TIDMAHT

RNS Number : 3116Z

Ashtead Group PLC

10 December 2014

Unaudited results for the half year and

second quarter ended 31 October 2014

Second quarter First half

2014 2013 Growth(1) 2014 2013 Growth(1)

GBPm GBPm % GBPm GBPm %

Underlying results(2)

Rental revenue 477.9 392.2 26% 895.6 765.4 24%

EBITDA 245.6 192.5 32% 455.5 369.2 31%

Operating profit 161.1 123.7 35% 294.6 234.1 34%

Profit before

taxation 145.1 112.8 33% 265.5 212.3 33%

Earnings per share 18.6p 14.3p 35% 33.9p 26.7p 35%

Statutory results

Revenue 529.4 439.2 24% 987.3 849.7 23%

Profit before

taxation 141.7 110.4 33% 259.2 207.8 33%

Earnings per share 18.1p 14.0p 34% 33.0p 26.1p 35%

(1) at constant exchange rates

(2) before intangible amortisation

Highlights

-- Group rental revenue up 24%(1)

-- Record first half pre-tax profit(2) of GBP266m, up 33% at constant exchange rates

-- Group EBITDA margin improves to 46% (2013: 43%)

-- GBP588m of capital invested in the business (2013: GBP451m) and full year guidance increased

-- Group RoI of 19% (2013: 18%)

-- Net debt to EBITDA leverage(1) of 2.0 times (2013: 2.1 times)

-- Interim dividend raised 33% to 3.0p per share (2013: 2.25p)

Ashtead's chief executive, Geoff Drabble, commented:

"The Group delivered another strong quarter with record

underlying pre-tax profits of GBP266m, up 33% on the prior year. It

was particularly pleasing to see a strong contribution from both

Sunbelt and A-Plant.

We continue to execute on our strategy, focused on organic

growth supplemented by bolt-on acquisitions. We invested GBP588m in

capital expenditure and a further GBP107m on bolt-on acquisitions

in the period. Given the profitable growth opportunities evident in

our markets, we are increasing our full year guidance for capital

expenditure to a range of GBP925m to GBP975m.

Even with these significant levels of investment, we continue to

grow responsibly, generating strong returns and maintaining

leverage within our stated objectives.

With both divisions performing well, recovering end markets, and

a proven track record of market share gains, we now anticipate a

full year result ahead of our previous expectations."

Contacts:

Geoff Drabble Chief executive +44 (0)20 7726 9700

Suzanne Wood Finance director

Brian Hudspith Maitland +44 (0)20 7379 5151

Geoff Drabble and Suzanne Wood will hold a meeting for equity

analysts to discuss the results and outlook at 9.30am on Wednesday,

10 December 2014 at The London Stock Exchange, 10 Paternoster

Square, London, EC4M 7LS. The meeting will be webcast live via the

Company's website at www.ashtead-group.com and a replay will also

be available via the website from shortly after the meeting

concludes. A copy of this announcement and the slide presentation

used for the meeting will also be available for download on the

Company's website. The usual conference call for bondholders will

begin at 3pm (10am EST).

Analysts and bondholders have already been invited to

participate in the analyst meeting and conference call for

bondholders but any eligible person not having received dial-in

details should contact the Company's PR advisers, Maitland (Astrid

Wright) at +44 (0)20 7379 5151.

Forward looking statements

This announcement contains forward looking statements. These

have been made by the directors in good faith using information

available up to the date on which they approved this report. The

directors can give no assurance that these expectations will prove

to be correct. Due to the inherent uncertainties, including both

business and economic risk factors underlying such forward looking

statements, actual results may differ materially from those

expressed or implied by these forward looking statements. Except as

required by law or regulation, the directors undertake no

obligation to update any forward looking statements whether as a

result of new information, future events or otherwise.

First half results

Revenue EBITDA Operating profit

2014 2013 2014 2013 2014 2013

Sunbelt in $m 1,367.9 1,107.5 666.5 514.8 449.3 344.8

Sunbelt in GBPm 821.7 711.5 400.4 330.8 269.9 221.5

A-Plant 165.6 138.2 60.1 43.2 29.7 17.4

Group central costs - - (5.0) (4.8) (5.0) (4.8)

987.3 849.7 455.5 369.2 294.6 234.1

Net financing costs (29.1) (21.8)

Profit before tax and amortisation 265.5 212.3

Amortisation (6.3) (4.5)

Profit before taxation 259.2 207.8

Taxation (93.6) (77.1)

Profit attributable to equity holders of the

Company 165.6 130.7

Margins

Sunbelt 48.7% 46.5% 32.8% 31.1%

A-Plant 36.3% 31.3% 17.9% 12.6%

Group 46.1% 43.4% 29.8% 27.6%

Group revenue increased 16% to GBP987m in the first half (2013:

GBP850m) with strong growth in both businesses. This revenue

growth, combined with ongoing operational efficiency, generated

record underlying profit before tax of GBP266m (2013: GBP212m).

The Group's growth is driven by strong same-store growth

supplemented by greenfield openings and bolt-on acquisitions. Over

the last 18 months we have added 105 locations in the US across a

range of market sectors with different characteristics. These

factors do impact a number of Sunbelt's metrics in the short term

and to aid the understanding of our performance, we have analysed

our year on year revenue growth as follows:

$m

2013 rental only revenue 774

Same stores (in existence at 1 May

2013) 17% 133

Bolt-ons and greenfields since 1

May 2013 8% 64

2014 rental only revenue 25% 971

Ancillary revenue 23% 276

2014 rental revenue 25% 1,247

Sales revenue 121

2014 total revenue 1,368

We continue to capitalise on the opportunity presented by our

markets which are up circa 7% year on year. Our same-store growth

of 17% demonstrates that we continue to take further market share.

In addition, bolt-ons and greenfields have contributed another 8%

growth as we execute our long-term structural growth strategy of

expanding our geographic footprint and our specialty

businesses.

Total rental only revenue growth of 25% can be broken down to a

23% increase in fleet on rent and a net 2% improvement in yield.

The improved yield reflects the combination of good rate growth,

the drag of greenfield and bolt-on activity as we capitalise on

market opportunities and the impact of mix which we highlighted in

quarter one. Average first half physical utilisation was 73% (2013:

73%).

A-Plant continues to perform well in improving markets and

delivered total rental revenue of GBP147m, up 18% on the prior year

(2013: GBP124m). This reflects 11% more fleet on rent and a 6%

improvement in yield. Yield has benefitted from an improved pricing

environment and the diversification of the product line.

Sunbelt's strong revenue growth resulted in a record first half

EBITDA margin of 49% (2013: 46%) as 59% of revenue growth dropped

through to EBITDA. Drop through reflects the impact of greenfield

openings and acquisitions. Stores open for more than one year saw

67% of revenue growth drop through to EBITDA. This contributed to

an operating profit of $449m (2013: $345m). A-Plant's EBITDA margin

improved to 36% (2013: 31%) and operating profit rose to GBP30m

(2013: GBP17m), with a drop through of 62%. As a result, Group

operating profit increased 26% to GBP295m (2013: GBP234m).

Net financing costs increased to GBP29m (2013: GBP22m),

reflecting the higher average debt during the period, the

additional $400m of senior secured notes issued last December and

the $500m senior secured notes issued in September.

