TIDMASTO

RNS Number : 6244Q

AssetCo PLC

19 June 2015

Providers of management and resources to the fire and emergency

services in the Middle East

Date: Friday, 19 June Immediate Release

2015

AssetCo plc

("AssetCo" or the "Company")

Half-yearly financial report

Six months ended 31 March 2015

Introduction

We are pleased to announce the results for the six months ended

31 March 2015 which show good progress and increased profits and

cash generation.

Results

The Income statement for the six months ended 31 March 2015

shows an Operating Profit of GBP1.76m (2014: GBP1.14m) on Revenue

of GBP10.4m (2014: GBP7.0m) and a Profit for the period of GBP1.5m

(2014: GBP1.0m). The improvement in profitability reflects the the

increase in the size of our contracts in the Middle East; headcount

has increased from 171 to 216. Basic Earnings per share in the

period was 12.30p (2014: 8.89p).

Cash generation

The Company generated GBP4.7m of free unrestricted cash in the

six months under review, with GBP2.5m net releases from contract

Bonds and the remaining GBP2.2m generated from operations.

We currently have total cash of GBP13.4m (2014: GBP9.9m)

comprising free cash balances of GBP10.5m (2014: GBP5.1m) and

restricted cash balances held in respect of Bonds amounting to

GBP2.9m (2014: GBP4.9m).

Claim against former auditors

We have now received a response to our claim against our former

auditors Grant Thornton, lodged under the Professional Negligence

Pre-action Protocol, and the next stage is a mediation hearing

which is expected to take place in October 2015.

Current trading

Trading continues in line with the current contracts and

management's expectations, and we will keep shareholders updated

with progress during the course of the year.

Tudor Davies

Chairman

19 June 2015

AssetCo plc

Consolidated Income Statement

for the six months ended 31 March 2015

Six months ended Year ended

31 March 31 March 30 September

2015 2014 2014

GBP'000 GBP'000 GBP'000

Revenue 10,418 7,027 14,634

Cost of sales (7,985) (5,101) (10,865)

--------- --------- -------------

Gross profit 2,433 1,926 3,769

Administrative expenses (672) (788) (1,169)

--------- --------- -------------

Operating profit 1,761 1,138 2,600

Finance income 10 28 9

Finance costs (269) (134) (356)

Profit before taxation 1,502 1,032 2,253

Income tax expense - - -

--------- --------- -------------

Profit for the period 1,502 1,032 2,253

Earnings per share (EPS):

Basic - pence 12.30 8.89 18.92

Diluted - pence 12.30 8.67 18.46

AssetCo plc

Consolidated Statement of Comprehensive Income

for the six months ended 31 March 2015

Six months ended Year ended

31 March 31 March 30 September

2015 2014 2014

GBP'000 GBP'000 GBP'000

Recognised profit for the

period 1,502 1,032 2,253

Other comprehensive income/(expense):

Exchange differences on

translating foreign operations 1,107 (232) 137

Other comprehensive income/(expense),

net of tax 1,107 (232) 137

--------- --------- -------------

Total comprehensive income

for the period 2,609 800 2,390

--------- --------- -------------

AssetCo plc

Consolidated Statement of Financial Position

As at 31 March 2015

At 31 March At 31 At 30 September

2015 March 2014

2014

Notes GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Property, plant and equipment 2 21 12

Cash held in respect of

Bonds 2,881 2,430 2,482

------------------------------- ------ ------------ --------- ----------------

Total non-current assets 2,883 2,451 2,494

Current assets

Inventories - - 333

Trade and other receivables 3 6,064 5,724 6,220

Cash and cash equivalents

(excluding bank overdrafts) 10,503 5,058 5,787

Cash held as security against 55 - -

letters of credit

Cash held in respect of

Bonds - 2,430 2,509

------------------------------- ------ ------------ --------- ----------------

Total current assets 16,622 13,212 14,849

------------------------------- ------ ------------ --------- ----------------

TOTAL ASSETS 19,505 15,663 17,343

------------------------------- ------ ------------ --------- ----------------

Shareholders' equity

Share capital 25,474 25,474 25,474

Share premium 64,941 64,941 64,941

Foreign currency translation

reserve 1,131 (345) 24

Profit and loss account (74,221) (76,944) (75,723)

------------------------------- ------ ------------ --------- ----------------

TOTAL EQUITY 17,325 13,126 14,716

LIABILITIES

Current liabilities

Trade and other payables 4 2,180 2,537 2,627

Total current liabilities 2,180 2,537 2,627

------------------------------- ------ ------------ --------- ----------------

TOTAL LIABILITIES 2,180 2,537 2,627

------------------------------- ------ ------------ --------- ----------------

TOTAL EQUITY AND LIABILITIES 19,505 15,663 17,343

------------------------------- ------ ------------ --------- ----------------

AssetCo plc

Consolidated Statement of Changes in Equity

for the six months ended 31 March 2015

Share Foreign Profit Share Total

Capital currency and premium equity

translation loss

reserve reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 30 September

2013 25,353 (113) (77,976) 62,645 9,909

Transactions with owners:

