TIDMAGR

RNS Number : 6793W

Assura PLC

16 November 2017

Assura plc

Accelerated investment and strong financial performance

16 November 2017

Assura plc ("Assura"), the leading primary care property

investor and developer, announces its half year results for the six

months to 30 September 2017.

Continued growth of portfolio

-- 76% increase in profit before tax to GBP73.4 million (2016: GBP41.7 million)

-- 8.3% increase in EPRA EPS to 1.3 pence (2016: 1.2 pence)

-- 16.0% increase in investment property to GBP1.6 billion (March 2017: GBP1.3 billion)

-- 7.7% growth in diluted EPRA NAV per share to 53.1 pence (March 2017: 49.3 pence)

-- 11.7% increase in rent roll to GBP83.1 million (March 2017: GBP74.4 million)

Strong balance sheet enabling reduction in cost of debt

-- GBP98 million, gross of expenses, raised from equity placing in June 2017

-- Unsecured revolving credit facility increased to GBP250 million at initial margin of 150bps

-- Weighted average cost of debt reduced by 28bps to 3.78% (March 2017: 4.06%)

-- Further facilities secured post period end

Sector leader in a market that is in significant need of

investment

-- Consensus that primary care must play a bigger role in health provision

-- Significant underinvestment in primary care space, many GP

premises not currently fit for purpose

-- The Naylor report released earlier this year highlighted a

need for significant investment in the NHS estate with support from

the private sector

Well positioned to help alleviate the pressures on primary care

infrastructure

-- Strong pipeline with GBP209 million of acquisitions and developments

-- Current LTV of 36%

-- Scalable, internally managed operating model, with in-house development model

-- Group operates in a highly fragmented market: portfolio of

475 medical centres compares with a total UK market of

approximately 9,000 surgery buildings

Jonathan Murphy, CEO, said: "Our unique business model and

strong, diversified funding structure has allowed us to accelerate

investment, grow our property portfolio and deliver a strong

financial performance with growth in profit before tax, EPRA NAV

and dividends. Primary care remains at the heart of the NHS agenda

and this, together with our acquisitions and development pipeline,

means Assura is well placed to continue improving and providing the

primary health care estate of the future."

For further information, please contact:

Assura plc: Tel: 01925

Jonathan Murphy 420660

Jayne Cottam

Orla Ball

Edelman: Tel: 0203

John Kiely 047 2546

Mav Wynn

Rob Yates

This announcement contains inside information as defined in

Article 7 of the EU Market Abuse Regulation No 596/2014 and has

been announced in accordance with the Company's obligations under

Article 17 of that Regulation.

Presentation and webcast:

A presentation will be held for analysts and investors on 16

November at 11am London time, with a webcast available from our

website or via the following link:

http://webcasting.brrmedia.co.uk/broadcast/59e8b29d2019c2348e0e7801

Notes to Editors

Assura plc, a constituent of the FTSE 250 and the EPRA* indices,

is a UK REIT and long-term investor in and developer of primary

care property. The company, headquartered in Warrington, works with

GPs, health professionals and the NHS to create innovative property

solutions in order to facilitate delivery of high quality patient

care in the community. At 30 September 2017, Assura's property

portfolio was valued at GBP1,560 million.

Further information is available at www.assuraplc.com

*EPRA is a registered trademark of the European Public Real

Estate Association.

CEO's statement

In the first half of the year, we have continued to grow our

portfolio and improve profitability. During the period, the value

of our investment property increased by 16% to GBP1.6 billion and

we completed GBP164 million of property additions, acquiring and

developing assets in excess of our plan for the year to date.

We have continued to strengthen our financial position. In May,

we increased our revolving credit facility to GBP250 million. The

Group also completed an equity issuance for GBP98 million, which

was significantly oversubscribed, and has been fully deployed to

fund the accelerated growth of our portfolio in the first half of

the year.

Since the period end we have secured a further GBP150 million in

the UK private placement market by issuing eight and 10 year notes

at a blended rate of 3.04% along with a further increase of our

revolving credit facility by GBP50 million to GBP300 million. This

expansion of unsecured facilities gives us the operational

flexibility to fund our pipeline of opportunities as well as

securing further funds at very competitive rates as we look to

bring our weighted average cost of debt down.

Gearing continues to be below our medium term loan-to-value

range of 40% to 50%, thus enabling us to take advantage of the

strong pipeline of investment opportunities. Our robust financial

position means we are able to maintain our progressive dividend

policy.

Financial highlights

Net rental income increased 16% to GBP38.3 million in the period

and profit before tax increased 76% to GBP73.4 million. EPRA EPS

increased 8% to 1.3 pence per share and diluted EPRA net asset

value grew 8% to 53.1 pence per share at the period-end. This

growth in EPRA EPS is a reflection of developments and acquisitions

in the period, our ability to manage, carefully, our internal

costs, further reducing the EPRA Cost Ratio to 11.7% and reductions

in our financing costs following the successful fundraising and

financing initiatives.

This strong financial performance has enabled us to announce an

intended increase of 9% in our dividend from January 2018 to 0.655

pence per share on a quarterly basis, subject to the completion of

the proposed equity raise announced today. A further announcement

formally declaring the January 2018 dividend will be made in due

course.

Market opportunity

In March 2017, Sir Robert Naylor released his detailed review of

the NHS estate, highlighting the essential role for primary care

premises in enabling the policy directives of increasing evening

and weekend access to GP's, encouraging practice networks with

central hubs and therefore increasing the primary care workforce.

The review recommends utilising private sector investment in

supporting GPs and improving the standard of premises.

Assura has an open dialogue with the key stakeholders within the

NHS and Government. We continue to demonstrate our excellent track

record and ability to deliver state of the art primary care

premises within the heart of the community. We are at the forefront

to deliver value for money for the NHS and for the taxpayer as a

third party developer ("3PD"). The ability to deliver these

developments presents limited development risk for Assura with

pre-let arrangements and the opportunity for future rental

growth.

We have continued to both source and complete acquisition

opportunities during the period utilising our proprietary database.

Assura's market share remains modest at approximately 7% and there

are many opportunities for further growth in a highly fragmented,

though specialist, market.

Board appointments

In the past few months we have strengthened our Board and

executive team with two key appointments. Jayne Cottam joined as

CFO and Ed Smith was appointed a Non-Executive Director. Both Jayne

and Ed bring a wealth of experience and fresh perspective to Assura

and I look forward to working with them as we continue to develop

the business and deliver on our strategy.

Outlook

The additional funding provided by the UK private placement and

the increase in the revolving credit facility provides a sound

financial footing for the business. The continued move to unsecured

funding offers a flexible platform for growth.

We have a strong pipeline of GBP126 million of targeted

acquisitions and GBP83 million of development opportunities.

The open market rent review mechanism in our sector provides

income growth whilst recent land and construction cost inflation

provides the potential for future rental growth.

We believe that Assura will continue to provide stable long term

returns and our confidence is reflected in our intention to

increase the quarterly dividend from January 2018.

