to 102.8 percent, compared to 101.5 percent in 2014.

Results primarily reflect revenue declines and shifts in the mix of

business.

Assurant Specialty Property

(in millions)

4Q15

4Q14 % Change

12M15 12M14 %

Change Net operating income $ 57.8 $ 71.0 (19)% $ 307.7

$ 341.8 (10)%

Net earned premiums, fees and other $

601.7 $ 686.5 (12)% $

2,450.2 $ 2,807.1 (13)%

Note: In fourth quarter 2014, ARIC accounted for net earned

premiums, fees and other income and net operating income of $62.3

million and $6.4 million, respectively. For the 12 months ended

2014, ARIC accounted for net earned premiums, fees and other income

and net operating income of $249.3 million and $12.1 million,

respectively. This divested business did not contribute to 2015

results.

- Net operating income decreased

in fourth quarter and full-year 2015, compared to the same periods

in 2014, primarily due to the ongoing normalization of

lender-placed insurance, including the previously disclosed loss of

client business as well as increased legal expenses. More favorable

non-catastrophe loss experience and lower catastrophe reinsurance

costs partially offset the decline.Fourth quarter 2015 results

include $9.8 million in reportable catastrophes, compared to no

reportable catastrophe losses in fourth quarter 2014. Full-year

2015 results include $19.3 million in reportable catastrophe

losses, compared to $18.5 million in 2014.

- Net earned premiums, fees and other

income decreased in the quarter and for the full year, compared

to the same periods in 2014. Net earned premiums decreased

primarily due to the divestiture of ARIC and the ongoing

normalization of lender-placed insurance, including the loss of

client business. Fee income increased in the quarter and in

full-year 2015, primarily reflecting organic growth from the

mortgage solutions business.

- Combined ratio increased in the

quarter to 90.0 percent, compared to 87.8 percent in fourth quarter

2014, primarily due to lower lender-placed insurance net earned

premiums and an increase in expenses related to outstanding legal

matters. Lower frequency and severity of non-catastrophe losses

partially offset the increase.For full-year 2015, the combined

ratio was 84.9 percent, compared to 85.2 percent in 2014. Results

reflect lower non-catastrophe claims, partially offset by lower

lender-placed insurance revenue and higher mix of fee-based

businesses.

Employee Benefits

As announced on Sept. 9, 2015, Assurant entered into a

definitive agreement to sell Assurant Employee Benefits to Sun Life

Assurance Company of Canada, the wholly-owned subsidiary of Sun

Life Financial Inc., for $940 million in cash. The transaction is

expected to close by the end of first quarter 2016.

Assurant Employee Benefits

(in millions)

4Q15

4Q14 % Change

12M15 12M14 %

Change Net operating income $ 15.5 $ 7.2 114% $ 47.3 $

48.7 (3)%

Net earned premiums, fees and other $ 270.8

$ 269.4 1% $ 1,091.8

$ 1,075.9 2%

- Net operating income increased

in the quarter, primarily due to favorable disability and life

experience.Full-year 2015 net operating income declined, compared

to 2014, primarily due to less favorable life experience.

- Net earned premiums, fees and other

income increased slightly in fourth quarter and full-year 2015,

primarily due to continued growth in voluntary products.

- Sales increased in the quarter

and full year 2015. Results reflect continued growth in voluntary

products sales.

Corporate & Other

(in millions)

4Q15

4Q14 % Change

12M15 12M14 %

Change Net operating loss $ (30.7)

$ (19.4) (58)% $ (70.4) $

(67.7) (4)%

- Net operating loss increased in

the fourth quarter, primarily reflecting a partial reversal of

prior quarter tax benefits as well as severance and other expenses

related to Assurant’s strategic realignment.For full-year 2015, net

operating loss increased, primarily reflecting severance and other

expenses related to Assurant’s strategic realignment.

Assurant Health Runoff Operations

The company announced on June 10, 2015 that it was beginning the

process to exit the health business, following a review of

strategic options for Assurant Health. Related to these plans, the

company established a premium deficiency reserve accrual in 2015

for claims and direct expenses on ACA-qualified policies. The

company completed the sale of Assurant Health's supplemental and

small group self-funded product lines and certain other assets to

National General Holdings Corp. on Oct. 1, 2015 for $14

million.

