TIDMAGR

RNS Number : 2232G

Assura PLC

19 November 2015

Assura plc

Interim Condensed Consolidated Accounts for the 6 months ended

30 September 2015

Another period of significant growth

19 November 2015

Highlights

Another period of significant growth

-- GBP100 million increase in investment property to GBP1,025.0

million (March 2015: GBP925.3 million)

-- Completed the acquisition of 36 properties for GBP65 million

-- 7.2% increase in total rent roll to GBP59.6 million (March 2015: GBP55.6 million)

Increase in net asset value and underlying profit

-- 5.5% increase in diluted EPRA NAV(1) per share to 46.4 pence (March 2015: 44.0 pence)

-- 26.6% increase in net rental income for the six months to

GBP28.1 million (2014: GBP22.2 million)

-- 79.4% increase in underlying profit from continuing

operations to GBP11.3 million for the six months (2014: GBP6.3

million)

-- 115% increase in profit before tax to GBP35.4 million (2014: GBP16.5 million)

Transformational equity raise since the period end, raising

GBP300 million to:

-- Fund the near term pipeline of acquisitions and developments,

with a cost of approximately GBP126 million

-- Repay GBP181 million of long-term fixed rate debt, allowing

the Group flexibility for further growth

Assura is now the sector leader in a market that is in critical

need of investment

-- An ageing population and growing pressures on the existing

health infrastructure provide immediate need

for increased primary care facilities

-- The UK has cross-party support to shift more health provision

from expensive hospitals into primary care

-- The NHS announced last year an investment of GBP1 billion

over five years to fund improvements in primary care premises

Assura is well positioned to continue outperforming in a

fragmented market

-- 301 practices throughout the country

-- Good pipeline of acquisitions to consolidate fragmented market

-- Strongest balance sheet in the sector

-- Group has a long-term track record; strong relationships with the NHS and GPs

Further increase in dividend indicative of management confidence

in the Group's future

-- 10% increase in quarterly dividend to 0.55 pence per share,

equivalent to 2.2 pence per share on an annual basis

1 Net Asset Value - Note 7

Graham Roberts, Chief Executive, said:

"The need for increased investment in high quality GP space is

immediate: There has been years of underinvestment in the primary

care market, and in a recent survey 40% of GPs considered their

premises to be inadequate for their services. The need for

increased investment is also growing fast: in 25 years' time the

population of those over 75 years old is set to have increased by

90%, and GPs will play a critical role in managing the health needs

of this ageing population. Assura, as the leader in the sector, is

well placed to help meet this demand."

For further information, please contact:

Assura plc: Tel: 01925 420660

Graham Roberts

Jonathan Murphy

Carolyn Jones

Finsbury: Tel: 0207 251 3801

Gordon Simpson

Presentation and webcast:

A presentation will be held for analysts and investors on 19

November 2015 at 11am London time, with a webcast available from

our website or via the following link:

http://webcasting.brrmedia.co.uk/broadcast/562a50c3b6c073d9055f5d8b

Alternatively to listen to the audio of the presentation live,

dial:

+44 (0) 20 3003 2666 - Standard International Access

0808 109 0700 - UK Toll Free

Access Pin: 9788936#

Password: Assura

Chief Executive's report

I am pleased to report a period of significant growth for

Assura, where our successful acquisitions programme has seen the

value of our investment property pass GBP1 billion. In the period

under review we have completed GBP65 million of property additions,

which were the largest contributor to the GBP100 million increase

in the value of our investment property in the six months to 30

September 2015.

Since the period end we have completed an equity raise of GBP300

million, net of expenses, that now gives us the strongest balance

sheet in the sector. We believe that a stronger balance sheet is

attractive to both our potential property partners amongst GPs and

the NHS and our equity and debt funders. As a result, we have

reduced our medium-term gearing target to between 40% and 50%.

In line with this we have, in the past month, redeemed GBP181

million of long-term fixed rate loans and our net debt has reduced

to GBP281 million and our loan to value now stands at 27%.

This strengthened balance sheet together with the longevity and

security of our property cash flows will underpin our progressive

dividend policy and leaves us well placed to take advantage of

further investment opportunities.

We have continued to deliver growth, achieving a 79% increase in

underlying profits to GBP11.3 million and 5.5% growth in diluted

EPRA net asset value to 46.4 pence per share at the period end. The

growth in underlying profits reflects the successful integration of

our acquisitions, and those from the prior year, by our property

management team and our ability to convert this greater scale into

increased underlying profits.

This robust financial performance has enabled us to announce an

increase of 10% in our dividend, to 0.55 pence per share on a

quarterly basis, from January 2016.

Market opportunity

There remains considerable underinvestment in primary care

infrastructure in the UK. The recently announced population

forecasts from the ONS are predicting a 79% increase in the over

70s population in the next 25 years. This age group is one of the

largest users of GP services and so the demands on GP premises are

likely to increase significantly.

The NHS announced last year an investment of GBP1 billion over

five years to fund improvements in primary care premises. There

remains some uncertainty over the details of this plan and new

guidelines have now been published as to its implementation. We are

monitoring the impact of these changes and it is too soon to assess

how this will affect investment in the short term. We already have

18 schemes approved for improvements to existing buildings which we

continue to progress.

Our leadership position in providing state of the art primary

care premises, adapted to each local community in which they

operate, means we are ideally placed to serve these changing needs.

The recent announcements by the NHS and the Government on the need

for the greater provision of care in the community give us

increased confidence that the process for approving new schemes

will be unblocked, although the timing remains uncertain. Once

approvals commence there will be the usual time lag between

approval and delivery.

Outlook

The recent fund raise has greatly strengthened the Company's

financial position and enhanced its ability to take advantage of a

fragmented market place and the significant opportunity to support

the NHS in its future plans for the increased provision of care in

the primary care setting. Primary care continues to provide strong

property fundamentals with good prospects for capital and income

growth, and Assura believes its brand, expertise and scale position

it well to capitalise on this.

Graham Roberts

Chief Executive

18 November 2015

Business review

For the six months ended 30 September 2015

Portfolio as at 30 September 2015 GBP999.8 million (31 March

2015: GBP908.3 million)

Our business is based on our investment portfolio of 301

properties. This has a passing rent roll of GBP59.6 million (March

2015: GBP55.6 million), 87% of which is underpinned by the NHS. The

WAULT is 14.1 years and 90% of the rent roll will still be

contracted in 2025.