Group profit before amortisation of intangibles and taxation was

GBP266m (2013: GBP212m). After a tax charge of 36% (2013: 37%) of

the underlying pre-tax profit, underlying earnings per share

increased 27% to 33.9p (2013: 26.7p). The cash tax charge increased

to 15% following the utilisation of brought forward tax losses

during the year.

Statutory profit before tax was GBP259m (2013: GBP208m) and

basic earnings per share were 33.0p (2013: 26.1p).

Capital expenditure and acquisitions

Capital expenditure for the first half of the year was GBP588m

gross and GBP538m net of disposal proceeds (2013: GBP451m gross and

GBP401m net). As a result of this investment, the Group's rental

fleet at 31 October 2014 at cost was GBP3.2bn, up 27% on the prior

year. Our average fleet age is now 26 months (2013: 29 months).

We spent GBP107m (2013: GBP61m) on ten bolt-on acquisitions

during the period as we continue to both expand our footprint and

diversify into specialty markets. Following the quarter end, we

took our first step into Canada with the acquisition of GWG

Rentals, a general tool business based in western Canada, for

GBP16m.

With the strong demand in both our end markets and an ongoing

greenfield opening programme, we are increasing our full year

capital expenditure guidance to support these activity levels. Full

year capital guidance is now in the range of GBP925m to GBP975m

which reflects both the increased activity but also the impact of

weaker sterling.

Return on Investment(1)

Sunbelt's pre-tax return on investment (excluding goodwill and

intangible assets) in the 12 months to 31 October 2014 was 26%

(2013: 26%), well ahead of the Group's pre-tax weighted average

cost of capital. In the UK, return on investment (excluding

goodwill and intangible assets) improved to 12% (2013: 9%). For the

Group as a whole, returns (including goodwill and intangible

assets) are 19% (2013: 18%).

(1) Underlying operating profit divided by the sum of net

tangible and intangible fixed assets, plus net working capital but

excluding net debt and deferred tax.

Cash flow and net debt

As expected, debt increased during the first half as we invested

in the fleet, made a number of bolt-on acquisitions and experienced

the usual seasonal increase in working capital.

Net debt at 31 October 2014 was GBP1,571m (2013: GBP1,230m)

while, reflecting our strong earnings growth, the ratio of net debt

to EBITDA reduced to 2.0 times (2013: 2.1 times) on a constant

currency basis.

The Group's debt package remains well structured and flexible,

enabling us to take advantage of prevailing end market conditions.

Following the issue of the new $500m 5.625% senior secured notes

due in 2024, the Group's debt facilities are committed for an

average of six years. At 31 October 2014, ABL availability was

$830m, with an additional $1,420m of suppressed availability -

substantially above the $200m level at which the Group's entire

debt package is covenant free.

Dividend

In line with its policy of providing a progressive dividend,

having regard to both underlying profit and cash generation and to

sustainability through the economic cycle, the Board has increased

the interim dividend 33% to 3.0p per share (2013: 2.25p per share).

This will be paid on 4 February 2015 to shareholders on record on

16 January 2015.

Current trading and outlook

Our strong performance continued in November. With both

divisions performing well and the benefit of weaker sterling, we

now anticipate a full year result ahead of our previous

expectations.

Directors' responsibility statement

We confirm that to the best of our knowledge:

a) the condensed consolidated interim financial statements have

been prepared in accordance with IAS 34 'Interim Financial

Reporting'; and

b) the interim management report includes a fair review of the

information required by Disclosure and Transparency Rule 4.2.7R

(indication of important events during the first six months and

description of principal risks and uncertainties for the remaining

six months of the year) and Disclosure and Transparency Rule 4.2.8R

(disclosure of related parties' transactions and changes

therein).

By order of the Board of Directors 9 December 2014

CONSOLIDATED INCOME STATEMENT FOR THE THREE MONTHS ENDED 31

OCTOBER 2014

2014 2013

Before Before

amortisation Amortisation Total amortisation Amortisation Total

GBPm GBPm GBPm GBPm GBPm GBPm

Second quarter - unaudited

Revenue

Rental revenue 477.9 - 477.9 392.2 - 392.2

Sale of new equipment,

merchandise and consumables 23.8 - 23.8 20.8 - 20.8

Sale of used rental

equipment 27.7 - 27.7 26.2 - 26.2

529.4 - 529.4 439.2 - 439.2

Operating costs

Staff costs (119.1) - (119.1) (109.4) - (109.4)

Used rental equipment

sold (21.0) - (21.0) (20.7) - (20.7)

Other operating costs (143.7) - (143.7) (116.6) - (116.6)

(283.8) - (283.8) (246.7) - (246.7)

EBITDA* 245.6 - 245.6 192.5 - 192.5

Depreciation (84.5) - (84.5) (68.8) - (68.8)

Amortisation of intangibles - (3.4) (3.4) - (2.4) (2.4)

Operating profit 161.1 (3.4) 157.7 123.7 (2.4) 121.3

Interest expense (16.0) - (16.0) (10.9) - (10.9)

Profit on ordinary

activities

before taxation 145.1 (3.4) 141.7 112.8 (2.4) 110.4

Taxation (52.0) 1.2 (50.8) (41.2) 0.8 (40.4)

Profit attributable

to equity

holders of the Company 93.1 (2.2) 90.9 71.6 (1.6) 70.0

Basic earnings per

share 18.6p (0.5p) 18.1p 14.3p (0.3p) 14.0p

Diluted earnings per

share 18.4p (0.4p) 18.0p 14.2p (0.3p) 13.9p

* EBITDA is presented here as an additional performance measure

as it is commonly used by investors and lenders.

All revenue and profit for the period is generated from

continuing operations.

Details of principal risks and uncertainties are given in the

Review of Second Quarter Balance Sheet and Cash Flow accompanying

these condensed consolidated interim financial statements.

CONSOLIDATED INCOME STATEMENT FOR THE SIX MONTHS ENDED 31

OCTOBER 2014

2014 2013

Before Before

amortisation Amortisation Total amortisation Amortisation Total

GBPm GBPm GBPm GBPm GBPm GBPm

First half - unaudited

Revenue

Rental revenue 895.6 - 895.6 765.4 - 765.4

Sale of new equipment,

merchandise and consumables 45.5 - 45.5 38.5 - 38.5

Sale of used rental

equipment 46.2 - 46.2 45.8 - 45.8

987.3 - 987.3 849.7 - 849.7

Operating costs

Staff costs (226.2) - (226.2) (213.0) - (213.0)

Used rental equipment

sold (35.5) - (35.5) (36.9) - (36.9)

Other operating costs (270.1) - (270.1) (230.6) - (230.6)

(531.8) - (531.8) (480.5) - (480.5)

EBITDA* 455.5 - 455.5 369.2 - 369.2

Depreciation (160.9) - (160.9) (135.1) - (135.1)

Amortisation of intangibles - (6.3) (6.3) - (4.5) (4.5)

Operating profit 294.6 (6.3) 288.3 234.1 (4.5) 229.6

Investment income 0.1 - 0.1 - - -

Interest expense (29.2) - (29.2) (21.8) - (21.8)

Profit on ordinary activities

before taxation 265.5 (6.3) 259.2 212.3 (4.5) 207.8

Taxation (95.7) 2.1 (93.6) (78.6) 1.5 (77.1)

Profit attributable

to

equity holders of the

Company 169.8 (4.2) 165.6 133.7 (3.0) 130.7

Basic earnings per share 33.9p (0.9p) 33.0p 26.7p (0.6p) 26.1p

Diluted earnings per

share 33.6p (0.8p) 32.8p 26.5p (0.6p) 25.9p

* EBITDA is presented here as an additional performance measure

as it is commonly used by investors and lenders.