Jonathan Murphy

CEO

15 November 2017

Business review

For the six months ended 30 September 2017

Portfolio as at 30 September 2017 GBP1,560.0 million (31 March

2017: GBP1,344.9 million)

Our business is based on our investment portfolio of 475

properties. This has a passing rent roll of GBP83.1 million (March

2017: GBP74.4 million), 86% of which is underpinned by the NHS. The

WAULT is 12.8 years and 74% of the rent roll will still be

contracted in 2027.

At 30 September 2017 our portfolio of completed investment

properties was valued at a total of GBP1,527.2 million, including

investment properties held for sale of GBP3.8 million (March 2017:

GBP1,315.3 million and GBPnil), which produced a net initial yield

("NIY") of 4.93% (March 2017: 5.10%). Taking account of potential

lettings of unoccupied space and any uplift to current market rents

on review, our valuers assess the net equivalent yield to be 5.09%

(March 2017: 5.29%). Adjusting this Royal Institution of Chartered

Surveyors standard measure to reflect the advanced payment of

rents, the true equivalent yield is 5.26% (March 2017: 5.47%).

Our EPRA NIY, based on our passing rent roll and latest annual

direct property costs, was 4.96% (March 2017: 5.05%).

Six months Six months

ended ended

30 September 30 September

2017 2016

GBPm GBPm

---------------------- ------------- -------------

Net rental income 38.3 32.9

Valuation movement 50.4 23.4

---------------------- ------------- -------------

Total Property Return 88.7 56.3

---------------------- ------------- -------------

Expressed as a percentage of opening investment property plus

additions, Total Property Return for the six months was 5.9%

compared with 4.7% in 2016.

Our annualised Total Return over the five years to 31 December

2016 as calculated by IPD was 8.9% compared with the IPD All

Healthcare Benchmark of 7.0% over the same period.

The net valuation gain in the six months of GBP50.4 million

represents a 4.29% uplift on a like-for-like basis and movements

relating to properties acquired in the period. The uplift has

arisen due to the downward pressure on yields with increased demand

for assets in the sector. Despite the downward pressure, the NIY on

our assets continues to represent a substantial premium over the

15-year UK gilt which traded at 1.67% at 30 September 2017.

Investment and development activity

We have invested substantially during the period, with this

expenditure split between investments in completed properties,

developments, forward funding projects, extensions and fit-out

costs enabling vacant space to be let as follows:

Six months

ended 30

September

2017

GBPm

------------------------------------------ ----------

Acquisition of completed medical

centres 152.8

Developments/forward funding arrangements 14.7

Like-for-like portfolio (improvements) 1.8

------------------------------------------ ----------

Total capital expenditure 169.3

------------------------------------------ ----------

The bulk of the growth in our investment portfolio has come from

the acquisition of 75 properties for GBP152.8 million during the

period.

Despite the continued delay in NHS approval of new developments,

we have completed three developments during the period (all under

forward funding agreements) with a total development cost of GBP9.5

million. This has added GBP0.5 million to our annual rent roll and

generated a 5.8% yield on cost.

During this period we recorded a revaluation gain of GBP4.2

million in respect of investment property under construction (2016:

net deficit of GBP0.3 million).

Development gains are recorded based on the stage of completion

whilst there has also been uplift reflecting an element of yield

shift, as with the existing portfolio.

As at 30 September 2017, we had five developments on site under

forward funding agreements, with a total committed investment value

of GBP34 million, and a further 12 which we would hope to be on

site shortly (estimated cost of GBP49 million).

Live developments and forward funding arrangements

Estimated

completion Development Costs

date costs to date Size

-------------- ----------- ----------- --------- ---------

Darley Dale Sep-18 GBP2.3m GBP0.6m 772 sq.m

2,069

Durham Apr-18 GBP10.2m GBP6.5m sq.m

4,389

Middlesbrough Jan-18 GBP18.3m GBP12.3m sq.m

Swansea Jan-18 GBP2.0m GBP1.2m 979 sq.m

Wivenhoe Oct-17 GBP1.5m GBP1.1m 628 sq.m

-------------- ----------- ----------- --------- ---------

Portfolio management

We have continued to deliver rental growth and have successfully

concluded 88 rent reviews during the six months to generate a

weighted average annual rent increase of 1.81% (year to March 2017:

1.57%) on those properties. Our portfolio benefits from a 27%

weighting in fixed, Retail Price Index ("RPI") and other uplifts

which generated an average uplift of 2.84% during the period. The

majority of our portfolio is subject to open market reviews and

these have generated an average uplift of 0.83% during the

period.

We have secured nine new tenancies with an annual rent roll of

GBP0.2 million, in addition to four lease regears (rent of GBP0.2

million) and three extensions to existing buildings (rent of GBP0.3

million). Our EPRA Vacancy Rate was 2.1% (March 2017: 2.1%).

Administrative expenses

The Group analyses cost performance by reference to our EPRA

Cost Ratios (including and excluding direct vacancy costs) which

were 11.7% and 11.5% respectively (2016: 13.5% and 12.3%).

We also measure our operating efficiency as the proportion of

administrative costs to the average gross investment property

value. This ratio during the period was 0.25% (2016: 0.29%) and

administrative costs stood at GBP3.6 million (2016: GBP3.4

million).

Financing

In May 2017, we extended the revolving credit facility to GBP250

million. The terms were unchanged, being unsecured and at an

initial margin of 150 basis points above LIBOR, subject to

leverage. In October 2017, this was further extended to GBP300

million.

In June 2017, we completed a GBP98.4 million, gross of expenses,

equity raise via a placing of approximately 164 million shares.

In October 2017, we announced the issuance of GBP150 million of

privately placed notes in two tranches with maturities of eight and

10 years.

The weighted average coupon is 3.04% and the notes are

unsecured.

At 30 September 2017, we had undrawn facilities and cash of

GBP101.9 million.

Financing statistics 30/09/2017 31/03/2017

-------------------------------- ---------- ----------

Net debt GBP569.1m GBP499.6m

Weighted average debt maturity 7.9 years 8.7 years

Weighted average interest rate 3.78% 4.06%

% of debt at fixed/capped rates 71% 81%

Interest cover(1) 308% 296%

LTV 36% 37%

-------------------------------- ---------- ----------

1. Interest cover is the number of times net interest payable is

covered by EPRA earnings before net interest.

Our loan to value ("LTV") ratio currently stands at 36%, which

is lower than our target range of 40%-50% and will increase as we

invest in our pipeline in the short to medium term (where this is

funded by debt facilities). 71% of the debt facilities are fixed

with a weighted average debt maturity of 7.9 years compared with a

WAULT of 12.8 years, which highlights the security of the cash

flows of the business.

Details of the facilities and their covenants are set out in

Note 11 to the accounts.

Net finance costs presented through EPRA earnings in the

six-month period amounted to GBP11.2 million (2016: GBP9.7

million).