Issue of shares 121 - - 2,296 2,417

--------------------------- --------- ------------- --------- --------- --------

Transactions with owners

for the period 121 - - 2,296 2,417

--------------------------- --------- ------------- --------- --------- --------

Profit for the period - - 1,032 - 1,032

Other comprehensive

expense:

Exchange differences

on translation - (232) - - (232)

Total comprehensive

(expense) / income for

the period - (232) 1,032 - 800

--------------------------- --------- ------------- --------- --------- --------

Balance at 31 March

2014 25,474 (345) (76,944) 64,941 13,126

--------------------------- --------- ------------- --------- --------- --------

Profit for the period - - 1,221 - 1,221

Other comprehensive

income:

Exchange differences

on translation - 369 - - 369

Total comprehensive

income for the period - 369 1,221 - 1,590

--------------------------- --------- ------------- --------- --------- --------

Balance at 30 September

2014 25,474 24 (75,723) 64,941 14,716

--------------------------- --------- ------------- --------- --------- --------

Profit for the period - - 1,502 - 1,502

Other comprehensive

income:

Exchange differences

on translation - 1,107 - - 1,107

--------------------------- --------- ------------- --------- --------- --------

Total comprehensive

income for the period - 1,107 1,502 - 2,609

--------------------------- --------- ------------- --------- --------- --------

Balance as at 31 March

2015 25,474 1,131 (74,221) 64,941 17,325

--------------------------- --------- ------------- --------- --------- --------

AssetCo plc

Consolidated Statement of Cash Flows

for the six months ended 31 March 2015

Six months ended Year ended

31 March 31 March 30 September

2015 2014 2014

Note GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

Cash generated / (used)

in operations 5 2,253 (1,324) (380)

Cash deposited in respect

of Performance Bonds (223) - (30)

Cash released in respect 2,814 - -

of Performance Bonds

Cash deposited in respect (55) - -

of a letter of credit

Interest paid (269) (134) (356)

Net cash generated from

/ (used in) operating

activities 4,520 (1,458) (766)

--------------------------- ----- --------- --------- -------------

Cash flows from investing

activities

Finance income 10 28 9

Net cash generated from

investing activities 10 28 9

--------------------------- ----- --------- --------- -------------

Cash flows from financing

activities

Issue of shares (net

of costs) - 2,417 2,417

Net cash generated from

financing activities - 2,417 2,417

--------------------------- ----- --------- --------- -------------

Net change in cash and

cash equivalents 4,530 987 1,660

Cash, cash equivalents

and bank overdrafts at

the beginning of the

period 5,787 4,134 4,134

Exchange differences

on translation 186 (63) (7)

Cash, cash equivalents

and bank overdrafts at

the end of the period 10,503 5,058 5,787

--------------------------- ----- --------- --------- -------------

AssetCo plc

Notes to the Financial Statements

for the six months ended 31 March 2015

1. Legal status and activities

AssetCo plc (the "Company") is principally involved

in the provision of management and resources to the

fire and rescue emergency services in international

markets. It currently trades through a branch in

UAE and its strategy is to develop this business.

As at period end, the Company has no trading subsidiaries

and therefore the principal activities of the Group

are restricted to those of the Company detailed above.

AssetCo plc is a public limited liability company

incorporated and domiciled in England and Wales.

The address of its registered office is Singleton

Court Business Park, Wonastow Road, Monmouth, Monmouthshire

NP25 5JA. The Group operates from one site in UAE.

AssetCo plc shares are listed on the Alternative

Investment Market ("AiM") of the London Stock Exchange

(Symbol: ASTO)

2. Basis of preparation

The financial information in the half-yearly financial

report has been prepared using the recognition and

measurement principles of International Accounting

Standards, International Financial Reporting Standards

and Interpretations adopted for use in the European

Union (collectively Adopted IFRSs). The principal

accounting policies used in preparing the half-year

report are those the Group expects to apply in its

financial statements for the year ending 30 September

2015 and are unchanged from those disclosed in the

Annual Report and Consolidated Financial Statements

for the year ended 30 September 2014.

The financial information for the six months ended

31 March 2015 and the six months ended 31 March 2014

is unaudited and does not constitute the Group's

statutory financial statements for those periods.

The comparative financial information for the full

year ended 30 September 2014 has, however, been derived

from the audited statutory financial statements for

that period. A copy of those statutory financial

statements has been delivered to the Registrar of

Companies.

While the financial figures included in this half-yearly

financial report have been computed in accordance

with IFRSs applicable to interim periods, this half-yearly

financial report does not contain sufficient information

to constitute an interim financial report as that

term is defined in IAS 34.