At 30 September 2015 our portfolio of completed investment

properties was valued at a total of GBP999.8 million (see Note 8,

March 2015: GBP908.3 million), which produced a net initial yield

("NIY") of 5.42% (March 2015: 5.56%). Taking account of potential

lettings of unoccupied space and any uplift to current market rents

on review, our valuers assess the net equivalent yield to be 5.60%

(March 2015: 5.77%). Adjusting this Royal Institute of Chartered

Surveyors standard measure to reflect the advanced payment of

rents, the true equivalent yield is 5.81% (March 2015: 5.98%).

Six months Six months

ended ended

30 September 30 September

2015 2014

GBPm GBPm

----------------------- -------------- --------------

Net rental income 28.1 22.2

Valuation movement 25.7 10.4

----------------------- -------------- --------------

Total Property Return 53.8 32.6

----------------------- -------------- --------------

Expressed as a percentage of opening investment property plus

additions, Total Property Return for the six months was 5.4%

compared with 4.2% in 2014.

Our annualised Total Return over the five years to 31 December

2014 as calculated by IPD was 9.1% compared with the IPD All

Healthcare Benchmark of 7.2% over the same period.

The valuation gain in the six months of GBP25.7 million

represents a 3.2% uplift on a like-for-like basis and movements

relating to properties acquired in the period. The uplift has

arisen due to the downward pressure on yields with increased

competition for acquiring assets in the sector. Despite the

downward pressure, the NIY on our assets continues to represent a

substantial premium over the 15-year gilt which traded at 2.1% at

30 September 2015.

Investment and development activity

Despite the recent hiatus in NHS development approvals, we have

invested substantially during the period.

(MORE TO FOLLOW) Dow Jones Newswires

November 19, 2015 02:00 ET (07:00 GMT)

We recorded an unrealised revaluation surplus of GBP0.5 million

during the period in respect of investment property under

construction (2014: deficit of GBP0.8 million).

Despite the reduction in developments being approved we have one

(end value c. GBP5 million) currently on site and five (end value

c. GBP23 million) which we would hope to be on site within 12

months.

The bulk of the growth in our investment portfolio has come from

the acquisition of 36 properties at a cost of GBP65 million.

In addition we have a pipeline of c. 40 acquisitions and forward

funding purchases (end value c. GBP103 million) currently in legal

hands.

Portfolio management

We have continued to deliver rental growth and have successfully

concluded on 62 rent reviews during the six months to generate a

weighted average annual rent increase of 1.42% (year to March 2015:

1.27%) on those properties. Our portfolio benefits from a 25%

weighting in fixed, Retail Price Index ("RPI") and other uplifts

which generated an average uplift of 1.96% during the period. The

majority of our portfolio is subject to open market reviews and

these have generated an average uplift of 0.80% during the

period.

We work very hard at developing and maintaining customer

relationships. This approach is carried across the range of

services we provide both during development and after completion,

as a portfolio manager.

We have a dedicated team of asset managers who are in regular

communication with our customers and we monitor progress through

regular customer satisfaction surveys. All asset managers are

appraised on achieving a continuous improvement in the results of

these surveys.

During the period we have successfully secured six new tenancies

with an annual rent roll of GBP0.3 million covering 3,462 square

metres. In addition we have significantly extended the lease on

four properties.

Our EPRA Vacancy Rate was 2.8% (March 2015: 3.2%) which has

started to decrease with this being a current area of focus for our

team.

Administrative expenses

The Group measures its operating efficiency as the proportion of

administrative costs to the average gross investment property

value. This ratio during the period was 0.31% (2014: 0.38%) and

administrative costs stood at GBP3.0 million (2014: GBP2.8

million).

We also analyse cost performance by reference to our EPRA Cost

Ratios (including and excluding direct vacancy costs) which were

19.2% and 18.2% respectively (2014: 18.4% and 16.7%). The increase

in the period is due to the national insurance costs associated

with the VCP shares issued and we would expect the ratios to reduce

going forward as we grow the portfolio.

Financing

In August 2015, we secured an increase in our available

revolving credit facility from GBP60 million to GBP120 million for

an initial five-year term, with interest variable at 170 basis

points above LIBOR further diversifying our available funding

sources.

We continue to hold discussions with potential funders to

broaden our base of lenders, who have maintained their appetite to

lend into our sector, and to ensure facilities are in place to

support future acquisitions. At 30 September 2015, we had undrawn

facilities and cash of GBP110.7 million.

Financing statistics 30/09/2015 31/03/2015

-------------------------------- ---------- ----------

Net debt GBP520.8m GBP450.0m

Weighted average debt maturity 11.0 years 11.9 years

Weighted average interest rate 5.09% 5.28%

% of debt at fixed/capped rates 94% 100%

Interest cover(1) 182% 160%

Loan to value 51% 48%

-------------------------------- ---------- ----------

(1) Interest cover is the number of times net interest payable

is covered by underlying profit before net interest.

At 30 September 2015 our loan to value ratio stands at 51%. 94%

of the debt facilities are fixed with a weighted average debt

maturity of 11.0 years and a weighted average interest rate of

5.09%. On 11 November 2015, following the successful equity raise

which reduced LTV initially to c. 27%, GBP181 million of long-term

fixed rate debt was repaid in full along with the associated early

repayment costs of GBP34 million.

Details of the facilities and their covenants are set out in

Note 11 to the accounts.

Net finance costs in the six-month period amounted to GBP13.8

million (2014: GBP13.1 million).

Underlying profit

Six months Six months

ended ended

30 September 30 September

2015 2014

GBPm GBPm

------------------------ ------------- -------------

Net rental income 28.1 22.2

Administrative expenses (3.0) (2.8)

Net finance costs (13.8) (13.1)

------------------------ ------------- -------------

Underlying profit 11.3 6.3

------------------------ ------------- -------------

The movement in underlying profit can be summarised as

follows:

GBPm

----------------------------------- -----

Six months ended 30 September 2014 6.3

Net rental income 5.9

Administrative expenses (0.2)

Net finance costs (0.7)

----------------------------------- -----

Six months ended 30 September 2015 11.3

----------------------------------- -----

Underlying profit has grown 79% to GBP11.3 million in the six

months to 30 September 2015 reflecting the property acquisitions

completed.

