Asia Air Travel Slow In June

August 18 2015 - 12:30PM

Dow Jones News

The surge in air travel in Asia that has powered record demand

for jetliners slowed significantly during the summer, in contrast

to the full planes that are stoking record profits for U.S.

carriers.

Airline traffic within Asia rose just 2.4% in June compared with

a year earlier, sharply down from the 13.8% rise in the previous

month, according to the International Air Transport Association, or

IATA, a global trade group.

"This result could be the first sign of weakness in air travel

demand following months of sluggish economic performance in some

parts of Asia," said IATA in its monthly traffic update.

The trade group said some of the positive trends in passenger

traffic had started to unwind, and though June data is backward

looking, the expansion in business-class travel lagged behind that

in coach. Premium traffic is often used as a proxy for future

economic growth, with an average lag of six months as business

travel translates into deals and other economic activity.

Notably, air travel within the Far East region defined by IATA

fell 2.5% in June from a year earlier, taking growth in the first

half down to 7.8%.

IATA's cautious stance contrasts with the more bullish outlook

for Asia travel from the big aircraft lessors that plan to place

hundreds of additional jets in Asia.

Executives from AerCap Holdings NV and Air Lease Corp. have said

in recent weeks that demand from Chinese airlines remains robust,

and the country's central aircraft ordering agency is expected to

detail its next five-year plan later this year.

Analysts at Cowen & Co. this week noted that Chinese orders

accounted for only 2% of the jet backlog at Boeing Co. compared

with 19% of deliveries over the past two years. Many hundreds of

jets may have been ordered for Chinese carriers, but the customers

have yet to be identified.

IATA also said were signs the recovery in air travel within

Europe was moderating, and with many Latin American countries also

suffering big falls in traffic, U.S. carriers and the big three

Middle East carriers remain the most buoyant sources of growth.

Airlines for America, a trade group, on Monday forecast 14.2

million passengers will fly over the coming Labor Day period, up 3%

from a year ago. The busiest day is expected to be Friday, Sept.

4.

"[We] A4A projected an all-time high for summer travel this year

and year-over-year increases continue," said John Heimlich, the

trade group's chief economist. "With capacity increasing and

airfares trending downward, air travel continues to be more

accessible and a bargain for cost-conscience consumers."

Write to Doug Cameron at doug.cameron@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 18, 2015 12:15 ET (16:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

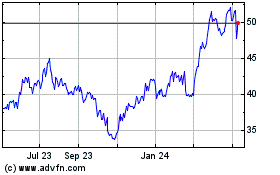

Air Lease (NYSE:AL)

Historical Stock Chart

From Mar 2024 to Apr 2024

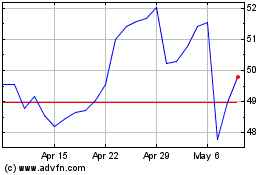

Air Lease (NYSE:AL)

Historical Stock Chart

From Apr 2023 to Apr 2024