Assurant Health

(in millions)

4Q15

4Q14 % Change

12M15 12M14 %

Change Net loss $ (15.8) $

(36.8) 57% $ (367.9) $

(63.7) (477)%

- Net loss in fourth quarter

primarily reflects $11.2 million after-tax of severance and other

exit-related costs as well as indirect expenses not included in the

previously established premium deficiency reserves. Actual

operating losses were in line with the premium deficiency accrual

estimate established in third quarter 2015.Full-year 2015 results,

compared to 2014, reflect unfavorable loss experience on

ACA-qualified policies and charges related to the company’s exit of

the health insurance market.

- ACA risk-mitigation payments

received from the Centers for Medicare and Medicaid Services as of

Dec. 31, 2015 for 2014 ACA-qualified policies totaled a net $351.8

million with no further remaining receivables accrued for 2014

policies.As of Dec. 31, 2015, ACA risk-mitigation estimated

recoverables for 2015 ACA-qualified policies totaled $521.6

million, reflecting $225.2 million from the risk-adjustment program

and $296.4 million from the reinsurance program. The company did

not record any net recoverables for the 2015 risk-corridors

program.

Capital Position

- Corporate capital approximated

$460 million as of Dec. 31, 2015. Adjusting for the company’s $250

million risk buffer, deployable capital totaled $210 million.During

the quarter, operating business segments, consisting of Assurant

Solutions, Assurant Specialty Property, and Assurant Employee

Benefits, paid approximately $262 million of dividends to the

holding company. Excluding proceeds from the sale of certain assets

to National General, the company infused approximately $260 million

into Assurant Health to ensure adequate levels of statutory surplus

and to fund estimated exit-related charges and claims through the

wind-down process.For full-year 2015, operating business segments

paid approximately $675 million of dividends net of infusions to

the holding company. Excluding proceeds from the sale of certain

assets to National General, the company infused approximately $500

million into Assurant Health to ensure adequate levels of statutory

surplus and to fund estimated exit-related charges and claims,

through the wind-down process.

- Share repurchases and dividends

totaled $107.5 million in fourth quarter 2015. Dividends to

shareholders totaled $33.3 million, and Assurant repurchased

approximately 925,000 shares of common stock for $74.2 million.For

full-year 2015, share repurchases and dividends totaled $378.8

million. Dividends to shareholders totaled $94.2 million, and

Assurant repurchased approximately 4.2 million shares of common

stock for $284.6 million. Through Feb. 5, 2016, the company

repurchased an additional 1.1 million shares for $90.0 million,

with $862.1 million remaining in the current repurchase

authorization.

Financial Position

- Stockholders’ equity, excluding

accumulated other comprehensive income (AOCI), decreased to $4.4

billion at Dec. 31, 2015, down $220.1 million since Dec. 31, 2014

due to share repurchases and dividends.

- Annual operating return on average

equity (ROE)1, excluding AOCI and Assurant Health runoff

operations, was 11.3 percent for 2015 compared to 12.1 percent for

2014.

- Total assets, as of Dec. 31,

2015, were approximately $30.1 billion.

- Ratio of debt to total capital3,

excluding AOCI and Assurant Health runoff operations, increased to

23.4 percent at Dec. 31, 2015 from 21.9 percent at Dec. 31,

2014.

Company Outlook

Based on current market conditions, for full-year 2016, the

company expects:

- Assurant Solutions’ net earned

premiums and fees and net operating income to increase from 2015

levels. Overall results expected to improve in the second half of

the year driven by new mobile programs, improved international

profitability and additional expense initiatives. Results to be

affected by foreign exchange volatility, lower service contract

revenue from legacy North American retail clients and continued

declines in credit insurance.

- Assurant Specialty Property’s

net earned premiums and net operating income to decrease from 2015

levels. Results to be affected by the ongoing normalization of

lender-placed insurance business partially offset by increased

efficiencies and expense savings initiatives. Multi-family housing

and mortgage solutions businesses to expand via market share gains.

Overall results to be affected by catastrophe losses.

- Capital to be deployed through a

combination of share repurchases, common stock dividends,

reinvestments in the business and acquisitions in Housing and

Lifestyle, subject to market conditions and other factors. Business

segment dividends from Assurant Solutions and Assurant Specialty

Property to approximate segment net operating income, subject to

the growth of the businesses, rating agency and regulatory capital

requirements. Sale of Assurant Employee Benefits to provide

approximately $1 billion of net proceeds, including capital

releases.

- Corporate & Other full-year

net operating loss to approximate $70 million. Expense savings

actions to offset residual expenses associated with Assurant

Employee Benefits and Assurant Health.

Based on the announced exit from the health insurance market,

the company expects:

- Assurant Health to substantially

complete the process to exit the health insurance market in 2016.