Underlying profit differs from EPRA earnings as it excludes

accounting adjustments such as IFRS 2 charges for share-based

payments and one-off expenses that we consider to be exceptional

and not reflective of continuing underlying performance.

Earnings per share

The basic earnings per share ("EPS") on profit for the period

was 3.5 pence (2014: 2.9 pence).

EPRA EPS, which excludes the net impact of valuation movements

and gains on disposal, was 0.9 pence (2014: 1.0 pence), the

decrease reflecting national insurance costs associated with the

VCP shares issued.

Underlying profit per share omits accounting adjustments and

certain exceptional items as referenced earlier and has remained at

1.1 pence (2014: 1.1 pence).

Based on calculations completed in accordance with IAS 33,

share-based payment schemes are currently expected to be dilutive

to EPS, with 11.7 million new shares expected to be issued. The

dilution is not material as illustrated by the table below:

EPS measure Basic Diluted

---------------------- ----- -------

Profit for six months 3.5p 3.4p

EPRA 0.9p 0.9p

Underlying 1.1p 1.1p

---------------------- ----- -------

Dividends

Total dividends paid in the six months to 30 September 2015 were

GBP10.0 million or 1.0 pence per share (2014: 0.9 pence per

share).

As a result of brought forward tax losses all dividends paid

during the year were normal dividends (non-PID) with an associated

tax credit.

The table below illustrates our cash flows over the period:

Six months ended

Six months ended 30 September

30 September 2015 2014

GBPm GBPm

----------------------------------- ------------------ ----------------

Opening cash 66.5 38.6

Net cash flow from operations 9.5 9.2

Dividends paid (10.0) (5.0)

Investment:

Property and business acquisitions (63.1) (15.9)

Development expenditure (7.5) (8.5)

Sale of properties 0.6 2.5

Financing:

Share issue costs - (0.2)

Net borrowings movement 29.7 (3.7)

----------------------------------- ------------------ ----------------

Closing cash 25.7 17.0

----------------------------------- ------------------ ----------------

Net cash flow from operations differs from underlying profit due

to movements in working capital balances.

Property additions during the period were GBP65.0 million,

although the cash outflow was only GBP63.1 million after taking

into account shares issued as consideration (GBP2.5 million) and

net working capital assumed (GBP0.6 million).

Net assets

Diluted EPRA NAV movement

Pence

per share

GBPm - diluted

---------------------------------- ------ ----------

EPRA NAV at 31 March 2015 452.4 44.0

Underlying profit 11.3 1.1

Capital (revaluations and capital

gains) 25.7 2.5

Dividends (10.0) (1.0)

Other (3.4) (0.2)

---------------------------------- ------ ----------

EPRA NAV at 30 September 2015 476.0 46.4

---------------------------------- ------ ----------

Our Total Accounting Return per share for the six months ended

30 September 2015 is 5.7% of which 1.0 pence per share (2.2%) has

been distributed to shareholders and 1.6 pence per share (3.5%) is

the movement on EPRA NAV.

Post balance sheet events

(MORE TO FOLLOW) Dow Jones Newswires

November 19, 2015 02:00 ET (07:00 GMT)

On 14 October 2015, the Company issued 618,000,000 Ordinary

Shares at a price of 50 pence per share by way of a Firm Placing,

Placing and Open Offer and Offer for Subscription. Gross proceeds

of the issue were GBP309.0 million before expenses, being raised to

make further investments into primary care properties and reduce

the overall level of borrowings.

On 11 November 2015, GBP181 million of long-term fixed rate debt

was repaid in full along with the associated early repayment cost

of GBP34 million.

Portfolio analysis by capital value

Total value

Number of properties GBPm Total value%

----------------------- ----------- ------------

>GBP10m 15 221.3 22

GBP5-10m 38 264.9 26

GBP1-5m 188 474.3 48

<GBP1m 60 39.3 4

---------------- ----- ----------- ------------

301 999.8 100

---------------- ----- ----------- ------------

Portfolio analysis by region

Total value

Number of properties GBPm Total value%

----------------------- ----------- ------------

North 119 429.0 43

South 85 271.9 27

Midlands 61 213.3 21

Scotland 18 33.0 3

Wales 18 52.6 6

---------------- ----- ----------- ------------

301 999.8 100

---------------- ----- ----------- ------------

Portfolio analysis by tenant covenant

Total rent

roll Total rent roll

GBPm %

--------- ---------- ---------------

GPs 41.0 69

NHS body 10.9 18

Pharmacy 4.5 8

Other 3.2 5

--------- ---------- ---------------

59.6 100

--------- ---------- ---------------

EPRA performance measures

The European Public Real Estate Association ("EPRA") has

published Best Practices Recommendations with the aim of improving

the transparency, comparability and relevance of financial

reporting with the real estate sector across Europe.

This section details the rationale for each performance measure

as well as our performance against each measure.

Summary table

Six months Six months

ended ended

30 September 30 September

2015 2014

--------------------------- ------------- -------------

EPRA EPS (p) 0.9 1.0

EPRA Cost Ratio (including

direct vacancy costs) (%) 19.2 18.4

EPRA Cost Ratio (excluding

direct vacancy costs) (%) 18.2 16.7

--------------------------- ------------- -------------

30/09/2015 31/03/2015

------------------------- ---------- ----------

EPRA NAV (p) 46.9 44.9

EPRA NNNAV (p) 38.2 35.9

EPRA NIY (%) 5.34 5.43

EPRA "topped-up" NIY (%) 5.34 5.43

EPRA Vacancy Rate (%) 2.8 3.2

------------------------- ---------- ----------

EPRA EPS

Six months Six months

ended ended

30 September 30 September

2015 2014

--------------------- ------------- -------------

EPRA EPS (p) 0.9 1.0

Diluted EPRA EPS (p) 0.9 1.0

--------------------- ------------- -------------

Definition Earnings from operational activities.