All revenue and profit for the period is generated from

continuing operations.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Unaudited

Three months Six months to

to

31 October 31 October

2014 2013 2014 2013

GBPm GBPm GBPm GBPm

Profit attributable to equity holders

of the Company for the period 90.9 70.0 165.6 130.7

Items that may be reclassified subsequently

to profit or loss:

Foreign currency translation differences 35.0 (27.1) 35.3 (15.7)

Total comprehensive income for the period 125.9 42.9 200.9 115.0

CONSOLIDATED BALANCE SHEET AT 31 OCTOBER 2014

Unaudited Audited

31 October 30 April

2014 2013 2014

GBPm GBPm GBPm

Current assets

Inventories 22.4 19.4 18.5

Trade and other receivables 364.0 277.0 259.8

Current tax asset 9.7 0.6 9.9

Cash and cash equivalents 6.9 1.5 2.8

403.0 298.5 291.0

Non-current assets

Property, plant and equipment

- rental equipment 2,200.5 1,659.8 1,716.3

- other assets 252.5 199.1 212.8

2,453.0 1,858.9 1,929.1

Goodwill 459.9 405.4 400.4

Other intangible assets 59.2 42.1 45.8

Net defined benefit pension plan asset 6.2 0.3 6.1

2,978.3 2,306.7 2,381.4

Total assets 3,381.3 2,605.2 2,672.4

Current liabilities

Trade and other payables 403.1 300.5 345.8

Current tax liability 11.4 5.6 5.8

Debt due within one year 1.9 1.9 2.2

Provisions 18.1 21.7 15.0

434.5 329.7 368.8

Non-current liabilities

Debt due after more than one year 1,576.2 1,229.4 1,149.2

Provisions 24.1 20.7 20.3

Deferred tax liabilities 385.6 282.9 309.7

1,985.9 1,533.0 1,479.2

Total liabilities 2,420.4 1,862.7 1,848.0

Equity

Share capital 55.3 55.3 55.3

Share premium account 3.6 3.6 3.6

Capital redemption reserve 0.9 0.9 0.9

Non-distributable reserve 90.7 90.7 90.7

Own shares held by the Company (33.1) (33.1) (33.1)

Own shares held through the ESOT (15.5) (12.2) (11.8)

Cumulative foreign exchange translation

differences 15.1 5.4 (20.2)

Retained reserves 843.9 631.9 739.0

Equity attributable to equity holders

of the Company 960.9 742.5 824.4

Total liabilities and equity 3,381.3 2,605.2 2,672.4

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHS ENDED 31 OCTOBER 2014

Own Cumulative

Own shares foreign

Share Capital Non- shares held exchange

Share premium redemption distributable held through translation Retained

by the

capital account reserve reserve Company the differences reserves Total

ESOT

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

At 1 May 2013 55.3 3.6 0.9 90.7 (33.1) (7.4) 21.1 551.4 682.5

Profit for the

period - - - - - - - 130.7 130.7

Other

comprehensive

income:

Foreign currency

translation

differences - - - - - - (15.7) - (15.7)

Total

comprehensive

income

for the period - - - - - - (15.7) 130.7 115.0

Dividends paid - - - - - - - (30.1) (30.1)

Own shares

purchased

by the ESOT - - - - - (22.4) - - (22.4)

Share-based

payments - - - - - 17.6 - (16.1) 1.5

Tax on share-based

payments - - - - - - - (4.0) (4.0)

At 31 October 2013 55.3 3.6 0.9 90.7 (33.1) (12.2) 5.4 631.9 742.5

Profit for the

period - - - - - - - 100.5 100.5

Other

comprehensive

income:

Foreign currency

translation

differences - - - - - - (25.6) - (25.6)

Remeasurement of

the defined

benefit pension

plan - - - - - - - 5.3 5.3

Tax on defined

benefit

pension plan - - - - - - - (1.0) (1.0)

Total

comprehensive

income

for the year - - - - - - (25.6) 104.8 79.2

Dividends paid - - - - - - - (11.2) (11.2)

Share-based

payments - - - - - 0.4 - 1.5 1.9

Tax on share-based

payments - - - - - - - 12.0 12.0

At 30 April 2014 55.3 3.6 0.9 90.7 (33.1) (11.8) (20.2) 739.0 824.4

Profit for the

period - - - - - - - 165.6 165.6

Other

comprehensive

income:

Foreign currency

translation

differences - - - - - - 35.3 - 35.3

Total

comprehensive

income

for the year - - - - - - 35.3 165.6 200.9

Dividends paid - - - - - - - (46.4) (46.4)

Own shares

purchased

by

the ESOT - - - - - (20.1) - - (20.1)

Share-based

payments - - - - - 16.4 - (14.5) 1.9

Tax on share-based

payments - - - - - - - 0.2 0.2

At 31 October 2014 55.3 3.6 0.9 90.7 (33.1) (15.5) 15.1 843.9 960.9

CONSOLIDATED CASH FLOW STATEMENT FOR THE SIX MONTHS ENDED 31

OCTOBER 2014

2014 2013

GBPm GBPm

Cash flows from operating activities

Cash generated from operations before exceptional

items and changes in rental equipment 376.8 302.2

Exceptional operating costs paid (0.4) (1.3)

Payments for rental property, plant and equipment (490.0) (408.7)

Proceeds from disposal of rental property, plant

and equipment 38.0 41.3

Cash used in operations (75.6) (66.5)

Financing costs paid (net) (25.0) (20.5)

Tax paid (net) (31.2) (9.2)

Net cash used in operating activities (131.8) (96.2)

Cash flows from investing activities

Acquisition of businesses (112.5) (61.3)

Payments for non-rental property, plant and equipment (44.3) (44.2)

Proceeds from disposal of non-rental property,

plant and equipment 4.3 4.1

Net cash used in investing activities (152.5) (101.4)

Cash flows from financing activities

Drawdown of loans 784.5 264.9

Redemption of loans (428.3) (33.1)

Capital element of finance lease payments (1.4) (0.5)

Dividends paid (46.4) (30.1)

Purchase of own shares by the ESOT (20.1) (22.4)

Net cash from financing activities 288.3 178.8

Increase/(decrease) in cash and cash equivalents 4.0 (18.8)

Opening cash and cash equivalents 2.8 20.3

Effect of exchange rate difference 0.1 -

Closing cash and cash equivalents 6.9 1.5

Reconciliation of net debt

(Increase)/decrease in cash in the period (4.0) 18.8

Increase in debt through cash flow 354.8 231.3

Change in net debt from cash flows 350.8 250.1

Exchange differences 69.9 (37.3)

Debt acquired - 1.2

Non-cash movements:

* deferred costs of debt raising 0.6 1.2

* capital element of new finance leases 1.3 0.5

Increase in net debt in the period 422.6 215.7

Net debt at 1 May 1,148.6 1,014.1

Net debt at 31 October 1,571.2 1,229.8

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

1. General information

Ashtead Group plc ('the Company') is a company incorporated and

domiciled in England and Wales and listed on the London Stock

Exchange. The condensed consolidated interim financial statements

as at, and for the six months ended, 31 October 2014 comprise the

Company and its subsidiaries ('the Group').