The financial statements have been presented in Sterling

to the nearest thousand pounds (GBP'000) except where

otherwise indicated.

3. Trade and other receivables

31 March 31 March 30 September

2015 2014 2014

GBP'000 GBP'000 GBP'000

Trade receivables 5,166 4,959 5,132

Other receivables 78 71 149

Prepayments and accrued

income 820 694 939

--------- --------- -------------

6,064 5,724 6,220

--------- --------- -------------

4. Trade and other payables

31 March 31 March 30 September

2015 2014 2014

GBP'000 GBP'000 GBP'000

Trade and other payables 263 859 1,108

Other payables 616 992 504

Other taxation and social

security 4 7 4

Accruals and deferred

income 1,297 679 1,011

--------- --------- -------------

2,180 2,537 2,627

--------- --------- -------------

5. Reconciliation of profit before taxation to net cash

generated from / (used) in operations

31 March 31 March 30 September

2015 2014 2014

GBP'000 GBP'000 GBP'000

Profit for the period before

taxation 1,502 1,032 2,253

Depreciation and impairment 11 12 22

Loss on sale of property, plant

and equipment - 19 19

Interest expense 269 134 356

Interest received (10) (28) (9)

Decrease / (increase) in inventories 365 28 (304)

Decrease / (increase) in debtors 762 (1,332) (1,720)

Decrease in creditors (646) (1,189) (997)

Cash generated from / (used)

in operations 2,253 (1,324) (380)

--------- --------- -------------

6. Contingent liabilities

During the period ended 30 September 2011 the Group

entered into a Performance Bond relating to a UAE based

contract that would determine a potential liability

of 10% of the total contract value upon failure to

fulfill all the terms of the contract. This liability

initially equated to a maximum of approximately GBP4m

but subsequently increased to a maximum of approximately

GBP5m as a result of a contract extension. During the

2015 financial year the customer confirmed that all

contractual terms had been met and consequently in

February 2015 the potential liability under this Bond

reduced to 5% of the contract value, approximately

GBP2.5m. This will reduce further to 0% upon expiration

of associated warranty periods which is expected to

occur in approximately July 2017.

During the period ended 30 September 2011 the Group

also provided an "Advanced Payment Guarantee" of approximately

GBP8m in connection to a UAE based contract. The guarantee

provided for the repayment in part or full of payments

received from the customer in advance of contractual

service delivery. The guarantee was released in full

by 31 October 2014.

During the period ended 30 September 2014 the Group

entered into a second Performance Bond, relating to

a contract replacing that referred to above, and that

would determine a potential liability of approximately

GBP2m upon failure to fulfill all the terms of the

contract. It is expected that this will reduce to approximately

GBP1m during the 2017 financial year and then will

be released in full during the 2020 financial year.

During the period ended 30 September 2014 the Group

also entered into a third Performance Bond, relating

to a further UAE based contract that would determine

a potential liability of 10% of the total contract

value upon failure to fulfil all the terms of the contract.

The potential liability equates to approximately GBP0.1m

and was released in full in March 2015.

During the period ended 31 March 2015 the Group entered

into a further Performance Bond, relating to an additional

UAE based contract that would determine a potential

liability of approximately GBP0.1m upon failure to

fulfil all the terms of the contract. It is expected

this will lapse during the 2017 financial year.

7. Electronic communications

The Company is not proposing to bulk print and distribute

hard copies of this Half-yearly financial report for

the six month period ended 31 March 2015 unless specifically

requested by individual shareholders; it can be downloaded

from the Company's website at www.assetco.com.

News updates, Regulatory news, & Financial statements,

can be viewed and downloaded from the Group's website,

www.assetco.com. Copies can also be requested, in writing

to, The Company Secretary, AssetCo plc, Singleton Court

Business Park, Wonastow Road, Monmouth, Monmouthshire

NP25 5JA.

Enquiries:

AssetCo plc Arden Partners TooleyStreet Communications

Tudor Davies, Chairman plc Fiona Tooley

John Llewelyyn-Lloyd

Tel: +44 (0) 7785 703523 Tel:+44 (0) 20 Mobile: +44 (0)

or +44 (0) 20 7614 5900 7614 5900 7785 703 523

fiona@tooleystreet.com

AssetCo is principally involved in the provision of management

and resources to the fire and emergency services in the

Middle East. For further details, visit the website,

www.assetco.com.

Symbol: AiM: ASTO; Market cap: GBP35.42m

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR GGUWUQUPAGMR

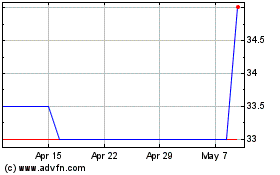

Assetco (LSE:ASTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Assetco (LSE:ASTO)

Historical Stock Chart

From Apr 2023 to Apr 2024