---------- -------------------------------------------

Purpose A key measure of a company's underlying

operating results and an indication of the

extent to which current dividend payments

are supported by earnings.

---------- -------------------------------------------

The calculation of EPRA EPS and diluted EPRA EPS are shown in

Note 6 to the accounts.

EPRA NAV

30/09/2015 31/03/2015

--------------------- ---------- ----------

EPRA NAV (p) 46.9 44.9

Diluted EPRA NAV (p) 46.4 44.0

--------------------- ---------- ----------

Definition NAV adjusted to include properties and other

investment interests at fair value and to

exclude certain items not expected to crystallise

in a long-term investment property business.

---------- --------------------------------------------------

Purpose Makes adjustments to IFRS NAV to provide

stakeholders with the most relevant information

on the fair value of the assets and liabilities

with a true real estate investment company

with a long-term investment strategy.

---------- --------------------------------------------------

The calculation of EPRA NAV is shown in Note 7 to the

accounts.

EPRA NNNAV

30/09/2015 31/03/2015

--------------- ---------- ----------

EPRA NNNAV (p) 38.2 35.9

--------------- ---------- ----------

Definition EPRA NAV adjusted to include the fair values

of (i) financial instruments, (ii) debt

and (iii) deferred taxes.

---------- ------------------------------------------------

Purpose Makes adjustments to EPRA NAV to provide

stakeholders with the most relevant information

on the current fair value of all the assets

and liabilities within a real estate company.

---------- ------------------------------------------------

The calculation of EPRA NNNAV is shown in Note 7 to the

accounts.

EPRA NIY and EPRA "topped-up" NIY

30/09/2015 31/03/2015

------------------------- ---------- ----------

EPRA NIY (%) 5.34 5.43

EPRA "topped-up" NIY (%) 5.34 5.43

------------------------- ---------- ----------

Definition Annualised rental income based on the

- cash rents passing at the balance sheet

EPRA NIY date, less non-recoverable property operating

expenses, divided by the market value

of the property, increased with (estimated)

purchasers' costs.

----------------- -----------------------------------------------

Definition This measure incorporates an adjustment

- to the EPRA NIY in respect of the expiration

EPRA "topped-up" of rent-free periods (or other unexpired

NIY lease incentives such as discounted rent

periods and step rents).

----------------- -----------------------------------------------

Purpose A comparable measure for portfolio valuations,

this measure should make it easier for

investors to judge for themselves how

the valuation compares with that of portfolios

in other listed companies.

----------------- -----------------------------------------------

30/09/2015 31/03/2015

GBPm GBPm

------------------------------------ ---------- ----------

Investment property 1,025.0 925.3

Less developments (15.1) (6.7)

------------------------------------ ---------- ----------

Completed investment property

portfolio 1,009.9 918.6

Allowance for estimated purchasers'

costs 58.1 52.7

------------------------------------ ---------- ----------

Gross up completed investment

property - B 1,068.0 971.3

------------------------------------ ---------- ----------

Annualised cash passing rental

income 59.6 55.6

Property outgoings (2.6) (2.9)

------------------------------------ ---------- ----------

Annualised net rents - A 57.0 52.7

Notional rent expiration of

rent-free periods or other

incentives - -

------------------------------------ ---------- ----------

Topped-up annualised rent -

C 57.0 52.7

------------------------------------ ---------- ----------

EPRA NIY - A/B (%) 5.34 5.43

EPRA "topped-up" NIY - C/B

(%) 5.34 5.43

------------------------------------ ---------- ----------

(MORE TO FOLLOW) Dow Jones Newswires

November 19, 2015 02:00 ET (07:00 GMT)

EPRA Vacancy Rate

30/09/2015 31/03/2015

---------------------- ---------- ----------

EPRA Vacancy Rate (%) 2.8 3.2

---------------------- ---------- ----------

Definition Estimated rental value ("ERV") of vacant

space divided by ERV of the whole portfolio.

---------- ---------------------------------------------

Purpose A "pure" (%) measure of investment property

space that is vacant, based on ERV.

---------- ---------------------------------------------

30/09/2015 31/03/2015

------------------------------------ ---------- ----------

ERV of vacant space (GBPm) 1.8 1.9

ERV of completed property portfolio

(GBPm) 61.9 57.9

EPRA Vacancy Rate (%) 2.8 3.2

------------------------------------ ---------- ----------

EPRA Cost Ratios

Six months Six months

ended ended

30 September 30 September

2015 2014

----------------------------- ------------- -------------

EPRA Costs (including direct

vacancy costs) (%) 19.2 18.4

EPRA Costs (excluding direct

vacancy costs) (%) 18.2 16.7

----------------------------- ------------- -------------

Definition Administrative and operating costs (including

and excluding direct vacancy costs) divided

by gross rental income.

---------- ----------------------------------------------

Purpose A key measure to enable meaningful measurement

of

the changes in a company's operating

costs.

---------- ----------------------------------------------

Six months Six months

ended ended

30 September 30 September

2015 2014

GBPm GBPm

-------------------------------- ------------- -------------

Direct property costs 1.3 1.4

Administrative expenses 3.0 2.8

Share-based payment costs 1.6 0.4

Net service charge costs/fees (0.1) (0.1)

Exclude:

Ground rent costs (0.2) (0.2)

-------------------------------- ------------- -------------

EPRA Costs (including direct

vacancy costs) - A 5.6 4.3

Direct vacancy costs (0.3) (0.4)

-------------------------------- ------------- -------------

EPRA Costs (excluding direct

vacancy costs) - B 5.3 3.9

-------------------------------- ------------- -------------

Gross rental income less ground

rent costs (per IFRS) 29.2 23.4

-------------------------------- ------------- -------------

Gross rental income - C 29.2 23.4

-------------------------------- ------------- -------------

EPRA Cost Ratio (including

direct vacancy costs) - A/C 19.2 18.4

EPRA Cost Ratio (excluding

direct vacancy costs) - B/C 18.2 16.7

-------------------------------- ------------- -------------

Interim Condensed Consolidated Income Statement

For the six months ended 30 September 2015

Six months ended Six months ended

30 September 2015 30 September 2014

Unaudited Unaudited

------------ ---- --------------------------- ---------------------------

Capital Capital

and and

Underlying other Total Underlying other Total

Note GBPm GBPm GBPm GBPm GBPm GBPm

------------------------- ---- ---------- ------- ------ ---------- ------- ------