Alternative Performance Measures ("APMs")

The financial performance for the period is reported including a

number of APMs (financial measures not defined under IFRS). We

believe that including these alongside IFRS measures provides

additional information to help understand the financial performance

for the period and calculations with reconciliations back to

reported IFRS measures are included where possible.

Profit before tax

Profit before tax for the period was GBP73.4 million (2016:

GBP41.7 million). The increase can primarily be attributed to the

increased valuation gain on investment property and the higher net

rental income following additions to the portfolio.

EPRA earnings

Six months Six months

ended 30 ended

September 30 September

2017 2016

GBPm GBPm

---------------------------------- ---------- -------------

Net rental income 38.3 32.9

Administrative expenses (3.6) (3.4)

Net finance costs (11.2) (9.7)

Share-based payments and taxation (0.2) -

---------------------------------- ---------- -------------

EPRA earnings 23.3 19.8

---------------------------------- ---------- -------------

The movement in EPRA earnings can be summarised as follows:

GBPm

----------------------------------- -----

Six months ended 30 September 2016 19.8

Net rental income 5.4

Administrative expenses (0.2)

Net finance costs (1.5)

Share-based payments and taxation (0.2)

----------------------------------- -----

Six months ended 30 September 2017 23.3

----------------------------------- -----

EPRA earnings has grown 18% to GBP23.3 million in the six months

to 30 September 2017 reflecting the property acquisitions completed

and the reduced finance costs from reducing our LTV and the average

cost of borrowings.

Earnings per share

The basic earnings per share ("EPS") on profit for the period

was 4.2 pence (2016: 2.5 pence).

EPRA EPS, which excludes the net impact of valuation movements

and gains on disposal, was 1.3 pence (2016: 1.2 pence).

Based on calculations completed in accordance with IAS 33,

share-based payment schemes are currently expected to be dilutive

to EPS, with 0.2 million new shares expected to be issued. The

dilution is not material as illustrated in the table below:

EPS measure Basic Diluted

----------------------- ----- -------

Profit for six months 4.2p 4.2p

EPRA 1.3p 1.3p

----------------------- ----- -------

Dividends

Total dividends settled in the six months to 30 September 2017

were GBP19.9 million or 1.2 pence per share (2016: 1.1 pence per

share). GBP3.3 million of this was satisfied through the issuance

of shares via scrip.

As a REIT with requirement to distribute 90% of taxable profits

(Property Income Distribution, "PID"), the Group expects to pay out

as dividends at least 90% of recurring cash profits. Both dividends

paid in the first half of the year were normal dividends (non-PID)

with an associated tax credit, as a result of brought forward tax

losses and available capital allowances. The October 2017 dividend

has subsequently been paid as a PID and future dividends will be a

mix of PID and normal dividends as required.

The table below illustrates our cash flows over the period:

Six months Six months

ended ended

30 September 30 September

2017 2016

GBPm GBPm

---------------------------------- ------------- -------------

Opening cash 23.5 44.3

Net cash flow from operations 20.3 15.6

Dividends paid (16.5) (15.8)

Investment:

Property acquisitions (155.3) (82.7)

Development expenditure (14.8) (10.5)

Sale of properties 1.1 1.1

Other - (0.4)

Financing:

Net proceeds from equity issuance 96.1 -

Net borrowings movement 67.5 76.1

---------------------------------- ------------- -------------

Closing cash 21.9 27.7

---------------------------------- ------------- -------------

Net cash flow from operations differs from EPRA earnings due to

movements in working capital balances.

Net assets

Diluted EPRA NAV movement

Pence per

GBPm share

---------------------------------- ------ ---------

Diluted EPRA NAV at 31 March 2017 817.5 49.3

EPRA earnings 23.3 1.3

Capital (revaluations and capital

gains) 50.1 2.9

Dividends (19.9) (1.2)

Shares issued 99.5 0.8

Other 0.2 -

---------------------------------- ------ ---------

Diluted EPRA NAV at 30 September

2017 970.7 53.1

---------------------------------- ------ ---------

Our Total Accounting Return per share for the six months ended

30 September 2017 is 9.9% of which 1.20 pence per share (2.4%) has

been distributed to shareholders and 3.7 pence per share (7.5%) is

the movement on EPRA NAV.

Portfolio analysis by capital value

Total Total

Number value value

of properties GBPm %

--------- -------------- ------- ------

>GBP10m 25 372.0 24

GBP5-10m 55 370.3 24

GBP1-5m 284 711.7 47

<GBP1m 111 73.2 5

--------- -------------- ------- ------

475 1,527.2 100

--------- -------------- ------- ------

Portfolio analysis by region

Total Total

Number value value

of properties GBPm %

--------- -------------- ------- ------

North 166 616.3 40

South 158 459.2 30

Midlands 82 301.8 20

Scotland 22 47.7 3

Wales 47 102.2 7

--------- -------------- ------- ------

475 1,527.2 100

--------- -------------- ------- ------

Portfolio analysis by tenant covenant

Total Total

rent rent

roll roll

GBPm %

--------- ----- -----

GPs 57.0 69

NHS body 14.2 17

Pharmacy 6.7 8

Other 5.2 6

--------- ----- -----

83.1 100

--------- ----- -----

EPRA performance measures

The European Public Real Estate Association ("EPRA") has

published Best Practices Recommendations with the aim of improving

the transparency, comparability and relevance of financial

reporting with the real estate sector across Europe. This section

details the rationale for each performance measure as well as our

performance against each measure.

Summary table

Six months Six months

ended ended

30 September 30 September

2017 2016

---------------------------------- ------------- -------------

EPRA EPS (p) 1.3 1.2

EPRA Cost Ratio (including direct

vacancy costs) (%) 11.7 13.5

EPRA Cost Ratio (excluding direct

vacancy costs) (%) 11.5 12.3

---------------------------------- ------------- -------------

30/09/2017 31/03/2017

------------------------- ---------- ----------

EPRA NAV (p) 53.1 49.3

EPRA NNNAV (p) 49.5 44.7

EPRA NIY (%) 4.96 5.05

EPRA "topped-up" NIY (%) 4.96 5.05

EPRA Vacancy Rate (%) 2.1 2.1

------------------------- ---------- ----------

EPRA EPS

six months ended 30 September 2017: 1.3p

Six months ended 30 September 2016: 1.2p

Diluted EPRA EPS (p)

six months ended 30 September 2017: 1.3p

Six months ended 30 September 2016: 1.2p

Definition

Earnings from operational activities.

Purpose

A key measure of a company's underlying operating results and an

indication of the extent to which current dividend payments are

supported by earnings.

The calculation of EPRA EPS and diluted EPRA EPS are shown in

Note 7 to the accounts.

EPRA NAV

30/09/2017: 53.1p

31/03/2017: 49.3p

Definition

NAV adjusted to include properties and other investment

interests at fair value and to exclude certain items not expected

to crystallise in a long-term investment property business.

