Asian Shares Regain Footing

September 29 2015 - 10:20PM

Dow Jones News

Asian shares mostly rebounded early Wednesday from near their

lowest levels this year, following a slight gain overnight in U.S.

markets as a commodities-related global selloff fizzled out.

The S&P/ASX 200 index in Australia rose 1.4% to 4981.20

shortly after the open, while Japan's Nikkei 225 gained 2% to

17274.06. At Tuesday's close, the ASX was at its lowest level since

mid-2013, following losses in commodities companies, and the Nikkei

was at its lowest since mid-January.

The Shanghai Composite Index opened up 0.5% at 3052.84 and the

smaller Shenzhen Composite Index gained 0.4% to 1719.19.

Healthcare and telecommunications companies led gains in Japan:

Olympus Corp. was up 2.8% and SoftBank Group was recovering from a

two-year low, trading 0.9% higher.

In Australia, resources companies also regained their footing, a

day after renewed worries about the spillover of China's slowing

demand battered prices of several commodities and related sectors.

Fortescue Metals Group rose 1.4% and BHP Billiton Ltd. gained 1.3%.

Internet-services provider TPG Telecom Ltd. surged 5.1% to A$10.66

(US$7.47) a share after the firm said it had struck deals worth

more than 1 billion Australian dollars to expand Vodafone Hutchison

Australia's transmission network.

Despite Wednesday's strength, investors remain cautious of more

volatility to come in Asian markets as several indicators point to

a harsher economic slowdown in China than previously thought.

Global stock markets have been sliding in recent sessions because

of fresh worries over slowing growth and questions over the Federal

Reserve's plan for raising interest rates.

Later this week, investors will get an update on the U.S. job

market, which could give guidance on the Fed's timeline for rate

increases. On Thursday, China will release manufacturing data for

September.

Meanwhile, markets remain vulnerable to sharp moves both up and

down as risk sentiment changes. "Risk on, off, on, off, ad

nauseam," ANZ wrote in a note.

Not all markets are trading higher on Thursday. South Korea's

Kospi 200 Index fell 1.1% to 1922.18.

In currency markets, the Japanese yen weakened against the U.S.

dollar. One U.S. dollar bought ¥ 119.95 Wednesday morning, compared

with Tuesday's close of ¥ 119.71. The Australian dollar traded at

US$0.7011 against the U.S. dollar, compared with US$0.6982 a day

earlier.

Write to Jake Maxwell Watts at jake.watts@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 29, 2015 22:05 ET (02:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

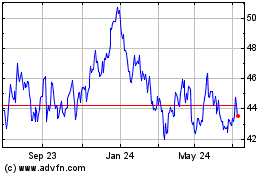

BHP (ASX:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

BHP (ASX:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024