The condensed consolidated interim financial statements for the

six months ended 31 October 2014 were approved by the directors on

9 December 2014.

The condensed consolidated interim financial statements do not

constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. The statutory accounts for the year ended 30

April 2014 were approved by the directors on 16 June 2014 and have

been mailed to shareholders and filed with the Registrar of

Companies. The auditor's report on those accounts was unqualified,

did not include a reference to any matter by way of emphasis and

did not contain a statement under Section 498(2) or (3) of the

Companies Act 2006.

The condensed consolidated interim financial statements are

unaudited but have been reviewed by the Group's auditors. Their

report is on page 26.

2. Basis of preparation

The condensed consolidated interim financial statements for the

six months ended 31 October 2014 have been prepared in accordance

with the Disclosure and Transparency Rules of the United Kingdom's

Financial Conduct Authority and relevant International Financial

Reporting Standards ('IFRS') as adopted by the European Union

(including IAS 34 - Interim Financial Reporting). The condensed

consolidated interim financial statements should be read in

conjunction with the Group's Annual Report and Accounts for the

year ended 30 April 2014, which were prepared in accordance with

IFRS as adopted by the European Union.

The accounting policies applied in the condensed consolidated

interim financial statements are consistent with those set out in

the Group's Annual Report and Accounts for the year ended 30 April

2014. There are no new IFRS or IFRIC Interpretations that are

effective for the first time for this interim period which have a

material impact on the Group.

The condensed consolidated interim financial statements have

been prepared on the going concern basis. The Group's internal

budgets and forecasts of future performance, available financing

facilities and facility headroom (see note 11), provide a

reasonable expectation that the Group has adequate resources to

continue in operation for the foreseeable future and consequently

the going concern basis continues to be appropriate in preparing

the condensed consolidated interim financial statements.

The exchange rates used in respect of the US dollar are:

2014 2013

Average for the three months ended 31

October 1.63 1.58

Average for the six months ended 31 October 1.66 1.56

At 30 April 1.69 1.56

At 31 October 1.60 1.61

3. Segmental analysis

Operating

profit before Operating

Revenue amortisation Amortisation profit

GBPm GBPm GBPm GBPm

Three months to 31 October

2014

Sunbelt 445.0 147.8 (2.2) 145.6

A-Plant 84.4 16.0 (1.2) 14.8

Corporate costs - (2.7) - (2.7)

529.4 161.1 (3.4) 157.7

2013

Sunbelt 367.6 116.6 (1.4) 115.2

A-Plant 71.6 9.5 (1.0) 8.5

Corporate costs - (2.4) - (2.4)

439.2 123.7 (2.4) 121.3

Six months to 31 October

2014

Sunbelt 821.7 269.9 (4.0) 265.9

A-Plant 165.6 29.7 (2.3) 27.4

Corporate costs - (5.0) - (5.0)

987.3 294.6 (6.3) 288.3

2013

Sunbelt 711.5 221.5 (2.7) 218.8

A-Plant 138.2 17.4 (1.8) 15.6

Corporate costs - (4.8) - (4.8)

849.7 234.1 (4.5) 229.6

Segment assets Cash Taxation assets Total assets

GBPm GBPm GBPm GBPm

At 31 October 2014

Sunbelt 2,863.0 - - 2,863.0

A-Plant 501.3 - - 501.3

Corporate items 0.4 6.9 9.7 17.0

3,364.7 6.9 9.7 3,381.3

At 30 April 2014

Sunbelt 2,252.7 - - 2,252.7

A-Plant 406.7 - - 406.7

Corporate items 0.3 2.8 9.9 13.0

2,659.7 2.8 9.9 2,672.4

4. Operating costs and other income

2014 2013

Before Before

amortisation Amortisation Total amortisation Amortisation Total

GBPm GBPm GBPm GBPm GBPm GBPm

Three months to 31 October

Staff costs:

Salaries 108.7 - 108.7 100.6 - 100.6

Social security costs 8.4 - 8.4 7.1 - 7.1

Other pension costs 2.0 - 2.0 1.7 - 1.7

119.1 - 119.1 109.4 - 109.4

Used rental equipment sold 21.0 - 21.0 20.7 - 20.7

Other operating costs:

Vehicle costs 31.3 - 31.3 28.5 - 28.5

Spares, consumables & external

repairs 24.1 - 24.1 21.2 - 21.2

Facility costs 13.6 - 13.6 12.6 - 12.6

Other external charges 74.7 - 74.7 54.3 - 54.3

143.7 - 143.7 116.6 - 116.6

Depreciation and amortisation:

Depreciation 84.5 - 84.5 68.8 - 68.8

Amortisation of intangibles - 3.4 3.4 - 2.4 2.4

84.5 3.4 87.9 68.8 2.4 71.2

368.3 3.4 371.7 315.5 2.4 317.9

Six months to 31 October

Staff costs:

Salaries 206.0 - 206.0 195.2 - 195.2

Social security costs 16.2 - 16.2 14.2 - 14.2

Other pension costs 4.0 - 4.0 3.6 - 3.6

226.2 - 226.2 213.0 - 213.0

Used rental equipment sold 35.5 - 35.5 36.9 - 36.9

Other operating costs:

Vehicle costs 59.9 - 59.9 56.1 - 56.1

Spares, consumables & external

repairs 48.0 - 48.0 40.2 - 40.2

Facility costs 26.7 - 26.7 24.8 - 24.8

Other external charges 135.5 - 135.5 109.5 - 109.5

270.1 - 270.1 230.6 - 230.6

Depreciation and amortisation:

Depreciation 160.9 - 160.9 135.1 - 135.1

Amortisation of intangibles - 6.3 6.3 - 4.5 4.5

160.9 6.3 167.2 135.1 4.5 139.6

692.7 6.3 699.0 615.6 4.5 620.1

5. Amortisation

Amortisation relates to the periodic write-off of intangible

assets. The Group believes this item should be disclosed separately

within the consolidated income statement to assist in the

understanding of the financial performance of the Group. Underlying

profit and earnings per share are stated before amortisation of

intangibles.

Three months Six months to

to

31 October 31 October

2014 2013 2014 2013

GBPm GBPm GBPm GBPm

Amortisation of intangibles 3.4 2.4 6.3 4.5

Taxation (1.2) (0.8) (2.1) (1.5)

2.2 1.6 4.2 3.0

6. Net financing costs

Three months Six months to

to

31 October 31 October

2014 2013 2014 2013

GBPm GBPm GBPm GBPm

Investment income:

Net interest on the net defined benefit - - (0.1) -

asset

Interest expense:

Bank interest payable 4.4 5.1 8.5 10.0

Interest payable on second priority senior

secured notes 11.0 5.1 19.6 10.4

Interest payable on finance leases - - 0.1 0.1

Non-cash unwind of discount on provisions 0.3 0.2 0.4 0.2

Amortisation of deferred debt raising

costs 0.3 0.5 0.6 1.1

Total interest expense 16.0 10.9 29.2 21.8

Net financing costs 16.0 10.9 29.1 21.8

7. Taxation

The tax charge for the period has been computed using an

estimated effective rate for the year of 39% in the US (2013: 39%)

and 21% in the UK (2013: 24%). The blended effective rate for the

Group as a whole is 36% (2013: 37%).