Presented on a diluted basis.

Purpose

Makes adjustments to IFRS NAV to provide stakeholders with the

most relevant information on the fair value of the assets and

liabilities with a true real estate investment company with a

long-term investment strategy.

The calculation of EPRA NAV is shown in Note 8 to the

accounts.

EPRA NNNAV

30/09/2017: 49.5p

31/03/2017: 44.7p

Definition

EPRA NAV adjusted to include the fair values of (i) financial

instruments, (ii) debt and (iii) deferred taxes.

Purpose

Makes adjustments to EPRA NAV to provide stakeholders with the

most relevant information on the current fair value of all the

assets and liabilities within a real estate company.

The calculation of EPRA NNNAV is shown in Note 8 to the

accounts.

EPRA NIY

30/09/2017: 4.96%

31/03/2017: 5.05%

EPRA "topped-up" NIY

30/09/2017: 4.96%

31/03/2017: 5.05%

Definition - EPRA NIY

Annualised rental income based on the cash rents passing at the

balance sheet date, less non-recoverable property operating

expenses, divided by the market value of the property, increased

with (estimated) purchasers' costs.

Definition - EPRA "topped-up" NIY

This measure incorporates an adjustment to the EPRA NIY in

respect of the expiration of rent-free periods (or other unexpired

lease incentives such as discounted rent periods and step

rents).

Purpose

A comparable measure for portfolio valuations, this measure

should make it easier for investors to judge for themselves how the

valuation compares with that of portfolios in other listed

companies.

30/09/2017 31/03/2017

GBPm GBPm

---------------------------------------- ---------- ----------

Investment property 1,560.0 1,344.9

Less developments (27.1) (20.2)

---------------------------------------- ---------- ----------

Completed investment property portfolio 1,532.9 1,324.7

Allowance for estimated purchasers'

costs 99.0 85.4

---------------------------------------- ---------- ----------

Gross up completed investment property

- B 1,631.9 1,410.1

---------------------------------------- ---------- ----------

Annualised cash passing rental

income 83.1 74.4

Annualised property outgoings (2.2) (3.2)

---------------------------------------- ---------- ----------

Annualised net rents - A 80.9 71.2

Notional rent expiration of rent-free

periods or other incentives - -

---------------------------------------- ---------- ----------

Topped-up annualised rent - C 80.9 71.2

---------------------------------------- ---------- ----------

EPRA NIY - A/B (%) 4.96 5.05

EPRA "topped-up" NIY - C/B (%) 4.96 5.05

---------------------------------------- ---------- ----------

EPRA Vacancy Rate

30/09/2017: 2.1%

31/03/2017: 2.1%

Definition

Estimated rental value ("ERV") of vacant space divided by ERV of

the whole portfolio.

Purpose

A "pure" (%) measure of investment property space that is

vacant, based on ERV.

30/09/2017 31/03/2017

------------------------------------ ---------- ----------

ERV of vacant space (GBPm) 1.8 1.6

ERV of completed property portfolio

(GBPm) 85.7 76.7

EPRA Vacancy Rate (%) 2.1 2.1

------------------------------------ ---------- ----------

EPRA Cost Ratios (including direct vacancy costs)

Six months ended 30 September 2017: 11.7%

Six months ended 30 September 2016: 13.5%

EPRA Cost Ratios (excluding direct vacancy costs)

Six months ended 30 September 2017: 11.5%

Six months ended 30 September 2016: 12.3%

Definition

Administrative and operating costs (including and excluding

direct vacancy costs) divided by gross rental income.

Purpose

A key measure to enable meaningful measurement of the changes in

a company's operating costs.

Six months Six months

ended 30 ended 30

September September

2017 2016

GBPm GBPm

------------------------------------- ---------- ----------

Direct property costs 1.1 1.5

Administrative expenses 3.6 3.4

Share-based payment costs 0.2 -

Net service charge costs/fees (0.1) (0.1)

Exclude:

Ground rent costs (0.2) (0.2)

------------------------------------- ---------- ----------

EPRA Costs (including direct vacancy

costs) - A 4.6 4.6

Direct vacancy costs (0.1) (0.4)

------------------------------------- ---------- ----------

EPRA Costs (excluding direct vacancy

costs) - B 4.5 4.2

------------------------------------- ---------- ----------

Gross rental income less ground

rent costs (per IFRS) 39.2 34.2

------------------------------------- ---------- ----------

Gross rental income - C 39.2 34.2

------------------------------------- ---------- ----------

EPRA Cost Ratio (including direct

vacancy costs) - A/C 11.7 13.5

EPRA Cost Ratio (excluding direct

vacancy costs) - B/C 11.5 12.3

------------------------------------- ---------- ----------

Interim condensed consolidated income statement

For the six months ended 30 September 2017

Six months ended Six months ended

30 September 2017 30 September 2016

Unaudited Unaudited

Capital

Capital and

EPRA and other Total EPRA other Total

Note GBPm GBPm GBPm GBPm GBPm GBPm

-------------------- ---- ------- ----------- ------- ------ -------- -------

Gross rental

and related

income 39.4 - 39.4 34.4 - 34.4

Property operating

expenses (1.1) - (1.1) (1.5) - (1.5)

-------------------- ---- ------- ----------- ------- ------ -------- -------

Net rental

income 38.3 - 38.3 32.9 - 32.9

Administrative

expenses (3.6) - (3.6) (3.4) - (3.4)

Revaluation

gains 9 - 50.4 50.4 - 23.4 23.4

Share-based

payment charge (0.2) - (0.2) - - -

Loss on sale

of property - (0.3) (0.3) - - -

Finance revenue - - - 0.1 - 0.1

Finance costs 5 (11.2) - (11.2) (9.8) (1.5) (11.3)

-------------------- ---- ------- ----------- ------- ------ -------- -------

Profit before

taxation 23.3 50.1 73.4 19.8 21.9 41.7

-------------------- ---- ------- ----------- ------- ------ -------- -------

Taxation 6 - - - - - -

-------------------- ---- ------- ----------- ------- ------ -------- -------

Profit for

the period

attributable

to equity

holders of

the parent 23.3 50.1 73.4 19.8 21.9 41.7

-------------------- ---- ------- ----------- ------- ------ -------- -------

Earnings per

share

EPS - basic

& diluted 7 4.2p 2.5p

EPRA EPS -

basic & diluted 7 1.3p 1.2p

-------------------- ---- ------- ----------- ------- ------ -------- -------

There were no items of other comprehensive income or expense and

therefore the profit for the period also represents the Group's

total comprehensive income. All income derives from continuing

operations.