Gross rental and related

income 29.4 - 29.4 23.6 - 23.6

Property operating

expenses (1.3) - (1.3) (1.4) - (1.4)

------------------------- ---- ---------- ------- ------ ---------- ------- ------

Net rental income 28.1 - 28.1 22.2 - 22.2

Administrative

expenses (3.0) - (3.0) (2.8) - (2.8)

Revaluation gains 8 - 25.7 25.7 - 10.4 10.4

Loss on sale of

property - - - - (0.1) (0.1)

Share-based payment

charge - (1.6) (1.6) - (0.4) (0.4)

Finance revenue 0.1 - 0.1 0.1 - 0.1

Finance costs (13.9) - (13.9) (13.2) - (13.2)

Revaluation of

derivative financial

instruments - - - - 0.3 0.3

------------------------- ---- ---------- ------- ------ ---------- ------- ------

Profit before

taxation 11.3 24.1 35.4 6.3 10.2 16.5

------------------------- ---- ---------- ------- ------ ---------- ------- ------

Taxation 5 (0.2) (0.2)

------------------------- ---- ---------- ------- ------ ---------- ------- ------

Profit for the period

attributable

to equity holders

of the parent 35.2 16.3

------------------------------- ---------- ------- ------ ---------- ------- ------

Earnings per share

from underlying

profit - basic 6 1.1p 1.1p

on profit

for year - basic 6 3.5p 2.9p

- diluted 6 3.4p 2.9p

------------------------ ---- ---------- ------- ------ ---------- ------- ------

There were no items of other comprehensive income or expense and

therefore the profit for the period also represents the Group's

total comprehensive income. All income derives from continuing

operations.

Interim Condensed Consolidated Balance Sheet

As at 30 September 2015

30 September 31 March

2015 2015

Unaudited Audited

Note GBPm GBPm

------------------------------------------ ---- ------------ --------

Non-current assets

Investment property 8 1,025.0 925.3

Investments 0.4 0.4

Property, plant and equipment - 0.1

Deferred tax asset 1.1 1.3

------------------------------------------ ---- ------------ --------

1,026.5 927.1

------------------------------------------ ---- ------------ --------

Current assets

Cash, cash equivalents and restricted

cash 9 25.7 66.5

Trade and other receivables 7.6 8.3

Property assets held for sale 8 4.6 5.4

------------------------------------------ ---- ------------ --------

37.9 80.2

------------------------------------------ ---- ------------ --------

Total assets 1,064.4 1,007.3

------------------------------------------ ---- ------------ --------

Current liabilities

Trade and other payables 20.5 18.9

Borrowings 11 8.4 8.0

Deferred revenue 10 13.7 12.7

Provisions 0.1 0.1

------------------------------------------ ---- ------------ --------

42.7 39.7

------------------------------------------ ---- ------------ --------

Non-current liabilities

Borrowings 11 535.1 505.5

Obligations due under finance

leases 3.0 3.0

Deferred revenue 10 6.7 6.9

Provisions 0.2 0.3

------------------------------------------ ---- ------------ --------

545.0 515.7

------------------------------------------ ---- ------------ --------

Total liabilities 587.7 555.4

------------------------------------------ ---- ------------ --------

Net assets 476.7 451.9

------------------------------------------ ---- ------------ --------

Capital and reserves

Share capital 12 101.5 100.7

(MORE TO FOLLOW) Dow Jones Newswires

November 19, 2015 02:00 ET (07:00 GMT)

Own shares held (0.4) (1.8)

Share premium 3.6 -

Merger reserve 231.2 231.2

Reserves 140.8 121.8

------------------------------------------ ---- ------------ --------

Total equity 476.7 451.9

------------------------------------------ ---- ------------ --------

Net asset value

per Ordinary Share - basic 7 47.0p 44.9p

- diluted 7 46.4p 44.0p

Adjusted (EPRA) net asset

value per Ordinary Share - basic 7 46.9p 44.9p

- diluted 7 46.4p 44.0p

------------------------------ ---------- ---- ------------ --------

The interim condensed consolidated financial statements were

approved at a meeting of the Board of Directors held on 18 November

2015 and signed on its behalf by:

Graham Roberts, Chief Executive Jonathan Murphy, Finance Director

Interim Condensed Consolidated Statement of Changes in

Equity

For the six months ended 30 September 2015

Own

Share shares Share Merger Total

capital held premium reserve Reserves equity

Note GBPm GBPm GBPm GBPm GBPm GBPm

------------------------ ---- -------- ------- -------- -------- -------- -------

1 April 2014 53.0 (1.9) 77.1 - 98.4 226.6

-------- ------- -------- -------- -------- -------

Profit attributable

to equity holders - - - - 16.3 16.3

-------- ------- -------- -------- -------- -------

Total comprehensive

income - - - - 16.3 16.3

Dividend 14 - - - - (5.0) (5.0)

Issue of Ordinary

Shares 12 4.4 - 14.5 - - 18.9

Issue costs - - (0.2) - - (0.2)

Employee share-based

incentives - - - - 0.4 0.4

------------------------ ---- -------- ------- -------- -------- -------- -------

30 September 2014

(Unaudited) 57.4 (1.9) 91.4 - 110.1 257.0

------------------------ ---- -------- ------- -------- -------- -------- -------

Profit attributable

to equity holders - - - - 20.9 20.9

-------- ------- -------- -------- -------- -------

Total comprehensive

income - - - - 20.9 20.9

Dividend 14 - - - - (9.4) (9.4)

Issue of Ordinary

Shares 12 43.3 - 146.3 - - 189.6

Issue costs - - (6.5) - - (6.5)

Scheme of arrangement - - (231.2) 231.2 - -

Own shares held - 0.1 - - (0.1) -

Employee share-based

incentives - - - - 0.3 0.3

------------------------ ---- -------- ------- -------- -------- -------- -------

31 March 2015 (Audited) 100.7 (1.8) - 231.2 121.8 451.9

------------------------ ---- -------- ------- -------- -------- -------- -------

