Assura PLC Scrip Dividend Declaration (1372U)

January 16 2017 - 2:00AM

UK Regulatory

TIDMAGR

RNS Number : 1372U

Assura PLC

16 January 2017

16 January 2017

Assura plc

Scrip Dividend Declaration

Assura plc ("Assura" or "the Company"), the UK's leading primary

care property investor and developer, today announces that,

pursuant to its Scrip Dividend Scheme and in response to the scrip

dividend alternative for the quarterly interim dividend payable on

18 January 2017 (the "Scrip Dividend Alternative"), elections were

received in respect of 17.1 per cent. of the Company's ordinary

shares in issue as at the record date of 16 December 2016.

Electing shareholders will receive ordinary shares in the

Company ("Shares") in lieu of cash in respect of this dividend and,

accordingly 3,032,527 Shares (the "New Shares") will be issued by

the Company to such shareholders.

Application has therefore been made for the admission of the New

Shares to the Official List of the UK Listing Authority and to

trading on the London Stock Exchange's market for listed securities

("Admission"). The New Shares will rank pari passu with the

Company's existing ordinary shares and Admission is expected to

occur at 8.00am on 18 January 2017.

Following the allotment of the New Shares, it is expected that

the total number of shares in issue will be 1,655,040,993 (none of

which will be held in treasury) and that, accordingly, the total

number of voting rights of the Company will be 1,655,040,993.

Copies of the documents relating to the Scrip Dividend

Alternative are available for inspection through the National

Storage Mechanism (http://www.morningstar.co.uk/uk/NSM).

No Property Income Distribution ("PID") is included in this

interim dividend. However, forms to register for gross PIDs (when

these become payable) are available on the Company's website.

Please click here for PID Forms.

-ENDS-

Enquiries

Assura plc Tel: 01925 420660

Orla Ball

Finsbury Tel: 0207 251 3801

Gordon Simpson

Notes to Editors

Assura plc, a constituent of the FTSE 250, is a UK REIT and

long-term investor in and developer of primary care property. The

company, headquartered in Warrington, works with GPs, health

professionals and the NHS to create innovative property solutions

in order to facilitate delivery of high quality patient care in the

community. At 30 September 2016, Assura's property portfolio was

valued at GBP1,227 million.

Further information is available at www.assuraplc.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCBGGDBSXBBGRX

(END) Dow Jones Newswires

January 16, 2017 02:00 ET (07:00 GMT)

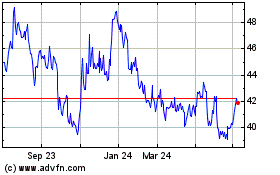

Assura (LSE:AGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

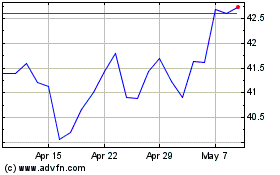

Assura (LSE:AGR)

Historical Stock Chart

From Apr 2023 to Apr 2024