Interim condensed consolidated balance sheet

As at 30 September 2017

30 September 31 March

2017 Unaudited 2017 Audited

Note GBPm GBPm

---------------------------------------------------------- ---- --------------- -------------

Non-current assets

Investment property 9 1,560.0 1,344.9

Property, plant and equipment 0.4 0.4

Deferred tax asset 0.5 0.5

---------------------------------------------------------- ---- --------------- -------------

1,560.9 1,345.8

---------------------------------------------------------- ---- --------------- -------------

Current assets

Cash, cash equivalents and restricted

cash 21.9 23.5

Trade and other receivables 13.7 9.4

Property assets held for sale 9 4.8 0.9

---------------------------------------------------------- ---- --------------- -------------

40.4 33.8

---------------------------------------------------------- ---- --------------- -------------

Total assets 1,601.3 1,379.6

---------------------------------------------------------- ---- --------------- -------------

Current liabilities

Trade and other payables 15.3 16.4

Borrowings 11 4.4 4.3

Deferred revenue 10 17.9 16.3

---------------------------------------------------------- ---- --------------- -------------

37.6 37.0

---------------------------------------------------------- ---- --------------- -------------

Non-current liabilities

Borrowings 11 583.6 515.8

Obligations due under finance

leases 3.0 3.0

Deferred revenue 10 5.9 5.8

---------------------------------------------------------- ---- --------------- -------------

592.5 524.6

---------------------------------------------------------- ---- --------------- -------------

Total liabilities 630.1 561.6

---------------------------------------------------------- ---- --------------- -------------

Net assets 971.2 818.0

---------------------------------------------------------- ---- --------------- -------------

Capital and reserves

Share capital 12 182.8 165.5

Share premium 328.6 246.1

Merger reserve 231.2 231.2

Reserves 228.6 175.2

---------------------------------------------------------- ---- --------------- -------------

Total equity 971.2 818.0

---------------------------------------------------------- ---- --------------- -------------

NAV per Ordinary Share - basic 8 53.1p 49.4p

- diluted 8 53.1p 49.3p

EPRA NAV per Ordinary Share -

basic 8 53.1p 49.4p

- diluted 8 53.1p 49.3p

---------------------------------------------------------- ---- --------------- -------------

The interim condensed consolidated financial statements were

approved at a meeting of the Board of Directors held on 15 November

2017 and signed on its behalf by:

Jonathan Murphy Jayne Cottam

CEO CFO

Interim condensed consolidated statement of changes in

equity

For the six months ended 30 September 2017

Share Own shares Share Merger Total

capital held premium reserve Reserves equity

Note GBPm GBPm GBPm GBPm GBPm GBPm

--------------------- ---- -------- ---------- -------- -------- -------- -------

1 April 2016 163.8 (0.6) 241.9 231.2 118.0 754.3

-------- ---------- -------- -------- -------- -------

Profit attributable

to equity

holders - - - - 41.7 41.7

-------- ---------- -------- -------- -------- -------

Total comprehensive

income - - - - 41.7 41.7

Dividend 14 0.4 - 1.8 - (18.0) (15.8)

Employee

share-based

incentives 0.8 0.6 - - (1.1) 0.3

--------------------- ---- -------- ---------- -------- -------- -------- -------

30 September

2016 165.0 - 243.7 231.2 140.6 780.5

--------------------- ---- -------- ---------- -------- -------- -------- -------

Profit attributable

to equity

holders - - - - 53.6 53.6

-------- ---------- -------- -------- -------- -------

Total comprehensive

income - - - - 53.6 53.6

Dividend 14 0.5 - 2.4 - (19.0) (16.1)

--------------------- ---- -------- ---------- -------- -------- -------- -------

31 March

2017 165.5 - 246.1 231.2 175.2 818.0

--------------------- ---- -------- ---------- -------- -------- -------- -------

Profit attributable

to equity

holders - - - - 73.4 73.4

-------- ---------- -------- -------- -------- -------

Total comprehensive

income - - - - 73.4 73.4

Issue of

Ordinary

Shares 16.4 - 82.0 - - 98.4

Issue costs - - (2.3) - - (2.3)

Dividend 14 0.6 - 2.8 - (19.9) (16.5)

Employee

share-based

incentives 0.3 - - - (0.1) 0.2

--------------------- ---- -------- ---------- -------- -------- -------- -------

30 September

2017 182.8 - 328.6 231.2 228.6 971.2

--------------------- ---- -------- ---------- -------- -------- -------- -------

Interim condensed consolidated statement of cash flow

For the six months ended 30 September 2017

Six months Six months

ended ended

30 September 30 September

2017 2016

Unaudited Unaudited

GBPm GBPm

--------------------------------------- ------------- -------------

Operating activities

Rent received 36.4 33.2

Interest paid and similar charges (11.1) (9.6)

Fees received 0.4 0.4

Interest received - 0.1

Cash paid to suppliers and employees (5.4) (8.5)

--------------------------------------- ------------- -------------

Net cash inflow from operating

activities 20.3 15.6

--------------------------------------- ------------- -------------

Investing activities

Purchase of investment property (155.3) (82.7)

Development spend (14.8) (10.5)

Investment in property, plant

and equipment - (0.4)

Proceeds from sale of property 1.1 1.1

--------------------------------------- ------------- -------------

Net cash outflow from investing

activities (169.0) (92.5)

--------------------------------------- ------------- -------------

Financing activities

Issue of Ordinary Shares 98.4 -

Issue costs paid on issuance

of Ordinary Shares (2.3) -

Dividends paid (16.5) (15.8)

Repayment of loan (2.1) (57.0)

Long-term loans drawn down 70.0 135.0

Loan issue costs (0.4) (1.9)

--------------------------------------- ------------- -------------

Net cash inflow from financing

activities 147.1 60.3

--------------------------------------- ------------- -------------

Decrease in cash and cash equivalents (1.6) (16.6)

--------------------------------------- ------------- -------------

Opening cash and cash equivalents 23.5 44.3

--------------------------------------- ------------- -------------

Closing cash and cash equivalents 21.9 27.7

--------------------------------------- ------------- -------------

Notes to the interim condensed consolidated accounts

For the six months ended 30 September 2017

1. Corporate information

The Interim Condensed Consolidated Accounts of the Group for the

six months ended 30 September 2017 were authorised for issue in

accordance with a resolution of the Directors on 15 November

2017.

Assura plc ("Assura") is incorporated in England and Wales and

the Company's Ordinary Shares are listed on the London Stock

Exchange.

As of 1 April 2013, the Group has elected to be treated as a UK

REIT. See Note 6 for further details.

Copies of this statement are available from the website at

www.assuraplc.com.

2. Basis of preparation

The Interim Condensed Consolidated Accounts for the six months

ended 30 September 2017 have been prepared in accordance with IAS

34 Interim Financial Reporting. These accounts cover the six-month

accounting period from 1 April 2017 to 30 September 2017 with

comparatives for the six-month accounting period from 1 April 2016

to 30 September 2016, or 31 March 2017 for balance sheet

amounts.

The Interim Condensed Consolidated Accounts do not include all

the information and disclosures required in the Annual Report, and

should be read in conjunction with those in the Group's Annual

Report as at 31 March 2017 which are prepared in accordance with

IFRSs as adopted by the European Union.

