Asian Shares Mostly Down on Skepticism About OPEC Deal

November 28 2016 - 12:00AM

Dow Jones News

Expectations that an Organization of the Petroleum Exporting

Countries production deal was unraveling dominated Asian trade

Monday, adding volatility to regional stocks and currencies.

OPEC officials said Saudi Arabian oil officials won't attend a

meeting Monday with Russia and others ahead of the 14-nation

cartel's closely watched meeting Wednesday.

Japan's Nikkei 225 was down 0.8% and Australia's S&P/ASX 200

was down 0.4%, while Hong Kong's Hang Seng Index was up 0.5%.

The price of Brent crude, a global benchmark, fell 3.6% on

Friday. This showed the market was starting to price in a failure

at this week's meeting, said Ric Spooner, chief market analyst at

CMC Markets. Brent crude extended its decline Monday, shedding 0.4%

in early Asia trade.

"We could see a big rally if they see a plausible agreement [on

a production cut]," said Mr. Spooner. "But assuming that OPEC does

not agree, for the next few months it does set up for a lower oil

price [in the] high 30s to low 40s range. We've still got big

inventories and supply overhang."

The oil gloom hit Asia's biggest energy stocks. In Australia,

Woodside Petroleum was down 2.5% and BHP Billiton, whose

second-biggest division is petroleum, was down 2.3%. Japanese oil

explorer Inpex was down 1.7% and in Hong Kong, Chinese oil major

Cnooc fell 1.4%.

The drop in oil prices is hitting U.S. inflation expectations,

which has pulled down U.S. Treasury yields, which has finally

knocked back a lengthy dollar rally.

The yield on 10-year U.S. Treasurys was last at 2.330%, down

from 2.359% on Friday, according to Thomson Reuters.

Asian currencies were broadly up Monday. The Korean won gained

0.4% and the Singapore dollar rose by 0.5%.

The Japanese yen was the biggest gainer in Asia on Monday,

rising 1.3%, partly as traders sought the safety of the yen on the

view OPEC's production deal was unraveling.

"Guys are very very nervous about the oil scenario and you see

that expressed in the sensitive pair," said Oanda senior

foreign-exchange trader Stephen Innes, referring to the U.S. dollar

and the yen.

Toyota Motor fell 1.2%, as Japanese exporters are less

competitive when the yen strengthens.

Japanese financial companies were hit by lower yields for

Japanese and U.S. government bonds, as the institutions depend on

investment income from the securities. Nomura Holdings was off 1%

and Dai-ichi Life Holdings fell 1.4%.

The yield on 10-year Japanese government bonds was last at

0.015%, sharply lower than 0.037% on Friday.

The Hang Seng Index strengthened after news Friday that the

trading link connecting the Shenzhen and Hong Kong stock exchanges

will open Dec. 5, allowing foreigners to invest in China's

fastest-growing companies.

Other important market events this week include the release of

U.S. jobs figures and purchasing managers' indexes, including the

U.S. ISM manufacturing PMI data due Thursday.

Rachel Rosenthal, Kenan Machado and Rhiannon Hoyle contributed

to this article.

Write to Willa Plank at willa.plank@wsj.com

(END) Dow Jones Newswires

November 27, 2016 23:45 ET (04:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

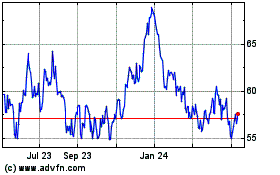

BHP (NYSE:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

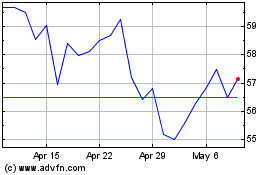

BHP (NYSE:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024