Ashmore Group PLC Trading Statement (0792K)

April 14 2015 - 2:00AM

UK Regulatory

TIDMASHM

RNS Number : 0792K

Ashmore Group PLC

14 April 2015

Ashmore Group plc

+0700 14 April 2015

THIRD QUARTER ASSETS UNDER MANAGEMENT STATEMENT

Ashmore Group plc ("Ashmore", "the Group"), the specialist

Emerging Markets asset manager, announces today the following

update to its assets under management ("AuM") in respect of the

quarter ended 31 March 2015.

Assets under Management

Actual Estimated Movement

31 December 2014 31 March 2015 Q3 vs Q2

Theme (US$ billion) (US$ billion) (%)

External debt(1) 12.4 12.2 -1.6

------------------- ---------------- ----------

Local currency 15.7 15.1 -3.8

------------------- ---------------- ----------

Corporate debt 7.4 6.8 -8.1

------------------- ---------------- ----------

Blended debt(1) 18.0 17.4 -3.3

------------------- ---------------- ----------

Equities 4.3 4.3 -

------------------- ---------------- ----------

Alternatives 1.3 0.9 -30.8

------------------- ---------------- ----------

Multi-strategy 2.0 1.7 -15.0

------------------- ---------------- ----------

Overlay / liquidity 2.6 2.7 +3.8

------------------- ---------------- ----------

Total 63.7 61.1 -4.1

------------------- ---------------- ----------

Assets under management declined during the quarter to US$61.1

billion through a combination of net outflows of US$2.0 billion and

negative investment performance of US$0.6 billion.

Fixed income and equity markets began to recover during the

quarter following the sell-off in December and January, although

local currency returns continued to be affected by the

strengthening of the US dollar. The Group's investment performance

for the quarter therefore primarily reflects negative absolute

performance in the local currency theme, although performance in

this theme continues to be strong against benchmarks. Modest

positive performance in external debt and overlay/liquidity was

offset by negative performance in corporate debt, alternatives and

multi-strategy. Blended debt and equities performance was flat over

the period.

In aggregate, net outflows reduced from the prior quarter with a

modest improvement in new subscriptions as some clients acted to

take advantage of the value available in a number of Emerging

Markets asset classes. Blended debt, corporate debt, external debt,

multi-strategy and local currency experienced net outflows, and

equities and overlay/liquidity were flat. Capital was returned to

investors as planned in the alternatives theme.

Mark Coombs, Chief Executive Officer, Ashmore Group plc,

commented:

"Those investors willing to look beyond short-term price

volatility and to focus on fundamentals are benefiting from the

recent recovery in markets. However, some investors remain cautious

given continued uncertainties such as the timing and impact of

higher US interest rates. Ashmore's investment processes are

delivering alpha as expected after buying into risk at lower market

levels. In our experience, while flows tend to lag investment

performance, the absolute and relative value opportunities across

the range of Emerging Markets asset classes will increasingly be

recognised by investors."

Notes:

1. During the quarter, there was a US$0.1 billion

reclassification from blended debt to external debt following a

change in investment guidelines for those assets. The above

commentary on flows has been adjusted for the reclassification and

it had no other material impact.

For further information please contact:

Ashmore Group plc

Paul Measday

Investor Relations +44 (0)20 3077 6278

FTI Consulting

Andrew Walton +44 (0)20 3727 1514

Paul Marriott +44 (0)20 3727 1341

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTLLFVRSLIVLIE

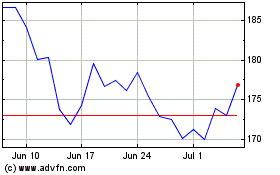

Ashmore (LSE:ASHM)

Historical Stock Chart

From Mar 2024 to Apr 2024

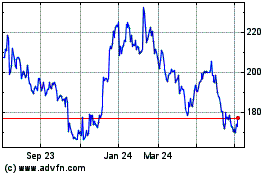

Ashmore (LSE:ASHM)

Historical Stock Chart

From Apr 2023 to Apr 2024