During the remainder of the wind down, the company to incur up to

$40 to $50 million pre-tax of additional exit-related charges, as

well as certain overhead expenses that are excluded from the

premium deficiency reserve accrual. Assurant Health dividends

expected to approximate $475 million, subject to ultimate

development of claims, actual expenses needed to wind down

operations, recoveries from ACA-risk mitigation payments and

regulatory approval.

Earnings Conference Call

- The fourth quarter 2015 earnings

conference call and webcast to be held on Feb. 10, 2016 at 8:00

a.m. ET. The live and archived webcast along with supplemental

information will be available in the Investor Relations section of

www.assurant.com.

About Assurant

A global provider of specialty protection products and related

services, Assurant (NYSE: AIZ) safeguards clients and consumers

against risk. A Fortune 500 company, Assurant partners with clients

who are leaders in their industries to provide consumers peace of

mind and financial security. Our diverse range of products and

services includes: mobile device protection products and services;

extended service products and related services for consumer

electronics, appliances and vehicles; pre-funded funeral insurance;

lender-placed homeowners insurance; property preservation and

valuation services; flood insurance; renters insurance and related

products; debt protection administration; credit insurance;

manufactured housing homeowners insurance; group dental insurance;

group disability insurance; and group life insurance.

With approximately $30 billion in assets and $8 billion in

annual revenue, Assurant provides its specialty protection

offerings primarily through Assurant Solutions, Assurant Specialty

Property, and Assurant Employee Benefits. Through the Assurant

Foundation, established more than 30 years ago, the company and its

employees are dedicated to supporting and partnering with

organizations that improve communities. Visit www.assurant.com and

follow us on Twitter @AssurantNews.

Safe Harbor Statement

Some of the statements included in this news release and its

exhibits, particularly those anticipating future financial

performance, business prospects, growth and operating strategies

and similar matters, are forward-looking statements within the

meaning of the U.S. Private Securities Litigation Reform Act of

1995. You can identify these statements by the use of words such as

“will,” “may,” “anticipates,” “expects,” “estimates,” “projects,”

“intends,” “plans,” “believes,” “targets,” “forecasts,”

“potential,” “approximately,” or the negative version of those

words and other words and terms with a similar meaning. Any

forward-looking statements contained in this news release or its

exhibits are based upon our historical performance and on current

plans, estimates and expectations. The inclusion of this

forward-looking information should not be regarded as a

representation by us or any other person that the future plans,

estimates or expectations contemplated by us will be achieved. Our

actual results might differ materially from those projected in the

forward-looking statements. The company undertakes no obligation to

update or review any forward-looking statements in this news

release or the exhibits, whether as a result of new information,

future events or other developments. The following risk factors

could cause our actual results to differ materially from those

currently estimated by management, including those projected in the

company outlook:

(i) actions by governmental agencies or government

sponsored entities or other circumstances, including pending

regulatory matters affecting our lender-placed insurance business,

that could result in reductions of premium rates or increases in

expenses, including claims, fines, penalties or other expenses;

(ii) inability to implement, or delays in implementing, strategic

plans for the Assurant Employee Benefits and Assurant Health

segments; (iii) loss of significant client relationships or

business, distribution sources or contracts and reliance on a few

clients; (iv)

the effects of the Patient Protection and

Affordable Care Act and the Health Care and Education

Reconciliation Act of 2010 (the "Affordable Care Act"), and the

rules and regulations thereunder, on our health and employee

benefits businesses; potential variations between the final risk

adjustment amount and reinsurance amounts, as determined by the

U.S. Department of Health and Human Services under the Affordable

Care Act, and the company's estimate;

(v) unfavorable outcomes in litigation and/or regulatory

investigations that could negatively affect our results, business

and reputation; (vi) inability to execute strategic plans related

to acquisitions, dispositions or new ventures; (vii) failure to

adequately predict or manage benefits, claims and other costs;

(viii) inadequacy of reserves established for future claims; (ix)

current or new laws and regulations that could increase our costs

and decrease our revenues; (x) significant competitive pressures in

our businesses; (xi) failure to attract and retain sales

representatives, key managers, agents or brokers; (xii) losses due

to natural or man-made catastrophes; (xiii) a decline in our credit

or financial strength ratings (including the risk of ratings

downgrades in the insurance industry); (xiv) deterioration in the

company’s market capitalization compared to its book value that

could result in an impairment of goodwill; (xv) risks related to

our international operations, including fluctuations in exchange

rates; (xvi) data breaches compromising client information and

privacy; (xvii) general global economic, financial market and

political conditions (including difficult conditions in financial,

capital, credit and currency markets, the global economic slowdown,

fluctuations in interest rates or a prolonged period of low

interest rates, monetary policies, unemployment and inflationary

pressure); (xviii) cyber security threats and cyber attacks; (xix)

