Asian Shares Fall

November 23 2015 - 9:30PM

Dow Jones News

A slide in commodities prices pressured Asian resources shares

Tuesday, as investors in the region also try to navigate global

central banks' split approaches to monetary policy.

Expectations the Federal Reserve will raise interest rates at

its December meeting has strengthened the U.S. dollar, which helped

push commodities from oil to copper and gold lower overnight. Many

are priced in the currency and become more expensive to global

buyers as it strengthens. Investors are also concerned about weak

global demand and oversupply.

Australia's S&P ASX 200 fell 0.6% to 5246.90, after closing

on Monday at its highest in about a month. The materials sector

fell 1.6%.

The Nikkei Stock Average was flat, though nearing a high since

late August. Investors there await Bank of Japan minutes on

Wednesday for further insight on why the central bank has kept its

annual asset purchase target unchanged despite slowing growth.

South Korea's Kospi gained 0.3%. Hong Kong's Hang Seng Index

slipped 0.4% while the Shanghai Composite Index fell 0.2%.

"I think Asian markets are in a trading range until there's

clarity" on moves by the Fed and the European Central Bank, said

Scott Clemons, chief investment strategist at Brown Brothers

Harriman. The ECB has hinted it stands ready to unleash more

stimulus as soon as its December meeting. "Dollar strength is

likely to continue and that puts a cap on Asian markets."

The U.S. dollar has strengthened as investors wager that the Fed

will raise interest rates for the first time since June 2006 at its

December policy meeting. The euro hit a seven-month low Monday in

Asia at $1.0591 but strengthened slightly to $1.0634 early

Tuesday.

U.S. stocks slipped Monday, amid a light holiday-week trading

before the Thanksgiving holiday.

In Australia, mining shares led losses with, BHP Billiton Ltd.

down 4.3% and Rio Tinto Ltd. 2.6% lower.

The ASX rallied to its highest since late October Monday,

despite continued weakness in commodities, as investors bought bank

and consumer stocks. Analysts say demand for dividend-paying assets

after a summer selloff has driven investors toward Australian

banks, while an improving domestic economy has inspired buying

among the retailers.

Copper futures fell to their lowest levels in more than six

years overnight, weighed down by a stronger dollar and expectations

of lackluster demand. Copper for December delivery, the most

actively traded contract, closed down 1.9% at $2.0215 a pound on

the Comex division of the New York Mercantile Exchange, the lowest

level since May 2009.

Iron-ore prices sit just a whisper above their July decade low

after another sharp daily fall on Monday. Spot iron ore fell 1.8%

on Monday to $44.20 a ton, according to the Steel Index.

Nickel hit another 12 1/2-year low on Monday with the LME's

three-month nickel contract closing down 4.9% at $8,300 a metric

ton.

Brent crude oil, the global benchmark, rose 0.9% to $45.21 a

barrel. In the U.S., crude-oil futures lost 0.4% overnight to

$41.75 a barrel.

Gold prices rose 0.3% at $1,069.80 a troy ounce.

Month-to-date, the gains in Asia have been lackluster compared

with October, when much of the region bounced back sharply from a

summer selloff.

The Shanghai Composite Index is up 6.7%, the Nikkei is up 4.1%

and the S&P ASX 200 is up 0.3%. Those benchmarks were up 10.8%,

9.8% and 4.3% respectively in October.

The Hang Seng Index is near flat while South Korea's Kospi is

off 1% month-to-date.

Write to Chao Deng at Chao.Deng@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 23, 2015 21:15 ET (02:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

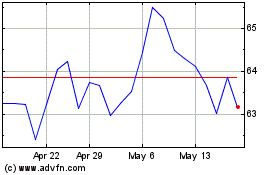

ASX (ASX:ASX)

Historical Stock Chart

From Mar 2024 to Apr 2024

ASX (ASX:ASX)

Historical Stock Chart

From Apr 2023 to Apr 2024