TIDMASTO

RNS Number : 6808A

AssetCo PLC

28 March 2017

Providers of management and resources to the fire and emergency

services in the Middle East

Tuesday, 28 March 2017 Immediate Release

AssetCo plc

("AssetCo" or the "Company")

Preliminary results for the year to 30 September 2016

Statement by the Chairman, Tudor Davies

Introduction

We are pleased to report an improvement in profits and cash

generation for the year ended 30 September 2016, principally all of

which arises from a Fire Services contract in Abu Dhabi we have

held since 2010 and which has been extended until November 2017

when it is due for renewal.

Results

The Income Statement for the year ended 30 September 2016 shows

an Operating Profit of GBP4.9m (2015; GBP4.4m) on Revenue of

GBP23.3m (2015; GBP21.7m) and a Profit before and after Taxation of

GBP4.6m (2015; GBP4.0m). The year on year increase is principally

due to the weakness of sterling versus the United Arab Emirates

Dirham in which currency our business is conducted.

The cash position remains strong at GBP18.8m (2015; GBP15.6m)

comprising free cash balances of GBP15.5m (2015; GBP12.8m) and

restricted cash balances held in respect of bonds amounting to

GBP3.3m (2015; GBP2.8m).

Claim against Grant Thornton

The litigation against the Company's former auditors, where we

have issued formal Court proceedings and amounts to a sum in the

region of GBP40m, continues but is not due to be heard until the

summer of 2018.

UAE Contract

As announced on 31 January 2017, we agreed and signed a one year

extension to our existing Abu Dhabi Fire Services contract, on

similar terms, effective from November 2016 until November 2017 and

are awaiting its final signature and return from Abu Dhabi.

Outlook

Trading continues to be in line with management's expectations

and we will keep shareholders informed regarding further progress

on extending the UAE contract and also any developments from the

Grant Thornton claim.

Enquiries:

AssetCo plc Arden Partners TooleyStreet

Tudor Davies, Chairman plc Communications

Tel: +44 (0) 7785 Nominated adviser Fiona Tooley

703523 and broker Email: fiona@tooleystreet.com

+44 (0) 20 7614 John Llewellyn-Lloyd/ Mobile: +44 (0)

5900 Ciaran Walsh 7785 703523

Tel: +44 (0) 20

7614 5900

AssetCo is principally involved in the provision

of management and resources to the fire and emergency

services in the Middle East.

For further details, visit the website, www.assetco.com

Ticker: AIM: ASTO.L

Market cap: GBP43.35m

AssetCo plc

Income Statement

for the year to 30 September 2016

Year to 30 September

2016 2015

GBP'000 GBP'000

Revenue 23,300 21,660

Cost of sales (16,550) (15,564)

----------- ----------

Gross profit 6,750 6,096

Administrative expenses (1,874) (1,647)

----------- ----------

Operating profit 4,876 4,449

Finance income 21 23

Finance costs (294) (459)

Profit before tax 4,603 4,013

Income tax - -

----------- ----------

Profit for the year 4,603 4,013

----------- ----------

Earnings per share (EPS):

Basic - pence 37.70 32.86

Diluted - pence 37.70 32.86

AssetCo plc

Statement of Comprehensive Income

for the year to 30 September 2016

Year to 30 September

2016 2015

GBP'000 GBP'000

Recognised profit for the

year 4,603 4,013

Other comprehensive income

Exchange differences on

translating foreign operations 1,858 866

----------- ----------

Other comprehensive income,

net of tax 1,858 866

----------- ----------

Total comprehensive income

for the year 6,461 4,879

----------- ----------

AssetCo plc

Statement of Financial Position

As at 30 September 2016

30 September 30 September

2016 2015

GBP'000 GBP'000

Assets

Non-current assets

Property, plant and equipment - -

Cash held in respect of

a bond 240 2,802

------------- -------------

Total non-current assets 240 2,802

------------- -------------

Current assets

Inventories - -

Trade and other receivables 12,498 6,629

Cash and cash equivalents 15,470 12,836

Cash held in respect of

a bond 3,040 11

------------- -------------

Total current assets 31,008 19,476

------------- -------------

Total assets 31,248 22,278

------------- -------------

Shareholders' equity

Share capital 25,474 25,474

Share premium 64,941 64,941

Profit and loss account (64,359) (70,820)

------------- -------------

Total equity 26,056 19,595

------------- -------------

Liabilities

Current liabilities

Trade and other payables 5,192 2,683

------------- -------------

Total current liabilities 5,192 2,683

------------- -------------

Total liabilities 5,192 2,683

------------- -------------

Total equity and liabilities 31,248 22,278

------------- -------------

The financial statements were authorised for issue by the board

of directors on 28 March 2017 and were signed on its behalf by

Tudor Davies.