The tax charge of GBP95.7m (2013: GBP78.6m) on the underlying

pre-tax profit of GBP265.5m (2013: GBP212.3m) can be explained as

follows:

Six months to 31 October

2014 2013

GBPm GBPm

Current tax

- current tax on income for the period 38.0 12.2

- adjustments to prior year 0.2 0.1

38.2 12.3

Deferred tax

- origination and reversal of temporary differences 57.7 66.1

- adjustments to prior year (0.2) 0.2

57.5 66.3

Tax on underlying activities 95.7 78.6

Six months to 31 October

2014 2013

GBPm GBPm

Comprising:

- UK tax 8.7 6.8

- US tax 87.0 71.8

95.7 78.6

In addition, the tax credit of GBP2.1m (2013: GBP1.5m) on

amortisation of intangibles of GBP6.3m (2013: GBP4.5m) consists of

a deferred tax credit of GBP0.5m relating to the UK (2013: GBP0.5m)

and GBP1.6m (2013: GBP1.0m) relating to the US.

8. Earnings per share

Basic and diluted earnings per share for the three and six

months ended 31 October 2014 have been calculated based on the

profit for the relevant period and the weighted average number of

ordinary shares in issue during that period (excluding shares held

by the Company and the ESOT over which dividends have been waived).

Diluted earnings per share is computed using the result for the

relevant period and the diluted number of shares (ignoring any

potential issue of ordinary shares which would be anti-dilutive).

These are calculated as follows:

Three months Six months to

to

31 October 31 October

2014 2013 2014 2013

Profit for the financial period (GBPm) 90.9 70.0 165.6 130.7

Weighted average number of shares

(m) - basic 501.4 501.1 501.3 500.9

- diluted 504.2 504.5 505.1 505.5

Basic earnings per share 18.1p 14.0p 33.0p 26.1p

Diluted earnings per share 18.0p 13.9p 32.8p 25.9p

Underlying earnings per share (defined in any period as the

earnings before amortisation of intangibles for that period divided

by the weighted average number of shares in issue in that period)

may be reconciled to the basic earnings per share as follows:

Three months Six months to

to

31 October 31 October

2014 2013 2014 2013

Basic earnings per share 18.1p 14.0p 33.0p 26.1p

Amortisation of intangibles 0.7p 0.4p 1.3p 0.8p

Tax on amortisation (0.2p) (0.1p) (0.4p) (0.2p)

Underlying earnings per share 18.6p 14.3p 33.9p 26.7p

9. Dividends

During the period, a final dividend in respect of the year ended

30 April 2014 of 9.25p (2013: 6.0p) per share was paid to

shareholders costing GBP46.4m (2013: GBP30.1m). In addition, the

directors are proposing an interim dividend in respect of the year

ending 30 April 2015 of 3.0p per share (2013: 2.25p) to be paid on

4 February 2015 to shareholders on record on 16 January 2015.

10. Property, plant and equipment

2014 2013

Rental Rental

equipment Total equipment Total

Net book value GBPm GBPm GBPm GBPm

At 1 May 1,716.3 1,929.1 1,407.8 1,584.6

Exchange difference 78.1 87.0 (35.0) (38.8)

Reclassifications (0.4) - (0.4) -

Additions 541.5 588.2 407.0 451.1

Acquisitions 42.0 48.1 34.8 35.4

Disposals (35.4) (38.5) (34.9) (38.3)

Depreciation (141.6) (160.9) (119.5) (135.1)

At 31 October 2,200.5 2,453.0 1,659.8 1,858.9

11. Borrowings

31 October 30 April

2014 2014

GBPm GBPm

Current

Finance lease obligations 1.9 2.2

Non-current

First priority senior secured bank debt 699.8 609.5

Finance lease obligations 2.6 2.4

6.5% second priority senior secured notes, due

2022 566.8 537.3

5.625% second priority senior secured notes, 307.0 -

due 2024

1,576.2 1,149.2

The senior secured bank debt and the senior secured notes are

secured by way of, respectively, first and second priority fixed

and floating charges over substantially all the Group's property,

plant and equipment, inventory and trade receivables.

Under the terms of our asset-based senior bank facility, $2.0bn

is committed until August 2018. The $900m 6.5% senior secured notes

mature in July 2022, whilst the new $500m 5.625% senior secured

notes mature in October 2024. Our debt facilities therefore remain

committed for the long term, with an average of six years

remaining. The weighted average interest cost of these facilities

(including non-cash amortisation of deferred debt raising costs) is

approximately 5%. The terms of the new $500m senior secured notes

are similar to the existing $900m senior secured notes with

financial performance covenants only measured at the time new debt

is raised.

There are two financial performance covenants under the first

priority senior bank facility:

-- funded debt to LTM (last twelve months) EBITDA before

exceptional items not to exceed 4.0 times; and

-- a fixed charge ratio (comprising LTM EBITDA before

exceptional items less LTM net capital expenditure paid in cash

over the sum of scheduled debt repayments plus cash interest, cash

tax payments and dividends paid in the last twelve months) which

must be equal to or greater than 1.0 times.

These covenants do not apply when excess availability (the

difference between the lower of the facility size and the borrowing

base and facility utilisation) exceeds $200m. At 31 October 2014,

excess availability under the bank facility was $830m ($916m at 30

April 2014), with an additional $1,420m of suppressed availability,

meaning that covenants were not measured at 31 October 2014 and are

unlikely to be measured in forthcoming quarters.

As a matter of good practice, we calculate the covenant ratios

each quarter. At 31 October 2014, as a result of the significant

investment in our rental fleet, the fixed charge ratio, as

expected, did not meet the covenant requirement whilst the leverage

ratio did so comfortably. The fact the fixed charge ratio is

currently below 1.0 times does not cause concern given the strong

availability and management's ability to flex capital expenditure

downwards at short notice. Accordingly, the condensed consolidated

interim financial statements are prepared on a going concern

basis.

Fair value of financial instruments

At 31 October 2014, the Group had no derivative financial

instruments.

With the exception of the Group's second priority senior secured

notes, the carrying value of non-derivative financial assets and

liabilities is considered to materially equate to their fair

value.

The carrying value of the second priority senior secured notes

due 2022, excluding deferred debt raising costs, was GBP576m at 31

October 2014 (GBP547m at 30 April 2014), while the fair value was

GBP620m (GBP593m at 30 April 2014). The carrying value of the

second priority senior secured notes due 2024, excluding deferred

debt raising costs, was GBP313m at 31 October 2014 (GBPnil at 30

April 2014) while the fair value was GBP326m (GBPnil at 30 April

2014). The fair value of the second priority senior secured notes

has been calculated using the quoted market prices at 31 October

2014.

