TIDMABF

RNS Number : 1729Y

Associated British Foods PLC

07 September 2015

7 September 2015

Associated British Foods plc

Pre Close Period Trading Update

Associated British Foods plc issues the following update prior

to entering the close period for its full year results, 52 weeks to

12 September 2015, which are scheduled to be announced on 3

November 2015.

Trading performance

Our expectation for the full year results is unchanged.

Operating profit at constant currency will be ahead of last year

for Grocery, Agriculture, Ingredients and Retail. As guided in the

interim results, the decline in operating profit in Sugar and the

net adverse impact on the translation of overseas results arising

from the strengthening of sterling, which is now some GBP30m, will

give rise to an overall decline in adjusted operating profit for

the group.

The net interest charge will be lower than last year with the

benefit of a lower average level of borrowings. The underlying tax

rate will also be lower than last year and in line with the rate

used at the half year. Our earnings expectation for this financial

year continues to reflect a modest decline in adjusted earnings per

share for the group for the full year.

Currency

The group is diverse and multinational with operations and

transactions in many currencies, and as a result has both

translational and transactional currency exposures. During the

current financial year, against a basket of currencies, sterling

and the US dollar both strengthened and the euro weakened

significantly. Since our half year, and particularly in recent

weeks, local currencies in our emerging markets have weakened

significantly.

If current rates persist we expect an adverse effect on adjusted

operating profit next year. The translation impact will be at a

similar level to the current year but the transactional impact will

be greater.

Net Debt

Another year of good cash generation will see a further

reduction in net debt from last year's GBP446m. Capital expenditure

will be lower than last year, although still well ahead of

depreciation, and we expect a working capital outflow.

Grocery

At actual exchange rates Grocery operating profit is expected to

be ahead of last year with an increase in margin, and revenue will

be lower, largely driven by commodity price deflation.

Twinings Ovaltine grew market share in a number of regions and

generated a strong profit increase. In the UK, where the market for

mainstream teas saw some contraction, Twinings' sales of premium

black tea, green teas and infusions all grew. Australia also had

another successful year with the relaunch of the English Breakfast

range supported by advertising and in-store promotion. Ovaltine

sales in Thailand, one of its most important markets, were lower

than last year on the back of economic weakness, but growth was

achieved in its developing markets, particularly south east Asia.

Strong factory performances delivered lower manufacturing

conversion costs and overheads were also lower benefiting from cost

reduction initiatives.

Sales volumes at Allied Bakeries increased over the financial

year. However, the UK bread market has continued to be very

challenging and lower bread prices resulted in a reduction in

profitability. The Kingsmill brand was relaunched in May and

revenues from Sandwich Thins have continued to build following last

year's launch. We have completed our major capital investment

programme and this year have reduced waste, further improved

production processes and manufactured products of a consistently

high quality.

Silver Spoon's cost reduction programme has substantially

improved operational efficiency. Commercial success this year

included the securing of two supply contracts with major UK

retailers. Since its acquisition last October, Dorset Cereals has

traded ahead of our business plan and its integration with Jordans

Ryvita has gone smoothly. Jordans continued to perform well, but

Ryvita crispbread sales were lower in a competitive market.

At AB World Foods, Patak's and Blue Dragon maintained their

positions as the leading Indian and Oriental ambient brands in the

UK but lost some non-core business leading to lower revenues. An

improved sales mix drove an overall margin increase and operating

profit will be ahead of last year. The UK ethnic restaurant and

take away market has seen some improvement after several years' of

decline, with increased consumer expenditure on out of home eating.

Westmill achieved margin improvement with its Chinese catering

brands performing particularly well driven by strong commercial

activity.

Revenue at George Weston Foods in Australia will be close to

last year in local currency but profit will be ahead. Bread margins

were lower as retailers featured bread in their drive for lower

prices with heavy price promotion activity which more than offset

the benefits of a cost reduction programme across all bakery sites.

Margins in the Don KRC meat business improved markedly in the

second half with higher volumes and much improved production

efficiency. As expected raw material cost and quality were

substantially better in the second half.

At ACH in North America, Mazola achieved strong volume growth

following increased investment in advertising and marketing which

highlighted the cholesterol-lowering benefits of corn oil.