AssetCo plc

Statement of Changes in Equity

for the year to 30 September 2016

Profit

Share Share and Total

capital premium loss equity

reserve

GBP'000 GBP'000 GBP'000 GBP'000

Balance at 30 September

2014 25,474 64,941 (75,699) 14,716

Profit for the year

Other comprehensive income: - - 4,013 4,013

Exchange differences on

translation - - 866 866

---------- ---------- ---------- ---------

Total comprehensive income

for the year - - 4,879 4,879

---------- ---------- ---------- ---------

Balance at 30 September

2015 25,474 64,941 (70,820) 19,595

Profit for the year

Other comprehensive income: - - 4,603 4,603

Exchange differences on

translation - - 1,858 1,858

---------- ---------- ---------- ---------

Total comprehensive income

for the year - - 6,461 6,461

---------- ---------- ---------- ---------

Balance at 30 September

2016 25,474 64,941 (64,359) 26,056

---------- ---------- ---------- ---------

AssetCo plc

Statement of Cash Flows

for the year to 30 September 2016

Year to 30

September

2016 2015

Note GBP'000 GBP'000

Cash flows from operating activities

Cash generated from operations 5 2,151 4,758

Cash deposited in respect of a performance

bond - (223)

Cash released in respect of a performance

bond - 2,814

Finance costs (294) (459)

Net cash generated from operating

activities 1,857 6,890

-------- --------

Cash flows from investing activities

Finance income 21 23

Net cash generated from investing

activities 21 23

-------- --------

Net change in cash and cash equivalents 1,878 6,913

Cash, cash equivalents and bank overdrafts

at beginning of year 12,836 5,787

Exchange differences on translation 756 136

-------- --------

Cash, cash equivalents and bank overdrafts

at end of year 6 15,470 12,836

-------- --------

AssetCo plc

Notes to the Financial Statements

for the year to 30 September 2016

1. Legal status and activities

AssetCo plc (the "Company") is principally involved

in the provision of management and resources to the

fire and rescue emergency services in international

markets. It currently trades through a branch in

UAE and its strategy is to develop this business.

As at period end, the Company has no subsidiaries.

AssetCo plc is a public limited liability company

incorporated and domiciled in England and Wales.

The address of its registered office is Singleton

Court Business Park, Wonastow Road, Monmouth, Monmouthshire

NP25 5JA.

AssetCo plc shares are listed on the Alternative

Investment Market ("AIM") of the London Stock Exchange.

This preliminary announcement has been presented

in sterling to the nearest thousand pounds (GBP'000)

except where otherwise indicated, as are the financial

statements, which were authorised for issue by the

board of directors on 28 March 2017.

2. Basis of preparation

The preliminary results for the period to 30 September

2016, which do not form the statutory accounts of

the Company, are an abridged statement of the full

Annual Report and Financial Statements, which have

been prepared in accordance with International Financial

Reporting Standards (IFRS), as adopted by the European

Union, and those parts of the Companies Act 2006

applicable to companies reporting under IFRS.

The preliminary results have been prepared on a going

concern basis.

The principal accounting policies are included in

the financial statements and have been applied consistently

in both periods presented.

3. Segmental reporting

The core principle of IFRS 8 'Operating Segments'

is to require an entity to disclose information that

enables users of the financial statements to evaluate

the nature and financial effects of the business

activities in which the entity engages and the economic

environments in which it operates. Segmental information

is therefore presented in respect of the Company's

geographical settlement. No secondary segmental information

has been provided as, in the view of the directors,

the Company operates in only one segment, being the

provision of management and resources to fire and

emergency services. The directors consider the chief

operating decision maker is the board.

The amounts provided to the board with respect to

net assets are measured in a manner consistent with

that of the financial statements. The Company is

domiciled in the UK and operates a branch in UAE.

Revenue by destination is not materially different

from revenue by origin shown above. All revenue relates

to services. Unallocated comprises the head office.