Profit attributable

to equity holders - - - - 35.2 35.2

-------- ------- -------- -------- -------- -------

Total comprehensive

income - - - - 35.2 35.2

Dividend 14 - - - - (10.0) (10.0)

Issue of Ordinary

Shares 12 0.4 - 2.1 - - 2.5

Employee share-based

incentives 0.4 1.4 1.5 - (6.2) (2.9)

------------------------ ---- -------- ------- -------- -------- -------- -------

30 September 2015

(Unaudited) 101.5 (0.4) 3.6 231.2 140.8 476.7

------------------------ ---- -------- ------- -------- -------- -------- -------

Interim Condensed Consolidated Statement of Cash Flow

For the six months ended 30 September 2015

Six months Six months

ended ended

30 September 30 September

2015 2014

Unaudited Unaudited

GBPm GBPm

------------------------------------------- ------------- -------------

Operating activities

Rent received 30.5 25.3

Interest paid and similar charges (13.8) (13.0)

Fees received 0.4 0.5

Interest received 0.1 0.1

Cash paid to suppliers and employees (7.7) (3.7)

------------------------------------------- ------------- -------------

Net cash inflow from operating activities 9.5 9.2

------------------------------------------- ------------- -------------

Investing activities

Purchase of investment property (63.1) (15.9)

Development spend (7.5) (8.5)

Proceeds from sale of property 0.6 2.5

------------------------------------------- ------------- -------------

Net cash outflow from investing activities (70.0) (21.9)

------------------------------------------- ------------- -------------

Financing activities

Issue costs paid on issuance of Ordinary

Shares - (0.2)

Dividends paid (10.0) (5.0)

Repayment of loan (3.9) (3.2)

Long-term loans drawn down 35.0 -

Loan issue costs (1.4) (0.5)

------------------------------------------- ------------- -------------

Net cash inflow from financing activities 19.7 (8.9)

------------------------------------------- ------------- -------------

Decrease in cash and cash equivalents (40.8) (21.6)

------------------------------------------- ------------- -------------

Opening cash and cash equivalents 66.5 38.6

------------------------------------------- ------------- -------------

Closing cash and cash equivalents 25.7 17.0

------------------------------------------- ------------- -------------

Notes to the Interim Condensed Consolidated Accounts

For the six months ended 30 September 2015

1. Corporate information

The Interim Condensed Consolidated Accounts of the Group for the

six months ended 30 September 2015 were authorised for issue in

accordance with a resolution of the Directors on 18 November

2015.

Assura plc ("Assura") is incorporated in England and Wales and

the Company's Ordinary Shares are listed on the London Stock

Exchange.

As of 1 April 2013, the Group has elected to be treated as a UK

REIT. See Note 5 for further details.

Copies of this statement are available from the website at

www.assuraplc.com.

2. Basis of preparation

The Interim Condensed Consolidated Accounts for the six months

ended 30 September 2015 have been prepared in accordance with IAS

34 Interim Financial Reporting. These accounts cover the six-month

accounting period from 1 April 2015 to 30 September 2015 with

comparatives for the six-month accounting period from 1 April 2014

to 30 September 2014, or 31 March 2015 for balance sheet

amounts.

The Interim Condensed Consolidated Accounts do not include all

the information and disclosures required in the Annual Report, and

should be read in conjunction with the Group's Annual Report as at

31 March 2015 which are prepared in accordance with IFRSs as

adopted by the European Union.

The accounts are presented in pounds sterling rounded to the

nearest 0.1 million unless specified otherwise.

The accounts are prepared on a going concern basis.

3. Accounts

The results for the six months to 30 September 2015 and to 30

September 2014 are unaudited. The interim accounts do not

constitute statutory accounts. The balance sheet as at 31 March

2015 has been extracted from the Group's 2015 Annual Report, on

which the auditor has reported and the report was unqualified.

4. New standards, interpretations and amendments thereof,

adopted by the Group

(MORE TO FOLLOW) Dow Jones Newswires

November 19, 2015 02:00 ET (07:00 GMT)

The accounting policies adopted in the preparation of the

Interim Condensed Consolidated Accounts are consistent with those

followed in the preparation of the Group's Annual Report for the

year ended 31 March 2015, except for the adoption of new standards

and interpretations as of 1 April 2015, noted below, none of which

have a material impact on the financial position or performance of

the Group:

-- Defined Benefit Plans: Employee Contributions (Amendments to IAS 19)

-- IFRIC 21 Levies

5. Taxation on profit on ordinary activities

Six months

Six months ended ended

30 September 30 September

2015 2014

GBPm GBPm

-------------------------- ---------------- -------------

Tax charged in the income

statement

Deferred tax:

Origination and reversal

of temporary differences 0.2 0.2

-------------------------- ---------------- -------------

Total tax charge 0.2 0.2

-------------------------- ---------------- -------------

The Group elected to be treated as a UK REIT with effect from 1

April 2013. The UK REIT rules exempt the profits of the Group's

property rental business from corporation tax. Gains on properties

are also exempt from tax, provided they are not held for trading or

sold in the three years post completion of development. The Group

will otherwise be subject to corporation tax at 20%.

The Group tax charge relates to its non-property income. As the

Group has sufficient brought forward losses no tax is due and so

the charge represents the movement in deferred tax.

As a REIT, the Group is required to pay Property Income

Distributions equal to at least 90% of the Group's exempted net

income. To remain as a UK REIT there are a number of conditions to

be met in respect of the principal company of the Group, the

Group's qualifying activities and the balance of business.

