Assura PLC Acquisition and Issue of Consideration Shares (6527M)

January 22 2016 - 2:00AM

UK Regulatory

TIDMAGR

RNS Number : 6527M

Assura PLC

22 January 2016

22 January 2016

Assura plc

Acquisition and Issue of Consideration Shares

Assura plc ("Assura"), the UK REIT and leading primary care

property investor and developer announces that on 21 January 2016,

it acquired Malmesbury Medical Enterprise Limited from its former

shareholders Kate Badcock, David Charles, Angela Charles, Nigel

Pickering, Janet Pickering, John Pettit, Philippa Pettit, Jaqueline

Neale, John Harrison, Pamela Harrison, Thomas Estcourt, Sonia

Munnelly & David Grogan (together, the "Sellers"). As part of

the consideration payable under the terms of the acquisition,

Assura has agreed to issue to the Sellers 876,222 ordinary shares

of 10 pence each ("Ordinary Shares"). These new shares will rank

pari passu with the existing Ordinary Shares.

Application has been made to the UK Listing Authority and to the

London Stock Exchange for the new shares to be admitted to the

Official List and to trading on the London Stock Exchange's main

market for listed securities ("Admission"). It is expected that

Admission will occur at 8.00 a.m. on 27 January 2016. Based on the

closing share price on 20 January 2016 of 52.6 pence per share, the

new shares issued are valued at GBP0.5 million.

For the purposes of the Financial Conduct Authority's Disclosure

and Transparency Rules ("DTRs"), the issued ordinary share capital

of the Company following Admission on 27 January 2016 will consist

of 1,637,706,738 Ordinary Shares. This total voting rights figure

may be used by shareholders as the denominator for the calculations

by which they will determine whether they are required to notify

their interests in, or a change to their interest in, the Company

under the DTRs.

For more information, please contact:

Assura plc Tel: 01925 420660

Orla Ball

Carolyn Jones

Finsbury Tel: 0207 251 3801

Gordon Simpson

Notes to Editors

Assura plc, a constituent of the FTSE 250, is a UK REIT and

long-term investor in and developer of primary care property. The

company, headquartered in Warrington, works with GPs, health

professionals and the NHS to create innovative property solutions

in order to facilitate delivery of high quality patient care in the

community. At 30 September 2015, Assura's property portfolio was

valued at GBP1,030 million.

Further information is available at www.assuraplc.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCDFLFLQFFXBBE

(END) Dow Jones Newswires

January 22, 2016 02:00 ET (07:00 GMT)

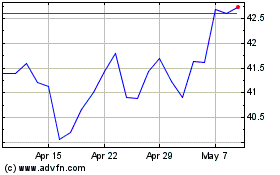

Assura (LSE:AGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

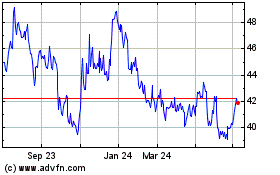

Assura (LSE:AGR)

Historical Stock Chart

From Apr 2023 to Apr 2024