12. Share capital

Ordinary shares of 10p each:

31 October 30 April 31 October 30 April

2014 2014 2014 2014

Number Number GBPm GBPm

Authorised 900,000,000 900,000,000 90.0 90.0

Allotted, called up and

fully paid 553,325,554 553,325,554 55.3 55.3

At 31 October 2014, 50m (2013: 50m) shares were held by the

Company and a further 1.9m (2013: 2.2m) shares were held by the

Company's Employee Share Ownership Trust.

13. Notes to the cash flow statement

Six months to 31 October

2014 2013

GBPm GBPm

a) Cash flow from operating activities

Operating profit before amortisation 294.6 234.1

Depreciation 160.9 135.1

EBITDA before exceptional items 455.5 369.2

Profit on disposal of rental equipment (10.7) (8.9)

Profit on disposal of other property, plant

and equipment (1.1) (1.3)

Increase in inventories (2.0) (2.9)

Increase in trade and other receivables (70.4) (52.2)

Increase/(decrease) in trade and other payables 3.7 (3.0)

Exchange differences (0.1) (0.2)

Other non-cash movements 1.9 1.5

Cash generated from operations before exceptional

items

and changes in rental equipment 376.8 302.2

b) Analysis of net debt

Net debt consists of total borrowings less cash and cash

equivalents. Borrowings exclude accrued interest. Foreign currency

denominated balances are retranslated to pounds sterling at rates

of exchange ruling at the balance sheet date.

1 May Exchange Cash Non-cash 31 October

2014 movement flow movements 2014

GBPm GBPm GBPm GBPm GBPm

Cash (2.8) (0.1) (4.0) - (6.9)

Debt due within

one year 2.2 - (1.3) 1.0 1.9

Debt due after one

year 1,149.2 70.0 356.1 0.9 1,576.2

Total net debt 1,148.6 69.9 350.8 1.9 1,571.2

Details of the Group's cash and debt are given in the Review of

Second Quarter, Balance Sheet and Cash Flow accompanying these

condensed consolidated interim financial statements.

c) Acquisitions

Six months to 31 October

2014 2013

GBPm GBPm

Cash consideration paid

- acquisitions in the period 107.0 61.3

- deferred consideration 5.5 -

112.5 61.3

During the period, ten acquisitions were made for a total cash

consideration of GBP107m (2013: GBP61m), after taking account of

net cash acquired of GBP0.6m. Further details are provided in note

14.

Payments for deferred consideration on prior year acquisitions

were also made of GBP5.5m (2013: GBPnil).

14. Acquisitions

During the period, the following acquisitions were

completed:

i) On 1 May 2014, Sunbelt acquired the entire issued share

capital of Metrolift, Inc. ('Metrolift') for a cash consideration

of GBP25m ($42m). Metrolift is a Chicago-based aerial work platform

rental business.

ii) On 19 May 2014, Sunbelt acquired the business and assets of

Northeast Equipment and Supply LLC, trading as Superior Heating

Solutions ('Superior'), for a cash consideration of GBP2m ($4m).

Superior is a Pennsylvania-based heating rental business.

iii) On 29 May 2014, Sunbelt acquired the business and assets of

Nashville High Lift, LLC ('NHL') and Contractors Equipment, LLC

('CE') for an aggregate cash consideration of GBP5m ($8m). Deferred

consideration of up to GBP0.3m ($0.5m) is payable over the next two

years, depending on revenue meeting or exceeding certain

thresholds. The business consisted of three aerial work platform

and general tool locations in Tennessee.

iv) On 1 August 2014, Sunbelt acquired the business and assets

of Hebbronville Lone Star Rentals, LLC ('Lone Star') for an initial

cash consideration of GBP21m ($36m) with deferred consideration of

up to GBP10m ($16m), payable over the next three years, depending

on revenue meeting or exceeding certain thresholds. Lone Star is a

Texas-based eight location energy-related rental and service

company.

v) On 1 September 2014, A-Plant acquired the business and assets

of East Coast Construction Services (Hire) Limited ('ECCS') for a

cash consideration of GBP0.7m. ECCS is a fusion and associated

equipment rental and service company.

vi) On 5 September 2014, Sunbelt acquired the business and

assets of ECM Energy Services, Inc. ('ECM') for a cash

consideration of GBP19m ($31m). ECM is a four location,

energy-related equipment rental business.

vii) On 26 September 2014, Sunbelt acquired the business and

assets of Ventura Rental, Inc. and Renegade Rental Center, Inc.

(together 'Ventura') for a cash consideration of GBP13m ($22m).

Ventura is a California-based two location general tool

business.

viii) On 2 October 2014, A-Plant acquired the business and

assets in Scotland of Hy-Ram Engineering Company Limited ('Hy-Ram')

for a cash consideration of GBP0.1m.

ix) On 16 October 2014, Sunbelt acquired the business and assets

of Atlas Sales and Rentals, Inc. ('Atlas') for a cash consideration

of GBP21m ($33m). Atlas is a 29 location business, specialising in

permanent and temporary cooling and heating solutions, which

operates across the US.

x) On 16 October 2014, Sunbelt acquired the business and assets

of Gustafson Enterprises, Inc., trading as General Rental Center,

for a cash consideration of GBP0.1m ($0.2m). General Rental Center

is a one location general tool business in Florida.

The following table sets out the book values of the identifiable

assets and liabilities acquired and their fair value to the Group.

The fair values have been determined provisionally at the balance

sheet date.

Acquirees' Fair value

book value to Group

GBPm GBPm

Net assets acquired

Trade and other receivables 12.4 12.4

Inventory 0.8 0.8

Property, plant and equipment

- rental equipment 40.4 42.0

- other assets 6.2 6.1

Creditors (0.5) (0.5)

Intangible assets (non-compete

agreements and customer relationships) - 17.5

59.3 78.3

Consideration:

- cash paid (net of cash acquired) 107.0

- deferred consideration payable in

cash 9.3

116.3

Goodwill 38.0

The goodwill arising can be attributed to the key management

personnel and workforce of the acquired businesses and to the

synergies and other benefits the Group expects to derive from the

acquisitions. GBP38m of the goodwill is expected to be deductible

for income tax purposes.

The gross value and fair value of trade receivables at

acquisition was GBP12m.

The contribution to revenue and operating profit from these

acquisitions from the date of acquisition to 31 October 2014 was

not material. On an annual basis they generate approximately GBP70m

of revenue.

Had these acquisitions taken place on 1 May 2014 their

contribution to revenue and operating profit would not have been

material.

15. Contingent liabilities

There have been no significant changes in contingent liabilities

from those reported in the financial statements for the year ended

30 April 2014.

16. Events after the balance sheet date

Since the balance sheet date the Group has completed three

acquisitions as follows:

(i) On 3 November, we acquired the entire issued share capital

of GWG Rentals, Ltd ('GWG') for an initial cash consideration of

GBP16m (C$29m) with deferred consideration of up to GBP4m (C$7m)

payable over the next three years depending on profitability. GWG

is a six location equipment rental business based in Canada.

(ii) On 10 November, Sunbelt acquired the business and assets of

Select Equipment, Inc. and High Lakes Leasing, LLC (together

'Select') for a cash consideration of GBP9m ($14m). Select is a one

location business in Utah providing rental equipment to the oil and

gas industry.