6. Earnings per Ordinary Share

Adjusted Adjusted

(EPRA) (EPRA)

Earnings earnings Earnings earnings

2015 2015 2014 2014

GBPm GBPm GBPm GBPm

------------------------------ ------------- ------------- ----------- -----------

Profit for the year from

continuing operations 35.2 35.2 16.3 16.3

------------------------------ ------------- ------------- ----------- -----------

Revaluation gains (25.7) (10.4)

Revaluation of derivative

financial instruments - (0.3)

Loss on sale of property - 0.1

------------------------------ ------------- ------------- ----------- -----------

Adjusted (EPRA) earnings 9.5 5.7

------------------------------ ------------- ------------- ----------- -----------

Weighted average number

of shares in issue - basic 1,008,829,551 1,008,829,551 556,155,818 556,155,818

Potential dilutive impact

of VCP 11,709,952 11,709,952 - -

------------------------------ ------------- ------------- ----------- -----------

Weighted average number

of shares in issue - diluted 1,020,539,503 1,020,539,503 556,155,818 556,155,818

------------------------------ ------------- ------------- ----------- -----------

Earnings per Ordinary Share

- basic 3.5p 0.9p 2.9p 1.0p

------------------------------ ------------- ------------- ----------- -----------

Earnings per Ordinary Share

- diluted 3.4p 0.9p 2.9p 1.0p

------------------------------ ------------- ------------- ----------- -----------

Underlying profit per share of 1.1 pence (2014: 1.1 pence) has

been calculated as underlying profit for the year as presented on

the income statement of GBP11.3 million (2014: GBP6.3 million)

divided by the weighted average number of shares in issue of

1,008,829,551 (2014: 556,155,818). Based on the diluted weighted

average shares, underlying profit per share is 1.1 pence (2014: 1.1

pence).

The current estimated number of shares over which nil-cost

options may be issued to participants is 12.5 million. After

allowing for shares held by the Employee Benefit Trust, this would

amount to a potential issuance of a further 11.7 million shares

over the course of the next two years.

7. Net asset value per Ordinary Share

Adjusted Adjusted

(EPRA) (EPRA)

Net asset net asset Net asset net asset

value value value value

30/09/2015 30/09/2015 31/03/2015 31/03/2015

GBPm GBPm GBPm GBPm

------------------------- ------------- ------------- ------------- -------------

Net assets 476.7 476.7 451.9 451.9

------------------------- ------------- ------------- ------------- -------------

Own shares held 0.4 1.8

Deferred tax (1.1) (1.3)

------------------------- ------------- ------------- ------------- -------------

NAV in accordance with

EPRA 476.0 452.4

------------------------- ------------- ------------- ------------- -------------

Number of shares in

issue 1,014,989,571 1,014,989,571 1,006,900,141 1,006,900,141

Potential dilutive

impact of VCP (Note

6) 11,709,952 11,709,952 20,723,772 20,723,772

------------------------- ------------- ------------- ------------- -------------

Diluted number of shares

in issue 1,026,699,523 1,026,699,523 1,027,623,913 1,027,623,913

------------------------- ------------- ------------- ------------- -------------

NAV per Ordinary Share

- basic 47.0p 46.9p 44.9p 44.9p

------------------------- ------------- ------------- ------------- -------------

NAV per Ordinary Share

- diluted 46.4p 46.4p 44.0p 44.0p

------------------------- ------------- ------------- ------------- -------------

Adjusted Adjusted

net asset net asset

value value

30/09/2015 31/03/2015

GBPm GBPm

---------------------------------- ----------- -----------

EPRA NAV 476.0 452.4

Mark to market of fixed rate debt (87.8) (90.7)

---------------------------------- ----------- -----------

EPRA NNNAV 388.2 361.7

---------------------------------- ----------- -----------

EPRA NNNAV per Ordinary Share 38.2p 35.9p

---------------------------------- ----------- -----------

The EPRA measures set out above are in accordance with the Best

Practices Recommendations of the European Property Real Estate

Association dated December 2014.

Mark to market adjustments have been provided by third party

valuers or the counterparty as appropriate.

8. Property assets

Investment property and investment property under construction

("IPUC")

Investment properties are stated at fair value, as determined

for the Company by Savills Commercial Limited and Jones Lang

LaSalle as at 30 September 2015. The properties have been valued

individually and on the basis of open market value in accordance

with RICS valuation - Professional Standards 2014 ("the Red

Book").

Initial yields mainly range from 4.85% to 5.25% (March 2015:

5.25% and 5.60%) for prime units, increasing up to 6.15% (March

2015: 6.15%) for older units with shorter unexpired lease terms.

For properties with weaker tenants and poorer units, the yields

range from 6.15% to over 8.0% (March 2015: 6.25% and over 8.0%) and

higher for those very close to lease expiry or those approaching

obsolescence.

Investment IPUC Total Investment IPUC Total

30/09/15 30/09/15 30/09/15 31/03/15 31/03/15 31/03/15

GBPm GBPm GBPm GBPm GBPm GBPm

----------------------------- ---------- --------- --------- ---------- --------- ---------

Opening fair

value 915.6 6.7 922.3 638.8 14.8 653.6

Additions:

---------- --------- --------- ---------- --------- ---------

- acquisitions 65.0 - 65.0 229.8 0.5 230.3

- improvements 1.1 - 1.1 0.7 - 0.7

---------- --------- --------- ---------- --------- ---------

(MORE TO FOLLOW) Dow Jones Newswires

November 19, 2015 02:00 ET (07:00 GMT)

66.1 - 66.1 230.5 0.5 231.0

Development

costs - 7.5 7.5 - 14.0 14.0

Transfers - - - 24.5 (24.5) -

Transfer from

assets held

for sale 0.6 0.2 0.8 1.5 4.7 6.2

Capitalised

interest - 0.2 0.2 - 0.4 0.4

Disposals (0.6) - (0.6) (2.0) (2.3) (4.3)

Unrealised surplus/(deficit)

on revaluation 25.2 0.5 25.7 22.3 (0.9) 21.4

----------------------------- ---------- --------- --------- ---------- --------- ---------

Closing market

value 1,006.9 15.1 1,022.0 915.6 6.7 922.3

Add finance

lease obligations

recognised separately 3.0 - 3.0 3.0 - 3.0

----------------------------- ---------- --------- --------- ---------- --------- ---------

Closing fair

value of investment

property 1,009.9 15.1 1,025.0 918.6 6.7 925.3

----------------------------- ---------- --------- --------- ---------- --------- ---------

30/09/2015 31/03/2015

GBPm GBPm

-------------------------------------------- ---------- ----------

Market value of investment property

as estimated by valuer 999.8 908.3

Add IPUC 15.1 6.7

Add pharmacy lease premiums 7.1 7.3

Add finance lease obligations recognised

separately 3.0 3.0

-------------------------------------------- ---------- ----------

Fair value for financial reporting purposes 1,025.0 925.3

-------------------------------------------- ---------- ----------

Vacant property held for sale - 0.6

Land held for sale 4.6 4.8

-------------------------------------------- ---------- ----------

Total property assets held for sale 4.6 5.4

-------------------------------------------- ---------- ----------

Total property assets 1,029.6 930.7

-------------------------------------------- ---------- ----------

Seven land sites are held as available for sale (31 March 2015:

three property investments and eight land sites).