The accounts are presented in pounds sterling rounded to the

nearest 0.1 million unless specified otherwise.

The accounts are prepared on a going concern basis.

3. Accounts

The results for the six months to 30 September 2017 and to 30

September 2016 are unaudited. The interim accounts do not

constitute statutory accounts. The financial information for the

year ended 31 March 2017 does not constitute the Company's

statutory accounts for that year, but is derived from those

accounts. Statutory accounts have been delivered to the Registrar

of Companies. The auditors reported on those accounts: their report

was unqualified, did not draw attention to any matters by way of

emphasis and did not contain a statement under s498(2) or (3) of

the Companies Act 2006.

4. New standards, interpretations and amendments thereof,

adopted by the Group

The accounting policies adopted in the preparation of the

Interim Condensed Consolidated Accounts are consistent with those

followed in the preparation of the Group's Annual Report for the

year ended 31 March 2017. The Group is not expecting new and

proposed changes in accounting standards endorsed by the EU to have

a material impact on reported numbers in future periods.

5. Finance costs

Six months Six months

ended ended

30 September 30 September

2017 2016

GBPm GBPm

-------------------------------------- ------------- -------------

Interest payable 11.3 9.7

Interest capitalised on developments (0.5) (0.2)

Amortisation of loan issue costs 0.4 0.3

-------------------------------------- ------------- -------------

Finance costs presented through

EPRA earnings 11.2 9.8

Write off of loan issue costs - 1.5

-------------------------------------- ------------- -------------

Total finance costs 11.2 11.3

-------------------------------------- ------------- -------------

6. Taxation on profit on ordinary activities

Six months Six months

ended ended

30 September 30 September

2017 2016

GBPm GBPm

-------------------------------------- ------------- -------------

Tax charged in the income statement

Deferred tax:

Origination and reversal of temporary

differences - -

-------------------------------------- ------------- -------------

Total tax charge - -

-------------------------------------- ------------- -------------

The Group elected to be treated as a UK REIT with effect from 1

April 2013. The UK REIT rules exempt the profits of the Group's

property rental business from corporation tax. Gains on properties

are also exempt from tax, provided they are not held for trading or

sold in the three years post completion of development. The Group

will otherwise be subject to corporation tax at 19%.

Group tax charges relate to its non-property income. As the

Group has sufficient brought forward losses no tax is due in

relation to the current or prior period.

As a REIT, the Group is required to pay Property Income

Distributions ("PIDs") equal to at least 90% of the Group's rental

profit calculated by reference to tax rules rather than accounting

standards. To remain as a UK REIT there are a number of conditions

to be met in respect of the principal company of the Group, the

Group's qualifying activities and the balance of business.

7. Earnings per Ordinary Share

EPRA EPRA

Earnings earnings Earnings earnings

2017 2017 2016 2016

GBPm GBPm GBPm GBPm

----------------------------- -------------- -------------- -------------- --------------

Profit for the period

from continuing operations 73.4 73.4 41.7 41.7

----------------------------- -------------- -------------- -------------- --------------

Revaluation gains (50.4) (23.4)

Loss on sale of property 0.3 -

Write off of loan issue

costs - 1.5

----------------------------- -------------- -------------- -------------- --------------

EPRA earnings 23.3 19.8

----------------------------- -------------- -------------- -------------- --------------

Weighted average number

of shares in issue -

basic 1,748,149,201 1,748,149,201 1,641,793,597 1,641,793,597

Potential dilutive impact

of share options 173,009 173,009 3,243,291 3,243,291

----------------------------- -------------- -------------- -------------- --------------

Weighted average number

of shares in issue -

diluted 1,748,322,210 1,748,322,210 1,645,036,888 1,645,036,888

----------------------------- -------------- -------------- -------------- --------------

EPS/EPRA EPS - basic

& diluted 4.2p 1.3p 2.5p 1.2p

----------------------------- -------------- -------------- -------------- --------------

The current estimated number of shares over which nil-cost

options may be issued to participants is 0.2 million.

8. Net asset value per Ordinary Share

EPRA EPRA

NAV NAV NAV NAV

30/09/2017 30/09/2017 31/03/2017 31/03/2017

GBPm GBPm GBPm GBPm

--------------------------- -------------- -------------- -------------- --------------

Net assets 971.2 971.2 818.0 818.0

--------------------------- -------------- -------------- -------------- --------------

Deferred tax (0.5) (0.5)

--------------------------- -------------- -------------- -------------- --------------

EPRA NAV 970.7 817.5

--------------------------- -------------- -------------- -------------- --------------

Number of shares in

issue 1,827,642,764 1,827,642,764 1,655,040,993 1,655,040,993

Potential dilutive impact

of share options (Note

7) 173,009 173,009 3,243,291 3,243,291

--------------------------- -------------- -------------- -------------- --------------

Diluted number of shares

in issue 1,827,815,773 1,827,815,773 1,658,284,284 1,658,284,284

--------------------------- -------------- -------------- -------------- --------------

NAV per Ordinary Share

- basic 53.1p 53.1p 49.4p 49.4p

NAV per Ordinary Share

- diluted 53.1p 53.1p 49.3p 49.3p

--------------------------- -------------- -------------- -------------- --------------

EPRA EPRA

NNNAV NNNAV

30/09/2017 31/03/2017

GBPm GBPm

--------------------------------------- ----------- -----------

EPRA NAV 970.7 817.5

Mark to market of fixed rate debt (65.5) (77.7)

--------------------------------------- ----------- -----------

EPRA NNNAV 905.2 739.8

--------------------------------------- ----------- -----------

EPRA NNNAV per Ordinary Share - basic 49.5p 44.7p

--------------------------------------- ----------- -----------

The EPRA measures set out above are in accordance with the Best

Practices Recommendations of the European Property Real Estate

Association dated November 2016.

Mark to market adjustments represent fair value and have been

provided by the counterparty as appropriate or by reference to the

quoted fair value of financial instruments.

9. Property assets

Investment property and investment property under construction

("IPUC")

Investment properties are stated at fair value, as determined

for the Company by Savills Commercial Limited and Jones Lang

LaSalle as at 30 September 2017. The properties have been valued

individually and on the basis of open market value in accordance

with RICS valuation - Professional Standards 2017 ("the Red

Book").

Initial yields mainly range from 4.25% to 4.75% (March 2017:

4.40% to 5.00%) for prime units, increasing up to 8.00% (March

2017: 8.00%) for older units with shorter unexpired lease terms.

For properties with weaker tenants and poorer units, the yields

range from 6.00% to over 8.00% (March 2017: 6.00% to over 8.00%)

and higher for those very close to lease expiry or those

approaching obsolescence.