(iii) On 2 December, A-Plant acquired the business and assets of

Balfour Beatty Equipment Services Limited for a cash consideration

of GBP0.5m.

The initial accounting for these acquisitions is incomplete. Had

these acquisitions taken place on 1 May 2014 their contribution to

revenue and operating profit would not have been material.

REVIEW OF SECOND QUARTER BALANCE SHEET AND CASH FLOW

Second quarter

Revenue EBITDA Operating profit

2014 2013 2014 2013 2014 2013

Sunbelt in $m 729.5 581.2 355.4 271.8 242.4 184.1

Sunbelt in GBPm 445.0 367.6 216.8 172.0 147.8 116.6

A-Plant 84.4 71.6 31.5 22.9 16.0 9.5

Group central costs - - (2.7) (2.4) (2.7) (2.4)

529.4 439.2 245.6 192.5 161.1 123.7

Net financing costs (16.0) (10.9)

Profit before tax and amortisation 145.1 112.8

Amortisation (3.4) (2.4)

Profit before taxation 141.7 110.4

Margins

Sunbelt 48.7% 46.8% 33.2% 31.7%

A-Plant 37.3% 32.0% 18.9% 13.3%

Group 46.4% 43.8% 30.4% 28.2%

Group revenue increased 21% to GBP529m in the second quarter

(2013: GBP439m) with strong growth in both businesses. This revenue

growth, combined with ongoing operational efficiency, generated

underlying profit before tax of GBP145m (2013: GBP113m).

As for the half year, the Group's growth was driven by strong

same store growth supplemented by greenfield openings and bolt-on

acquisitions. Sunbelt's revenue growth for the quarter can be

analysed as follows:

$m

2013 rental only revenue 403

Same stores (in existence at 1 August

2013) +19% 76

Bolt-ons and greenfields since 1

August 2013 +8% 33

2014 rental only revenue +27% 512

Ancillary revenue +28% 149

2014 rental revenue +27% 661

Sales revenue 69

2014 total revenue 730

Our same-store growth of 19% is more than double that of the

rental market as we continue to take market share. In addition,

bolt-ons and greenfields have contributed a further 8% growth as we

execute our long-term structural growth strategy of expanding our

geographic footprint and our specialty businesses. Total rental

only revenue growth of 27% consists of a 24% increase in fleet on

rent and a net 2% improvement in yield.

A-Plant continues to perform well and delivered total rental

revenue up 17% at GBP75m (2013: GBP64m) in the quarter. This

consisted of 12% more fleet on rent and a 4% improvement in

yield.

Group operating profit increased 30% to GBP161m (2013: GBP124m).

Net financing costs increased to GBP16m (2013: GBP11m) reflecting

the higher level of debt in the period and a higher proportion of

longer term fixed rate debt. As a result, Group profit before

amortisation and taxation was GBP145m (2013: GBP113m). After

amortisation of GBP3m, the statutory profit before taxation was

GBP142m (2013: GBP110m).

Balance sheet

Fixed assets

Capital expenditure in the first half totalled GBP588m (2013:

GBP451m) with GBP542m invested in the rental fleet (2013: GBP407m).

Expenditure on rental equipment was 92% of total capital

expenditure with the balance relating to the delivery vehicle

fleet, property improvements and IT equipment. Capital expenditure

by division was:

2014 2013

Replacement Growth Total Total

Sunbelt in $m 160.6 534.7 695.3 552.7

Sunbelt in GBPm 100.4 334.2 434.6 344.0

A-Plant 20.4 86.5 106.9 63.0

Total rental equipment 120.8 420.7 541.5 407.0

Delivery vehicles, property improvements

& IT equipment 46.7 44.1

Total additions 588.2 451.1

In a strong US rental market, $535m of rental equipment capital

expenditure was spent on growth while $161m was invested in

replacement of existing fleet. The growth proportion is estimated

on the basis of the assumption that replacement capital expenditure

in any period is equal to the original cost of equipment sold.

The average age of the Group's serialised rental equipment,

which constitutes the substantial majority of our fleet, at 31

October 2014 was 26 months (2013: 29 months) on a net book value

basis. Sunbelt's fleet had an average age of 25 months (2013: 27

months) while A-Plant's fleet had an average age of 29 months

(2013: 35 months).

LTM LTM

Rental fleet at original cost LTM rental dollar physical

31 Oct 2014 30 April LTM average revenue utilisation utilisation

2014

Sunbelt in

$m 4,241 3,596 3,670 2,222 61% 71%

Sunbelt in

GBPm 2,651 2,130 2,294 1,341 61% 71%

A-Plant 534 446 468 266 57% 71%

3,185 2,576 2,762 1,607

Dollar utilisation is defined as rental revenue divided by

average fleet at original (or "first") cost and, measured over the

last twelve months to 31 October 2014, remained constant at 61% at

Sunbelt (2013: 61%) and rose to 57% at A-Plant (2013: 54%).

Physical utilisation is time based utilisation, which is calculated

as the daily average of the original cost of equipment on rent as a

percentage of the total value of equipment in the fleet at the

measurement date. Measured over the last twelve months to 31

October 2014, average physical utilisation at Sunbelt was 71%

(2013: 72%) and 71% at A-Plant (2013: 71%). At Sunbelt, physical

utilisation is measured for equipment with an original cost in

excess of $7,500 which comprised approximately 89% of its fleet at

31 October 2014.

Trade receivables

Receivable days at 31 October 2014 were 48 days (2013: 45 days).

The bad debt charge for the six months ended 31 October 2014 as a

percentage of total turnover was 0.6% (2013: 0.6%). Trade

receivables at 31 October 2014 of GBP314m (2013: GBP234m) are

stated net of allowances for bad debts and credit notes of GBP20m

(2013: GBP18m) with the allowance representing 6.0% (2013: 7.3%) of

gross receivables.

Trade and other payables

Group payable days were 62 days in 2014 (2013: 68 days) with

capital expenditure related payables, which have longer payment

terms, totalling GBP202m (2013: GBP138m). Payment periods for

purchases other than rental equipment vary between seven and 60

days and for rental equipment between 30 and 120 days.

Cash flow and net debt

Six months LTM to Year

to to

31 October 31 October 30 April

2014 2013 2014 2014

GBPm GBPm GBPm GBPm

EBITDA before exceptional items 455.5 369.2 771.4 685.1

Cash inflow from operations before exceptional

items and changes in rental equipment 376.8 302.2 720.1 645.5

Cash conversion ratio* 82.7% 81.9% 93.3% 94.2%

Replacement rental capital expenditure (127.5) (144.1) (233.0) (249.6)

Payments for non-rental capital expenditure (44.3) (44.2) (85.4) (85.3)

Rental equipment disposal proceeds 38.0 41.3 87.1 90.4

Other property, plant and equipment

disposal proceeds 4.3 4.1 11.7 11.5

Tax (net) (31.2) (9.2) (36.9) (14.9)

Financing costs (25.0) (20.5) (45.0) (40.5)

Cash inflow before growth capex and

payment of exceptional costs 191.1 129.6 418.6 357.1

Growth rental capital expenditure (362.5) (264.6) (503.5) (405.6)

Exceptional costs (0.4) (1.3) (1.3) (2.2)

Total cash used in operations (171.8) (136.3) (86.2) (50.7)

Business acquisitions (112.5) (61.3) (154.5) (103.3)

Total cash absorbed (284.3) (197.6) (240.7) (154.0)

Dividends (46.4) (30.1) (57.6) (41.3)

Purchase of own shares by the ESOT (20.1) (22.4) (20.1) (22.4)

Increase in net debt (350.8) (250.1) (318.4) (217.7)

* Cash inflow from operations before exceptional items and

changes in rental equipment as a percentage of EBITDA before

exceptional items.