9. Cash, cash equivalents and restricted cash

30/09/15 31/03/15

GBPm GBPm

----------------------------- -------- --------

Cash held in current account 24.4 65.3

Restricted cash 1.3 1.2

----------------------------- -------- --------

25.7 66.5

----------------------------- -------- --------

Restricted cash arises where there are interest payment

guarantees, cash is ring-fenced for committed property development

expenditure, which is released to pay contractors' invoices

directly, or under the terms of security arrangements under the

Group's banking facilities or its bond.

10. Deferred revenue

30/09/15 31/03/15

GBPm GBPm

---------------------------------------- -------- --------

Arising from rental received in advance 13.3 12.3

Arising from pharmacy lease premiums

received in advance 7.1 7.3

---------------------------------------- -------- --------

20.4 19.6

---------------------------------------- -------- --------

Current 13.7 12.7

Non-current 6.7 6.9

---------------------------------------- -------- --------

20.4 19.6

---------------------------------------- -------- --------

11. Borrowings

30/09/15 31/03/15

Secured bank loans GBPm GBPm

----------------------------------------------------- -------- --------

At 1 April 513.5 450.3

Amount issued or drawn down in period/year 35.0 -

Amount repaid in period/year (3.9) (64.1)

Acquired with acquisition of properties/subsidiaries - 135.3

Amortisation of loan fair value adjustments - (0.3)

Cash settlement of loan fair value adjustment - (7.8)

Loan issue costs (1.4) (0.5)

Amortisation of loan issue costs 0.3 0.6

----------------------------------------------------- -------- --------

At the end of the period/year 543.5 513.5

----------------------------------------------------- -------- --------

Due within one year 8.4 8.0

Due after more than one year 535.1 505.5

----------------------------------------------------- -------- --------

At the end of the period/year 543.5 513.5

----------------------------------------------------- -------- --------

The Group has the following bank facilities:

1. 10-year senior secured bond for GBP110 million at a fixed

interest rate of 4.75% maturing in December 2021. The secured bond

carries a loan to value covenant of 75% (70% at the point of

substitution of an investment property or cash) and an interest

cover requirement of 1.15 times (1.5 times at the point of

substitution).

2. Loans from Aviva with an aggregate balance of GBP402.6

million at 30 September 2015 (31 March 2015: GBP406.6 million). The

Aviva loans are partially amortised by way of quarterly instalments

and partially repaid by way of bullet repayments falling due

between 2021 and 2041 with a weighted average term of 12.9 years to

maturity, GBP8.4 million is due within a year. These loans are

secured by way of charges over specific medical centre investment

properties with cross-collateralisation between the loans and

security. The loans are subject to fixed all-in interest rates

ranging between 4.11% and 6.66% and have a weighted average of

5.43%. The loans carry a debt service cover covenant of 1.05 times,

calculated across all loans and secured properties.

3. Five-year club revolving credit facility with RBS, HSBC and

Barclays for GBP120 million at an initial margin of 1.70% above

LIBOR, expiring in May 2020. The facility is subject to a

historical interest cover requirement of at least 175% and a

weighted average lease length of nine years. As at 30 September

2015, GBP35 million of this facility was drawn.

The Group has been in compliance with all financial covenants on

all of the above loans as applicable throughout the period.

12. Share capital

Share Share

Number capital Number capital

of shares 30/09/2015 of shares 31/03/2015

30/09/2015 GBPm 31/03/2015 GBPm

------------------------- ------------- ----------- ------------- -----------

Ordinary Shares of 10

pence each issued and

fully paid

At 1 April 1,006,900,141 100.7 529,548,924 53.0

Issued 13 June 2014 - - 44,264,196 4.4

Issued 15 October 2014 - - 414,252,873 41.4

Issued 6 November 2014 - - 18,834,148 1.9

Issued 22 July 2015 4,545,455 0.4 - -

Issued 25 September 2015 3,543,975 0.4 - -

------------------------- ------------- ----------- ------------- -----------

Total at 30 September/31

March 1,014,989,571 101.5 1,006,900,141 100.7

Own shares held (790,048) (0.4) (3,911,551) (1.8)

------------------------- ------------- ----------- ------------- -----------

Total share capital 1,014,199,523 101.1 1,002,988,590 98.9

------------------------- ------------- ----------- ------------- -----------

On 22 July 2015, 4,545,455 Ordinary Shares were issued as part

consideration for the acquisition of Pentagon HS Limited. Based on

the closing share price on 20 July 2015 of 55.25 pence per Ordinary

Share the shares were valued at GBP2.5 million and this has been

allocated accordingly between share capital (GBP0.4 million) and

share premium (GBP2.1 million).

On 25 September 2015, 3,543,975 Ordinary Shares were issued to

participants of the Value Creation Plan ("VCP") following the

completion of the first measurement period. In addition, 3,121,503

Ordinary Shares were transferred from the Employee Benefit Trust to

participants. The VCP has two remaining measurement periods in 2016

and 2017.

13. Commitments

At the period end the Group had five developments or forward

funding purchases on site (31 March 2015: five developments) with a

contracted total expenditure of GBP25.7 million (31 March 2015:

GBP22.2 million) of which GBP13.4 million (31 March 2015: GBP6.1

million) had been expended.

(MORE TO FOLLOW) Dow Jones Newswires

November 19, 2015 02:00 ET (07:00 GMT)

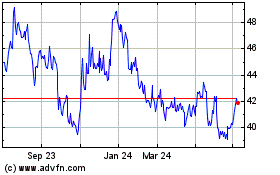

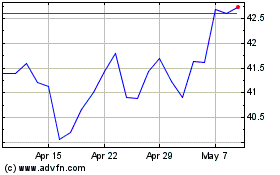

Assura (LSE:AGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Assura (LSE:AGR)

Historical Stock Chart

From Apr 2023 to Apr 2024