Assura PLC Scrip Calculation Price (5408S)

December 22 2016 - 2:00AM

UK Regulatory

TIDMAGR

RNS Number : 5408S

Assura PLC

22 December 2016

22 December 2016

Assura plc

Scrip Calculation Price

Assura plc ("the Company") announces, in accordance with the

terms and conditions of the Company's Scrip Dividend Scheme ("the

Scheme"), that the Scrip Calculation Price in respect of the

quarterly interim dividend proposed to be paid on 18 January 2017,

is 56.0 pence. This is the average closing mid-market price of an

ordinary share in the Company for the five dealing days commencing

with, and including, the ex-dividend date of 15 December 2016.

If you wish to receive this quarterly interim dividend in cash,

you do not need to take any action.

If you wish to participate in the Scheme and receive New Shares

instead of your cash dividend, you should complete a Mandate, as

follows:

-- If you hold your Ordinary Shares in certificated form, and if

you have not already done so, you should complete the Mandate Form

(which is available to download from Assura's website

www.assuraplc.com) in accordance with the instructions printed

thereon and return it to Capita Asset Services at The Registry, 34

Beckenham Road, Beckenham, Kent BR3 4TU by no later than 4.30 p.m.

(London time) on 4 January 2017. The Mandate Form will remain in

force for any future dividends in respect of which a Scrip Dividend

Alternative is offered, until such time as the Mandate Form is

cancelled.

-- If you hold your Ordinary Shares in uncertificated form via

the CREST System, you can only elect to receive dividends in the

form of New Shares by submitting a CREST Dividend Election Input

Message via the CREST System. Evergreen elections will not be

permitted. This means that if you wish to receive New Shares

instead of cash as a matter of routine whenever a Scrip Dividend

Alternative is offered, you must complete and submit a CREST

Dividend Election Input Message on each occasion, otherwise you

will receive the relevant dividend in cash.

If you have any questions about the Scheme or how it operates,

you can contact our Registrar, Capita Asset Services, at the

address above or by telephone on 0371 664 0321. Lines are open

between 9.00am and 5.30pm Monday to Friday, excluding public

holidays.

Based upon the above Scrip Calculation Price, if all eligible

Shareholders were to elect to take up their full entitlement to New

Shares in respect of this quarterly interim dividend, approximately

17,700,091 New Shares would be issued. This would represent

approximately 1.1 per cent. of the Company's issued share capital

as at 21 December 2016. The total cash cost of this quarterly

interim dividend if no Shareholders were to elect to take up their

entitlement (and therefore no New Shares were to be issued) would

be approximately GBP9.9 million.

Words and expressions defined in the circular dated 9 December

2015 in relation to the Scheme bear the same meanings in this

announcement.

No Property Income Distribution ("PID") is included in this

interim dividend. However, forms to register for gross PIDs (when

these become payable) are available on the Company's website.

Please click here for PID Forms.

- Ends -

For more information, please contact:

Assura plc Tel: 01925 420660

Orla Ball

Finsbury Tel: 0207 251 3801

Gordon Simpson

Notes to Editors

Assura plc, a constituent of the FTSE 250, is a UK REIT and

long-term investor in and developer of primary care property. The

company, headquartered in Warrington, works with GPs, health

professionals and the NHS to create innovative property solutions

in order to facilitate delivery of high quality patient care in the

community. At 31 September 2016, Assura's property portfolio was

valued at GBP1,227 million.

Further information is available at www.assuraplc.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCFEEFWFFMSEDE

(END) Dow Jones Newswires

December 22, 2016 02:00 ET (07:00 GMT)

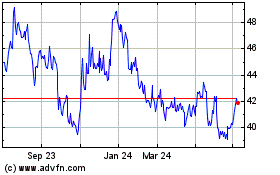

Assura (LSE:AGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

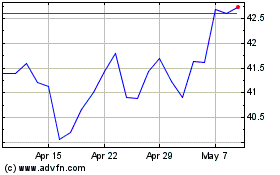

Assura (LSE:AGR)

Historical Stock Chart

From Apr 2023 to Apr 2024