A 0.25% shift of valuation yield would have approximately a

GBP81.7 million (March 2017: GBP68.1 million) impact on the

investment property valuation:

Investment IPUC Total Investment IPUC Total

30/09/17 30/09/17 30/09/17 31/03/17 31/03/17 31/03/2017

GBPm GBPm GBPm GBPm GBPm GBPm

---------------------- ---------- --------- --------- ---------- --------- -----------

Opening fair

value 1,321.7 20.2 1,341.9 1,094.9 11.5 1,106.4

Additions:

---------- --------- --------- ---------- --------- -----------

- acquisitions 152.8 - 152.8 155.6 - 155.6

- improvements 1.8 - 1.8 2.4 - 2.4

---------- --------- --------- ---------- --------- -----------

154.6 - 154.6 158.0 - 158.0

Development

costs - 14.7 14.7 - 20.9 20.9

Transfers 11.4 (11.4) - 14.0 (14.0) -

Transfer (to)/from

assets held

for sale (3.8) (0.2) (4.0) - 0.8 0.8

Capitalised

interest - 0.5 0.5 - 0.4 0.4

Disposals (0.2) (0.9) (1.1) (0.9) (0.2) (1.1)

Unrealised

surplus on

revaluation 46.2 4.2 50.4 55.7 0.8 56.5

---------------------- ---------- --------- --------- ---------- --------- -----------

Closing market

value 1,529.9 27.1 1,557.0 1,321.7 20.2 1,341.9

Add finance

lease obligations

recognised

separately 3.0 - 3.0 3.0 - 3.0

---------------------- ---------- --------- --------- ---------- --------- -----------

Closing fair

value of investment

property 1,532.9 27.1 1,560.0 1,324.7 20.2 1,344.9

---------------------- ---------- --------- --------- ---------- --------- -----------

30/09/2017 31/03/2017

GBPm GBPm

------------------------------------------ ---------- ----------

Market value of investment property

as estimated by valuer 1,523.4 1,315.3

Add IPUC 27.1 20.2

Add pharmacy lease premiums 6.5 6.4

Add finance lease obligations recognised

separately 3.0 3.0

------------------------------------------ ---------- ----------

Fair value for financial reporting

purposes 1,560.0 1,344.9

------------------------------------------ ---------- ----------

Assets held for sale 4.8 0.9

------------------------------------------ ---------- ----------

Total property assets 1,564.8 1,345.8

------------------------------------------ ---------- ----------

Six properties and three land sites are held as available for

sale (31 March 2017: two land sites).

10. Deferred revenue

30/09/2017 31/03/2017

GBPm GBPm

----------------------------------------- ---------- ----------

Arising from rental received in advance 17.3 15.7

Arising from pharmacy lease premiums

received in advance 6.5 6.4

----------------------------------------- ---------- ----------

23.8 22.1

----------------------------------------- ---------- ----------

Current 17.9 16.3

Non-current 5.9 5.8

----------------------------------------- ---------- ----------

23.8 22.1

----------------------------------------- ---------- ----------

11. Borrowings

30/09/2017 31/03/2017

GBPm GBPm

---------------------------------- ---------- ----------

At 1 April 520.1 369.2

Amount issued or drawn down in

period/year 70.0 210.0

Amount repaid in period/year (2.1) (59.0)

Loan issue costs (0.4) (2.2)

Amortisation of loan issue costs 0.4 0.7

Write off of loan issue costs - 1.4

---------------------------------- ---------- ----------

At the end of the period/year 588.0 520.1

---------------------------------- ---------- ----------

Due within one year 4.4 4.3

Due after more than one year 583.6 515.8

---------------------------------- ---------- ----------

At the end of the period/year 588.0 520.1

---------------------------------- ---------- ----------

The Group has the following bank facilities:

1. 10-year senior secured bond for GBP110 million at a fixed

interest rate of 4.75% maturing in December 2021. The secured bond

carries a loan to value covenant of 75% (70% at the point of

substitution of an investment property or cash) and an interest

cover requirement of 1.15 times (1.5 times at the point of

substitution). In addition, the bond is subject to a WAULT test of

10 years which, if not met, gives the bondholder the option to

request repayment of GBP5.5 million every six months.

2. Loans from Aviva Commercial Finance with an aggregate balance

of GBP211.7 million at 30 September 2017 (31 March 2017: GBP213.8

million). The Aviva loans are partially amortised by way of

quarterly instalments and partially repaid by way of bullet

repayments falling due between 2024 and 2044 with a weighted

average term of 12.8 years to maturity; GBP4.4 million is due

within a year. These loans are secured by way of charges over

specific medical centre investment properties with

cross-collateralisation between the loans and security. The loans

are subject to fixed all-in interest rates ranging between 4.11%

and 6.66% and have a weighted average of 5.43%. The loans carry a

debt service cover covenant of 1.05 times and an LTV covenant of

70%, calculated across all loans and secured properties.

3. Five-year club revolving credit facility with RBS, HSBC,

Santander and Barclays for GBP250 million on an unsecured basis at

an initial margin of 1.50% above LIBOR, expiring in May 2021. The

margin increases based on the LTV of the subsidiaries to which the

facility relates, up to 2.0% where the LTV is in excess of 50%. The

facility is subject to a historical interest cover requirement of

at least 175%, maximum LTV of 60% and a weighted average lease

length of seven years. As at 30 September 2017, GBP170 million of

this facility was drawn (31 March 2017: GBP100 million). Subsequent

to the period end, the available facility has been increased to

GBP300 million.

4. 10-year notes in the US private placement market for a total

GBP100 million. The notes are unsecured, have a fixed interest rate

of 2.65% and were drawn on 13 October 2016. The facility is subject

to a historical interest cover requirement of at least 175%,

maximum LTV of 60% and a weighted average lease length of seven

years.

The Group has been in compliance with all financial covenants on

all of the above loans as applicable throughout the period.

Subsequent to the period end, the Group has issued GBP150 million

of privately placed notes in two tranches with maturities of eight

and ten years. The weighted average coupon is 3.04%, the notes are

unsecured and covenants match existing unsecured facilities.

12. Share capital

Share Share

Number capital Number capital

of shares 30/09/2017 of shares 31/03/2017

30/09/2017 GBPm 31/03/2017 GBPm

Ordinary Shares of 10

pence each issued and

fully paid

At 1 April 1,655,040,993 165.5 1,637,706,738 163.8

Issued April 2016 - scrip - - 2,291,541 0.2

Issued July 2016 - scrip - - 1,880,037 0.2

Issued August 2016 - - 8,000,000 0.8

Issued October 2016 -

scrip - - 2,130,150 0.2

Issued January 2017 -

scrip - - 3,032,527 0.3

Issued April 2017 - scrip 1,514,247 0.2 - -

Issued June 2017 163,999,820 16.4 - -

Issued July 2017 - scrip 3,861,017 0.4 - -

Issued August 2017 3,226,687 0.3 - -

--------------------------- -------------- ----------- -------------- -----------

Total at 30 September/31

March 1,827,642,764 182.8 1,655,040,993 165.5

Own shares held - - (61,898) -

--------------------------- -------------- ----------- -------------- -----------

Total share capital 1,827,642,764 182.8 1,654,979,095 165.5

--------------------------- -------------- ----------- -------------- -----------

The ordinary shares issued in April 2016, July 2016, October

2016, January 2017, April 2017 and July 2017 were issued to

shareholders who elected to receive Ordinary Shares in lieu of a

cash dividend under the Company scrip dividend alternative.

