Asian Shares Rattled by Deutsche Bank

September 30 2016 - 12:30AM

Dow Jones News

Asian shares traded lower Friday as enthusiasm over possible

production curbs by major oil producers receded and worries over

Deutsche Bank's troubles rattled financial stocks.

The Nikkei Stock Average was lower by 1.5% with Australia's

S&P/ASX 200 was down 0.9%. Korea's Kospi was lower by 0.9% as

well. Hong Kong's Hang Seng Index fell 1.4% and the Shanghai

Composite Index was 0.1% higher.

Oil prices were down in early Asian trade as doubts grew about a

plan to limit production among members of the Organization of the

Petroleum Exporting Countries. Traders noted that details of the

plan were scarce.

"A real agreement is not possible so they do a fake agreement.

It means nothing but it is better than nothing," said Fereidun

Fesharaki, chairman of consultancy FGE in a note. Analysts said

that almost all members of the OPEC were already at their maximum

producing capacity, with Saudi Arabia, the world's biggest oil

producer, continuing high production at low prices to keep market

share. High production levels are expected to be maintained and the

proposed production cuts to be decided in November are likely to be

marginal.

Nymex light, sweet crude futures were last down 7 cents at

$47.76 a barrel and Brent crude, the international oil benchmark,

was down 8 cents at $49.16 a barrel.

Meanwhile, worries over Deutsche Bank's troubles expanded

following reports that some clients—among them several large hedge

funds—have pulled billions of dollars from the bank amid concerns

about its stability and their exposure.

Deutsche Bank's New York-traded American depositary receipts

closed down 6.7% Thursday.

The Dow Jones Industrial Average fell 1.1% or nearly 200 points,

to 18143.45, and the S&P 500 closed at 2151.13, down 0.9%, its

biggest drop since Sept. 13.

Weakness in Asian shares, primarily in banking are "very much

related to what we could see in U.S. markets and issues with the

banking sector in Europe," said Frank Benzimra, head of Asia equity

strategy at Socié té Gé né rale. "The risk premium is rising on

global concern over the financial system."

In Japan, financial stocks traded lower with Sumitomo Mitsui

Trust off 1.9% and Nomura trading down 2%.

Also weighing on the Nikkei was data showing Japan's August

consumer prices fell 0.5% compared with a year ago, down for the

sixth straight month, defeating the Bank of Japan's attempt to push

up inflation and growth. The August core Consumer Price Index,

which excludes fresh food prices but includes energy, also fell

0.5% from a year earlier, the same pace as in July.

Meanwhile, the Japanese yen hasn't served its usual role as a

safe-haven amid the Deutsche Bank fears as weak inflation at home

fueled selling in the currency, countering safe-haven bids. The

currency was about unchanged against the U.S. dollar. Other Asian

currencies were also stable to the greenback with the exception of

the Malaysian ringgit which was down 0.5%.

In Australia, where financial stocks make up for half the top 10

stocks by index weight, Macquarie Group Ltd. was lower by 2.2%.

Hong Kong's HSI was also dragged down by banking stocks. HSBC

was down 1% and Bank of East Asia was off by 1.5%.

Stocks of Chinese manufacturers were also lower despite slightly

improved indications of the sector's prospects.

The Caixin China manufacturing purchasing managers index, a

private gauge of nationwide factory activity, edged up in

September, pointing to modest expansion, Caixin Media Co. and

research firm Markit said Friday. The index rose to 50.1 in

September from 50.0 in August, and stayed out of contractionary

territory—below 50—for a third straight month. Suzhou Electrical

Apparatus was down 8.8%, Shandong Geo-Mineral fell 5.9% and Fujian

Start Group trading lost 5.1%

Gold was 0.1% higher on expectations that the coming political

uncertainty in the U.S. could lead to demand for the yellow

metal.

Liyan Qi, Jenny Hsu and Takashi Nakamichi contributed to this

article.

Write to Kenan Machado at kenan.machado@wsj.com

(END) Dow Jones Newswires

September 30, 2016 00:15 ET (04:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

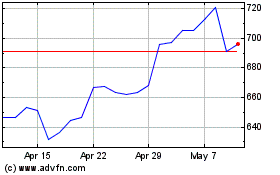

Hsbc (LSE:HSBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

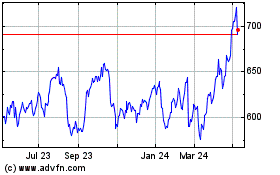

Hsbc (LSE:HSBA)

Historical Stock Chart

From Apr 2023 to Apr 2024