Asian Shares Mostly Lower

July 08 2016 - 1:10AM

Dow Jones News

Shares in Asia broadly slipped Friday amid unease over lower oil

prices and a coming U.S. jobs report.

Japan's Nikkei Stock Average fell 0.4%, Korea's Kospi was down

0.6%, while Hong Kong's Hang Seng Index dropped 0.9%. China's

Shanghai Composite Index fell 0.9%. Australia's S&P/ASX 200 was

roughly flat.

The focus of traders' anxiety shifted from Brexit to the

possibility of another dire U.S. jobs report, with June nonfarm

payroll numbers due Friday after Asian markets close.

Nerves were on edge despite unofficial data Wednesday from

payroll processor ADP showing U.S. payrolls in June rose at the

fastest pace in three months. Starkly weaker official jobs data

would shock markets, as they did last month, and a repeat this

month could reinforce fears the U.S. economy is faltering.

"It's still the most important data point that we get every

month," said Siddharth Mathur, a Citigroup strategist based in

Singapore. "The one thing people always fear," he said, is data

that completely miss estimates on the downside.

U.S. jobs data present a decidedly mixed bag to Asian investors.

A stronger reading would restore confidence in the health of the

American economy. It would also take some pressure off yen

appreciation, which would be good for Japanese exporters. However,

it would also lift expectations for a U.S. interest-rate increase,

boosting the U.S. dollar and increasing the likelihood of capital

flight from Asia to higher-yielding assets in the U.S.

A decline in the price of Brent crude oil hit energy shares in

China, Hong Kong and Japan. Brent plunged overnight amid concerns

of a gasoline oversupply, but rose slightly in early Asian trade to

$46.97 a barrel. China Petroleum & Chemical was down 2.2% and

Idemitsu Kosan fell 2.2%.

"Markets have just reacted to the overnight move which in turn

was led by the drop in oil prices," Mr. Mathur said. "Typically

people consolidate their portfolios and wait for the [jobs]

data."

Chinese stocks fell amid worries of rising risks in the

country's banking sector. Nonperforming loans surpassed $299.2

billion at the end of May, which increased banks' bad-loan ratio to

2.15%, said Yu Xuejun, a senior Chinese banking regulator.

The loans data swamped the good news that came Thursday after

market close about China's foreign-exchange reserves. The reserves

in June rose $14 billion to $3.205 trillion, according to the

People's Bank of China, a surprise increase that suggests currency

pressure is easing.

In other markets, the yield on the newest 10-year Japanese

government bond fell to a record low of minus 0.290%.

The yen, a recent source of safety for rattled investors, was

recently stable at 100.7320 against the U.S. dollar.

Gold trading was muted, as the metal's price drifted lower in

Asia to $1,355.85 a troy ounce.

Yifan Xie and Biman Mukherji contributed to this article.

Write to Dominique Fong at Dominique.Fong@wsj.com

(END) Dow Jones Newswires

July 08, 2016 00:55 ET (04:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

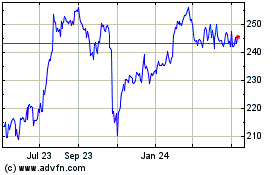

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Mar 2024 to Apr 2024

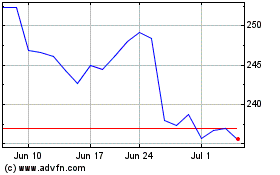

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Apr 2023 to Apr 2024