Ashmore Group PLC Trading Statement (0496L)

July 14 2017 - 2:00AM

UK Regulatory

TIDMASHM

RNS Number : 0496L

Ashmore Group PLC

14 July 2017

Ashmore Group plc

+0700 14 July 2017

FOURTH QUARTER ASSETS UNDER MANAGEMENT STATEMENT

Ashmore Group plc ("Ashmore", "the Group"), the specialist

Emerging Markets asset manager, announces the following update to

its assets under management ("AuM") in respect of the quarter ended

30 June 2017.

Assets under management

Actual Estimated Movement

31 March

2017 30 June 2017 Q4 vs Q3

Theme (US$ billion) (US$ billion) (%)

---------------- --------------- --------------- ----------

External debt 12.9 13.3 +3%

---------------- --------------- --------------- ----------

Local currency 13.5 13.7 +1%

---------------- --------------- --------------- ----------

Corporate

debt 5.5 6.3 +15%

---------------- --------------- --------------- ----------

Blended debt 13.6 14.6 +7%

---------------- --------------- --------------- ----------

Equities 3.1 3.4 +10%

---------------- --------------- --------------- ----------

Alternatives 1.4 1.5 +7%

---------------- --------------- --------------- ----------

Multi-asset 1.1 1.1 -

---------------- --------------- --------------- ----------

Overlay /

liquidity 4.8 4.8 -

---------------- --------------- --------------- ----------

Total 55.9 58.7 +5%

---------------- --------------- --------------- ----------

Assets under management increased by US$2.8 billion during the

period, comprising positive investment performance of US$1.6

billion and net inflows of US$1.2 billion.

Momentum in gross sales continued across the product range in

the quarter and gross redemptions reduced again quarter-on-quarter.

Subscriptions were from a diverse range of client types, and

included both new mandates and additional allocations from existing

clients. Net inflows were delivered in blended debt, corporate

debt, equities and alternatives, while flows were flat in external

debt, multi-asset and overlay/liquidity. Local currency experienced

a net outflow as a consequence of a large institutional account

redemption.

Emerging Markets assets continued to deliver good absolute

returns during the quarter and outperformed developed world fixed

income and equity markets. Ashmore's investment processes generated

positive investment performance across its fixed income and

equities investment themes, with particularly strong performance in

local currency followed by external debt. Performance was flat in

multi-asset, alternatives and overlay/liquidity. The Group's

investment track record relative to benchmarks remains strong over

one, three and five years.

Mark Coombs, Chief Executive Officer, Ashmore Group plc,

commented:

"Ashmore has performed well over the past 12 months, delivering

a 12% increase in AuM through strong investment performance and net

inflows in the past two quarters. Emerging Markets asset prices

have started to reflect the resilient fundamentals of the

underlying economies and investor activity levels are responding.

Looking ahead, there is substantial absolute and relative value

still available in Emerging Markets and investor allocations have

much further to run from their significantly underweight

levels."

Notes

1. For the translation of US dollar-denominated balance sheet

items, the GBP/USD exchange rate was 1.2946 at 30 June 2017 (30

June 2016: 1.3234; 31 December 2016: 1.2340). For the translation

of US dollar management fees, the average GBP/USD exchange rate

achieved for the financial year was 1.2766 (FY2015/16: 1.4759).

Ashmore will announce its financial results in respect of the

year ended 30 June 2017 on 7 September 2017.

For further information please contact:

Ashmore Group plc

Paul Measday

Investor Relations +44 (0)20 3077 6278

FTI Consulting

Andrew Walton +44 (0)20 3727 1514

Kit Dunford +44 (0)20 3727 1143

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTLLFERDSIVLID

(END) Dow Jones Newswires

July 14, 2017 02:00 ET (06:00 GMT)

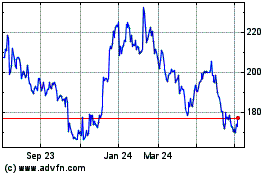

Ashmore (LSE:ASHM)

Historical Stock Chart

From Mar 2024 to Apr 2024

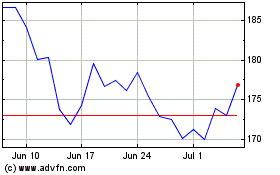

Ashmore (LSE:ASHM)

Historical Stock Chart

From Apr 2023 to Apr 2024