Cash inflow from operations before payment of exceptional costs

and the net investment in the rental fleet increased by 25% to

GBP377m. Reflecting a higher level of working capital due to higher

activity levels, the first half cash conversion ratio was 83%

(2013: 82%). As the year progresses, we anticipate that these

seasonal impacts on working capital will substantially reverse.

Total payments for capital expenditure (rental equipment and

other PPE) in the first half were GBP534m (2013: GBP453m). Disposal

proceeds received totalled GBP42m, giving net payments for capital

expenditure of GBP492m in the period (2013: GBP408m). Financing

costs paid totalled GBP25m (2013: GBP21m) while tax payments were

GBP31m (2013: GBP9m). The increase in tax payments reflects the

utilisation of brought forward tax losses during the year.

Financing costs paid differ from the charge in the income statement

due to the timing of interest payments in the year and non-cash

interest charges.

Accordingly, in the first half the Group generated GBP191m

(2013: GBP130m) of net cash before discretionary investments made

to enlarge the size and hence earning capacity of its rental fleet

and on acquisitions. After growth investment, payment of

exceptional costs (closed property costs) and acquisitions, there

was a net cash outflow of GBP284m (2013: GBP198m).

Net debt

31 October 30 April

2014 2013 2014

GBPm GBPm GBPm

First priority senior secured bank debt 699.8 922.1 609.5

Finance lease obligations 4.5 4.0 4.6

6.5% second priority senior secured

notes, due 2022 566.8 305.2 537.3

5.625% second priority senior secured 307.0 - -

notes, due 2024

1,578.1 1,231.3 1,151.4

Cash and cash equivalents (6.9) (1.5) (2.8)

Total net debt 1,571.2 1,229.8 1,148.6

Net debt at 31 October 2014 was GBP1,571m with the increase

since 30 April 2014 reflecting principally the net cash outflow set

out above and exchange rate fluctuations. The Group's EBITDA for

the twelve months ended 31 October 2014 was GBP771m and the ratio

of net debt to EBITDA was therefore 2.0 times at 31 October 2014

(2013: 2.1 times) on a constant currency basis and 2.0 times (2013:

2.0 times) on a reported basis.

Principal risks and uncertainties

Risks and uncertainties in achieving the Group's objectives for

the remainder of the financial year, together with assumptions,

estimates, judgements and critical accounting policies used in

preparing financial information remain unchanged from those

detailed in the 2014 Annual Report and Accounts on pages 20 to 27.

Our business is subject to significant fluctuations in performance

from quarter to quarter as a result of seasonal effects. Commercial

construction activity tends to increase in the summer and during

extended periods of mild weather and to decrease in the winter and

during extended periods of inclement weather. Furthermore, due to

the incidence of public holidays in the US and the UK, there are

more billing days in the first half of our financial year than the

second half leading to our revenue normally being higher in the

first half. On a quarterly basis, the second quarter is typically

our strongest quarter, followed by the first and then the third and

fourth quarters.

In addition, the current trading and outlook section of the

interim statement provides commentary on market and economic

conditions for the remainder of the year.

Fluctuations in the value of the US dollar with respect to the

pound sterling have had, and may continue to have, a significant

impact on our financial condition and results of operations as

reported in pounds due to the majority of our assets, liabilities,

revenues and costs being denominated in US dollars. The Group has

arranged its financing such that, at 31 October 2014, 97% of its

debt was denominated in US dollars so that there is a natural

partial offset between its dollar-denominated net assets and

earnings and its dollar-denominated debt and interest expense. At

31 October 2014, dollar-denominated debt represented approximately

71% of the value of dollar-denominated net assets (other than

debt). Based on the current currency mix of our profits and on

dollar debt levels, interest and exchange rates at 31 October 2014,

a 1% change in the US dollar exchange rate would impact pre-tax

profit by approximately GBP4m.

OPERATING STATISTICS

Number of rental stores Staff numbers

31 October 30 April 31 October 30 April

2014 2013 2014 2014 2013 2014

Sunbelt 493 407 425 8,459 7,325 7,562

A-Plant 129 121 131 2,496 2,220 2,361

Corporate office - - - 11 11 11

Group 622 528 556 10,966 9,556 9,934

Sunbelt's rental store number includes 30 Sunbelt at Lowes

stores at 31 October 2014 (2013: 30).

INDEPENDENT REVIEW REPORT TO THE BOARD OF DIRECTORS OF ASHTEAD

GROUP PLC

We have been engaged by the Company to review the condensed

consolidated interim financial statements for the six months ended

31 October 2014 which comprise the consolidated income statement,

the consolidated statement of comprehensive income, the

consolidated balance sheet, the consolidated statement of changes

in equity, the consolidated cash flow statement and related notes 1

to 16. We have read the other information contained in the

half-yearly financial report and considered whether it contains any

apparent misstatements or material inconsistencies with the

information in the condensed consolidated interim financial

statements.

This report is made solely to the Company in accordance with

International Standard on Review Engagements (UK and Ireland) 2410

"Review of Interim Financial Information performed by the

Independent Auditor of the Entity" issued by the Auditing Practices

Board. Our work has been undertaken so that we might state to the

Company those matters we are required to state to them in an

independent review report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility

to anyone other than the Company, for our review work, for this

report, or for the conclusions we have formed.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the Disclosure and Transparency Rules of the United Kingdom's

Financial Conduct Authority.

As disclosed in note 2, the annual financial statements of the

Group are prepared in accordance with IFRS as adopted by the

European Union and issued by the IASB. The condensed consolidated

interim financial statements included in this half-yearly financial

report have been prepared in accordance with International

Accounting Standard 34, "Interim Financial Reporting", as adopted

by the European Union.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the condensed consolidated interim financial statements in the

half-yearly financial report based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity" issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making inquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK and Ireland) and consequently does not enable us to

obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do

not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed consolidated interim

financial statements for the six months ended 31 October 2014 are

not prepared, in all material respects, in accordance with

International Accounting Standard 34 as adopted by the European

Union and the Disclosure and Transparency Rules of the United

Kingdom's Financial Conduct Authority.

Deloitte LLP Chartered Accountants and Statutory

Auditor

London 9 December 2014

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR VKLFBZLFZFBZ

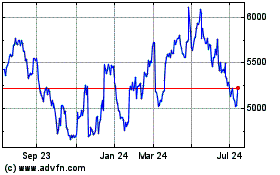

Ashtead (LSE:AHT)

Historical Stock Chart

From Mar 2024 to Apr 2024

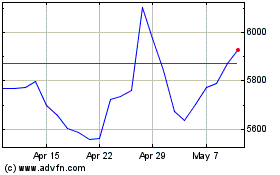

Ashtead (LSE:AHT)

Historical Stock Chart

From Apr 2023 to Apr 2024