In June 2017, a total of 163,999,820 new ordinary shares of 10

pence each were placed at a price of 60 pence per share. The

raising resulted in gross proceeds of approximately GBP98.4 million

which has been allocated appropriately between share capital

(GBP16.4 million) and share premium (GBP82.0 million). Issue costs

totalling GBP2.3 million were incurred and have been allocated

against share premium.

In August 2017 and August 2016, 3,226,687 and 8,000,000 Ordinary

Shares were issued following employees exercising nil-cost options

awarded under the VCP.

13. Commitments

At the period end the Group had five forward funding purchases

on site (31 March 2017: seven) with a contracted total expenditure

of GBP34.3 million (31 March 2017: GBP39.7 million) of which

GBP21.7 million (31 March 2017: GBP15.9 million) had been

expended.

14. Dividends paid on Ordinary Shares

Six months Six months

ended ended

Number 30 September 30 September

Pence of Ordinary 2017 2016

Payment date per share Shares GBPm GBPm

--------------- ---------- -------------- ------------- -------------

20 April 2016 0.55 1,637,706,738 - 9.0

27 July 2016 0.55 1,639,998,279 - 9.0

19 April 2017 0.60 1,655,040,993 9.9 -

19 July 2017 0.60 1,656,555,240 10.0 -

--------------- ---------- -------------- ------------- -------------

19.9 18.0

--------------- ---------- -------------- ------------- -------------

A dividend of 0.60 pence per share was paid to shareholders on

18 October 2017.

Directors' responsibilities statement

Principal risks and uncertainties

The factors identified by the Board as having the potential to

affect the Group's operating results, financial control and/or the

trading price of its shares were set out in detail in the Annual

Report for the year ended 31 March 2017.

The Directors have reconsidered the principal risks and

uncertainties facing the Group. Accordingly, the Directors do not

consider that the principal risks and uncertainties have changed

significantly since the publication of the Annual Report for the

year ended 31 March 2017.

Going concern

The Directors continue to adopt the going concern basis of

accounting in preparing the financial statements. The Group's

properties are substantially let with the majority of rent paid or

reimbursed by the NHS and they benefit from a weighted average

lease length on the portfolio of 12.8 years. The Group has

facilities from a variety of lenders with modest annual

amortisation, in addition to the secured bond, and has remained in

compliance with all covenants throughout the period. In making the

assessment, and having considered the continuing economic

uncertainty, the Directors have reviewed the Group's financial

forecasts which cover a period of 18 months beyond the balance

sheet date, showing that borrowing facilities are adequate and the

business can operate within these facilities and meet its

obligations when they fall due for the foreseeable future. There

have been no material changes in assumptions in the forecast from

the basis adopted in making the assessment at the previous year

end.

Directors' responsibilities statement

The Board confirms to the best of their knowledge:

-- that the Interim Condensed Consolidated Accounts for the six

months to 30 September 2017 have been prepared in accordance with

IAS 34 Interim Financial Reporting as adopted by the European

Union; and

-- that the Half Year Management Report comprising the Business

Review and the principal risks and uncertainties includes a fair

review of the information required by sections 4.2.7R and 4.2.8R of

the Disclosure and Transparency Rules.

The above Directors' Responsibilities Statement was approved by

the Board on 15 November 2017.

JONATHAN MURPHY JAYNE COTTAM

CEO CFO

15 November 2017

Independent review report to Assura plc

For the six months ended 30 September 2017

Introduction

We have been engaged by the Company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 September 2017 which comprise the Interim

Condensed Consolidated Income Statement, the Interim Condensed

Consolidated Balance Sheet, the Interim Condensed Consolidated

Statement of Changes in Equity, the Interim Condensed Consolidated

Statement of Cash Flow and the related Notes 1 to 14. We have read

the other information contained in the half-yearly financial report

and considered whether it contains any apparent misstatements or

material inconsistencies with the information in the condensed set

of financial statements.

This report is made solely to the Company in accordance with

guidance contained in International Standard on Review Engagements

2410 (UK and Ireland) "Review of Interim Financial Information

Performed by the Independent Auditor of the Entity" issued by the

Auditing Practices Board. Our work has been undertaken so that we

might state to the Company those matters we are required to state

to it in an independent review report and for no other purpose. To

the fullest extent permitted by law, we do not accept or assume

responsibility to anyone other than the Company, for our work, for

this report, or for the conclusions we have formed.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the Directors. The Directors are responsible

for preparing the half-yearly financial report in accordance with

the Disclosure and Transparency Rules of the United Kingdom's

Financial Conduct Authority.

As disclosed in Note 2, the annual financial statements of the

Group are prepared in accordance with IFRSs as adopted by the

European Union. The condensed set of financial statements included

in this half-yearly financial report has been prepared in

accordance with International Accounting Standard 34, "Interim

Financial Reporting", as adopted by the European Union.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity" issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK and Ireland) and consequently does not enable us to

obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do

not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

September 2017 is not prepared, in all material respects, in

accordance with International Accounting Standard 34 as adopted by

the European Union and the Disclosure and Transparency Rules of the

United Kingdom's Financial Conduct Authority.

Deloitte LLP - Statutory Auditor

Manchester, UK

15 November 2017

Corporate information

Registered The Brew House

Office: Greenalls Avenue

Warrington

Cheshire

WA4 6HL

---------------- --------------------------------

Company Orla Ball

Secretary:

---------------- --------------------------------

Auditor: Deloitte LLP

2 Hardman Street

Manchester

M3 3HF

---------------- --------------------------------

Legal Advisors: Ernst & Young LLP

2 St Peter's Square

Manchester

M2 3DF

---------------- --------------------------------

Stockbrokers: Stifel Nicolaus Europe Limited

150 Cheapside

London

EC2V 6ET

---------------- --------------------------------

J.P. Morgan Securities plc

25 Bank Street

London

E14 5YP

---------------- --------------------------------

Bankers: Aviva plc

Barclays Bank plc

HSBC Bank plc

Santander UK plc

The Royal Bank of Scotland plc

---------------- --------------------------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BFBFTMBJBMJR

(END) Dow Jones Newswires

November 16, 2017 02:01 ET (07:01 GMT)

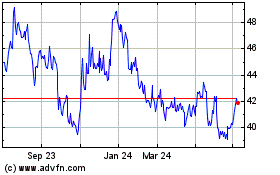

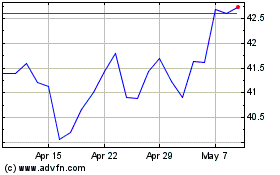

Assura (LSE:AGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Assura (LSE:AGR)

Historical Stock Chart

From Apr 2023 to Apr 2024