failure to effectively maintain and modernize our information

systems; (xx) uncertain tax positions and unexpected tax

liabilities; (xxi) risks related to outsourcing activities; (xxii)

unavailability, inadequacy and unaffordable pricing of reinsurance

coverage; (xxiii) diminished value of invested assets in our

investment portfolio (due to, among other things, volatility in

financial markets; the global economic slowdown; credit, currency

and liquidity risk; other than temporary impairments and increases

in interest rates); (xxiv) insolvency of third parties to whom we

have sold or may sell businesses through reinsurance or modified

co-insurance; (xxv) inability of reinsurers to meet their

obligations; (xxvi) credit risk of some of our agents in Assurant

Specialty Property and Assurant Solutions; (xxvii) inability of our

subsidiaries to pay sufficient dividends; (xxviii) failure to

provide for succession of senior management and key executives; and

(xxix)

cyclicality of the insurance industry.

For a detailed discussion of the risk factors that could affect

our actual results, please refer to the risk factors identified in

our SEC reports, including, but not limited to our 2014 Annual

Report on Form 10-K and 2015 First Quarter, Second Quarter and

Third Quarter Quarterly Reports on Form 10-Q, as filed with the

SEC.

Non-GAAP Financial Measures

Assurant uses the following non-GAAP financial measures to

analyze the company’s operating performance for the periods

presented in this news release. Because Assurant’s calculation of

these measures may differ from similar measures used by other

companies, investors should be careful when comparing Assurant’s

non-GAAP financial measures to those of other companies.

(1) Assurant uses operating ROE, excluding AOCI and Assurant

Health runoff operations, as an important measure of the company’s

operating performance. Operating ROE equals net operating income

for the periods presented divided by average stockholders’ equity

for the year-to-date period, excluding AOCI and Assurant Health

runoff operations. The company believes operating ROE, excluding

AOCI and Assurant Health runoff operations, provides investors a

valuable measure of the performance of the company’s ongoing

business, because it excludes the effect of net realized gains

(losses) on investments that tend to be highly variable from

period-to-period, other AOCI items, Assurant Health runoff

operations and those events that are unusual and/or unlikely to

recur. The comparable GAAP measure would be GAAP ROE, defined as

net income, for the periods presented, divided by average

stockholders’ equity for the year-to-date period. GAAP ROE for the

12 months ended Dec. 31, 2015 and 12 months ended Dec. 31, 2014 was

2.9 percent and 9.4 percent, respectively, as shown in the

following reconciliation table.

12 Months

12 Months 2015

2014 Annual operating return on average equity (excluding

AOCI and Assurant Health runoff operations) 11 .3% 12 .1%

Assurant Health runoff operations (9 .2)% (1 .5)% Net realized

gains on investments 0 .5% 1 .0% Gain (loss) on divested business 0

.3% (0 .5)% Change in tax liabilities 0 .4% 0 .3% Payment received

related to previous sale of subsidiary 0 .2% - Change in derivative

investment (0 .1)% (0 .1)% Change due to effect of including AOCI

(0 .5)% (1 .9)%

Annual GAAP return on average

equity 2 .9% 9 .4% (2)

Assurant uses net operating income as an

important measure of the company’s operating performance. As shown

in the net operating income reconciliation table, net operating

income equals net income, excluding net realized gains (losses) on

investments, other unusual and/or infrequent items and Assurant

Health runoff operations. The company believes net operating income

provides investors a valuable measure of the performance of the

company’s ongoing business, because it excludes the effect of net

realized gains (losses) on investments that tend to be highly

variable from period-to-period, those events that are unusual

and/or unlikely to recur and Assurant Health runoff operations.

Please refer to page 2 of this release for a reconciliation of net

operating income to net income.

(3) Assurant uses a ratio of debt to total capital,

excluding AOCI and Assurant Health runoff operations, as an

important measure of the company’s financial leverage. Assurant’s

debt to total capital ratio, excluding AOCI and Assurant Health

runoff operations, equals debt divided by the sum of debt and total

stockholders’ equity excluding AOCI and Assurant Health runoff

operations. The company believes that the debt to total capital

ratio, excluding AOCI and Assurant Health runoff operations,

provides investors a valuable measure of financial leverage,

because it excludes the effect of unrealized gains (losses) on

investments, which tend to be highly variable from

period-to-period, other AOCI items and Assurant Health runoff

operations. The comparable GAAP measure would be the ratio of debt

to total capital. The debt to total capital ratio as of Dec. 31,

2015 and Dec. 31, 2014 was 20.6 percent and 18.4 percent,

respectively, as shown in the following reconciliation table.