Sugar

Revenue and adjusted operating profit for AB Sugar for the full

year, at both actual and constant currency, will again be

substantially lower than the previous year driven by the further

decline in European sugar prices. Further benefits delivered by our

ongoing performance improvement programme, including significant

reductions in overheads, made an important contribution to reducing

our ongoing cost base. However, these could not compensate for the

impact of lower prices.

Sugar prices in the EU have now stabilised and with quota stock

levels reducing back towards historic norms, we expect to see some

price recovery during 2015/16. Prices in China increased during the

year, as a consequence of lower domestic production and reduced

imports leading to lower inventory levels, but they are still at a

premium to import parity prices. World prices declined with recent

pricing below 11.0 cents per pound which is the lowest for more

than six years. This has led to an increase in low-cost imports

into Africa which has held back some domestic prices.

UK sugar production of 1.45 million tonnes was driven by very

high beet yields and excellent factory performances. The UK crop

for the 2015/16 season has made good progress but, with a reduction

in the contracted area under cultivation in excess of 20%, and a

return to more typical beet yields, sugar production is expected to

be just short of 1.0 million tonnes. This will lead to a fall in

our quota stock levels. Delivered beet costs for the 2015/16

campaign will be some 20% lower than the current year with a

further substantial cost reduction now secured for the 2016/17

campaign.

In Spain, all factories performed well. Total production will be

ahead of last year at 709,000 tonnes of which 414,000 tonnes was

from beet and 295,000 tonnes from refined raw sugars.

Illovo is expected to produce 1.69 million tonnes in the year to

September in line with last year. The effect of drought on cane

growth in South Africa was largely offset by strong production

volumes across all other countries of operation. Zambia achieved

record sugar production and further development at the factory is

now planned which will increase sugar refining capacity and create

new sugar conditioning and storage facilities to enable the supply

of higher quality sugars to the regional market. The Malawi sugar

market has been seriously disrupted by the country's continued

economic difficulties and sales volumes and prices reduced as a

result. Across the group we continue to focus on domestic and

regional sales to mitigate the effect of lower world and EU

prices.

In China there has been some recovery in market prices and

profitability has improved as a result. Following the sale of the

Yi'an beet sugar factory in Heilongjiang in February, we completed

the sale of the BoCheng factory in August, so bringing to an end

our involvement in sugar production in the Heilongjiang region. The

final cost of ceasing these operations was GBP99m all of which was

a non-cash charge. Subsequent to these disposals we have commenced

the relocation of most of our management team from the head office

in Beijing to the operating sites in order to provide maximum focus

on our remaining facilities.

Agriculture

We expect another record year at AB Agri with strong

performances across all businesses. Adjusted operating profit at

actual exchange rates will show further progress, on lower revenues

than last year as a result of softer commodity prices. Continued

investment in more energy-efficient manufacturing and distribution

reduced overheads and contributed to our commitment to reduce

energy use.

UK feed volumes held up well despite continued pressure on the

UK dairy sector where AB Connect's range of ruminant feed products

offered a cost effective way of maintaining or improving milk

yields and quality. In Speciality Nutrition, the recent expansion

and modernisation of the UK pre-mix and starter feed plant at

Rugeley enabled the business to meet higher domestic demand.

Frontier Agriculture, our joint venture arable operation, traded at

similar levels to last year and, after a slow start, sales volumes

of crop inputs improved. Currency changes and geographical

influences added complexity to grain trading operations, and lower

than normal protein levels in domestic wheat increased the demand

for quality wheat imports.

AB Agri China delivered a strong result driven by good

procurement and a favourable product mix. The new feed mills are

performing well with Zhenlai delivering substantial cost savings to

its major customer and Rudong, which was built to supply feed

exclusively to a major international processor, already performing

to plan.

(MORE TO FOLLOW) Dow Jones Newswires

September 07, 2015 02:00 ET (06:00 GMT)

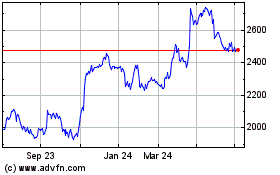

Associated British Foods (LSE:ABF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Associated British Foods (LSE:ABF)

Historical Stock Chart

From Apr 2023 to Apr 2024