Analysis of revenue and results by geographical

settlement

Continuing

Year to 30 September 2016 UAE Unallocated operations

GBP'000 GBP'000 GBP'000

Revenue

Revenue to external customers 23,300 - 23,300

Total revenue 23,300 - 23,300

--------- ------------- ------------

Segment result

EBITDA 6,050 (1,174) 4,876

Depreciation - - -

--------- ------------- ------------

Operating profit 6,050 (1,174) 4,876

Finance income 7 14 21

Finance costs (294) - (294)

Profit for the year 5,763 (1,160) 4,603

--------- ------------- ------------

Assets and liabilities

Total segment assets 19,110 12,138 31,248

Total segment liabilities (4,414) (778) (5,192)

--------- ------------- ------------

Total net assets 14,696 11,360 26,056

--------- ------------- ------------

Other segment information

Total capital expenditure - - -

--------- ------------- ------------

Analysis of revenue and results by geographical settlement

......continued

Continuing

Year to 30 September 2015 UAE Unallocated operations

GBP'000 GBP'000 GBP'000

Revenue

Revenue to external customers 21,660 - 21,660

---------- -------------- ------------

Total revenue 21,660 - 21,660

---------- -------------- ------------

Segment result

EBITDA 5,383 (922) 4,461

Depreciation (12) - (12)

---------- -------------- ------------

Operating profit 5,371 (922) 4,449

Finance income 11 12 23

Finance costs (459) - (459)

---------- -------------- ------------

Profit for the year 4,923 (910) 4,013

---------- -------------- ------------

Assets and liabilities

Total segment assets 13,942 8,336 22,278

Total segment liabilities (2,294) (389) (2,683)

---------- -------------- ------------

Total net assets 11,648 7,947 19,595

---------- -------------- ------------

Other segment information

Total capital expenditure - - -

---------- -------------- ------------

4. Earnings per share

Basic earnings per share is calculated by dividing

the profit attributable to ordinary equity holders

of the Company by the weighted average number of

ordinary shares outstanding during the period.

Year to 30

September

2016 2015

GBP'000 GBP'000

Profit for the year 4,603 4,013

----------- -----------

Weighted average number of shares in

issue 12,211,163 12,211,163

Basic and diluted earnings per share

(EPS) - pence 37.70 32.86

5. Reconciliation of profit before tax to cash generated

from operations

Year to 30

September

2016 2015

GBP'000 GBP'000

Profit for the year before tax 4,603 4,013

Depreciation and impairment - 12

Finance costs 294 459

Finance income (21) (23)

Decrease in inventories - 333

(Increase)/decrease in debtors (4,766) 65

Increase/(decrease) in creditors 2,041 (101)

Cash generated from operations 2,151 4,758

--------- --------

At 30 September

6. Analysis of net cash: 2016 2015

GBP'000 GBP'000

Cash at bank and in hand 15,470 12,836

15,470 12,836

------------ -----------

There was cash of GBP15,470,000 as at 30 September

2016 (2015: GBP12,836,000) and cash held in respect

of bonds of GBP3,280,000 (2015: GBP2,813,000).

7. Contingent liabilities

Approximate

maximum liability

2016 2015

GBP'000 GBP000

Performance bond related to a UAE contract,

expected to be released in full in

2017 3,000 2,500

----------- --------

Performance bond related to a UAE contract,

expected to reduce to approximately

GBP1m in 2017 and to be released in

full in 2020 2,400 2,000

----------- --------

Performance bond related to a UAE contract,

expected to be released in full in

2017 130 100

----------- --------

8. Post balance sheet events

There are no post balance sheet events to report.

9. Annual General Meeting

The annual general meeting is to be held at 11.30

a.m. on Friday, 5 May 2017 at Harwood Capital, 6 Stratton

Street, London, W1J 8LD.

A Notice convening the annual general meeting will

be posted to shareholders in due course.

10. Electronic communications

This Preliminary Announcement is available on the

Company's website www.assetco.com. News updates, regulatory

news and financial statements can be viewed and downloaded

from the Company's website, www.assetco.com. Copies

can also be requested, in writing, from The Company

Secretary, AssetCo plc, Singleton Court Business Park,

Wonastow Road, Monmouth, Monmouthshire NP25 5JA. The

Company is not proposing to bulk print and distribute

hard copies of the Annual Report and Financial Statements

for the year to 30 September 2016 unless specifically

requested by individual shareholders; it can be downloaded

from the Company's website.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR PGUMAWUPMPUM

(END) Dow Jones Newswires

March 28, 2017 02:01 ET (06:01 GMT)

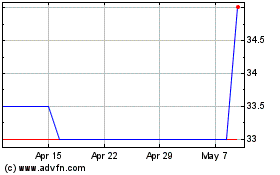

Assetco (LSE:ASTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Assetco (LSE:ASTO)

Historical Stock Chart

From Apr 2023 to Apr 2024