Asian Shares Mixed; Stronger Yen, Aussie Dollar Put Pressure on Local Stocks

August 18 2016 - 1:20AM

Dow Jones News

Shares in Asia were mixed Thursday, with stronger regional

currencies putting pressure on some stocks, while China's plans to

further open its equities market provided a delayed boost.

The Nikkei Stock Average was hit by a stronger yen, falling 0.2%

in morning trade. The yen broke below the 100 level versus the U.S.

dollar. Elsewhere, Australia's S&P/ASX 200 edged down 0.4% as

its local currency strengthened following strong jobs data.

Hong Kong's Hang Seng Index was up 1.5%, Seoul's Kospi added

0.3%, while the Shanghai Composite Index gained 0.2%.

"The main mover [of markets] is the dollar falling," said Tareck

Horchani, deputy head of Asian Pacific sales trading at Saxo

Capital Markets.

Minutes from the U.S. Federal Reserve's July meeting, released

late Wednesday, reflected a split on the timing of an interest-rate

increase, diluting hopes among some investors who expected a more

hawkish tone.

Some investors had expected more clarity from the Fed over the

timeline for a rise after two officials waxed optimistic on the

economy earlier in the week.

Expectations of continued low interest rates sent the U.S.

dollar weaker, driving up some of the region's main currencies.

Shares of key Japanese auto makers were hit as a stronger yen

makes the country's exports more expensive. Mazda Motor Corp. was

down 2.3%, Toyota Motor Corp. fell 0.6% and Nissan Motor Co. shed

1.2% in Thursday's morning session.

In Hong Kong, the market threw caution to the wind over the

Shenzhen-Hong Kong Stock Connect program and stocks caught an

updraft.

China on Tuesday gave the green light to a stock-trading link

between Hong Kong and Shenzhen, which would let global investors

buy Shenzhen stocks.

"If you look at the sentiment, it is still a little bit

cautious," said Alex Wong, director of asset management at Ample

Capital Ltd, who manages a $100 million fund. "But I think they are

basically ignoring that and they are still trading on the

expectation that liquidity will be abundant and quality assets will

be supported," he said.

Shares of exchange operator Hong Kong Exchanges & Clearing

Ltd. rose 0.8%, rebounding from Wednesday's 4.7% decline.

Meanwhile, China shares were trading about flat as Beijing

signaled that its crackdown on speculative trading continues.

The head of China's insurance regulator said that some insurers

ignored consumer interest in offering insurance products that

actually served as a platform for investing.

Separately, the Economic Information Daily, which is affiliated

with the official Xinhua News Agency, wrote in a front-page opinion

article Thursday that the recent regulatory clampdown will "purify"

the stock market of speculative punts, restoring principles of

value investing.

Though such regulatory posturing had driven markets down before,

investors have become inured to such tough talk, say analysts. The

Shenzhen Composite Index was last up 0.2%.

--Yifan Xie, Kosaku Narioka and Saurabh Chaturvedi contributed

to the article.

Write to Ese Erheriene at ese.erheriene@wsj.com

(END) Dow Jones Newswires

August 18, 2016 01:05 ET (05:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

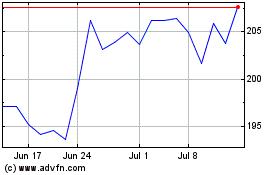

Toyota Motor (NYSE:TM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Toyota Motor (NYSE:TM)

Historical Stock Chart

From Apr 2023 to Apr 2024