4Q 4Q 2015

2014 Debt to total capital ratio (excluding AOCI

and Assurant Health runoff operations) 23.4 % 21.9 % Change due

to effect of including AOCI (0.4 )% (1.8 )% Change due to effect of

including Assurant Health runoff operations (2.4 )%

(1.7 )%

Debt to total capital ratio 20.6 %

18.4 %

A summary of net operating income disclosed items is included on

page 21 of the company’s Financial Supplement, which is available

in the Investor Relations section of www.assurant.com.

Assurant, Inc. Consolidated

Statement of Operations (unaudited) Three and 12 Months

Ended Dec. 31, 2015 and 2014 4Q 12 Months

2015 2014 2015

2014 (in thousands except number of shares and per share

amounts) Revenues Net earned premiums $

1,994,756 $ 2,142,137 $ 8,350,997 $ 8,632,142 Fees and other income

382,772 316,955 1,303,466 1,033,805 Net investment income 157,392

158,854 626,217 656,429 Net realized gains on investments 9,669

17,201 31,826 60,783 Amortization of deferred gain on disposal of

businesses 3,245 (12,455 ) 12,988

(1,506 ) Total revenues 2,547,834 2,622,692

10,325,494 10,381,653

Benefits, losses and

expenses Policyholder benefits 1,009,889 1,123,995 4,742,535

4,405,333 Selling, underwriting, general and administrative

expenses 1,413,950 1,394,573 5,326,662 5,173,788 Interest expense

13,781 13,778 55,116 58,395

Total benefits, losses and expenses 2,437,620

2,532,346 10,124,313 9,637,516 Income

before provision for income taxes 110,214 90,346 201,181 744,137

Provision for income taxes 44,470 40,591

59,626 273,230 Net income $ 65,744 $ 49,755

$ 141,555 $ 470,907

Net income per

share: Basic $ 0.99 $ 0.70 $ 2.08 $ 6.52 Diluted $ 0.97 $ 0.69

$ 2.05 $ 6.44

Dividends per share $ 0.50 $ 0.27 $

1.37 $ 1.06

Share data: Basic weighted average shares

outstanding 66,732,896 71,054,598 68,163,825 72,181,447

Diluted weighted average shares outstanding 67,592,973 72,104,349

69,017,209 73,152,010

Assurant, Inc.

Consolidated Condensed Balance Sheets

(unaudited) At Dec. 31, 2015 and Dec. 31, 2014

December 31, December 31, 2015 2014

(in thousands) Assets Investments and cash and

cash equivalents $ 14,315,897 $ 15,450,108 Reinsurance recoverables

7,470,403 7,254,585 Deferred acquisition costs 3,150,934 2,957,740

Goodwill 833,512 841,239 Assets held in separate accounts 1,798,104

1,906,237 Other assets 2,507,098 3,152,557 Total

assets $ 30,075,948 $ 31,562,466

Liabilities

Policyholder benefits and claims payable $ 13,363,413 $ 13,182,278

Unearned premiums 6,423,720 6,529,675 Debt 1,171,382 1,171,079

Liabilities related to separate accounts 1,798,104 1,906,237

Deferred gain on disposal of businesses 92,327 100,817 Accounts

payable and other liabilities 2,703,035 3,491,073

Total liabilities 25,551,981 26,381,159

Stockholders' equity Equity, excluding accumulated other

comprehensive income 4,405,418 4,625,540 Accumulated other

comprehensive income 118,549 555,767 Total

stockholders' equity 4,523,967 5,181,307 Total

liabilities and stockholders' equity $ 30,075,948 $ 31,562,466

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160209006700/en/

Media:Vera Carley, 212.859.7002Assistant Vice President,

External Communicationvera.carley@assurant.comorInvestor

Relations:Suzanne Shepherd, 212.859.7062Assistant Vice

President, Investor Relationssuzanne.shepherd@assurant.com

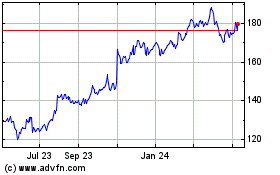

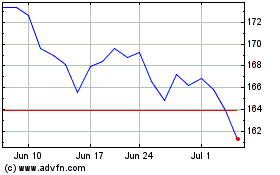

Assurant (NYSE:AIZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Assurant (NYSE:AIZ)

Historical Stock Chart

From Apr 2023 to Apr 2024